In this IBM earnings call summary, we summarize key metrics and topics discussed on the Q4 2023 call, including:

- Earnings Call Summary

- Revenue Highlights

- Profitability

- Industry Trends

- New Initiatives

- Mergers & Acquisitions (M&A)

- Key Partnerships

- Upcoming Product Launches

- Guidance

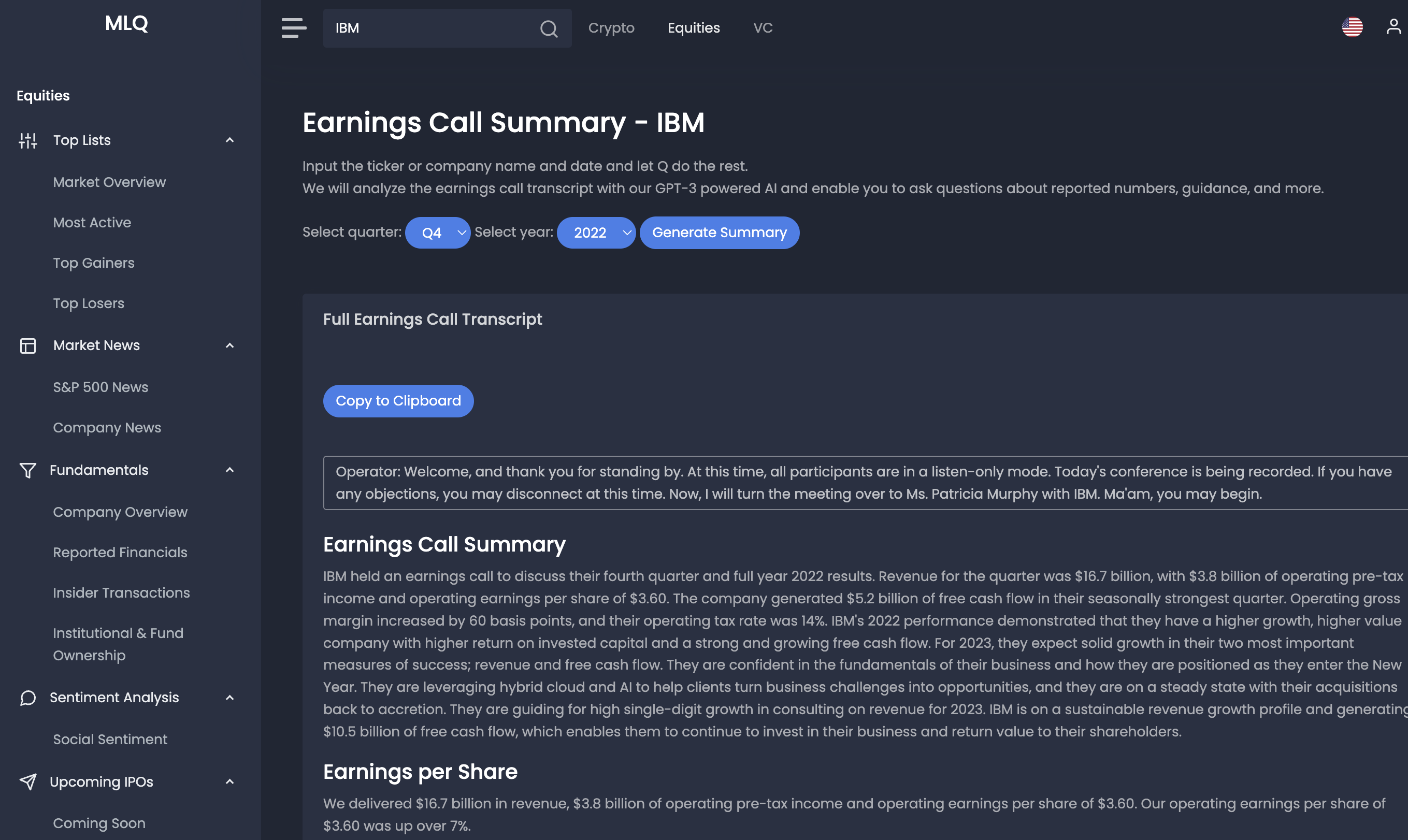

This earning call summary was partially done by our GPT-3 enabled earnings call assistant, which you can learn more about here.

Earnings Call Summary

IBM held an earnings call to discuss their fourth quarter and full year 2022 results on January 25th, 2022. Revenue for the quarter was $16.7 billion, with $3.8 billion of operating pre-tax income and operating earnings per share of $3.60.

The company generated $5.2 billion of free cash flow in their seasonally strongest quarter. Operating gross margin increased by 60 basis points, and their operating tax rate was 14%.

IBM's 2022 performance demonstrated that they have a higher growth, higher value company with higher return on invested capital and a strong and growing free cash flow. For 2023, they expect solid growth in their two most important measures of success; revenue and free cash flow. They are confident in the fundamentals of their business and how they are positioned as they enter the New Year.

They are leveraging hybrid cloud and AI to help clients turn business challenges into opportunities, and they are on a steady state with their acquisitions back to accretion.

They are guiding for high single-digit growth in consulting on revenue for 2023. IBM is on a sustainable revenue growth profile and generating $10.5 billion of free cash flow, which enables them to continue to invest in their business and return value to their shareholders.

Earnings Per Share (EPS)

IBM delivered $16.7 billion in revenue, $3.8 billion of operating pre-tax income and operating earnings per share of $3.60. Their operating earnings per share of $3.60 was up over 7%.

Revenue Highlights

The revenue for the fourth quarter was reported at $16.7 billion, up 6% from the previous quarter at constant currency. This was driven by strong performance in software and consulting, with software revenue up 8% and consulting revenue up 9%.

This was further supported by good growth across geographies, with mid single-digit growth or better in the Americas, EMEA, and Asia Pacific. The revenue growth was broad-based, with infrastructure up 7%, transaction processing up 3%, and hybrid infrastructure up 11%. This performance was fueled by strength in power following the extension of Power 10 innovation throughout the product line. Overall, the revenue performance was above the company's model.

Profitability

The fourth quarter saw a 250 basis point improvement in operating margin, coming in at 170. This was driven by a strong portfolio mix, improving software and consulting margins, and a 60 basis point increase in operating gross margin. The operating pre-tax income was $3.8 billion, and operating earnings per share was $3.60, up 7% year-over-year.

The consulting pre-tax margin was 11% for the quarter and nearly 9% for the year, up nearly 2 points year-over-year and over 1 point sequentially. The Infrastructure segment pre-tax margin was down less than 1 point in the quarter, and for the full year, the pre-tax margin was nearly 15%.

Industry Trends

This quarter, key industry trends included the recognition that technology is a fundamental source of competitive advantage, the need to leverage hybrid cloud and AI to help clients turn business challenges into opportunities, and the need to deploy automated ways to get from the front to the back.

Companies are also leveraging cloud technologies to better handle client demand, and are partnering with key ISV partners like SAP, Salesforce, and Adobe to transform critical workloads at scale. Additionally, clients are leveraging cyber resiliency to comply with business regulations and proactively avoid outages in their operations.

New Initiatives

This quarter, IBM introduced Red Hat Device Edge, a lightweight solution to flexibly deploy and manage edge computing workloads. They also launched Partner Plus, a new simplified program that increases their reach and scale through new and existing IBM partners.

Additionally, they extended Power 10 innovation throughout the product line, and clients are leveraging cyber resiliency to comply with business regulations and proactively avoid outages in their operations. Finally, they strengthened their consulting expertise and expanded strategic partnerships to bolster their software portfolio.

Mergers & Acquistions (M&A)

This quarter, the company saw an increase in M&A activity. The acquisitions made were back to being accretive, meaning they were adding value to the company.

This was seen in the strong 17% increase in signings in the December quarter, and the quarterly book-to-bill was an improvement from the September quarter. The company's strategy of leveraging hybrid cloud and AI to help clients turn business challenges into opportunities resonated with clients and partners, and this gave the company a solid foundation to build upon.

The company's M&A activity is expected to continue in the New Year, as they are well-equipped to meet their clients' needs.

Key Partnerships

IBM had a successful year with their strategic partnerships, with revenue growing 25% in 2022 and making up 40% of their consulting base of business. This was a 50% increase year-over-year. IBM also had success with their hyperscaler partnerships with Azure and AWS, with signings growth that delivered a 1.3 book-to-bill.

IBM also had success with their ISV portfolio, with partners such as SAP, Salesforce, and Adobe. IBM also launched Partner Plus, a new simplified program that increases their reach and scale through new and existing IBM partners. This year, IBM is looking to expand and better enable their broader ecosystem.

Upcoming Product Launches

On the call, Arvind Krishna discussed the progress they have made in the area of AIOps, which is a form of automation. He also mentioned that they have made a couple of small acquisitions to help with their revenue growth profile. Additionally, he discussed the investments they have made in their software portfolio, hybrid cloud and AI capabilities, and their z16 and Power platforms. These investments have enabled them to bring to market a more technical and experiential sales approach. Finally, Arvind mentioned that they will be unlocking more productivity and expanding their strategic partnerships.

Guidance

IBM provided guidance for 2023 of mid-single-digit revenue growth and four points of operating margin improvement. This guidance was slightly below expectations from the beginning of the year, due to headwinds from Russia and currency, as well as a cash tax headwind for the year.

However, IBM is expecting to see modest structural actions tailwinds, as well as strong transactional business in the month of December, which will create an opportunity for free cash flow generation in 2023. IBM is also expecting to see another one point plus in operating margins going forward.

As always, none of this is financial advice, do your own research, and see our full terms and conditions for more.