In this ServiceNow earnings call summary, we summarize key metrics and topics discussed on the Q4 2023 call, including:

- Earnings Call Summary

- Revenue Highlights

- Profitability

- Industry Trends

- New Initiatives

- Mergers & Acquisitions (M&A)

- Key Partnerships

- Upcoming Product Launches

- Guidance

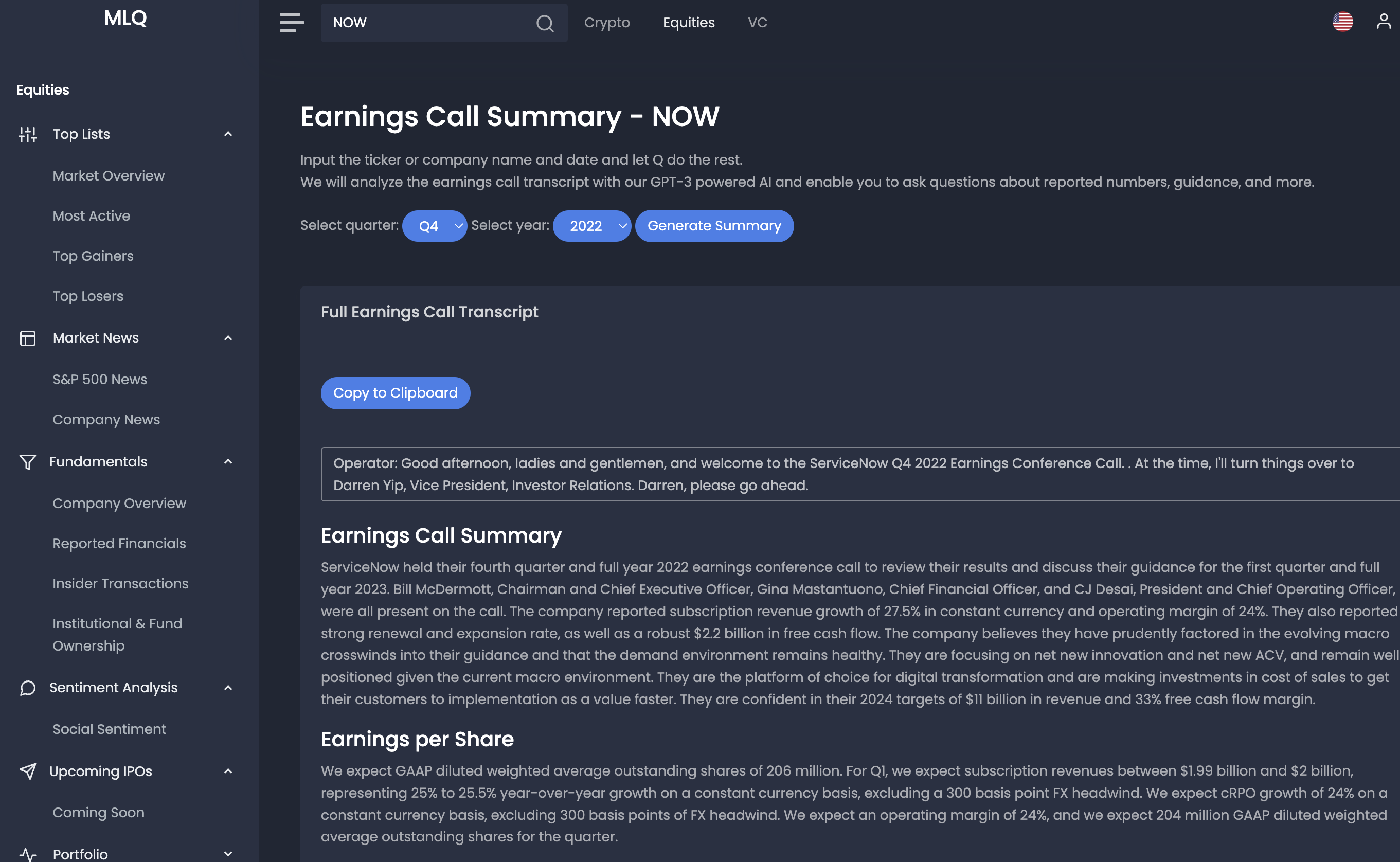

This earning call summary was partially done by our GPT-3 enabled earnings call assistant, which you can learn more about here.

Q4 2022 Earnings Call Summary

ServiceNow held their fourth quarter and full year 2022 earnings conference call to review their results and discuss their guidance for the first quarter and full year 2023.

Bill McDermott, Chairman and Chief Executive Officer, Gina Mastantuono, Chief Financial Officer, and CJ Desai, President and Chief Operating Officer, were all present on the call.

The company reported subscription revenue growth of 27.5% in constant currency and operating margin of 24%. They also reported a strong renewal and expansion rate, as well as a robust $2.2 billion in free cash flow.

The company believes they have prudently factored in the evolving macro crosswinds into their guidance and that the demand environment remains healthy. They are focusing on net new innovation and net new ACV, and remain well positioned given the current macro environment.

They are the platform of choice for digital transformation and are making investments in cost of sales to get their customers to implementation as a value faster. They are confident in their 2024 targets of $11 billion in revenue and 33% free cash flow margin.

Revenue Highlights

Subscription revenues for Q4 were $1.86 billion, representing a 27.5% year-over-year growth in constant currency. This exceeded the high end of the guidance range by 50 basis points.

Current RPO was approximately $6.94 billion, representing a 22% year-over-year growth and a versus our guidance, primarily driven by favorable FX movements in the quarter.

On a constant currency basis, growth was 25.5%. Subscription gross margin was 84%, reflecting the expected diminishing impact of the change in useful life of their data center equipment as well as investments to accelerate customer time to value.

Profitability

This quarter, the operating margin was 28%, 200 basis points above the guidance, driven by disciplined spend management and less-than-expected FX headwinds. The cash flow margin was 53%, up 650 basis points year-over-year.

For the full year 2022, the operating margin was 26%, 100 basis points above the guidance and the free cash flow margin was 30%, also 100 basis points above the guidance. Total free cash flow for 2022 was a robust $2.2 billion, ending the year with a healthy balance sheet, including $6.4 billion in cash and investments.

Industry Trends

This quarter saw strong net new ACV growth across a variety of industries, including retail, hospitality, transportation, and logistics. This growth was driven by customers renewing their contracts and expanding with ServiceNow, as well as new customers signing on.

The company also saw strong expansion rates in Q4, indicating that customers are not changing their behaviors with respect to renewals or net new expansion. ServiceNow also saw strong growth in international markets, with no difference in renewal dynamics between domestic and international customers.

This quarter also saw a focus on net new innovation and net new ACV, with a loyal customer base that will remain ever loyal with many upsells, cross-sells, and same account revenue growth.

New Initiatives

This quarter, ServiceNow focused on net new innovation and net new ACV. They invested in cost of sales to get customers to implementation faster, and they saw strong growth in net new ACV.

They also saw strong growth in retail, hospitality, transportation, and logistics, and they are excited about their growth potential in Japan and India.

They also focused on larger-than-average Q4 customer cohorts, and they ended the quarter with 1,637 customers paying over $1 million in ACV.

Finally, they are investing in digital technologies to power new business models and accelerate productivity while reducing costs.

Mergers & Acquistions (M&A)

There were no merger & acquisitions (M&A) reported this quarter. However, the company did report strong net new customer ACV growth, with new customer net new ACV growing over 30%.

This was added to existing customers, and the company ended the quarter with 1,637 customers paying over $1 million in ACV, up 20% year-over-year.

From an industry perspective, retail and hospitality and transportation and logistics saw net new ACV growth, driving growth in very specific industries from telco to public sector and health care.

The company also reported strong renewal and expansion rates, with a 98% renewal rate remaining the industry benchmark.

Key Partnerships

ServiceNow had strong partnerships this quarter, with 126 deals greater than $1 million in net new ACV. This included 2 of their top 5 largest ever deals. They also saw 100% increases in the number of both $5 million plus and 10 million-plus net new ACV deals.

ServiceNow's platform as a unified platform is leading to more multiproduct deals, with 5 of their top 10 deals containing 10 or more products. They are also investing in cost of sales to get customers to implementation as a value faster.

Upcoming Product Launches

During the call, CJ Desai discussed the company's focus on net new innovation and net new ACV. William McDermott mentioned the company's focus on digital transformation and their proud culture built on Fred Luddy's founding vision.

Gina Mastantuono discussed the company's investments in cost of sales to get customers to implementation faster, as well as sales and marketing efficiencies. William McDermott also mentioned the company's focus on multiproduct deals, with 5 of their top 10 deals containing 10 or more products.

These product launches and investments suggest that the company is well-positioned to continue to grow and innovate in the coming year.

Guidance

During the call, the team discussed their guidance for the first quarter and full year 2023. They emphasized that the guidance is based on information as of today and contains forward-looking statements that involve risks, uncertainties and assumptions.

They also discussed their disciplined forecast that appropriately balances their optimism for ServiceNow's business. They are driving net new innovation, fast growth and operating leverage, and remain well-positioned given the current macro environment. They will update their long-term targets at their Analyst Day in May.

As always, none of this is financial advice, do your own research, and see our full terms and conditions for more.