Artificial intelligence is one of the biggest secular trends that is rapidly penetrating many of the facets of our daily lives. With the global rollout of 5G connectivity, artificial intelligence is no longer something that only exists in science fiction movies. It is in our mobile phones, appliances, apps, and even our vehicles.

As investors, we are always looking for the next big industry to explode. Investing in secular trends as they are happening is a fine way to make money in the stock market, but investing in these trends on the ground floor can bring life-changing returns. As an industry and as a technology, artificial intelligence is still in its infancy so there is still time to make some major gains if you know which stocks to target.

You may be wondering which stocks those may be. Luckily, we’ve compiled a list of the best AI stocks to watch.

Stay up to date with AI

Disclaimer: The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.

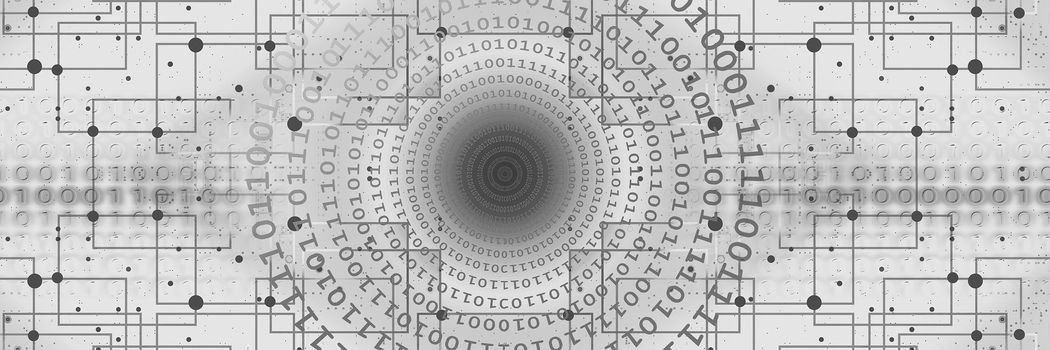

1. C3.ai (NYSE:AI)

Founded in 2009 by Thomas Siebel, C3.ai is looking to streamline enterprise solutions using its C3.ai enterprise platform. The software uses machine learning to solve complex analytical problems for companies and increase efficiencies and output.

It seems like a vague concept but take one look at C3.ai’s client portfolio and you can see the company is for real. It includes the likes of Microsoft, Baker Hughes, Bank of America, 3M, Royal Dutch Shell, and the U.S. Air Force. C3.ai is a SaaS company at heart and charges subscription contracts for its enterprise software.

The company identifies itself as the world’s largest enterprise AI footprint with over 1.5 billion predictions per day and nearly 5 million machine learning models. Revenues have been growing year over year at a substantial rate, although 2020 to 2021 saw a decline due to COVID-19 interruptions with both its own business and its clients. One thing to note moving forward, both Microsoft and Amazon have integrated their own AI platforms into their cloud services, which may make for some substantial competition in the future.

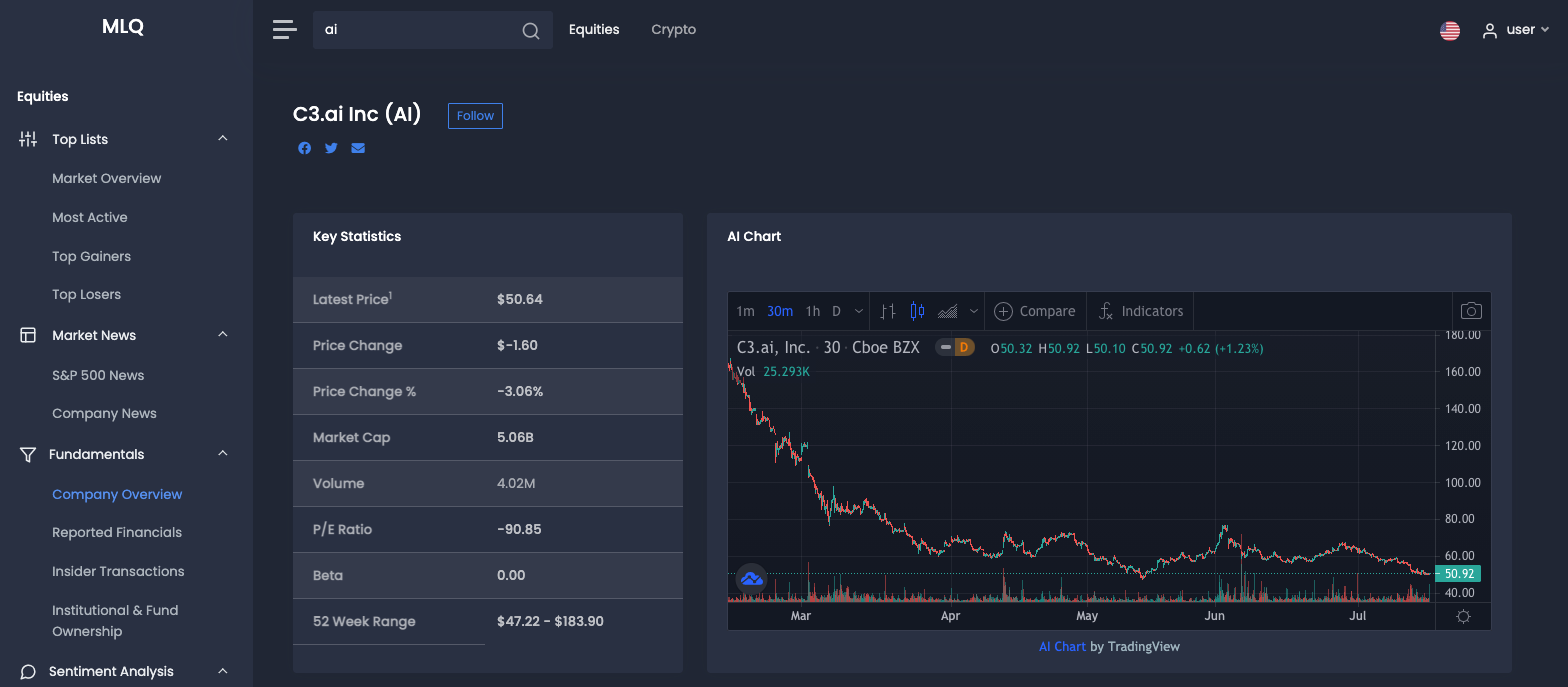

2. Palantir Technologies (NYSE:PLTR)

Similar to C3.ai, Palantir is an enterprise software company that charges contracts for the usage of its platforms. Palantir is one of the more polarizing stocks on the markets, with a faithful following from both retail and institutional investors, as well as its fair share of bears as well.

Palantir is also controversial, as its cooperation with ICE to identify and locate illegal immigrants for deportation, earned the company a black eye in the public relations world.

But what exactly does Palantir do?

Palantir is the industry leader in big data analytics. Using its three platforms, Gotham, Foundry, and Metropolis, companies and agencies can take massive amounts of data and sift through them seamlessly. The company has received flack for relying on government contracts, although since it went public in September of 2020, it has focussed on establishing its consumer-facing side.

Like C3.ai, Palantir has a long list of global partners including the U.S. government, 3M, IBM, Amazon, Airbus, and Morgan Stanley, just to name a few. Despite operating for over 20 years, Palantir still isn’t profitable, but the company does estimate revenues to grow to over $4 billion per year by 2025.

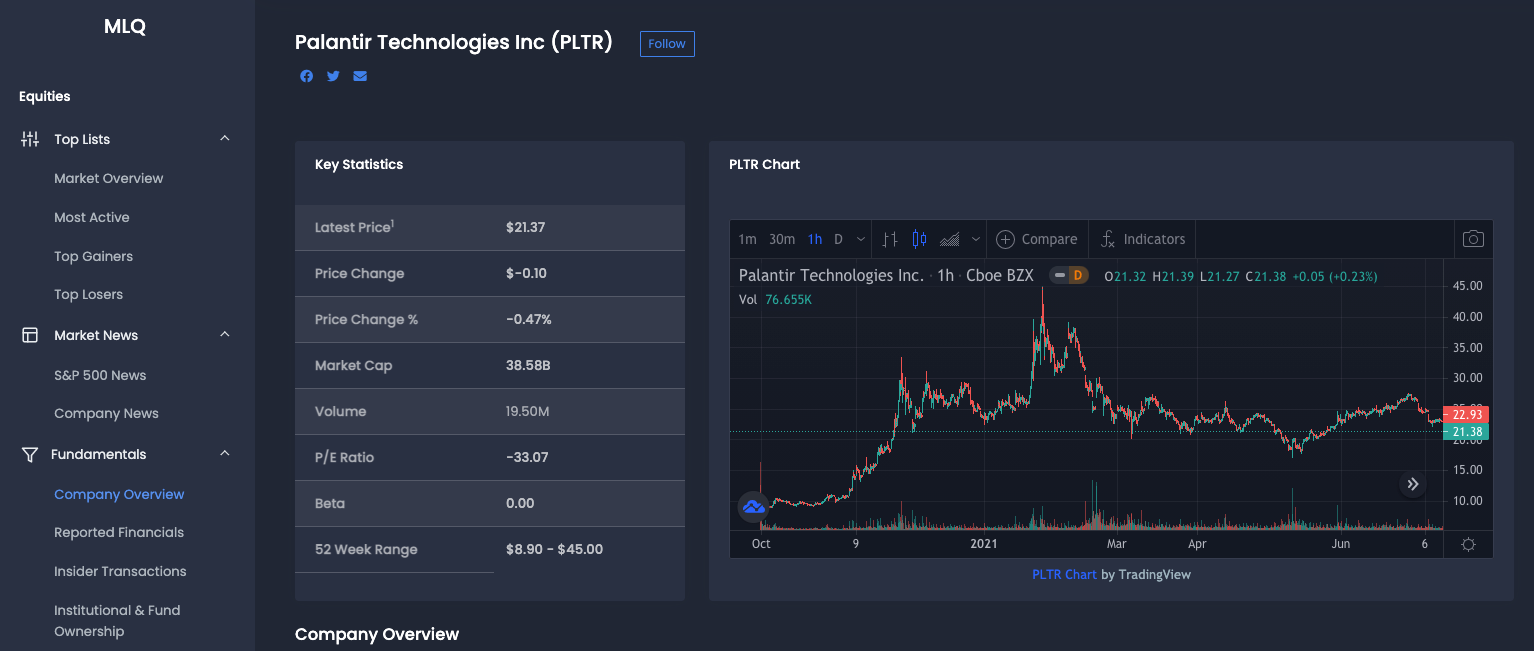

3.NVIDIA (NASDAQ:NVDA)

Simply put, NVIDIA is a beast of a company and is set to be one of the tech leaders for the next few decades. NVIDIA has its hands in all sorts of sectors including CPU and GPU chips for computers, gaming devices, and even cryptocurrency miners, as well as being the industry leader in data centers, which provide an end-to-end computing platform that provides enterprise solutions for the modern world.

NVIDIA is involved in multiple different forms of deep learning and machine learning, including the development of autonomous vehicle technology, its VMWare hybrid software suites, and its Volta GPU chips which can bring AI to any industry, Volta provides over 125 teraFLOPs of deep learning performance.

The best part is that NVIDIA is still growing and hasn’t even hit its stride yet. The company already has a market cap of over $450 billion and is still growing its revenues nearly 90% year over year, while growing its operating income, net income, earnings per share, and cash flow by over 100% each. NVIDIA is well-positioned to be a 1 trillion company over the next decade, if not sooner.

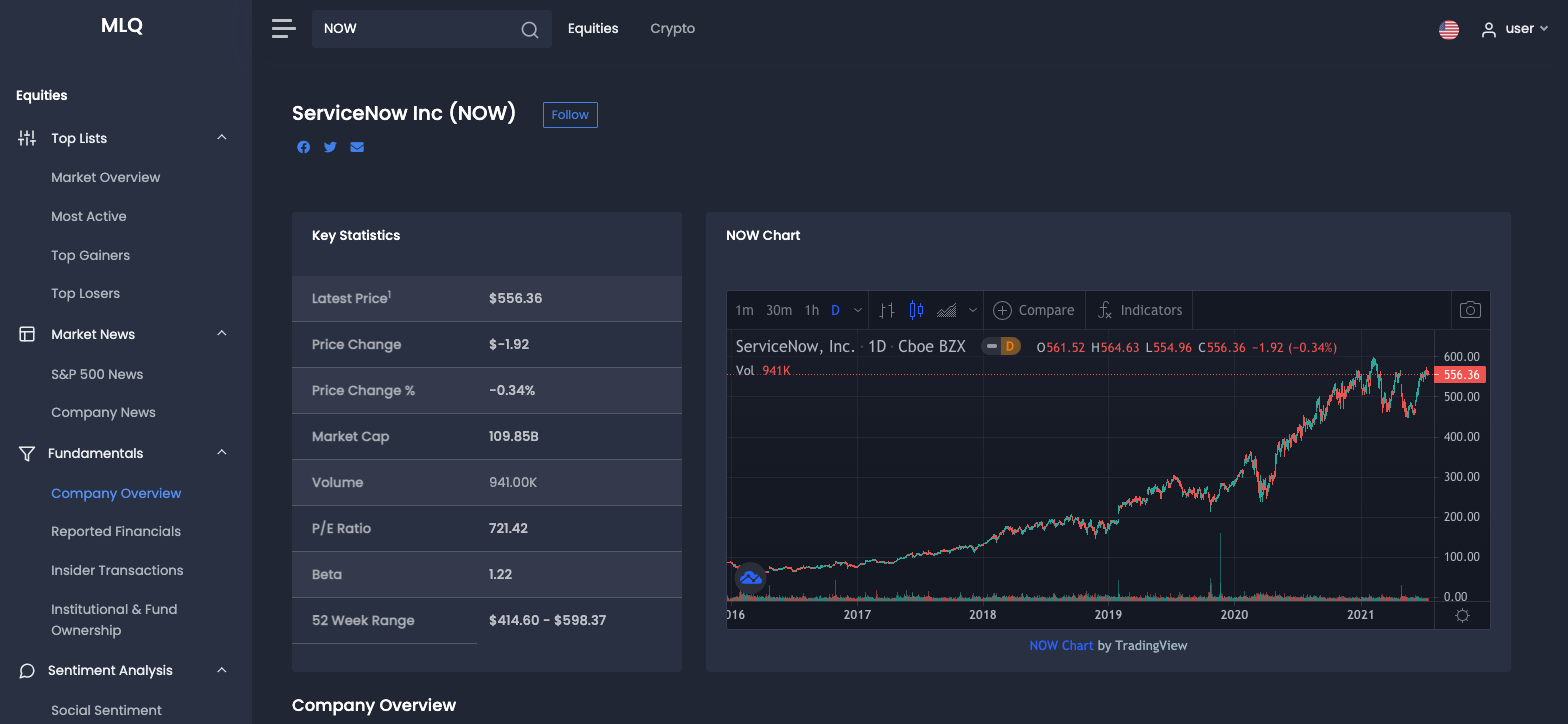

4. ServiceNow (NYSE:NOW)

ServiceNow is one of those rock-solid SaaS companies that for some reason just flies under most investors’ radar. It is also an enterprise software platform that helps to streamline efficiency and automate tasks that were once done by human employees.

The company calls its brand of artificial intelligence, predictive intelligence, and is a part of the Now Intelligence enterprise software platform. Machine learning works in the background and learns which tasks need to be automated, recommends answers and solutions, detects major incidents, and even discovers hidden patterns in day-to-day tasks.

Predictive Intelligence is available as an add-on to the Now Platform, so it will cost extra for enterprises to integrate this into their ecosystem. ServiceNow has over 6,900 global partners, including an impressive 80% of the Fortune 500.

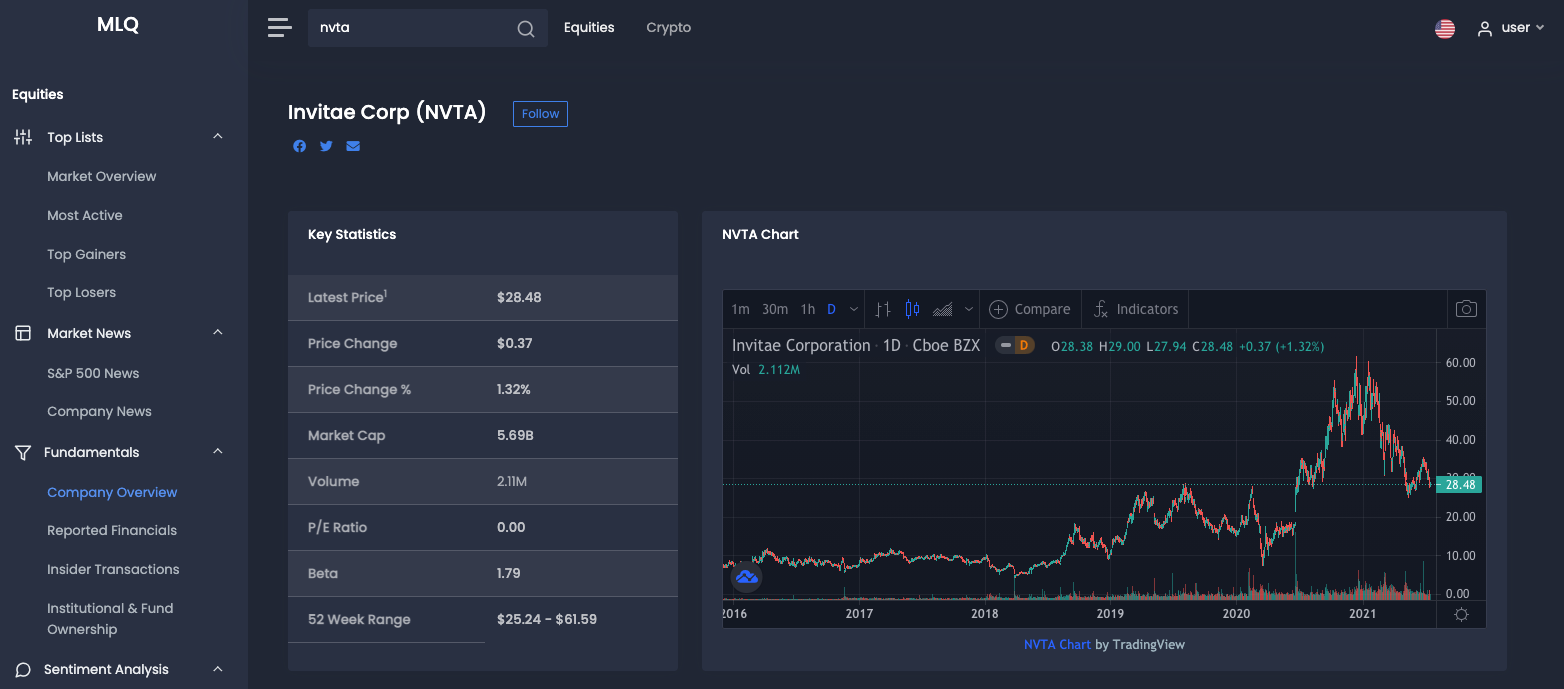

5. Invitae Corp (NYSE:NVTA)

Adding in another secular trend that is taking the investing world by storm, Invitae is a genetics biotech company that provides gene panels and single-gene testing for a broad range of illnesses which includes cancer, cardiology, neurology, pediatrics, and metabolic diseases.

Invitae sells genetic testing kits that can help you determine which disease you may have a higher chance of developing, as well as being able to test pregnant women with non-invasive prenatal screening.

In March of 2020, Invitae acquired Diploid which is a maker of AI-powered clinical diagnosis technology which allows Invitae to perform whole genome sequencing in a matter of minutes. Genetics is the future of healthcare, and companies like Invitate are utilizing artificial intelligence to capture accurate results in a much shorter amount of time.

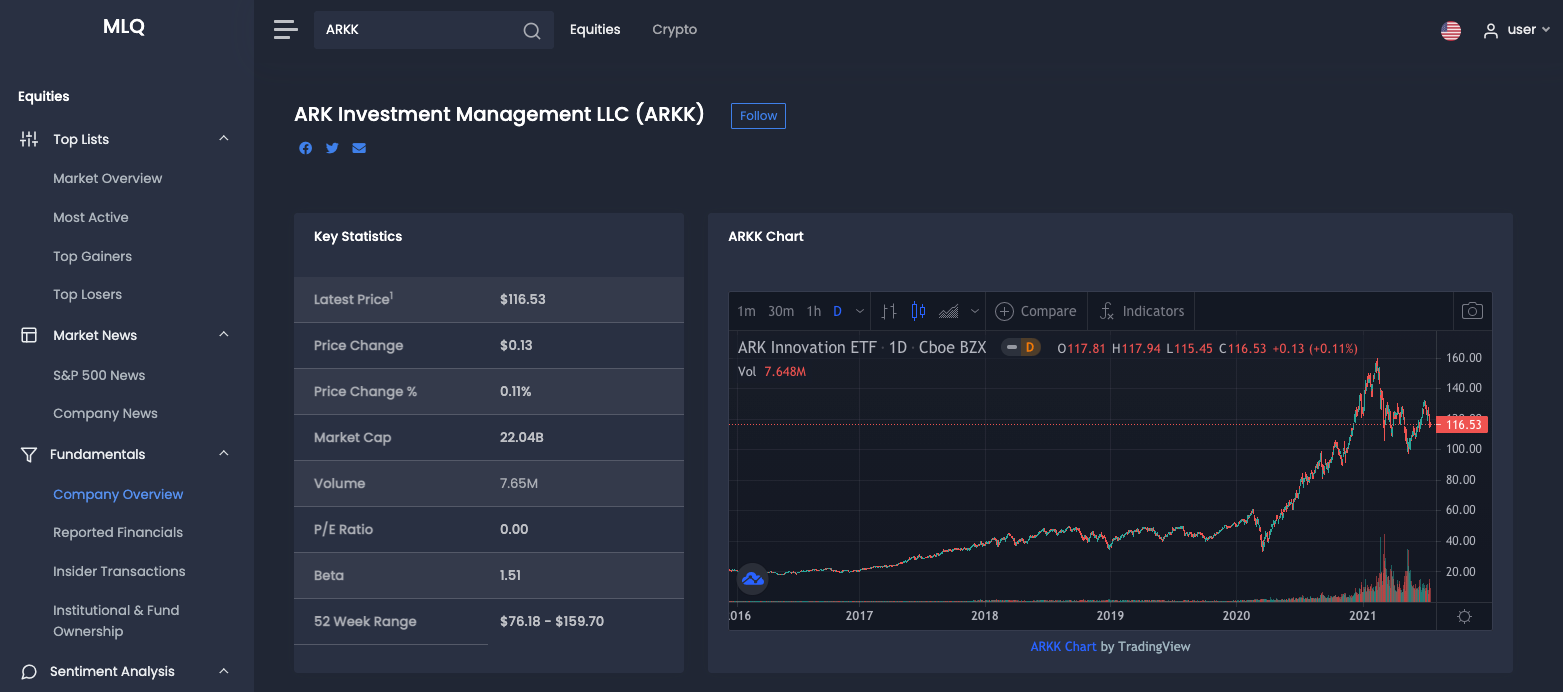

6. Ark Innovation ETF (ARKK)

Ark Invest is a cutting-edge investment firm that focuses on disruptive innovation and high-growth technology companies. The Ark Innovation ETF is its flagship fund and is hand-selected by Ark Invest founder, Catherine Wood.

In 2019, ARKK was named the Active ETF of the year, and it is often cited as the benchmark measure of how growth sectors are performing in the broader markets. Some companies that operate in the artificial intelligence industry that are held in ARK.K include it’s single largest holding Tesla, Palantir, UIPath, Invitae, and Twilio.

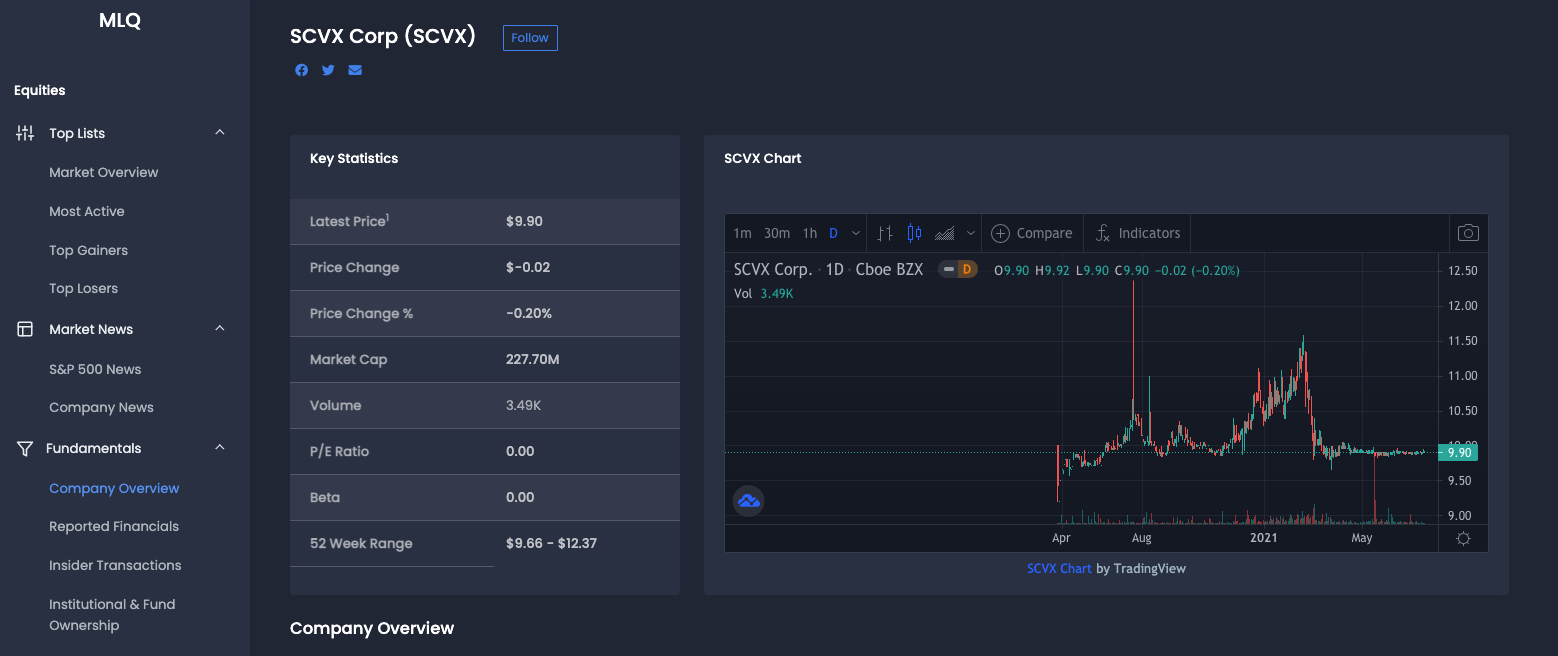

7. Bright Machines (NYSE:SCVX)

Bright Machines is a manufacturer of factory robotics that utilizes automation to complete mundane and monotonous tasks. The company is not yet trading on the public markets, but has agreed to a reverse merger with SPAC stock SCVX, and will debut at some point in the second half of 2021.

Bright Machines is exactly what its name implies: it manufactures intelligent machines that can cut costs, raise margins, save floor space, and minimize human errors. Founded in 2018, Bright Machines owns proprietary intellectual property which includes 36 patents for automating workflows and processes. The company is involved in a number of different manufacturing sectors with existing partnerships with companies like Honeywell, Microsoft, General Electric, Siemens, and Autodesk.

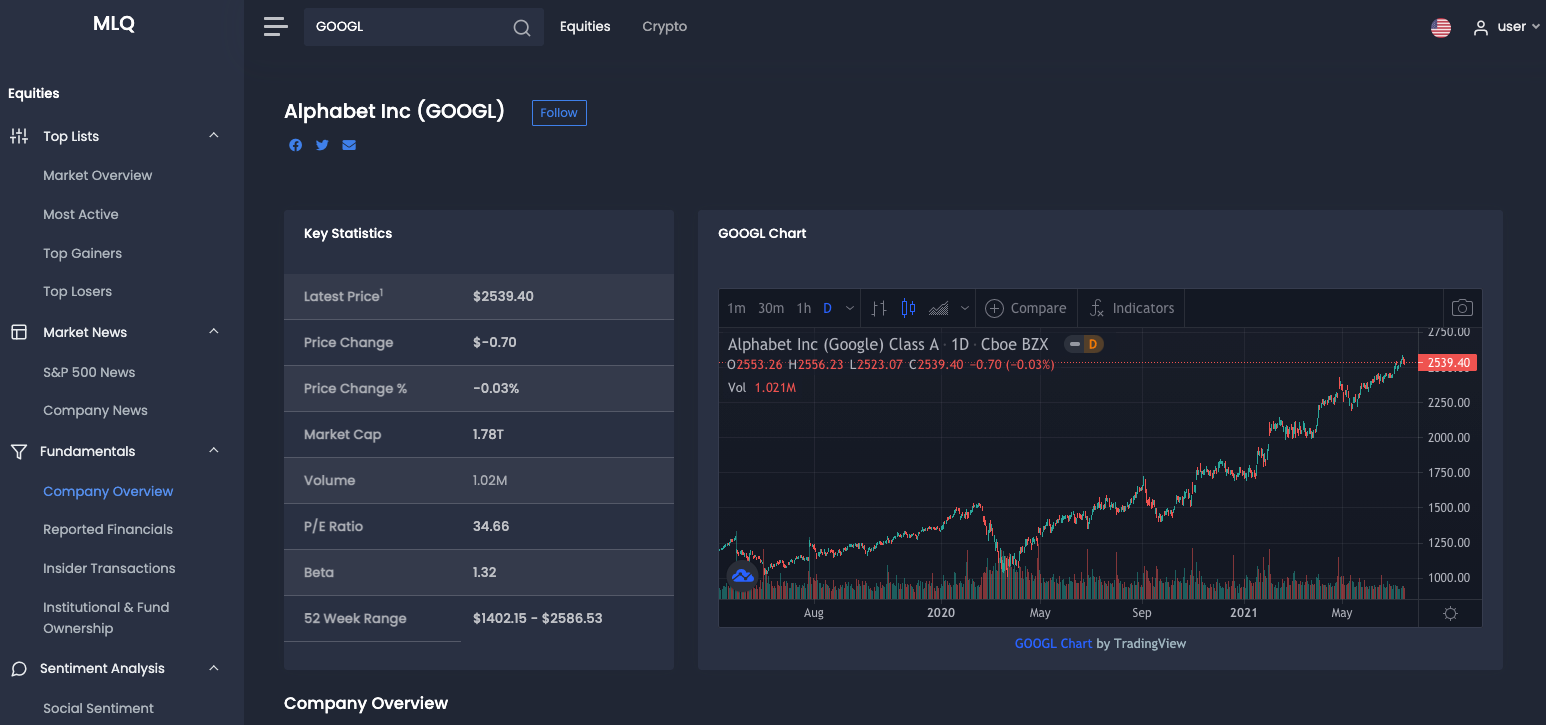

8. Alphabet (NASDAQ:GOOGL)

We all know what Google and its suite of apps is, but have you ever heard of DeepMind? It is the British artificial intelligence subsidiary of Google that was founded back in 2010.

DeepMind grabbed headlines back in 2016 when its AlphaGo program defeated the world champion in the game of Go. While this was a fun exercise, DeepMind is involved in projects that are more beneficial to the world like its recent successes in protein folding. With its AlphaFold system, DeepMind can accurately predict the shapes of proteins that can be the runway to curing diseases and understanding the very basic building blocks of life itself.

DeepMind has also developed methods of diagnosing eye diseases before they manifest, as well as saving energy for its parent company Google by developing an artificial intelligence system that helps with data center cooling which reduces energy consumption by 30%. Oh and all of those apps you use on a daily basis like Gmail, Google Search, Google Maps, Google Assistant, and Google Cloud? DeepMind is constantly working to make those more efficient, as it analyzes usage patterns which have led to Android operating systems that can reduce battery usage and improve user experience.

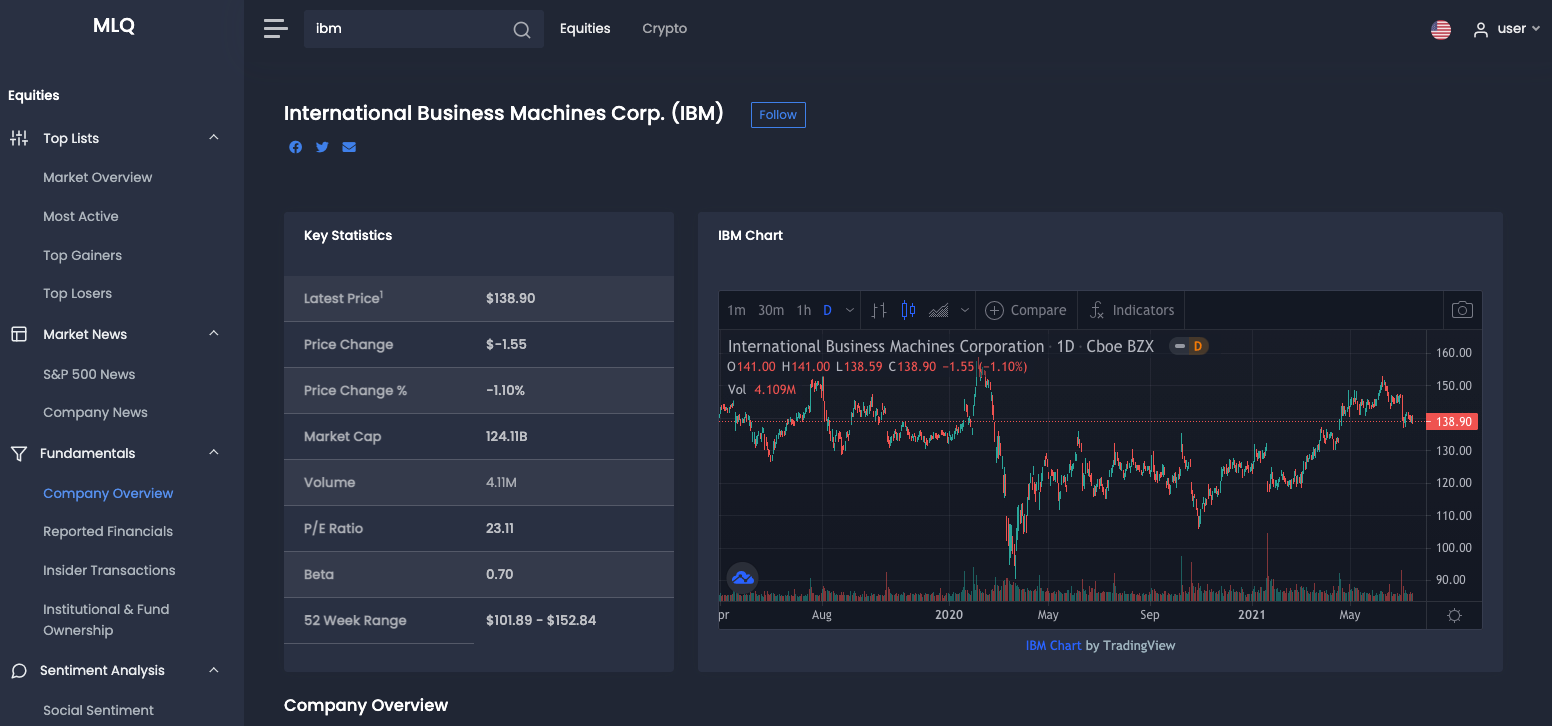

9. IBM (NYSE:IBM)

IBM’s Watson AI question and answer software was one of the original artificial intelligence programs to make it to the mainstream. While it started out as a way of answering questions through machine learning, it has evolved into yet another enterprise software system that assists people in making decisions on a daily basis. Watson comes as a software or as a supercomputer hardware system and is utilized by companies like KMPG, Korean Air, Thomson Reuters, and Humana.

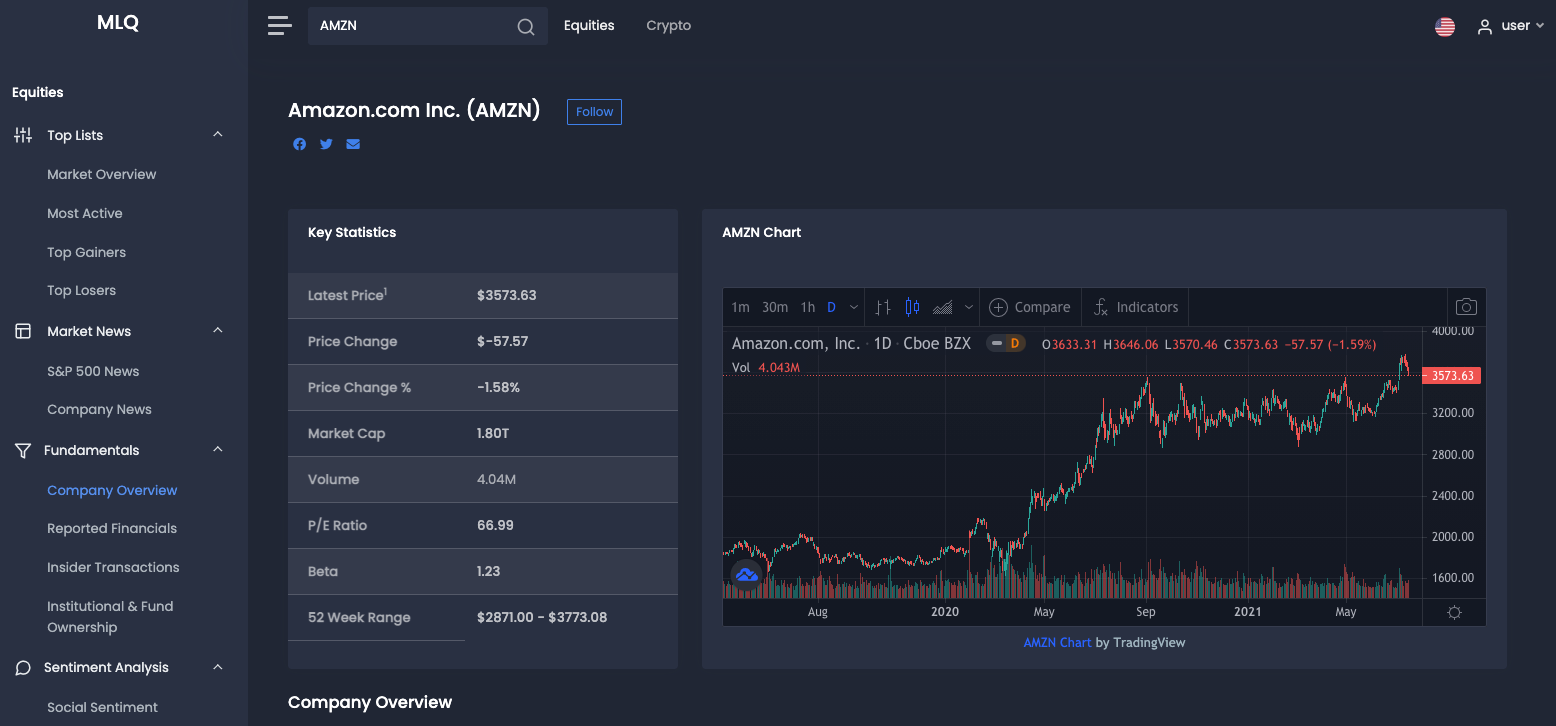

10. Amazon (NASDAQ:AMZN)

Amazon may not be the first company you usually think of when it comes to artificial intelligence, but the global eCommerce leader utilizes machine learning for its Amazon Web Services cloud platform. AWS and Amazon SageMaker can implement machine learning directly into the integrated environment, and more companies use AWS AI than any other cloud platform.

Companies like Disney use AWS AI to sift through millions of images in their vast library of intellectual property, T-Mobile uses it for customer service, and Duolinguo uses it to analyze data and provide intelligent predictions in helping people around the world learn new languages.

Amazon also utilizes machine learning in its eCommerce site. It’s not a coincidence that the things you buy often pop up again when shopping through the site, and searches can be filtered and catered towards each individual shopper’s previous search history. We don’t have to tell you that Amazon is an interesting AI investment, as it is one of a handful of companies that could dethrone Apple (AAPL) as the most valuable company in the world.

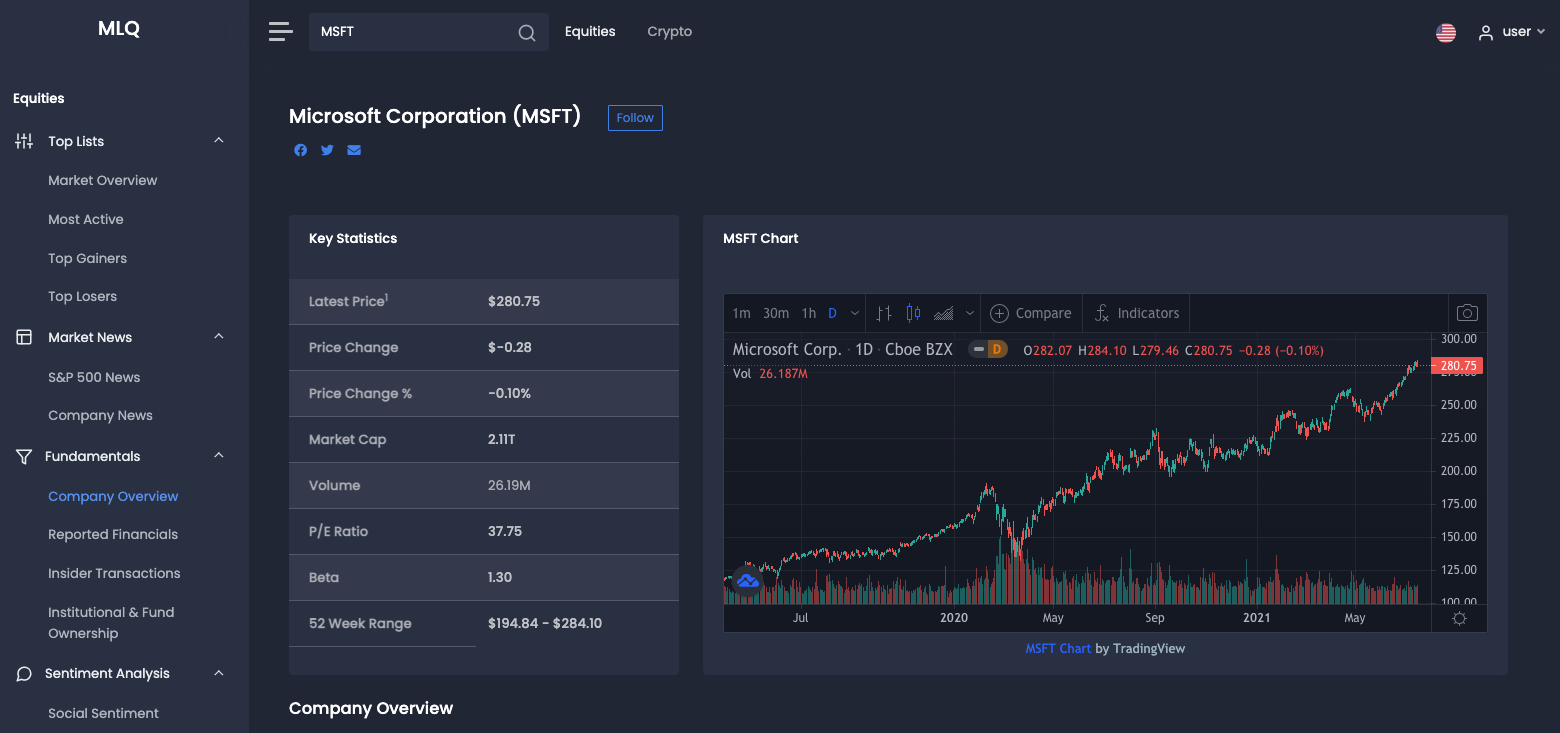

11. Microsoft (NASDAQ:MSFT)

When Microsoft made a $1 billion investment into OpenAI back in 2019, the industry was abuzz with excitement. After all, OpenAI is seen as one of the main competitors to Google’s DeepMind, so it was another arena where two tech giants could go head to head.

OpenAI was founded back in 2015 by a group of investors including Tesla CEO Elon Musk. The partnership hasn’t made too many advancements until OpenAI developed GPT-3, which is a developer tool that utilizes deep learning to create source code for applications. The program has already gained popularity amongst the developer community, and utilizing Microsoft’s wide reach into nearly every industry in the world, OpenAI is positioned to compete with Amazon’s AWS in the years ahead. But that’s not all, Microsoft has several other AI projects coming down the pipe including Project Bonsai which creates autonomous systems that can detect changes in an environment, which can be utilized in temperature or humidity sensitive conditions.

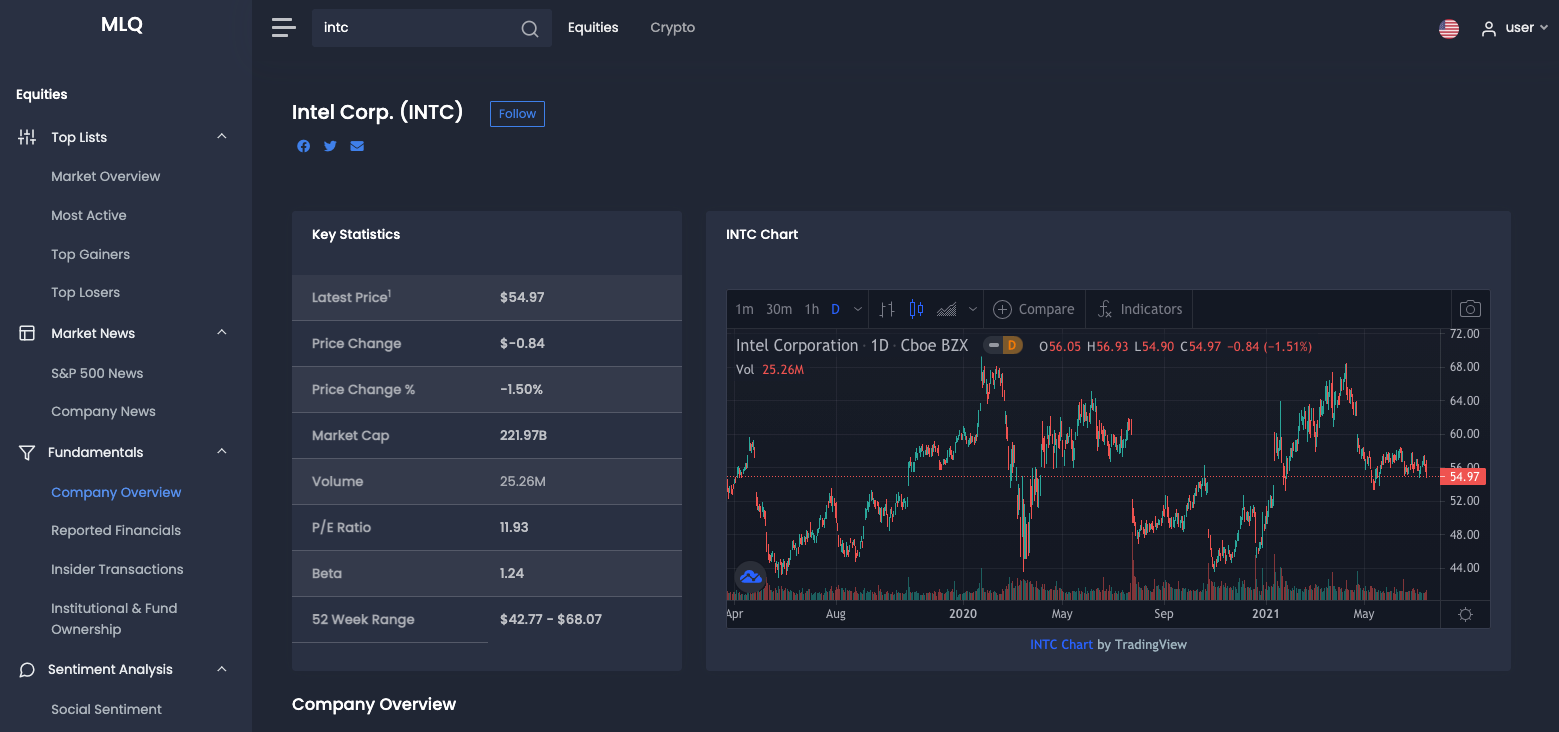

12. Intel (NASDAQ:INTC)

Like NVIDIA, Intel is one of the leading chipmakers with a focus on CPUs for personal computers. Intel has lost some market share to NVIDIA and AMD as of late, but the company is still a leading force in the tech sector and is developing its own Xeon Scalable Processors which are used for CPU machine learning.

Some familiar global companies utilize Intel’s CPUs for their own machine learning platforms including the biggest cloud providers in Microsoft, Amazon, Google, Alibaba, Baidu, and Tencent. Intel also has a full developer zone which is a full end-to-end software where developers can use Intel resources to learn and develop new platforms using machine learning. While Intel has definitely lost some of its swagger, it is still a $220 billion company with A-list clients from a number of different sectors.

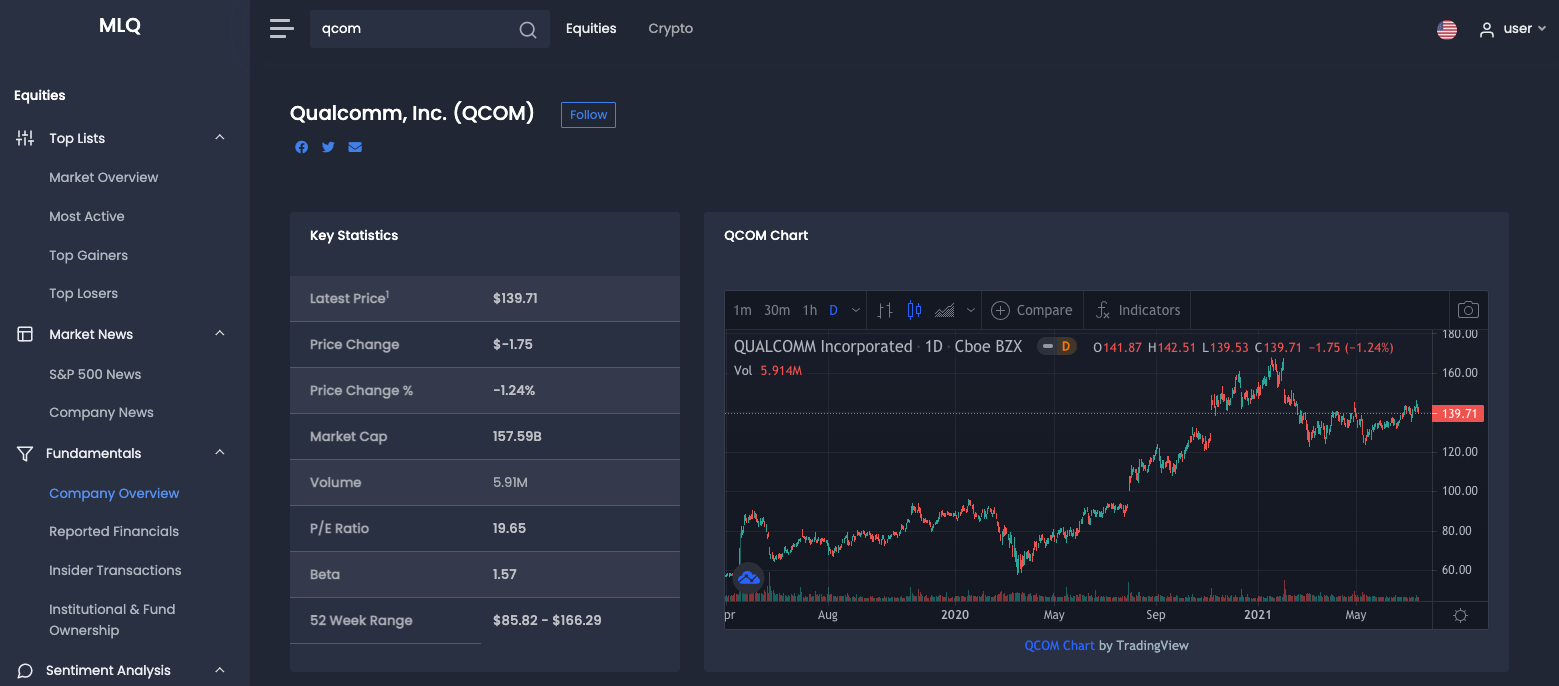

13. Qualcomm (NASDAQ:QCOM)

Qualcomm is a semiconductor company that focuses on mobile devices and wireless technology. Qualcomm already utilizes artificial intelligence in its smartphone technology, especially given the recent implementation of 5G networks.

The company’s trademark Snapdragon chips provide the ability for devices to connect and speak to one another, as ubiquitous connectivity becomes a part of our daily lives. Using machine learning, Qualcomm’s chips can allow smartphones to act more intuitively to how we use them, and can even begin to reason with users.

Machine learning can improve the device itself as it learns usage patterns and improves battery life and efficient use of network bandwidth. Qualcomm foresees its artificial intelligence technology used in smartphones, the Internet of Things (IoT), connected vehicles, and autonomous driving.

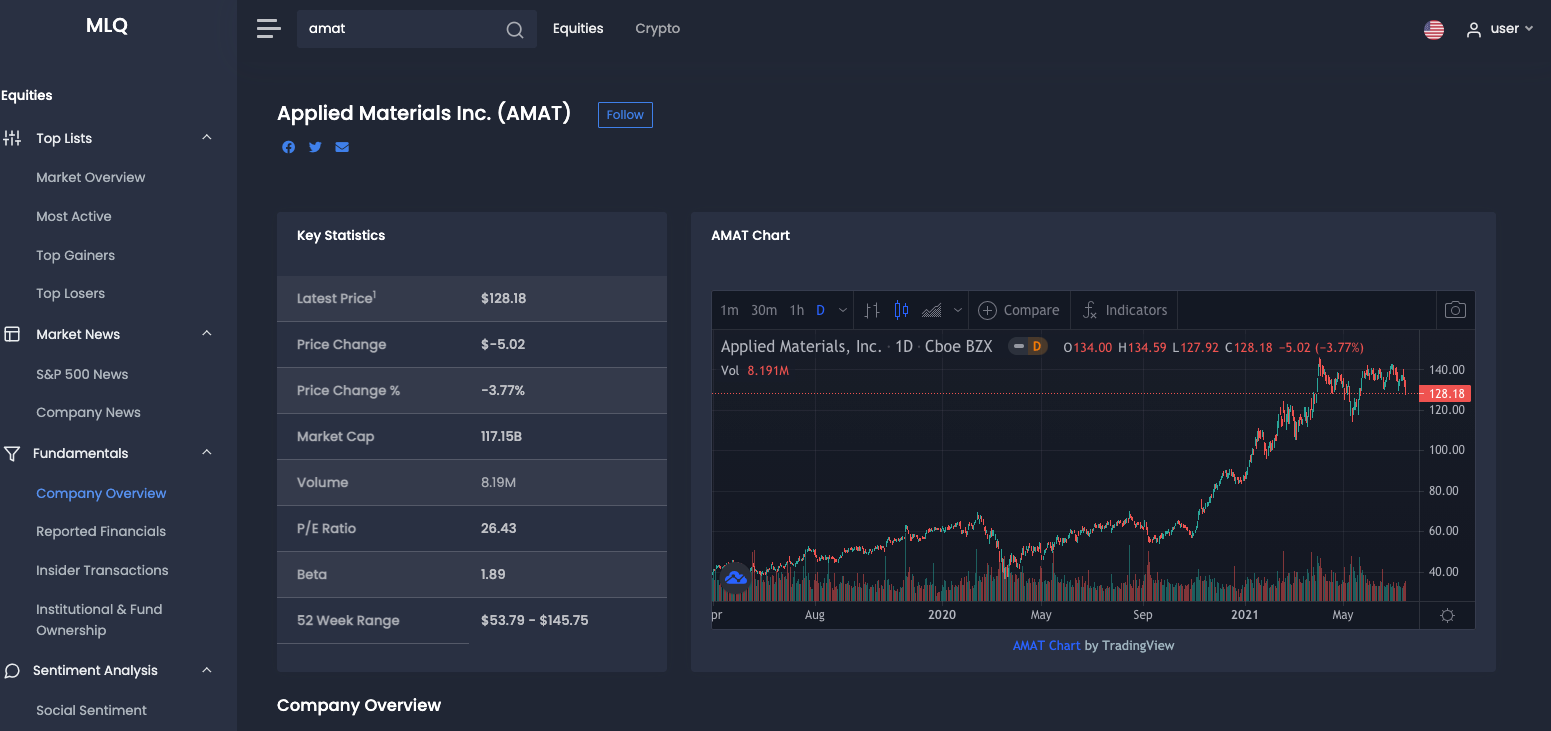

14. Applied Materials (NASDAQ:AMAT)

Applied Materials produces and manufactures materials to be used in the production of semiconductor chips. So while its clients may utilize semiconductors to create artificial intelligence technology in their devices, Applied Materials uses machine learning to help in the production of the materials that go into making those chips.

Not only does Applied Materials use artificial intelligence in its manufacturing machines, but it also has a new optical inspection system that can identify mistakes and faults in chips much earlier than before. This saves both time and money, especially as chips become smaller and nearly impossible to check with a human eye. The inspection system is called Enlight, and has been in development for the past five years. Defective chips are one of the biggest drains on chipmakers and spotting these defects early on will help to raise margins in the long run.

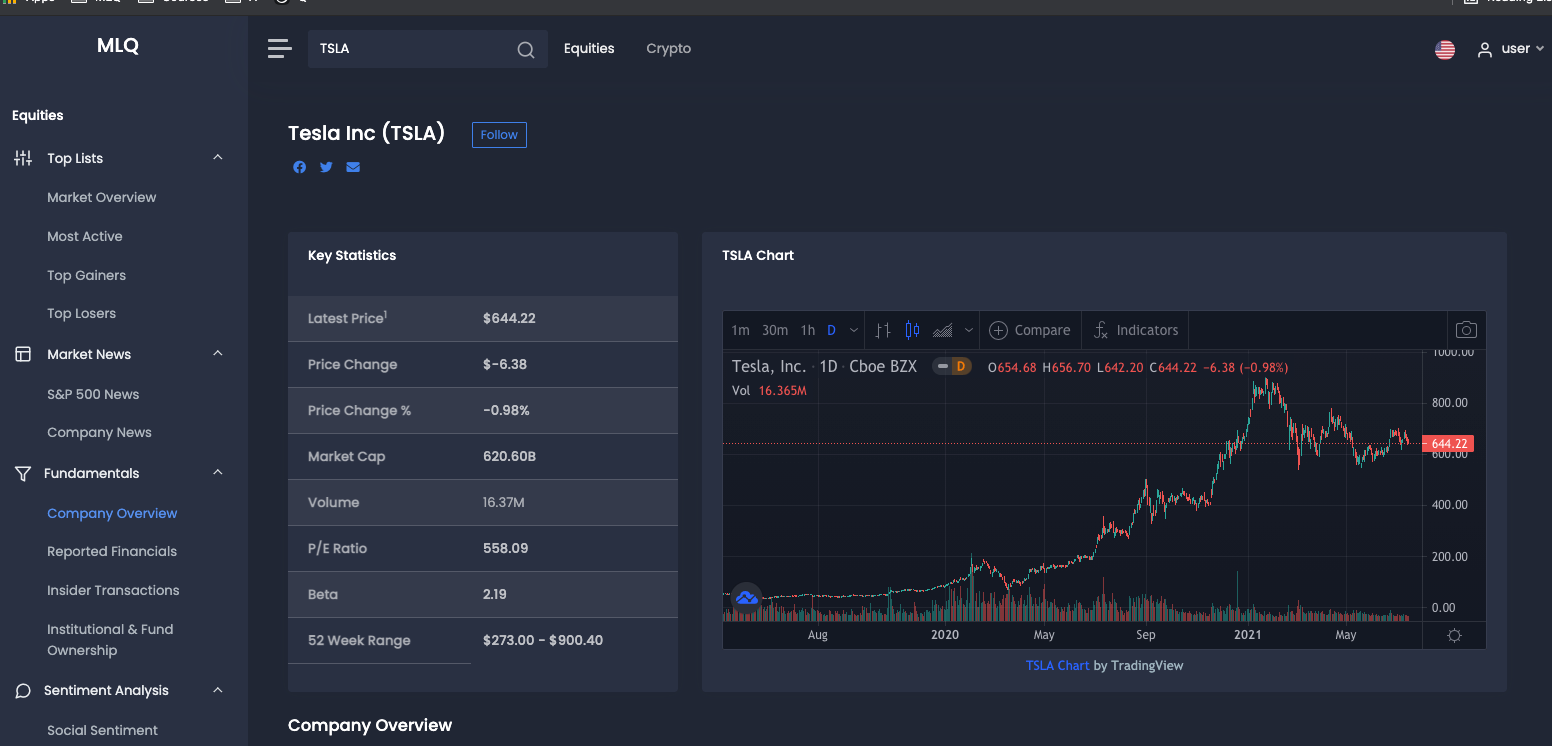

15. Tesla (NASDAQ:TSLA):

You didn’t think we could write a tech investing article without including Tesla, did you? Tesla is the industry leader in the global electric vehicle sector, delivering over 200,000 vehicles last quarter alone. Its Model 3 and Model Y vehicles are the best-selling electric vehicle models in the world.

One of the biggest advancements in Tesla’s business is the recent rollout of FSD Version 9.0 Beta software. FSD or Full Self Driving, is Tesla’s answer to autonomous driving, and utilizes neural networks consisting of machine learning via over 70,000 GPU hours of training.

Since Tesla vehicles are essentially computers on wheels, there is the ability to transfer machine learning to the entire vehicle fleet via software updates and real-time learning through the company’s autonomy algorithms. These create accurate representations and road maps of the world around the vehicles, and can constantly scale new information to the entire fleet.

Tesla is building a supercomputer that can analyze video footage and data from 1.5 million of its vehicles around the world, which effectively trains the Neural Net. In the long run, CEO Elon Musk has discussed a world where autonomous vehicles are much safer compared to human drivers, and Tesla robo-taxis can get you where you want to go without ever having to lift a finger.

That's it for our list of the top 15 AI stocks to watch in 2021. If you want to learn more about using AI and machine learning in your investment research process, check out the MLQ app.

The platform combines fundamentals, alternative data, and machine learning-based insights for both equities and crypto.

You can sign up for a free account here or learn more about the platform here.