As the world continues to progress towards a fully digital world, cybersecurity is becoming an increasingly critical part of our lives. Not just on an enterprise level, but a personal one as well. An estimated 60% of the world’s population has direct access to the internet now, and with rapid escalation of infrastructure in emerging markets, this number should grow exponentially over the next decade.

On top of this, nearly 50% of the world’s population has a smartphone, and some estimates have this number jumping to 7.5 billion smartphones by 2025. Our entire lives are now digital, especially with the introduction of super apps like WeChat and AliPay in China and the Cash App or Venmo in North America. Consumers are increasingly doing all of their financial transactions online, through devices that are susceptible to hackers and other malicious groups. On top of this, a large percentage of the working force is now able to work from home, or remotely, away from the security infrastructure of an office.

Identifying these secular trends early is what makes good investors great. With a continued reliance on technology and cloud computing, cybersecurity companies will be looked upon as an essential service for every enterprise in the future. So as an investor, how can you take advantage of this? We’ve done the research for you.

Here are 15 stocks from the cybersecurity industry to consider for your portfolio:

- Fortinet (NASDAQ:FTNT)

- CrowdStrike Holdings (NASDAQ:CRWD)

- ProofPoint (NASDAQ:PFPT)

- Mimecast (NASDAQ:MIME)

- Zscaler (NASDAQ:ZS)

- Palo Alto Networks (NASDAQ:PANW)

- Microsoft (NASDAQ:MSFT)

- Rapid7, Inc (NASDAQ:RPD)

- Check Point Software Technologies (NASDAQ:CHKP)

- Tenable Holdings (NASDAQ:TENB)

- Norton LifeLock Inc. (NASDAQ:NLOK)

- Qualys (NASDAQ:QYLS)

- SentinelOne (NYSE:S)

- Splunk (NASDAQ:SPLK)

- Cyberark Software Ltd (NASDAQ:CYBR)

Stay up to date with AI

Disclaimer: The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice. See our full Terms of Service here.

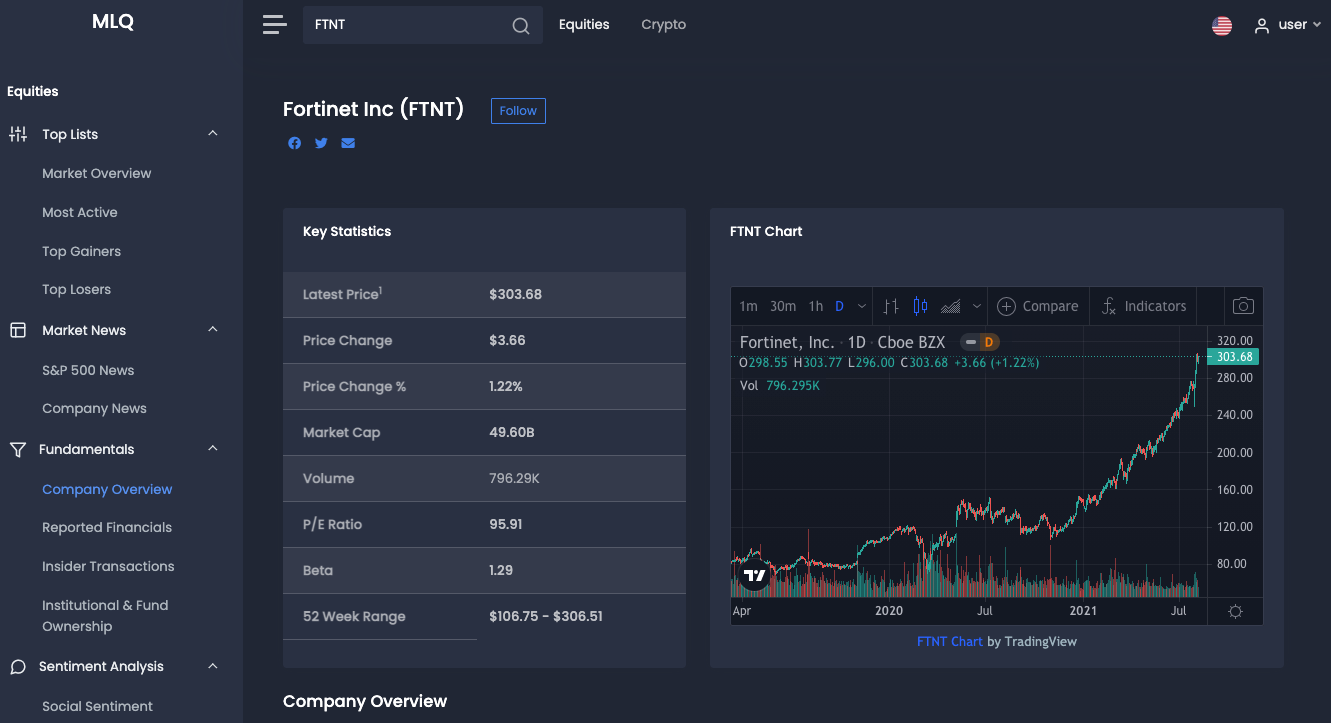

1. Fortinet (NASDAQ:FTNT)

Fortinet (FTNT) is almost considered a legacy security company at this point, having been around since 2000. The company started with physical security tools like firewalls and anti-virus software. As the internet has evolved, so too has the focus for Fortinet. The company now stands on four main pillars of execution: User/Device Security, Network Security, Cloud Security, and Security Ops.

Fortinet anticipates its Network Security arm will have a total addressable market of $48 billion by 2024, as the implementation of 5G networks and cloud infrastructure improves around the world. Fortinet has a long list of global partners, including Siemens, Waste Management, Autodesk, and Microstrategy. In addition to this, Fortinet is trusted by government agencies all around the world. Compared to other companies, Fortinet does trade at a premium though. With a price-to-earnings ratio of nearly 100, and a market cap of only $49 billion, there are stocks with a more friendly valuation than Fortinet.

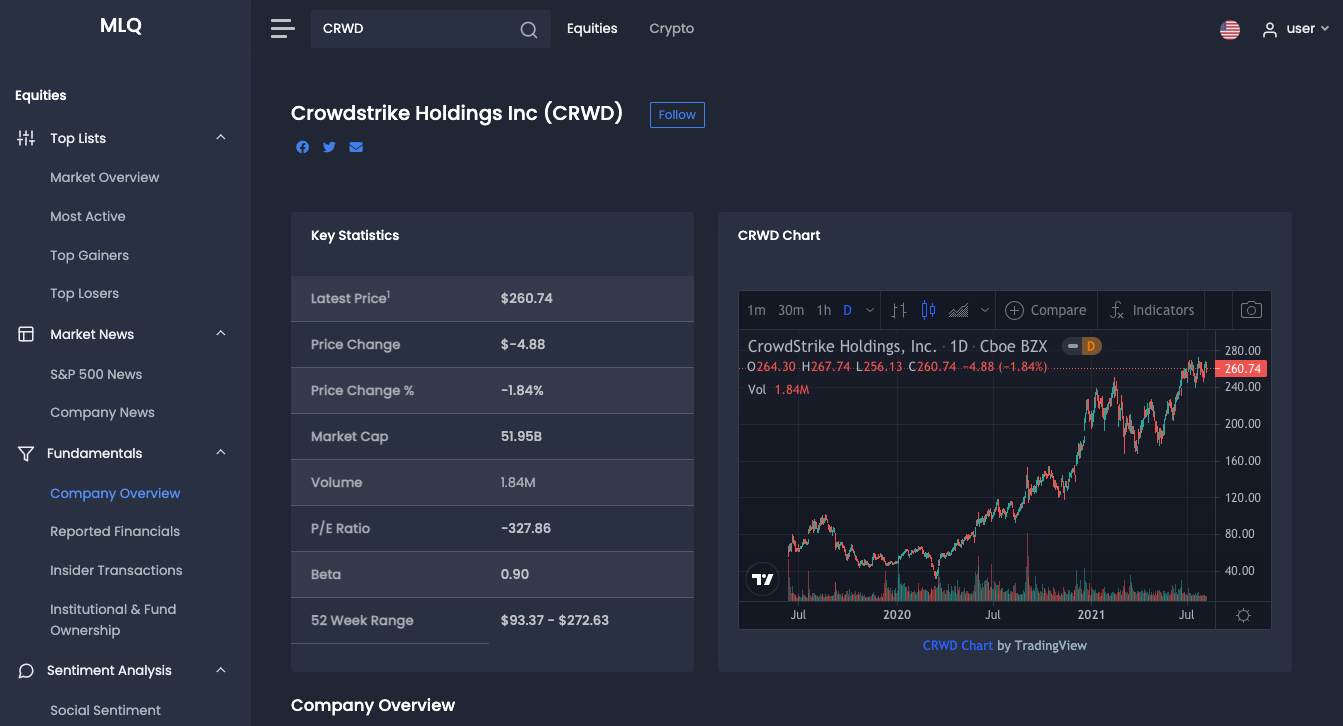

2. CrowdStrike Holdings (NASDAQ:CRWD)

A current favorite amongst growth investors, CrowdStrike (CRWD) has emerged as an industry leader in endpoint security solutions. If you want a look into how fast CrowdStrike has grown, it was founded in 2011 and is already a larger company than Fortinet.

CrowdStrike specializes in cloud security using endpoint security, threat assessment, and cyber-attack security responses. What sets CrowdStrike apart? Its massive Falcon network utilizes artificial intelligence and machine learning for every attack or threat that it detects. Not only is that endpoint neutralized and secured, but Falcon sends this data to every other endpoint on the network. This means that effectively, any new threat is programmed into every one of its client’s security networks.

CrowdStrike also utilizes the one/ten/sixty rule: one minute to diagnose a threat, ten minutes to analyze it, and sixty minutes to neutralize the threat. CrowdStrike has already reached $1 billion in annual recurring revenues and is already partnered with two of the largest cloud platforms in AWS and Google Cloud. CrowdStrike could easily be a $500 billion company one day, so buying it now at just under $60 billion might be a steal.

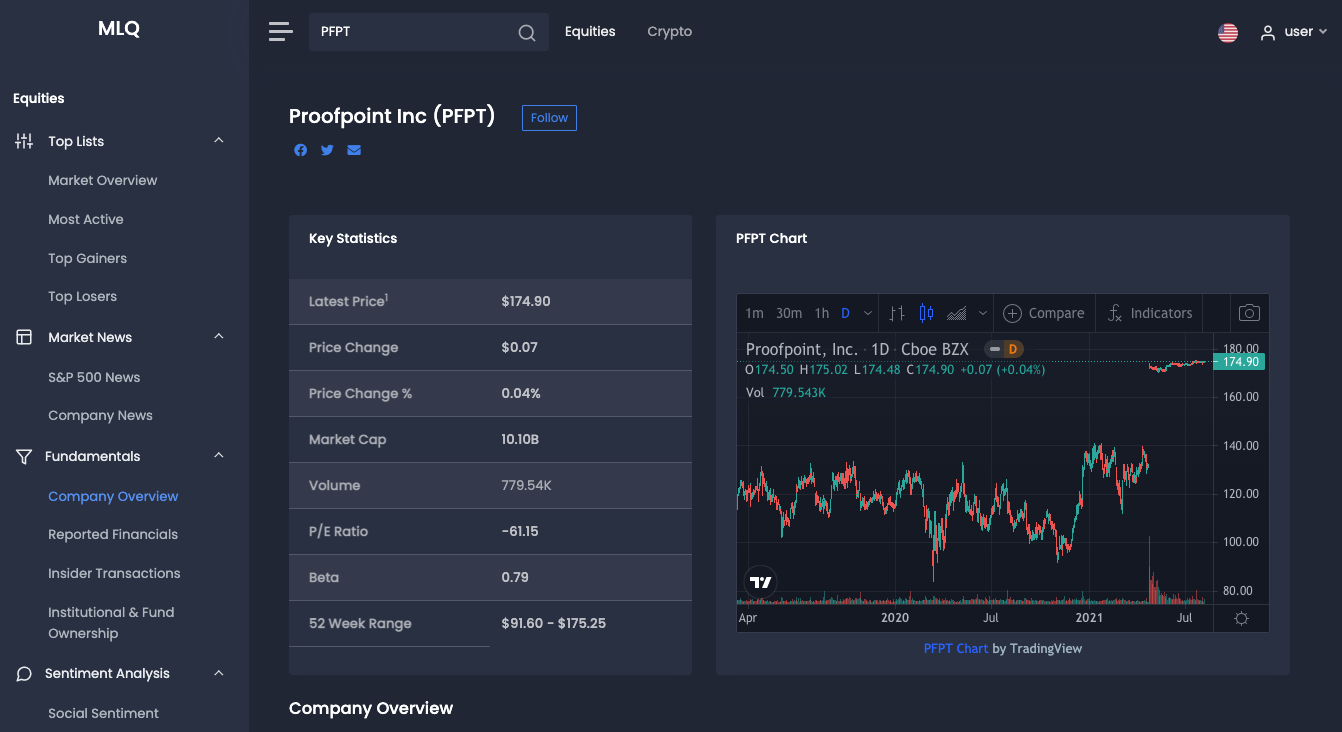

3. ProofPoint (NASDAQ:PFPT)

ProofPoint (PFPT) is probably a company that not too many consumers have heard of. The company focuses on enterprise security solutions, with an industry-leading security platform for inbound enterprise email systems.

The software has become a staple in enterprise security protection, as ProofPoint now has nearly 60% of the Fortune 1000 companies as its clients. On top of that, nearly 70% of its over 8,000 clients purchase three or more products from ProofPoint, showing how strong the company’s net retention is.

ProofPoint doesn’t directly compete with other cybersecurity companies since it has a fairly strong lockdown on the email security software market. What it does is it integrates with other cybersecurity brands in order to create a fully secure enterprise ecosystem. ProofPoint works alongside a lot of companies on this list including Paloalto, CrowdStrike, Okta, and Splunk.

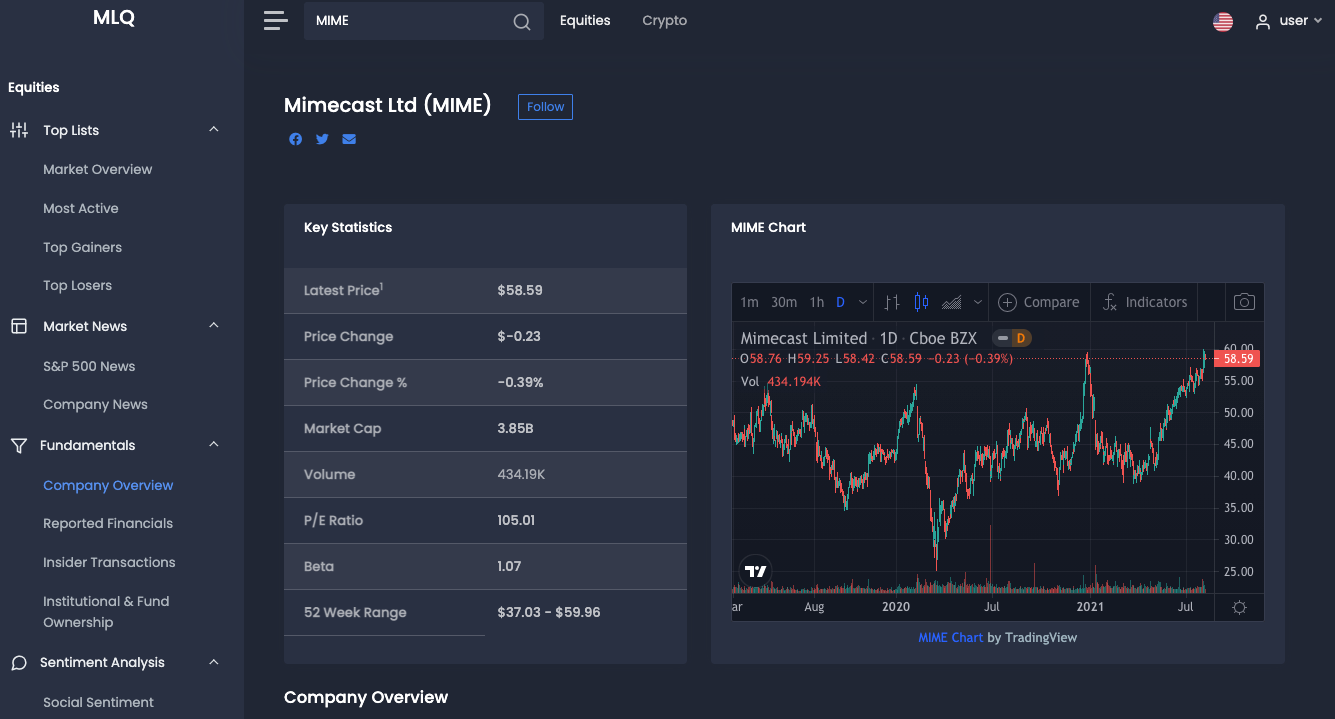

4. Mimecast (NASDAQ:MIME)

Another company that consumers most likely haven’t heard about unless you work in the cybersecurity field, Mimecast (MIME) is one of the smaller companies on this list with only a $3 billion market cap.

The interesting thing is, if you thought ProofPoint was a niche market, Mimecast is actually one of the only direct competitors. Mimecast is another email server security program that focuses solely on providing security for Microsoft Exchange and Microsoft Office 365. If you are going to focus on one thing, it may as well be Windows enterprise security. Just under 75% of the world’s companies use Windows as their operating system, so the total addressable market is a significant advantage. Mimecast has an impressive CAGR of 29% for annual revenues over the past six years, showing just how steadily this company is growing.

Its forthcoming software platform is called Mime OS and is a fully scalable multi-tenant platform that enables multi-product suite integration. It is open-source and allows integration with big names like CrowdStrike, Okta, and Palo Alto, much like ProofPoint. Currently, Mimecast has 17 million global users, but it anticipates this to increase with the total number of business email users hitting 1 billion companies worldwide.

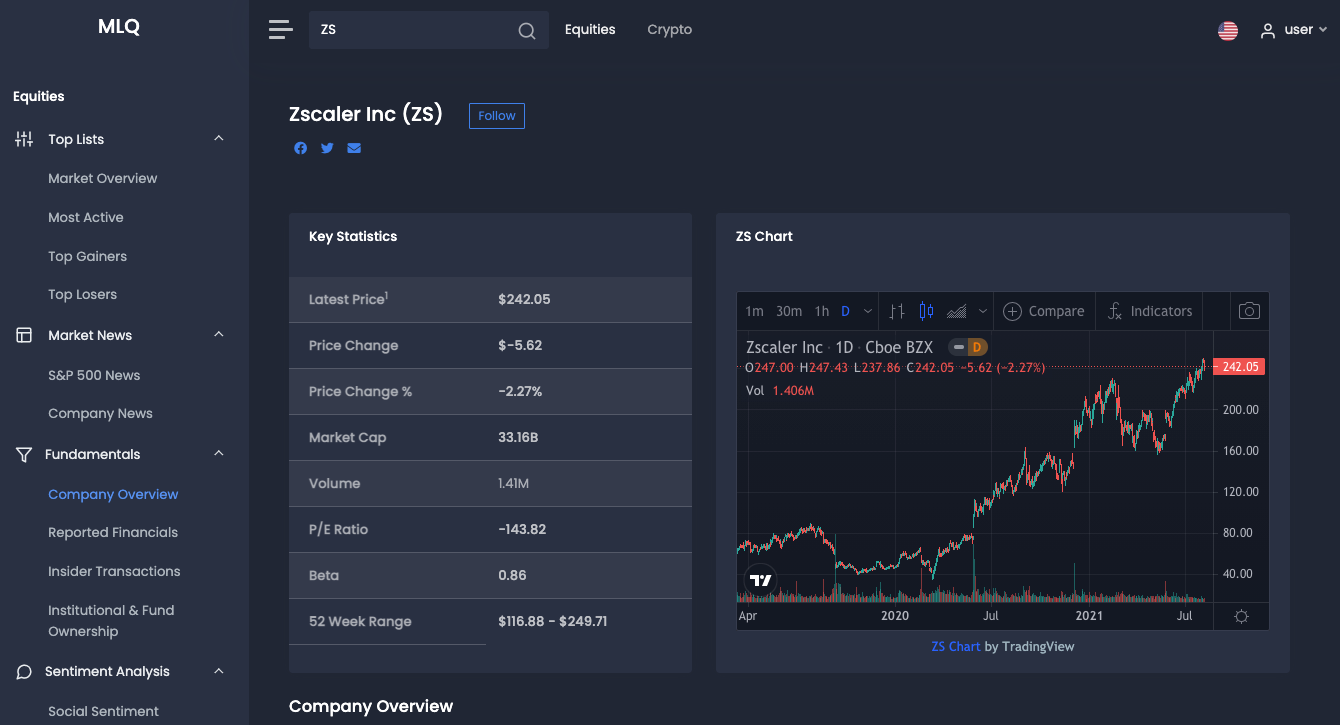

5. Zscaler (NASDAQ:ZS)

Zscaler (ZS) is a cloud security company that enables new zero-trust architecture to protect its users. The zero-trust exchange is all-encompassing and is a dynamic, policy-based secure access service. The focus here is on protecting the users and data, not the network itself.

Zscaler has over 150 data centers globally, and incorporates 150 billion transactions per day through its security exchange, ten times the number of transactions that is undertaken by Google. Most importantly for investors, Zscaler saw a 64% year-over-year growth in billings, a 52% year-over-year revenue growth, and an impressive 122% net retention rate of its clients.

Zscaler currently serves 7 of the top 10 conglomerates, 8 of the top 10 chemical makers, and 7 of the top 10 beverage companies in the world. Zscaler works with two of the largest Cloud providers in the world in AWS and Microsoft Azure, as well as integrating into endpoint security systems like CrowdStrike and Splunk.

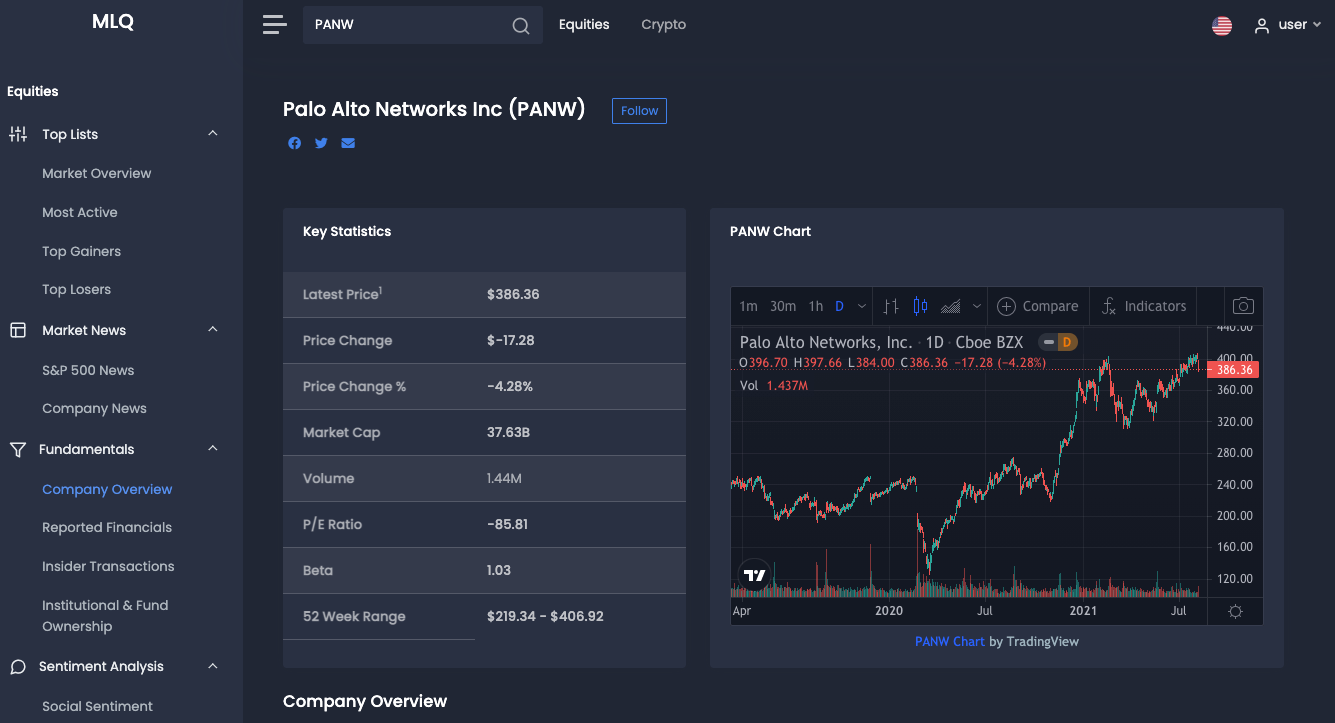

6. Palo Alto Networks (NASDAQ:PANW)

One of the better-known cloud security software providers, Palo Alto Networks (PANW) started out with and still offers enterprise firewalls. As the internet has shifted to the cloud, Palo Alto has moved its focus to enterprise cloud security.

Palo Alto has a number of different enterprise and cloud products, including the famous Unit 42, a security threat system that has identified numerous hacker groups. Last quarter saw an impressive 27% year-over-year growth in total billings, as well as a staggering 71% growth in annual recurring revenue.

Its Prisma Cloud platform is the single largest cloud-native security business. Palo Alto also provides its services to Google Cloud in order to provide a cloud-native and high-performance network using Google Cloud IDs.

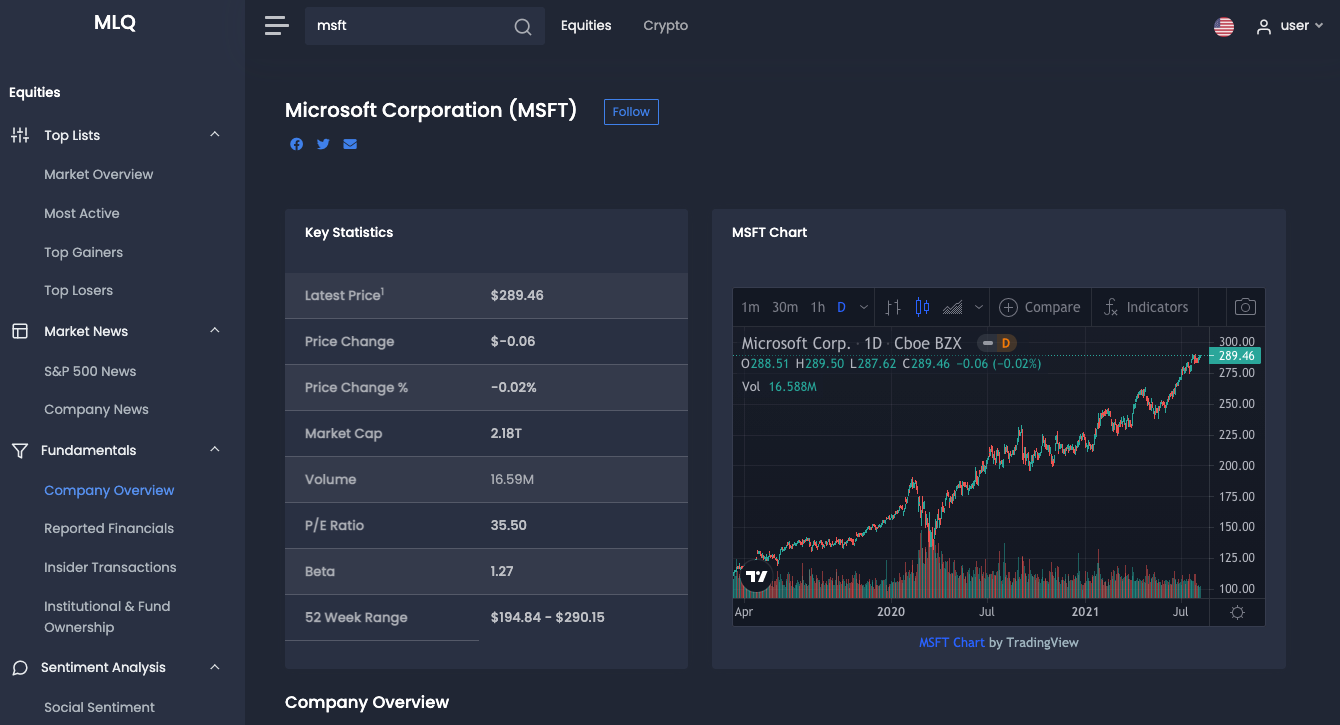

7. Microsoft (NASDAQ:MSFT)

A company that needs no introduction, Microsoft (MSFT) announced in July that it was acquiring security company RiskIQ for an undisclosed sum believed to be worth more than $500 million. For Microsoft, that’s pocket change, and the acquisition of RiskIQ is more of a supplement to its existing security services. You don’t end up in 70% of the world’s offices without having some form of security system.

Microsoft already offers its enterprise users security platforms like Microsoft 365 Defender, Microsoft Azure Defender, and Microsoft Azure Sentinel. Specifically, Microsoft wanted access to RiskIQ’s two main platforms of security: Attack Surface and Threat Intelligence.

Microsoft’s Azure cloud platform is becoming an increasingly important part of the company, accounting for over 40% of Microsoft’s revenues in the most recent quarter. With a system that gets hacked as much as Windows and Microsoft Azure does, any further Cloud security will only help.

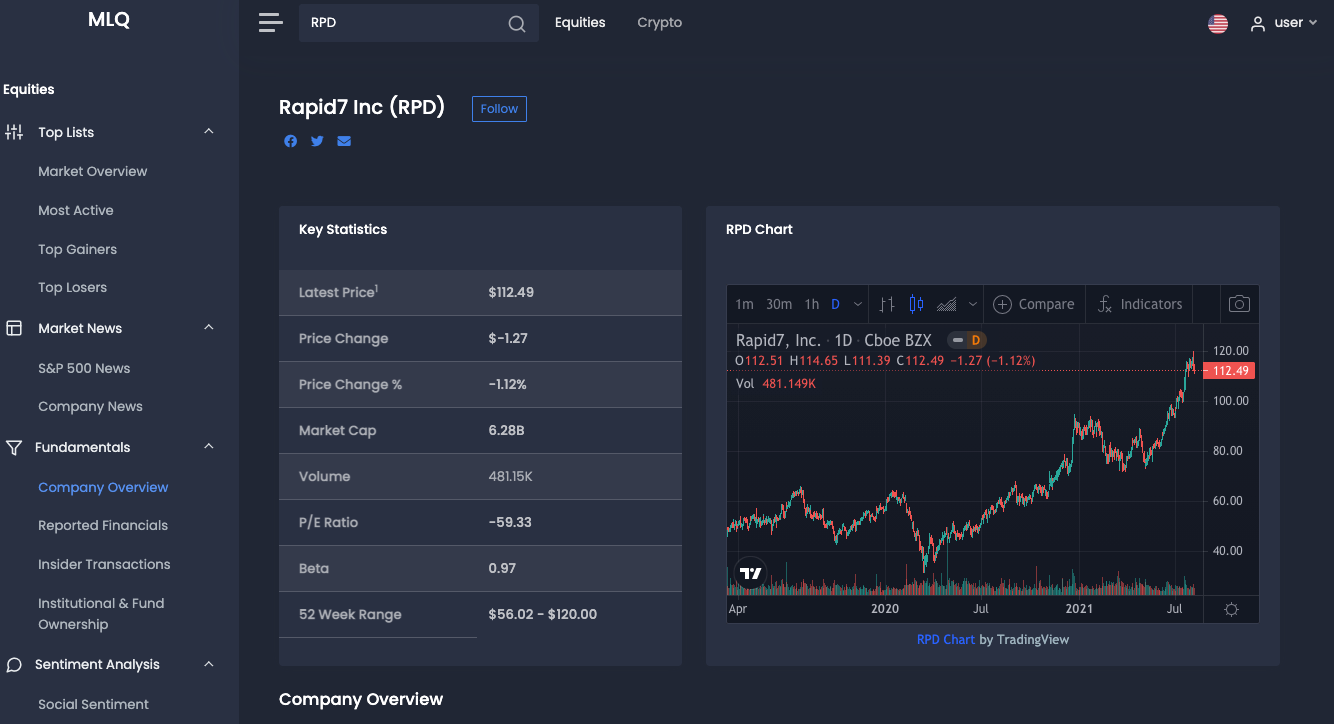

8. Rapid7, Inc (NASDAQ:RPD)

Yet another enterprise security company, Rapid7 (RPD) utilizes machine learning to protect its clients from malicious attacks. Like with most cybersecurity companies, Rapid7 is exhibiting high speed growth, with an estimated 38% CAGR for its annualized recurring revenues.

Rapid7 boasts six different Insight platforms that provide enterprises with a complete security package. Rapid7 already partners with some of the largest companies in the world including Autodesk, Hilton Hotels, CVS, Dominos, Lam Research, and Thermo Fisher Scientific.

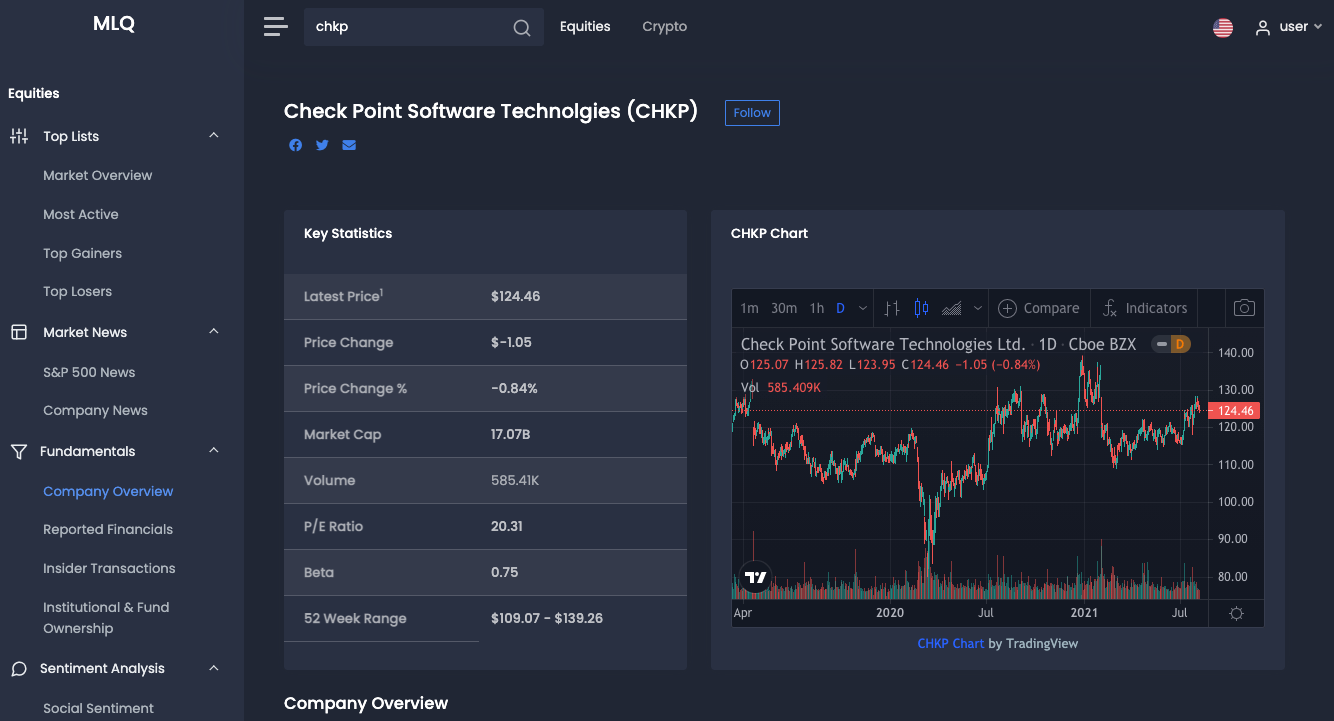

9. Check Point Software Technologies (NASDAQ:CHKP)

Check Point Software (CHKP) is an American-Israeli owned operation that provides, you guessed it, enterprise security software solutions. The company offers a large suite of security programs, including its Infinity Architecture which includes Quantum, Cloudguard, and Harmony.

Check Point recently reported its second-quarter earnings, and while across the board the company did improve on a year-over-year basis, the improvements were not as strong as investors wanted to hear. Another plus? Check Point is currently engaging in international expansion, with strong pushes into Europe and Asia. Why are all these enterprise security companies doing well? Because most enterprises hire 5-10 different firms to handle all of the threats.

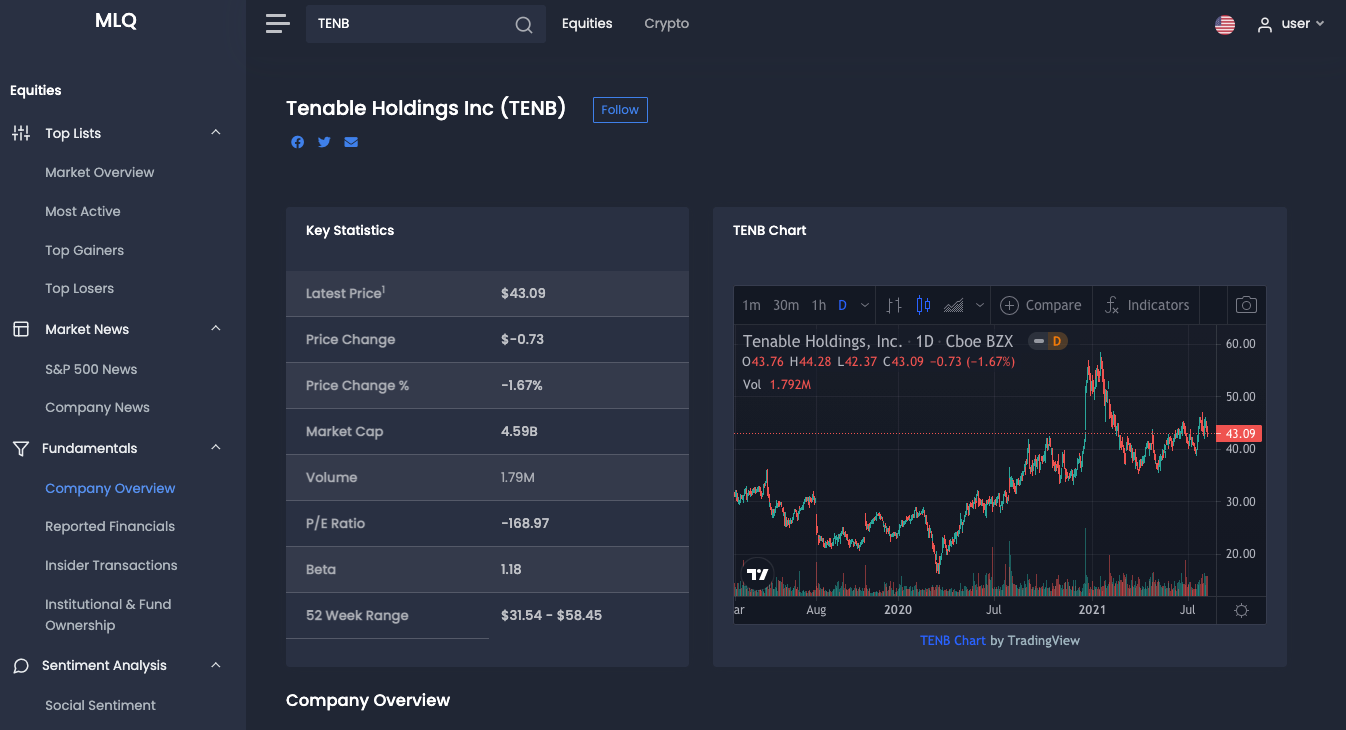

10. Tenable Holdings (NASDAQ:TENB)

Tenable (TENB) is a smaller company, with a market cap of just over $4.5 billion. This company focuses on a segment we haven’t touched on yet: virtual machines. In fact, Tenable claims it has the #1 Virtual Machines or VM market share in the world. So what’s a virtual machine? These are basically a separate computer that runs inside your real one. Why would a company need to do this? It is actually a great way to run security checks and undergo malware analysis on your computers. It’s also a great way to test new things without having a direct impact on the host.

Tenable already works with 50% of the Fortune 500 and 30% of the Global 200 and posted some incredible numbers in the most recent quarter. Gross margins for the company came in at 83% and it also reported 94% in recurring revenue. Tenable has over 30,000 corporate partners including Starbucks, Tesla, NASA, and Amazon.

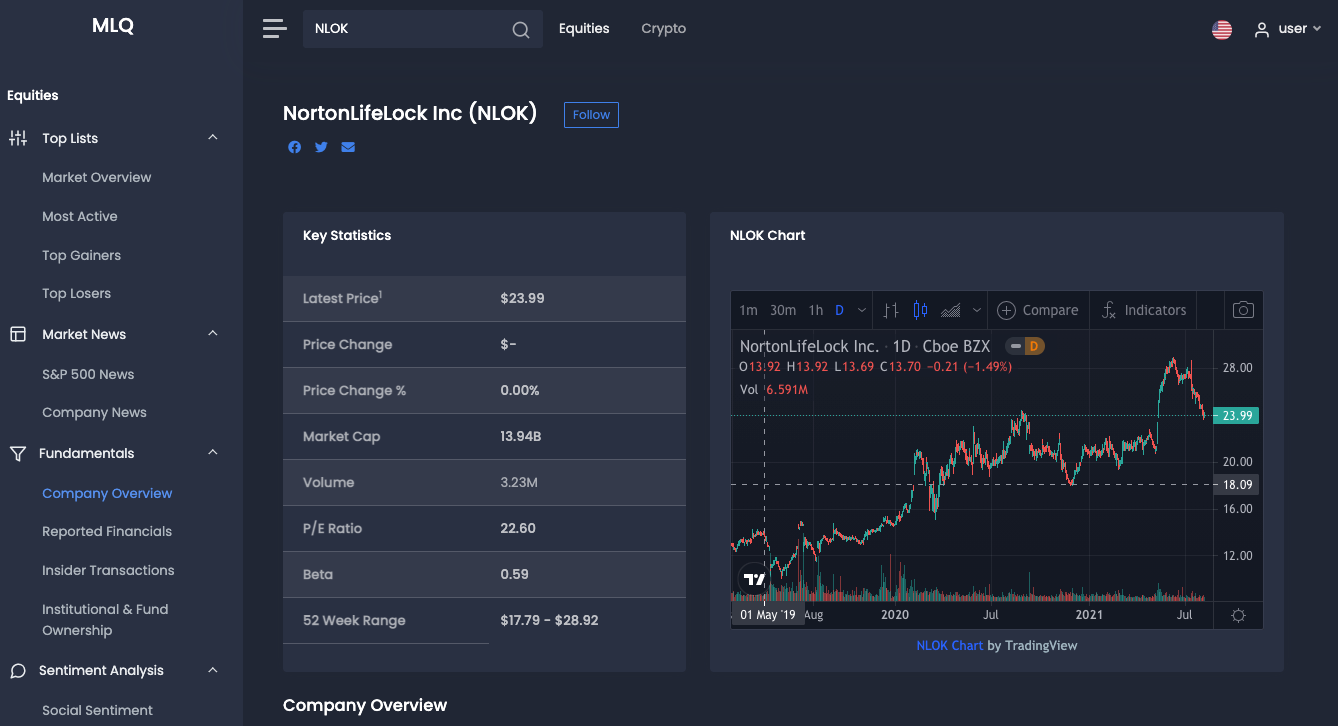

11. Norton LifeLock Inc. (NASDAQ:NLOK)

Consumers may recognize this more as Symantec Norton Antivirus products, especially in North America. If you haven’t seen antivirus software for a while, it’s because Norton (NLOK) has mostly moved on to other home products. Norton launched three new products this year that are capitalizing on many of the current global trends. Game Optimizer is included in Norton 360, and protects your computer while you are online on different game servers, as well as optimize your hardware for more energy-efficient usage.

Norton Crypto is an interesting route for the company to take. This software allows you to safely mine cryptos like Bitcoin and Ethereum. This platform also comes with a Norton crypto wallet, where the company can continue to securely store your cryptocurrencies.

Finally, Norton SecureVPN allows safe connections and other features including split tunneling. This will surely be used more as companies transition to working from home. Norton boasts that its security software stops over 7 million threats per day, and over 500,000 ransomware attacks blocked. Perhaps what is most impressive is the continued growth for the 40-year old company. Revenues grew by 13% year over year and gross margins hit 87%.

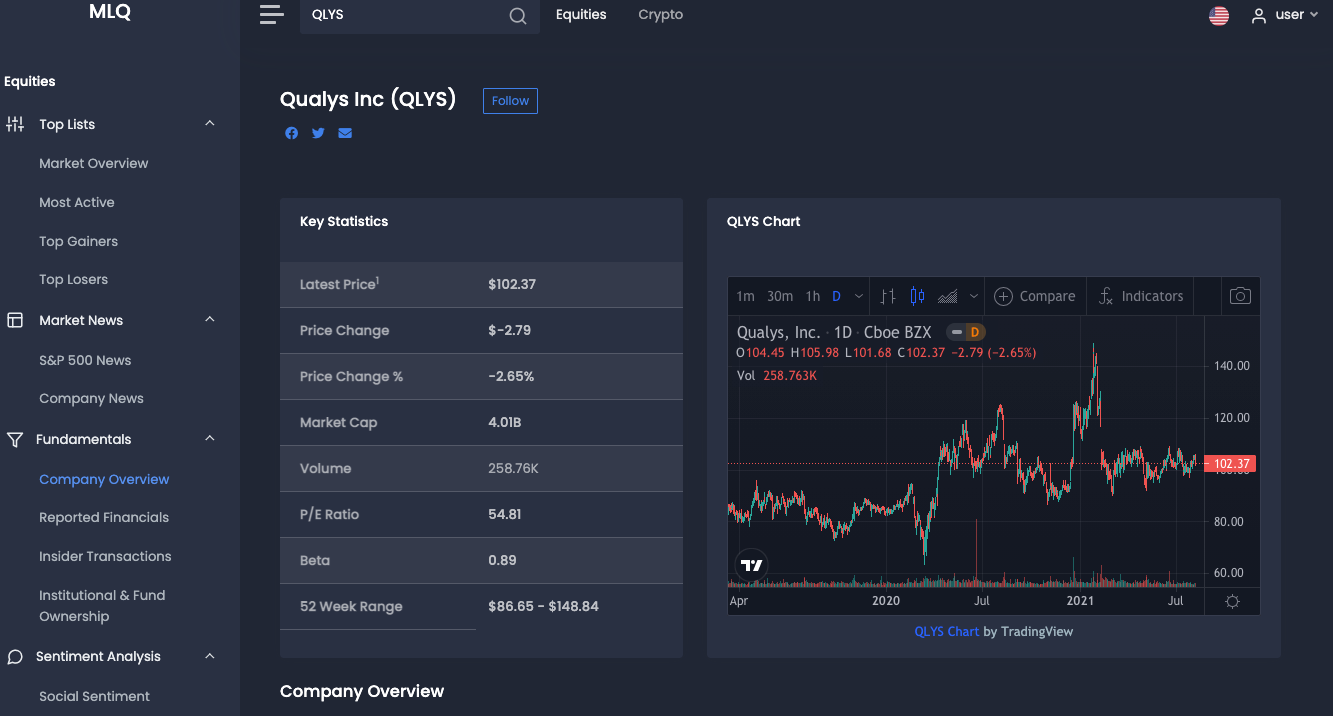

12. Qualys (NASDAQ:QLYS)

Another enterprise security software company, Qualys (QLYS) was the first to deliver vulnerability management solutions. Qualys has an industry-leading cloud security and compliance program and already has these blue-chip companies as sponsors: Apple, McDonald’s, Coca Cola, Visa, Microsoft, Amazon, Neftflix, and Alphabet.

In fact, for such a small company, Qualys has over 19,000 global customers across over 130 different countries. Its Qualys Sensor Program is highly scalable, self-updating, and centrally managed. One advantage to Qualys’ cloud platform is there is no hardware to buy or manage, as everything is accessible through its web interface. This allows for increased operating margins, lower operating costs, and unprecedented scalability.

Finally, Qualys has the approval of big tech, as it operates alongside all three of the largest cloud providers in the world in AWS, Google Cloud, and Microsoft Azure.

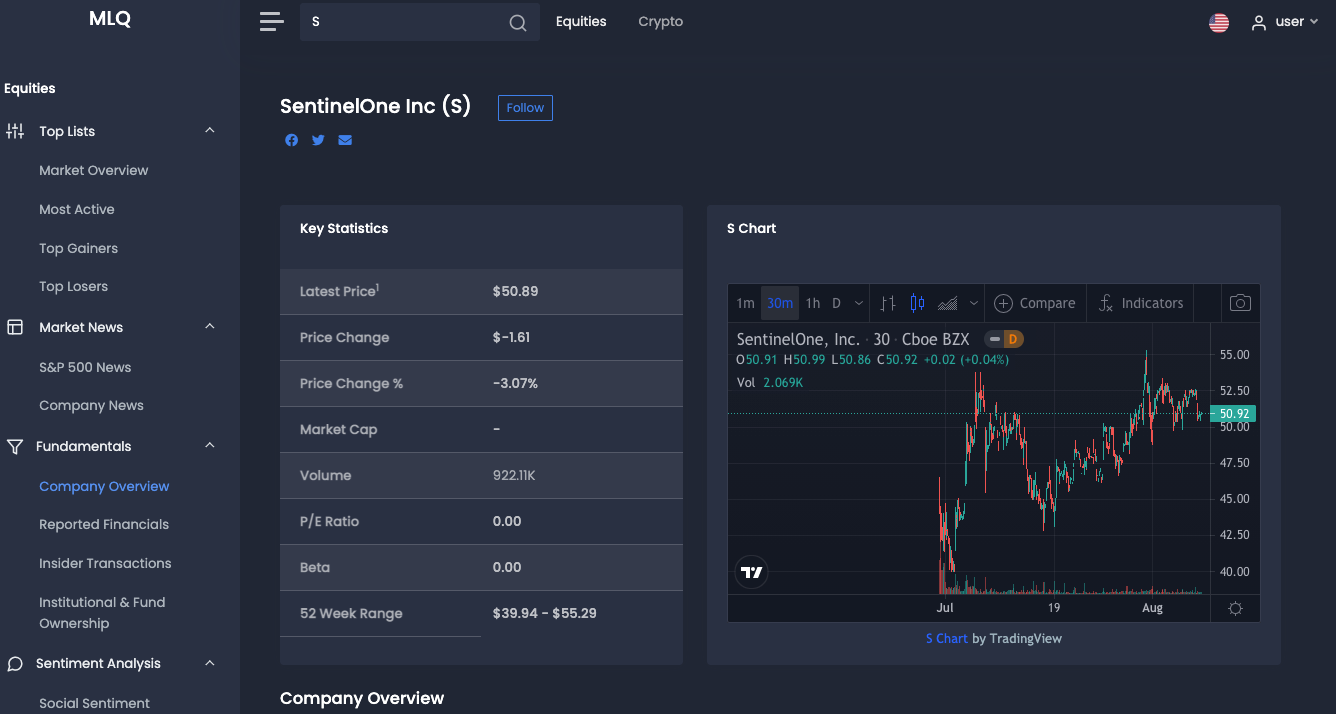

13. SentinelOne (NYSE:S)

SentinelOne is new to the public markets, making its debut on Wall Street at the end of June. The company provides more cloud security services, as well as on-site virtual appliances. If there is a bearish case for SentinelOne it's that it competes directly with CrowdStrike, the difference being CrowdStrike is solely cloud-based, while SentinelOne has on-site security as well.

While SentinelOne claims this dual system is faster than CrowdStrike, it also apparently eats into the company’s gross margins, which are consistently lower than CrowdStrike. In addition to this, SentinelOne’s dollar based net retention rate dipped slightly, and CrowdStrike has seen consistent growth since its IPO.

When it comes to cloud endpoint security, it seems as though companies either choose CrowdStrike or SentinelOne, and unfortunately for SentinelOne, CrowdStrike is winning that race. CrowdStrike also trades at nearly half the price to sales ratio of SentinelOne, which indicates that SentinelOne’s stock is currently overvalued. If you are investing in one of these companies, it’s hard not to like CrowdStrike right now over SentinelOne.

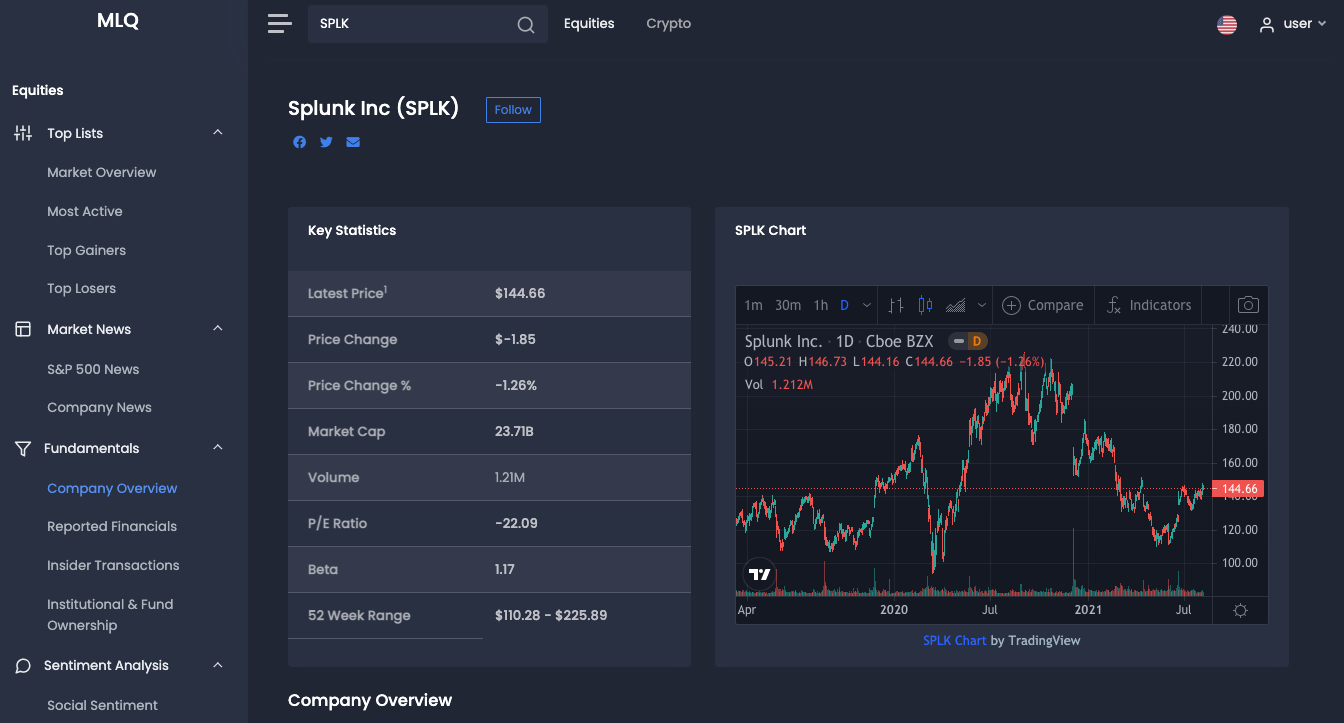

14. Splunk (NASDAQ:SPLK)

More than just a fun word to say, Splunk (SPLK) is an enterprise cloud services security company that operates out of San Francisco, California. Splunk boasts an incredibly high net retention rate, as it has not fallen below 129% during the last five quarters.

Recently Splunk switched to a subscription based service for its software, something that investors love to see as it brings in incredibly high recurring revenues. Its average cloud services subscription contract lasts for 24 months, and its non-cloud services are just as long.

One thing to note about Splunk in its last quarter, its international total revenues declined although its international cloud revenues increased. Splunks main program undertakes the analysis of high volumes of machine-generated data, and is trusted by 91 of the Fortune 100 companies.

Splunk’s stock is currently trading at a discount, as the stock has actually lost 13% year to date, and is down 28% over the past year, so now may be as good a time as any to begin a position in Splunk.

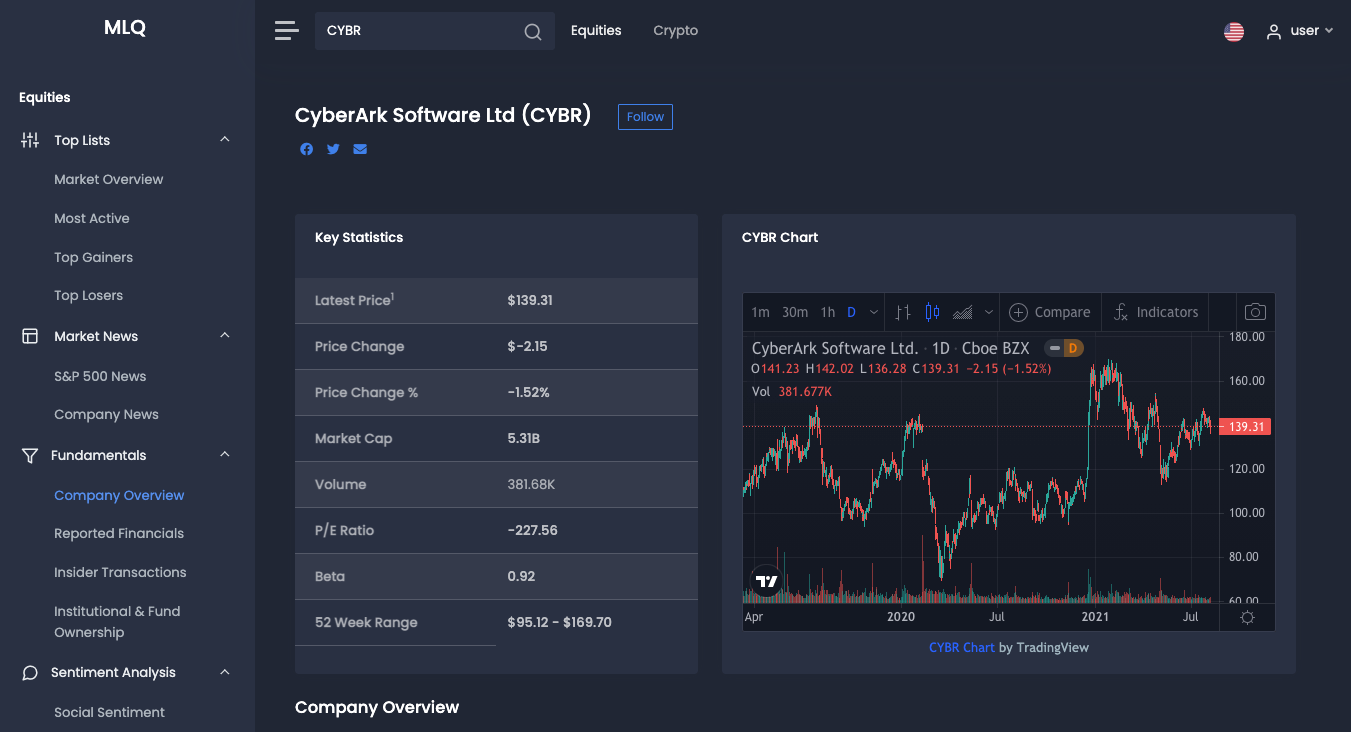

15. Cyberark Software Ltd (NASDAQ:CYBR)

Cyberark (CYBR) is a company that deals specifically with Privileged Account Security. It is another smaller company with a market cap of just over $5 billion, although Cyberark does nearly $300 million in annual recurring revenue.

Cyberark boasts over 6,700 customers, and over 50% of Fortune 500 companies. Its Identity Security Platform is industry leading, and utilizes artificial intelligence and machine learning to identify threats. Cyberark’s partners are the who’s who of the business world with partnerships like AWS, Microsoft, Google, Okta, and IBM. Cyberark is growing fast too with a 41% year over year increase in annualized recurring revenues buoyed by its recurring subscription revenues.

The largest direct competitor to Cyberak is Okta (NASDAQ:OKTA), which is an identity management and security company. Cyberark is following in the footsteps of newer companies like CrowdStrike by going completely cloud-based and ditching the old-school on-prem appliances.

Cyberark’s largest bull case is just how niche its market is and how dominant the company is in it, as is cited in the Gartner Market Research reports that name Cyberark as a market leader.

That's it for our list of the 15 cybersecurity stocks to watch in 2021, we'll be sure to keep this article updated as new companies enter the industry.