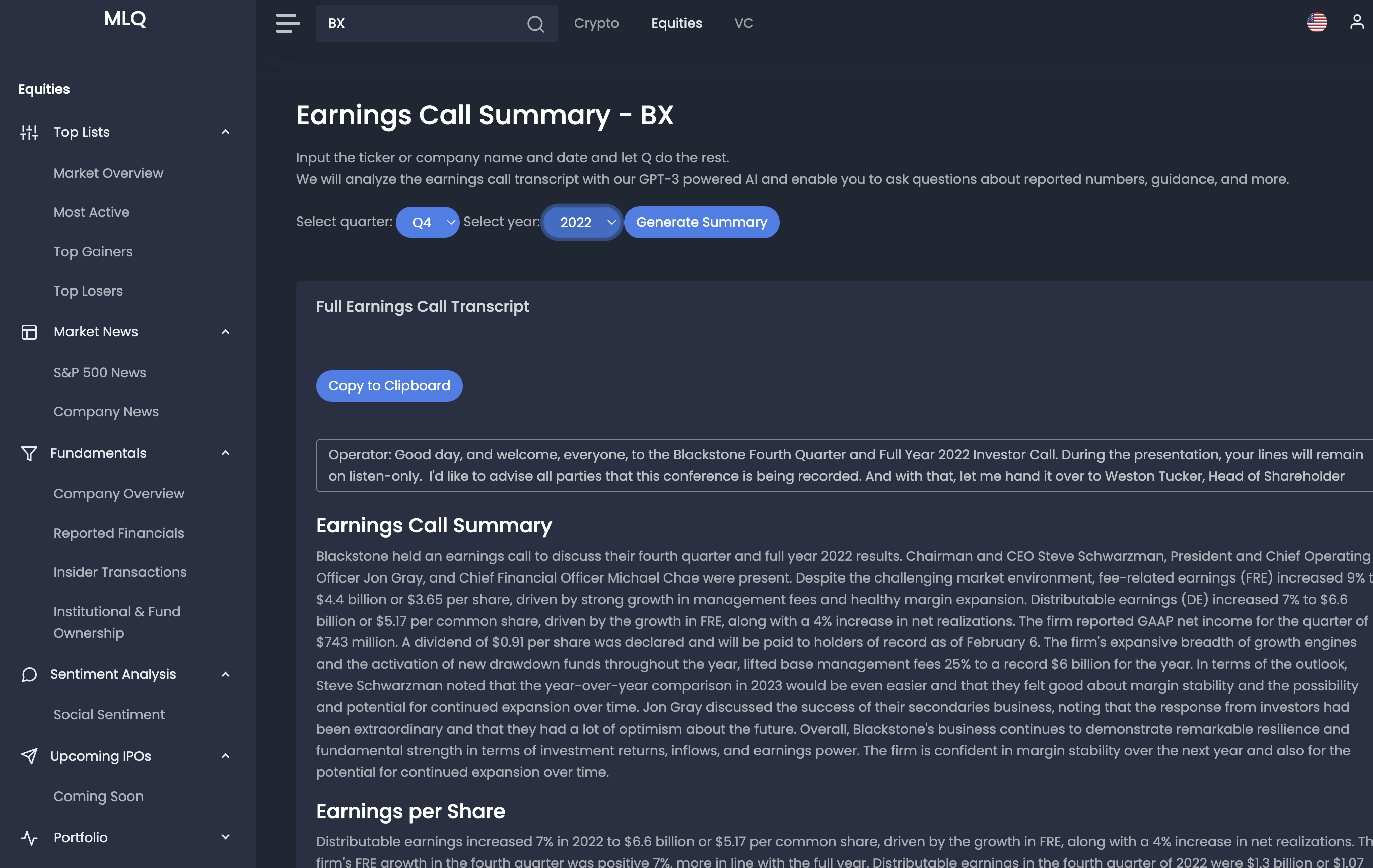

In this Blackstone earnings call summary, we summarize key metrics and topics discussed on the Q4 2022 call, including:

- Earnings Call Summary

- Revenue Highlights

- Profitability

- Industry Trends

- New Initiatives

- Mergers & Acquisitions (M&A)

- Key Partnerships

- Upcoming Product Launches

- Guidance

This earning call summary was partially done by our GPT-3 enabled earnings call assistant, which you can learn more about here.

Earnings Call Summary

Blackstone held an earnings call to discuss their fourth quarter and full year 2022 results on Jan 26, 2023.

Chairman and CEO Steve Schwarzman, President and Chief Operating Officer Jon Gray, and Chief Financial Officer Michael Chae were present. Despite the challenging market environment, fee-related earnings (FRE) increased 9% to $4.4 billion or $3.65 per share, driven by strong growth in management fees and healthy margin expansion.

A few other key highlights include:

- Distributable earnings (DE) increased 7% to $6.6 billion or $5.17 per common share, driven by the growth in FRE, along with a 4% increase in net realizations.

- The firm reported GAAP net income for the quarter of $743 million.

- A dividend of $0.91 per share was declared and will be paid to holders of record as of February 6.

- The firm's expansive breadth of growth engines and the activation of new drawdown funds throughout the year, lifted base management fees 25% to a record $6 billion for the year.

In terms of the outlook, Steve Schwarzman noted that the year-over-year comparison in 2023 would be even easier and that they felt good about margin stability and the possibility and potential for continued expansion over time.

Jon Gray discussed the success of their secondaries business, noting that the response from investors had been extraordinary and that they had a lot of optimism about the future.

Overall, Blackstone's business continues to demonstrate resilience and fundamental strength in terms of investment returns, inflows, and earnings power. The firm is confident in margin stability over the next year and also for the potential for continued expansion over time.

Revenue Highlights

This quarter, Blackstone reported a record fourth quarter with distributable earnings of $1.3 billion or $1.07 per common share, down from the prior year record quarter.

This was driven by a 9% increase in FRE to $4.4 billion or $3.65 per share, powered by strong growth in management fees and healthy margin expansion. Notably, excluding the change in the crystallization schedule for BREIT's fee-related performance revenues, the firm's FRE growth in the fourth quarter was positive 7%.

Looking ahead, Blackstone has strong confidence in continued FRE expansion in 2023 and beyond, with multiple embedded key drivers and attractive incremental margins.

Profitability

The BPS gross composite return was 2.1% in the quarter, indicating positive performance.

Distributable earnings increased 7% in 2022 to $6.6 billion or $5.17 per common share, driven by the growth in FRE, along with a 4% increase in net realizations.

Fee-related earnings, net realizations, and distributable earnings all saw a meaningful positive growth for the full year, with FRE and DE reaching record levels.

The fourth quarter saw strong DE of $1.3 billion, reflective of the firm's substantial earnings power, which has grown dramatically over the past several years.

Industry Trends

This quarter, there has been a strong focus on semi-liquid investments, infrastructure, data centers, and towers, as well as energy and energy transition investments.

These investments are seen as attractive in an inflationary environment and have been delivering good performance. Additionally, there has been a move towards more alternative investments, which is positive for the industry.

Real estate has seen a decline in new permits and starts, but the 10-year treasury has come back down, which makes investors feel more confident. Finally, there is expected to be a material step-up in FRE over the next several years.

New Initiatives

In Q4, Blackstone launched several new initiatives in order to deploy capital. These included a majority stake in Emerson Electric's Climate Technologies segment, CoreTrust in partnership with HCA, and a $1 billion commitment from Nippon Life, Japan's leading life insurance company.

Blackstone also raised $3 billion in the fourth quarter for their growth fund, BXG, and $3 billion for their infrastructure fund. Lastly, Blackstone raised $8 billion from their large insurance mandates, bringing platform AUM to $160 billion.

Mergers & Acquistions (M&A)

Blackstone completed a $14 billion corporate carve-out in Q4, acquiring a majority stake in Emerson Electric's Climate Technologies segment. This was the result of a year-long dialogue, completed at a time when traditional financing sources were largely unavailable.

Blackstone also completed a privatization of Atlantia, one of the largest transportation infrastructure companies alongside the Benetton family.

Additionally, Blackstone made investments in CoreTrust in partnership with HCA and in logistics portfolios in Canada, the UK and Sweden. Overall, Blackstone's global scale and reputation as a partner of choice have positioned them well for future M&A opportunities.

Key Partnerships

Blackstone had a number of key partnerships this quarter, including a majority stake in Emerson Electric's Climate Technologies segment.

This $14 billion corporate carve-out was the result of a year-long dialogue, completed at a time when traditional financing sources were largely unavailable. Blackstone also partnered with HCA to invest in CoreTrust, and with UC and BREIT to invest in BPP.

Additionally, Blackstone commenced fundraising for their latest debt vehicle, targeting over $10 billion in aggregate, and for their seventh European opportunistic strategy, targeting a similar size to the prior fund.

These partnerships demonstrate Blackstone's ability to source, structure, and finance complex transactions at scale in a difficult investment environment.

Upcoming Product Launches

Blackstone discussed the potential for growth in their secondaries business, with the recent increase in capital for their latest fund. They also discussed the launch of their global infrastructure fund, as well as their European opportunistic real estate fund.

Additionally, they discussed the launch of their direct lending capability, which has multiple ways to access capital. Finally, they discussed the possibility of tweaks to their existing products in order to increase liquidity.

Guidance

On the call, guidance was discussed in terms of FRE margin expectation for fiscal 2023 and how it should grow over the next couple of years. It was stated that Blackstone does not give spot guidance on every margin target in the short-term, but that their track record of sustained expansion is evident.

It was also mentioned that the firm has a high degree of control and an ability to scale up strategies, which is why their optimism remains high. Finally, it was noted that clients are actually talking about increasing their allocation to alternatives, which is a very different sentiment than the last sharp down cycle in 2008, 2009.

As always, none of this is financial advice, do your own research, and see our full terms and conditions for more.