5G is undoubtedly one of the fastest-growing trends in the technology sector. With the promise of bringing connectivity and speed to the future, it's understandable why investors are actively looking for companies that are taking advantage of this massive growth opportunity.

Just like other advanced technology trends such as artificial intelligence and quantum computing, there is a lot of hype surrounding 5G stocks. Despite the hype, the growth potential is difficult to ignore as McKinsey states about the 5G revolution:

The use cases we identified in these four commercial domains alone could boost global GDP by $1.2 trillion to 2 trillion by 2030.

In particular, the four main commercial application of 5G that McKinsey highlights—which are meant to be illustrative, not exhaustive—include:

- Mobility: Connectivity is a foundational benefit of 5G networks and mobility is one sector poised to improve greatly. Specifically, mobility refers to a broad concept in the automotive industry that includes ride-sharing services, public transportation, transportation infrastructure, as well as hardware and software required to enable this transition. McKinsey estimates that mobility will increase global GDP by $170 to 280 billion by 2030.

- Healthcare: Advanced networks of connected devices will also drastically transform the healthcare industry. Applications of low-latency networks include real-time monitoring of patients at home, which could open an entirely new subsector of coordinating medical care. In addition, AI will support the healthcare industry by facilitating faster and more accurate diagnoses and automating many caregiver tasks. All told, McKinsey estimates the 5G-enabled healthcare sector could add between $250 and 420 billion in global GDP by 2030.

- Manufacturing: With the potential of coordinating and executing highly precise operations with low latency, manufacturing is also poised to gain significantly from 5G networks. These "smart factories" will largely be run by artificial intelligence, data analytics, and autonomous robots that are optimized for efficiency. The speed and computing power to run these factories will be astronomical, which is where the ultra-low latency and high-bandwidth 5G networks will come into play. McKinsey estimates 5G-enabled manufacturing will bring in between 400 and $650 billion by the end of the decade.

- Retail: The retail sector will also change drastically from 5G by relying on sensors, tracking, and computer vision to manage warehouse inventory and supply chain operations. On the consumer side, 5G and AI will also enable personalized shopping experiences, augmented reality, and more. It's estimated the retail sector could increase global GDP by 420 and $700 billion by the decade's end.

As major telecom, hardware, and software providers are all looking to profit from the forthcoming upgrades to 5G networks around the world, investors are also looking for the companies poised to gain market share in the burgeoning industry.

It's important to note that investors will need to have patience with 5G stocks as it will take some time for the network upgrades to roll out across the globe. That said, in this article we've put together the top 20 5G stocks to watch in 2021.

Below are the top 20 5G stocks to watch, in no particular order:

- Qualcomm (QCOM)

- Skyworks Solutions Inc. (SWKS)

- T-Mobile US Inc. (TMUS)

- Marvell Technology (MRVL)

- Analog Devices (ADI)

- Teradyne (TER)

- Qorvo (QRVO)

- Broadcom (AVGO)

- NXP Semiconductors (NXPI)

- Nvidia (NVDA)

- Alphabet's (GOOGL)

- Apple Inc. (NASDAQ: AAPL)

- Cirrus Logic (CRUS)

- Ericsson (ERIC)

- Micron Technology (MU)

- Nokia (NOK)

- Advanced Micro Devices (AMD)

- Verizon Communications (VZ)

- Global X Internet of Things ETF (SNSR)

- Defiance Next Gen Connectivity ETF (FIVG)

Stay up to date with AI

Disclaimer: The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice. See our full Terms of Service here.

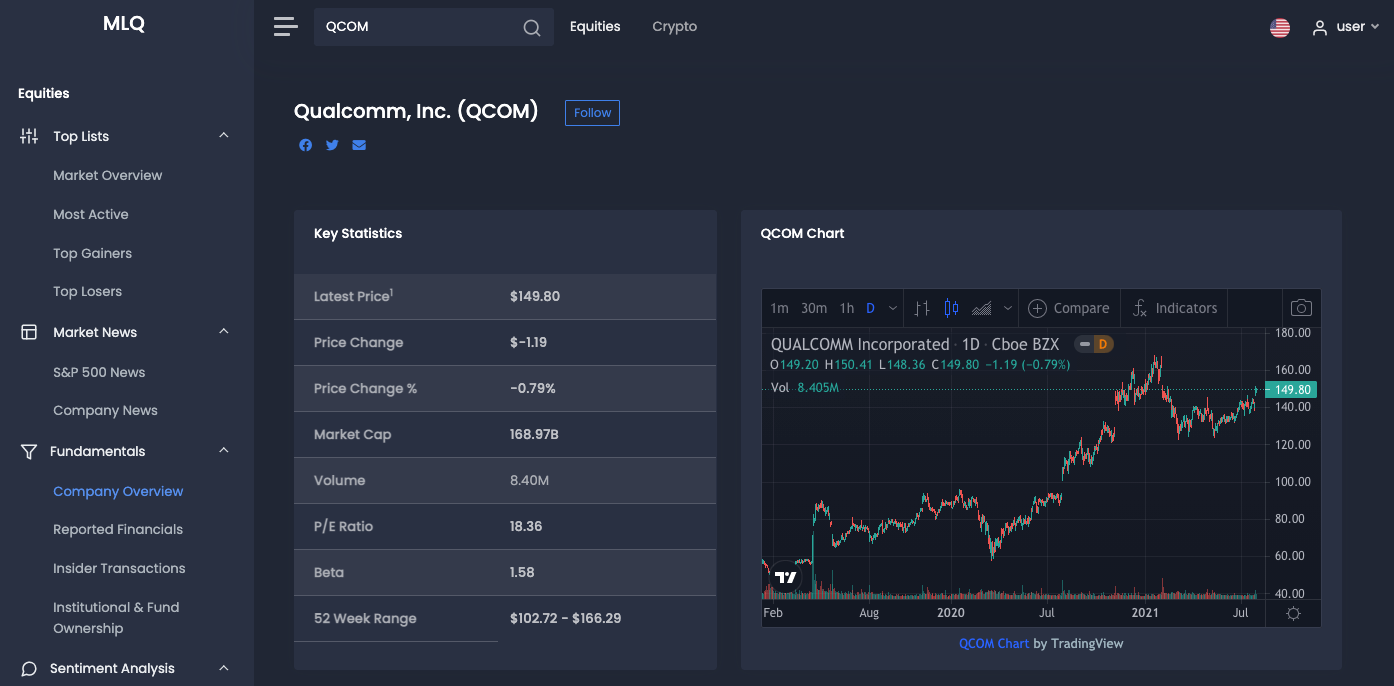

1. Qualcomm (QCOM)

Known as one of the market leaders in 5G, Qualcomm (QCOM) is a semiconductor company that specializes in building sophisticated wireless broadband technology. According to analyst Tal Liani, 5G deployment rates and subscriber growth are roughly two years ahead of 3G and 4G installations.

Given the more sophisticated technologies involved, Qualcomm management expects the 5G life cycle will be longer than the normal 10-year network cycle. Meanwhile, Qualcomm's supply relationship with Apple (AAPL) continues to be profitable.

In terms of Qualcomm's business model, their chipmaking business (QCT) drives the majority of the company's revenue. That said, the majority of its profits typically come from its higher-margin patent licensing business Qualcomm Technology Licensing (QTL).

Qualcomm an average price target of $182.50 and a "Strong Buy" rating.

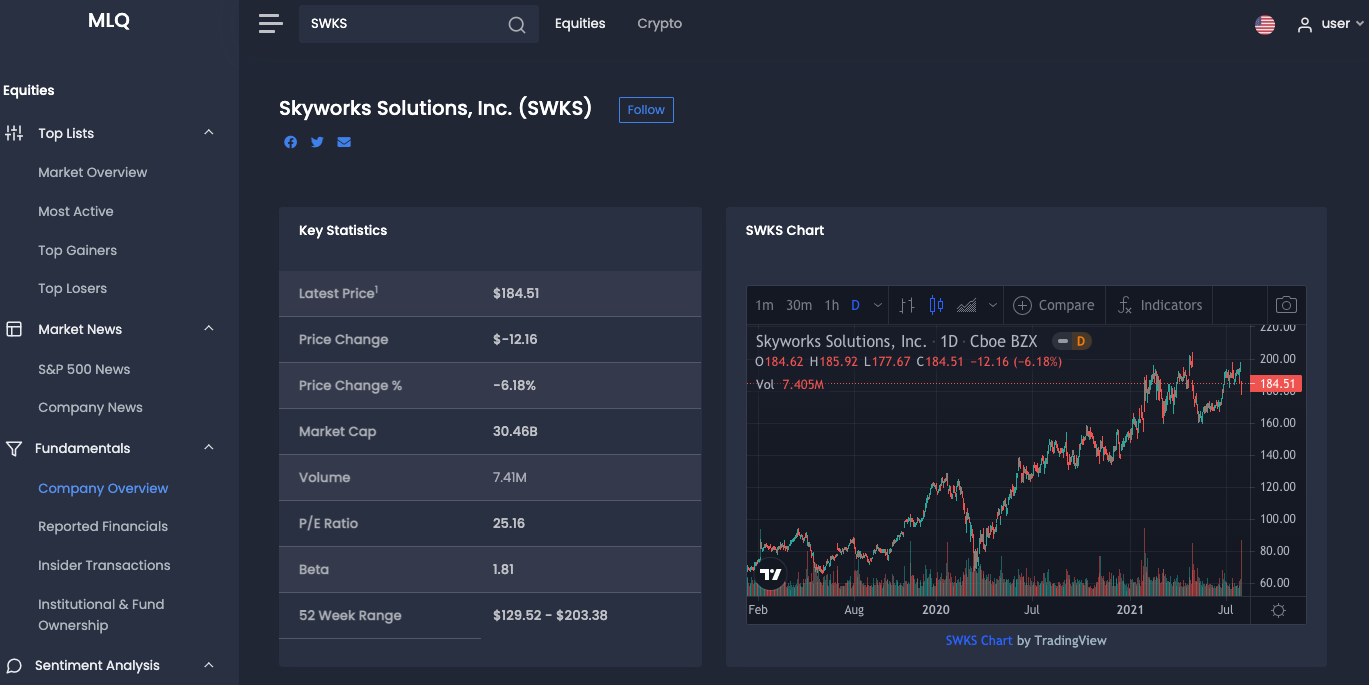

2. Skyworks Solutions Inc. (SWKS)

Skyworks Solutions (SWKS) develops and sells analog semiconductors and RF chips to a variety of companies, amongst other products. As the Fool highlights, one of their largest customers is Apple—specifically, Skyworks makes the power amplifier modules (PAMs) and diversity receive front-end modules for the newest iPhones. Samsung and Huawei are two of its other big customers, accounting for around 10% of its sales in prior years.

Analysts have an average price target of $228.4 with a Moderate Buy rating consensus for Skyworks.

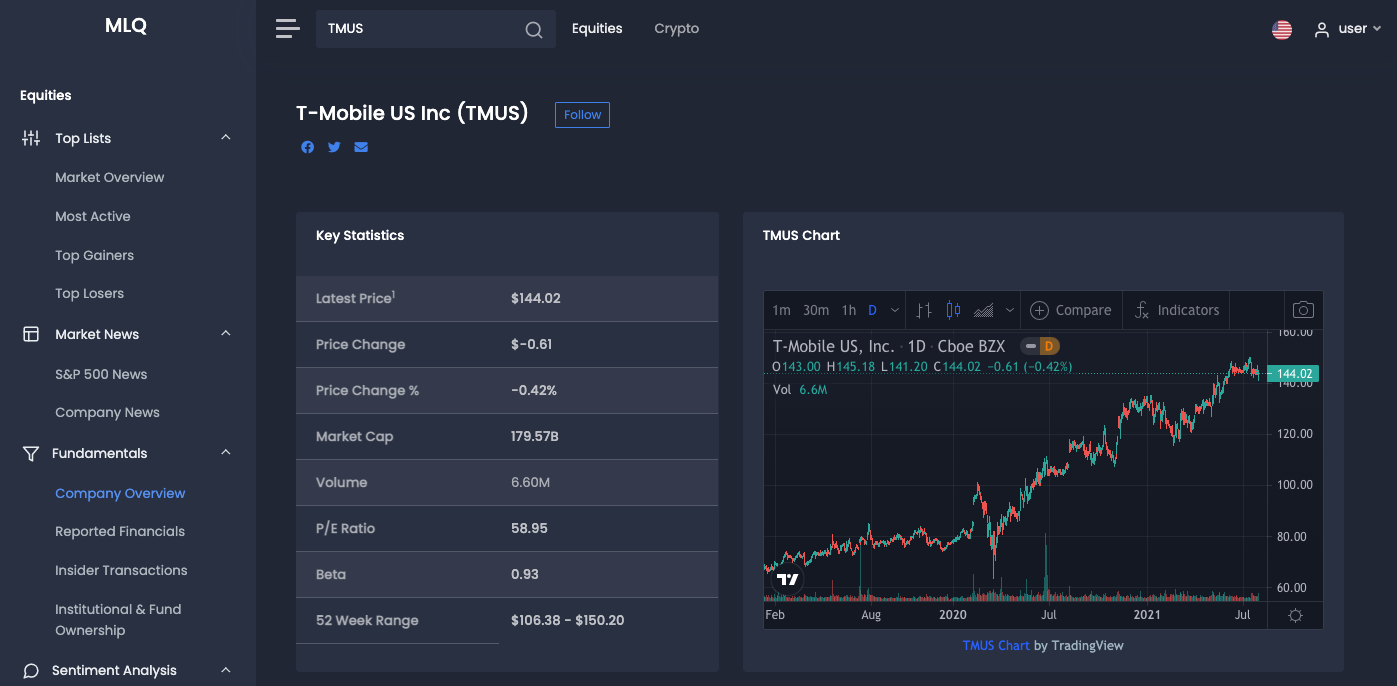

3. T-Mobile US Inc. (TMUS)

After exceeding stock market forecasts last year in fiscal year 2020, T-Mobile (TMUS) is anticipated to maintain its strong growth trajectory in the coming years. The majority of this growth expectation reflects the impact of merging with Sprint and the projected subscriber growth from 5G development.

T-Mobile's partnership with Sprint is also helping the business increase its subscriber base while also giving it access to Sprint's essential radiofrequency assets, which, when coupled with T- Mobile's, will provide the company industry-leading 5G technology.

As this Forbes author writes, T-Mobile's 5G network now spans 1.6 million square miles of the United States, which is more than double the size of their nearest competitor: AT&T.

T-Mobile intends to expand its network to smaller markets and rural regions, with the goal of increasing its market share to close to 20% in the next five years, up from its present low teens. Over the following several quarters, a strong increase in revenue will likely balance a short-term reduction in margins due to their investments in 5G expansion.

Analysts have an average price target of $165 with a "Strong Buy" rating consensus.

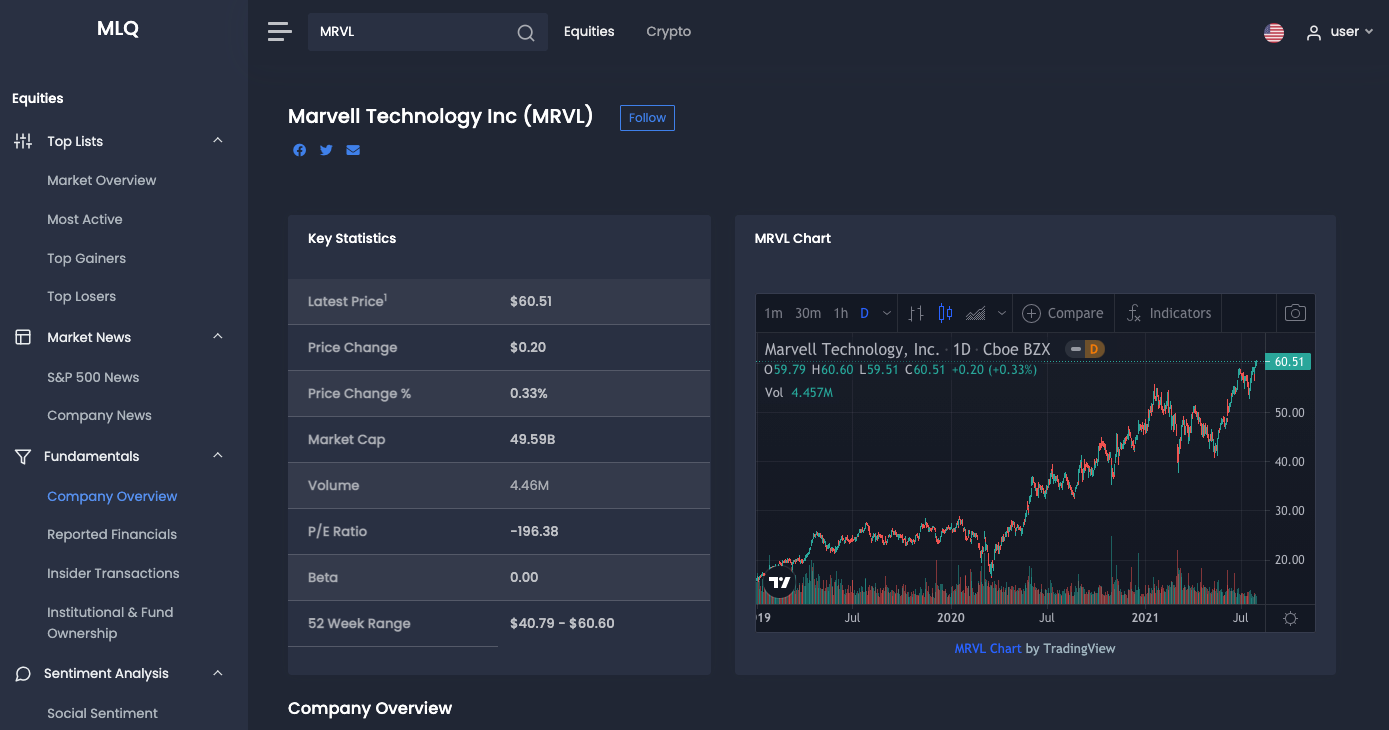

4. Marvell Technology (MRVL)

Marvell Technology (MRVL) is another semiconductor manufacturer that specializes in data storage, communications, and consumer electronics. Analyst Vivek Arya claims that 5G is just one of the company's many major growth drivers in the coming years, which also include cloud services and next-generation car technology. Analysts also claim that synergies from Marvell's acquisition of Inphi, which makes semiconductor components, will enhance the company's overall performance in the coming quarters.

Analysts have an average price target of $60.82 with a "Strong Buy" rating consensus.

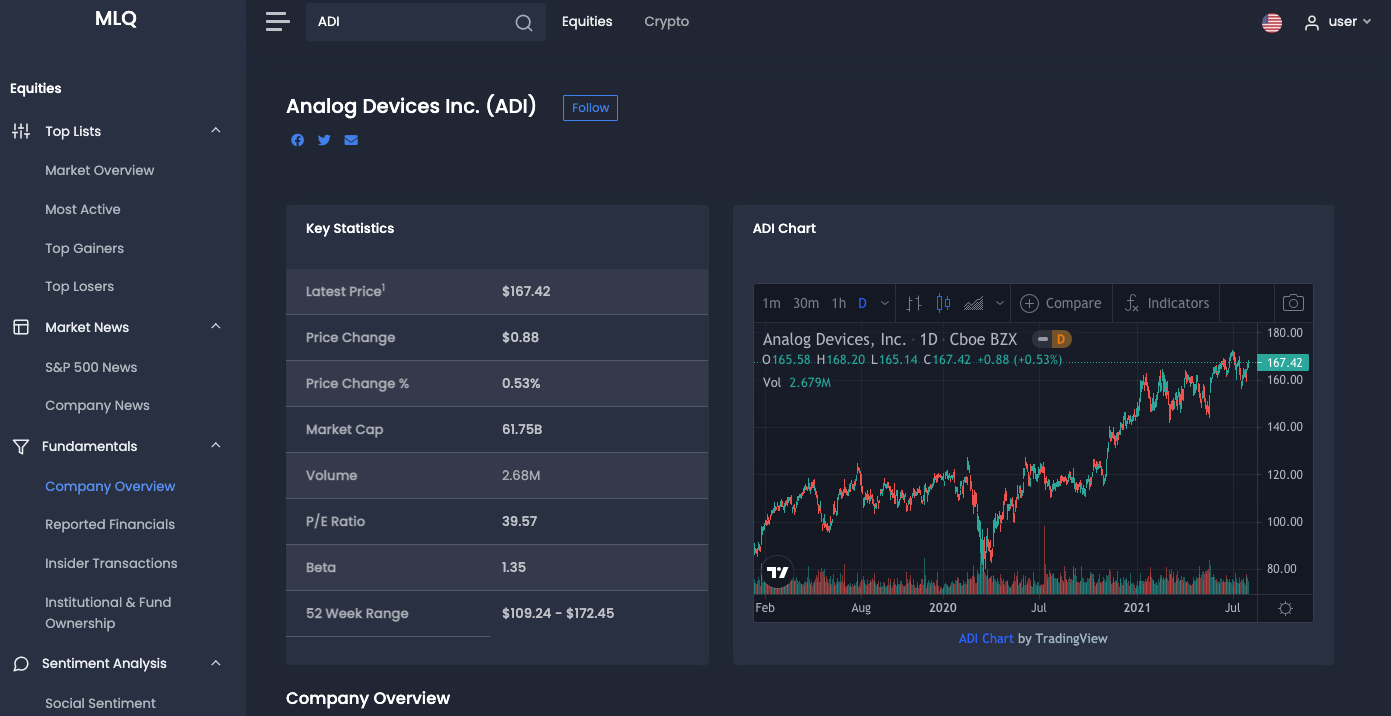

5. Analog Devices (ADI)

Analog Devices (ADI) designs and manufactures high-performance integrated circuits for signal processing. Analog Devices has four times the content in 5G radios as it had in 4G radios, according to Bank of America.

ADI recently announced an ASIC-based radio platform for 5G radio units, which are designed to reduce time to market and address the changing demands of 5G networks.

Currently trading at roughly 167 per share, ADI has a "Strong Buy" rating and an average price target of $183.82.

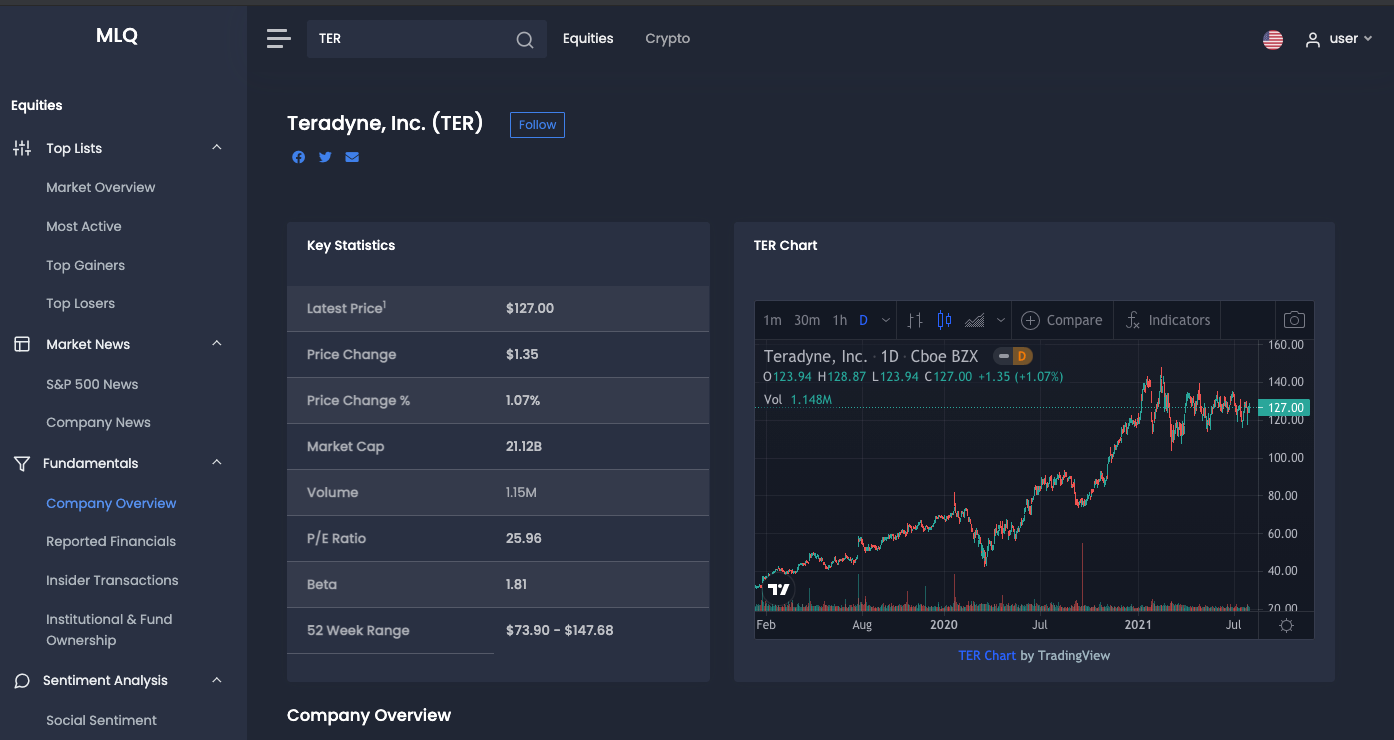

6. Teradyne (TER)

Teradyne (TER) is another 5G stock to watch that creates semiconductor, telecommunications, and industrial testing equipment. As one author writes, Teradyne's semiconductor test equipment is well-positioned to benefit from the exponential rise in semiconductor demand as the worldwide deployment of 5G accelerates. Specifically, the company's development of robotics combined with 5G rollout makes it uniquely positioned in the market.

The average analyst price target of TER is $157 with a Strong Buy consensus rating.

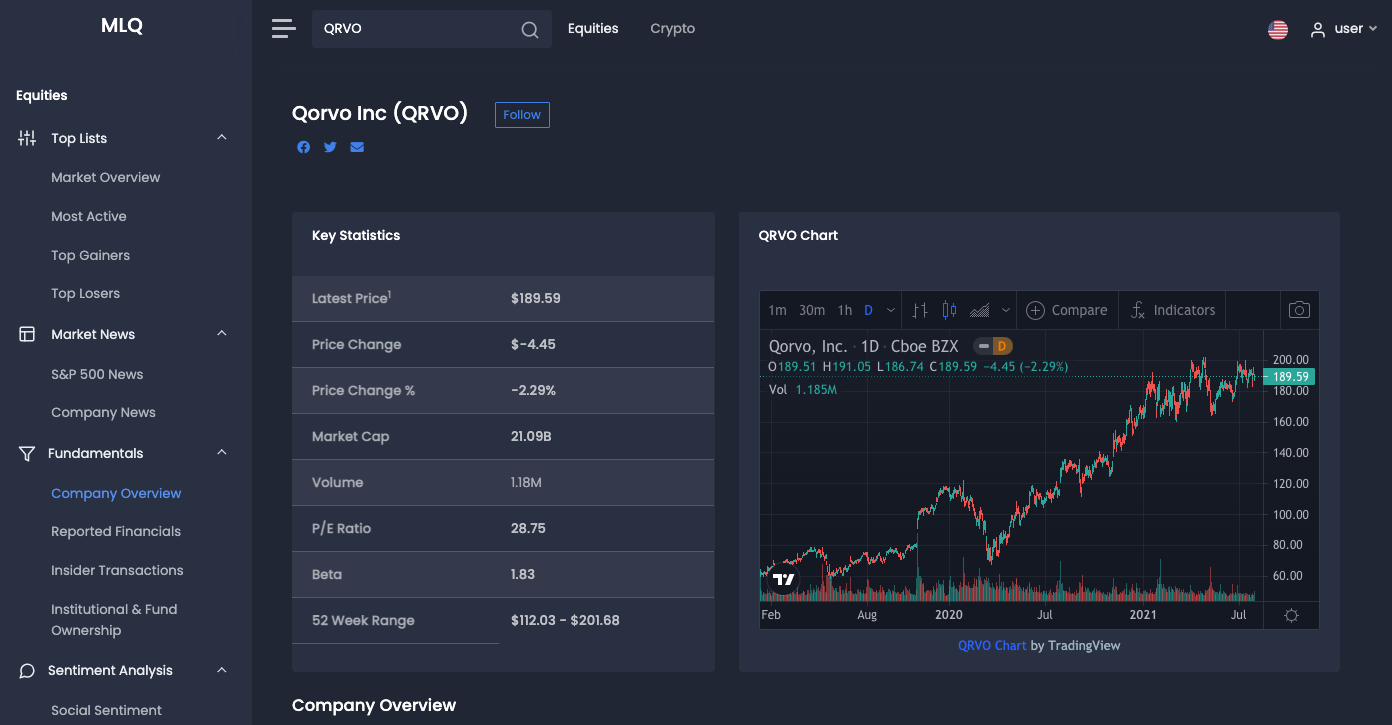

7. Qorvo (QRVO)

Qorvo (QRVO) is a company that makes radio frequency integrated circuits for wireless communications. With a wide range of RF connection technologies, Qorvo is enabling 5G deployment and supporting the rise of mobile data.

As a Fool author writes, The mobile business accounts for 75% of the company's revenue. Qorvo is also a wireless chip provider to Apple, with the iPhone maker accounting for 30% of its sales in fiscal 2021. Samsung, Vivo, and Xiaomi all utilize Qorvo processors, showing that the company's client base is similar to Skyworks.

QRVO currently has a "Strong Buy" rating and a $220.85 price average price target.

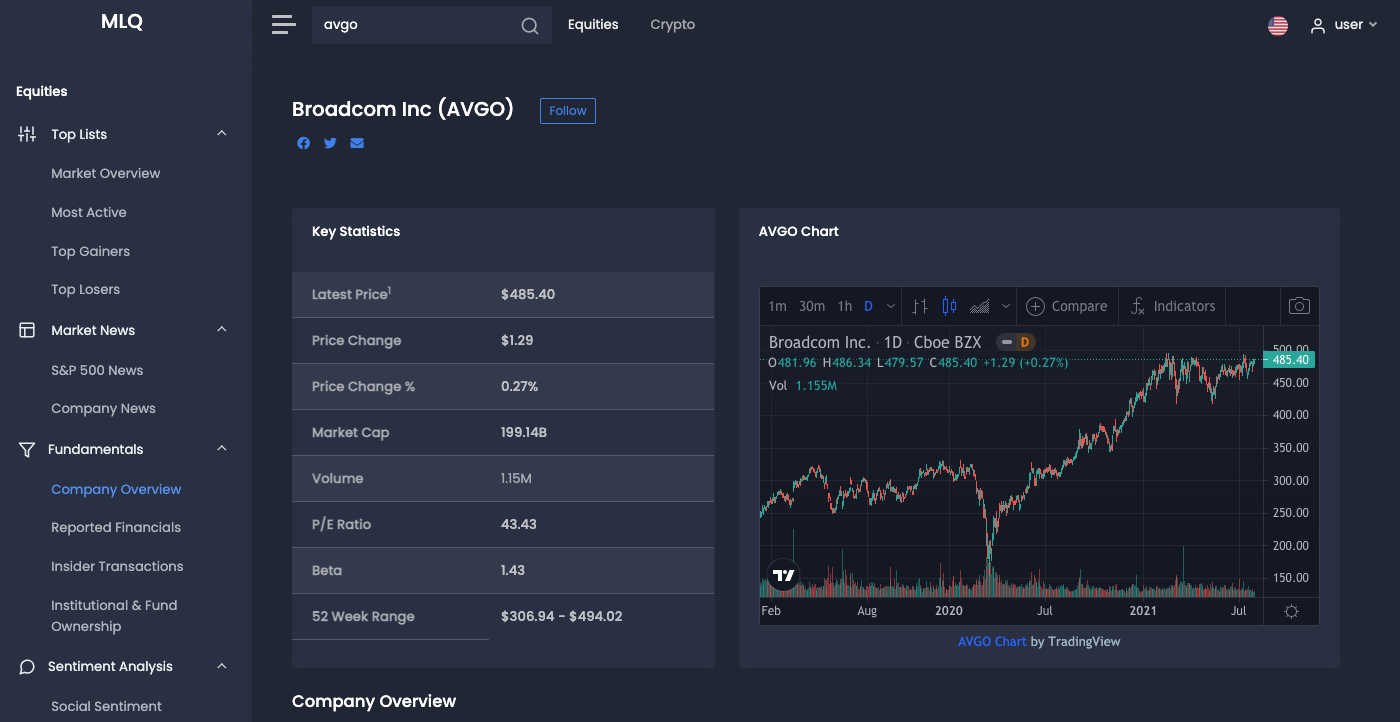

8. Broadcom (AVGO)

Broadcom (AVGO) is one of the world's leading manufacturers of analog semiconductor devices. Broadcom products range from networking gear, data centers, linked industrial equipment, and more. Many analysts believe that Broadcom will benefit greatly from 5G and its ability to revolutionize industries as it assists its clients in putting the higher-speed, lower-latency service to use.

AVGO has a "Strong Buy" rating and a $543 average price target from analysts.

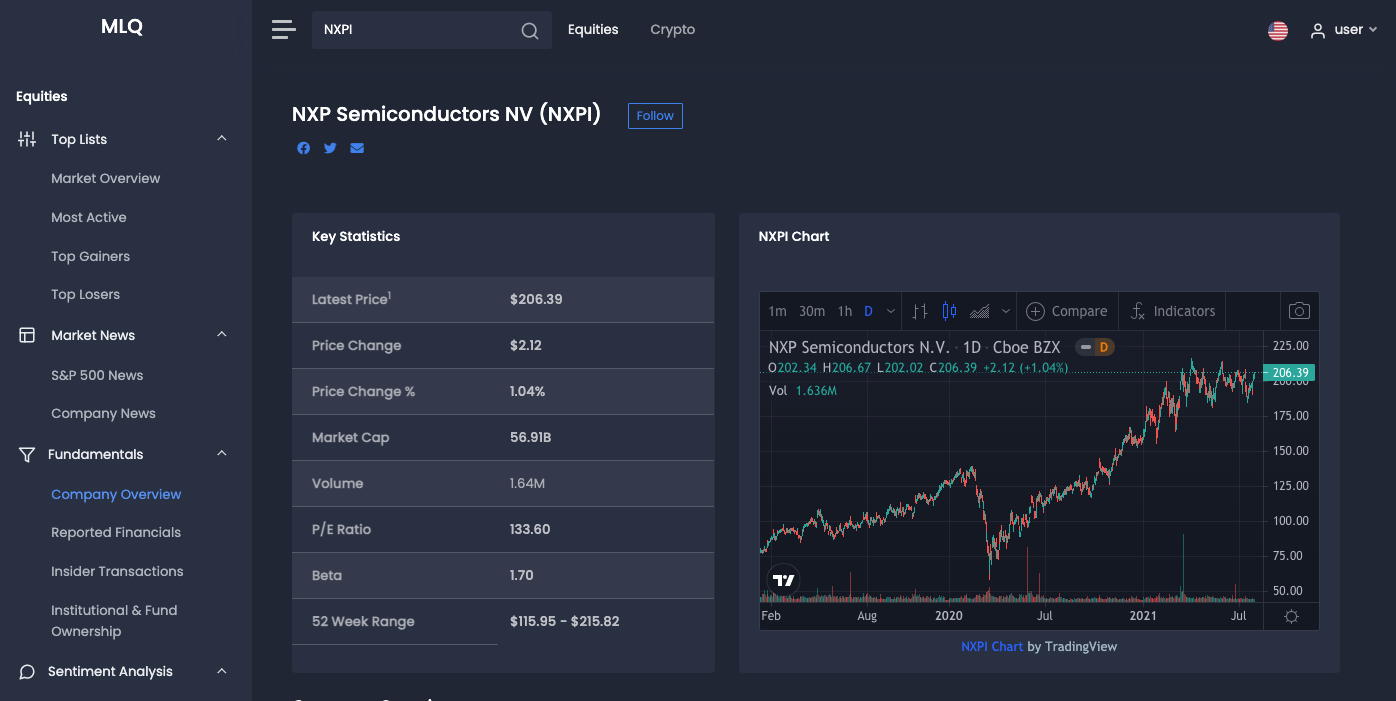

9. NXP Semiconductors (NXPI)

NXP Semiconductors (NXPI) is another 5G stock to watch that specializes in mixed-signal semiconductors for applications like automotive and mobile payments. As 5G rollouts increase, communication demand from providers like NXPI will accelerate in the second half of 2021. Specifically, Zachs Equity Research highlights that NXPI is expanding its presence in India's 5G market with its partnership with Jio Platforms.

NXPI stock has a "Hold" rating and an average price target of $220 per share.

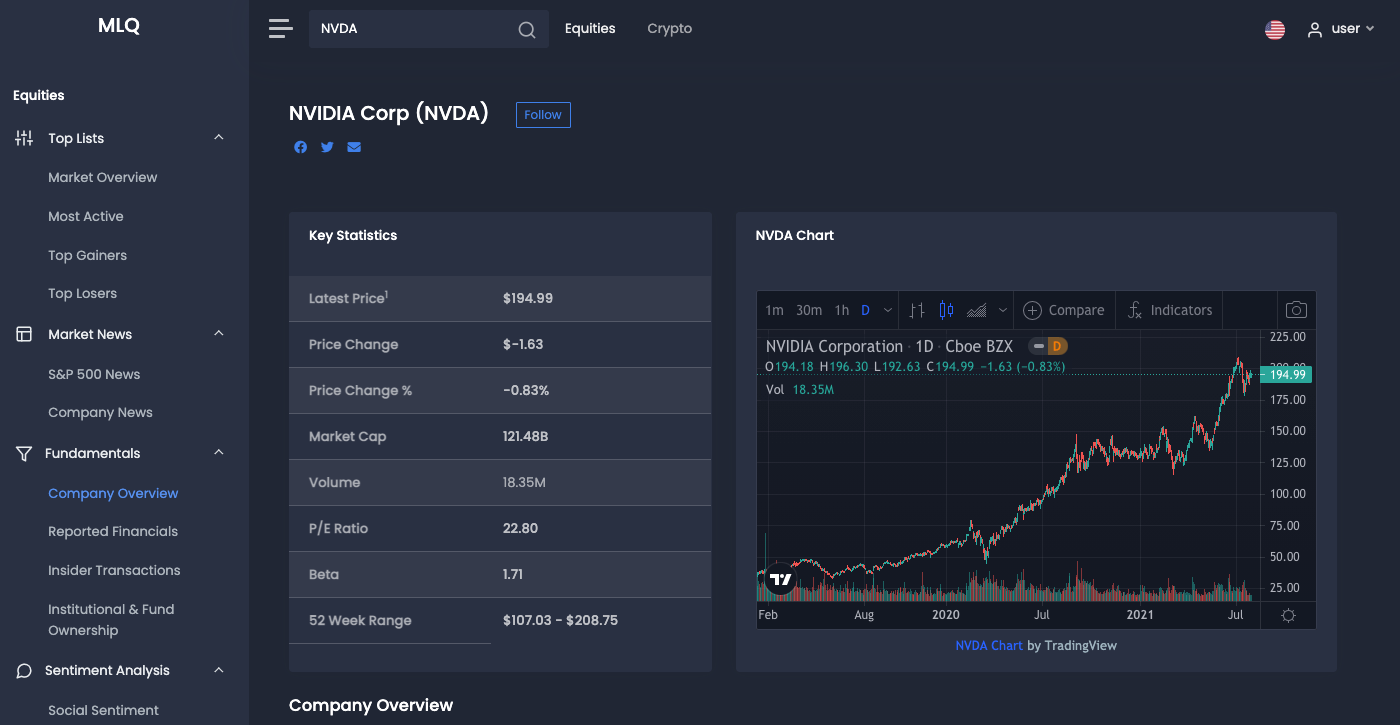

10. Nvidia (NVDA)

As a giant in the chipmaking business, NVIDIA's (NVDA) graphics processing units (GPUs) have widespread applications in the 5G sector. Since 5G promises faster download speeds and the ability to manage more traffic, high-end GPUs like those made by NVIDIA will likely be essential for adoption. 5G deployment is likely to increase the telecom markets' needs for GPUs to facilitate cloud-based applications like gaming, video streaming, and more.

NVDA currently has a "Strong Buy" consensus and an average analyst price target of $202 on TipRanks.

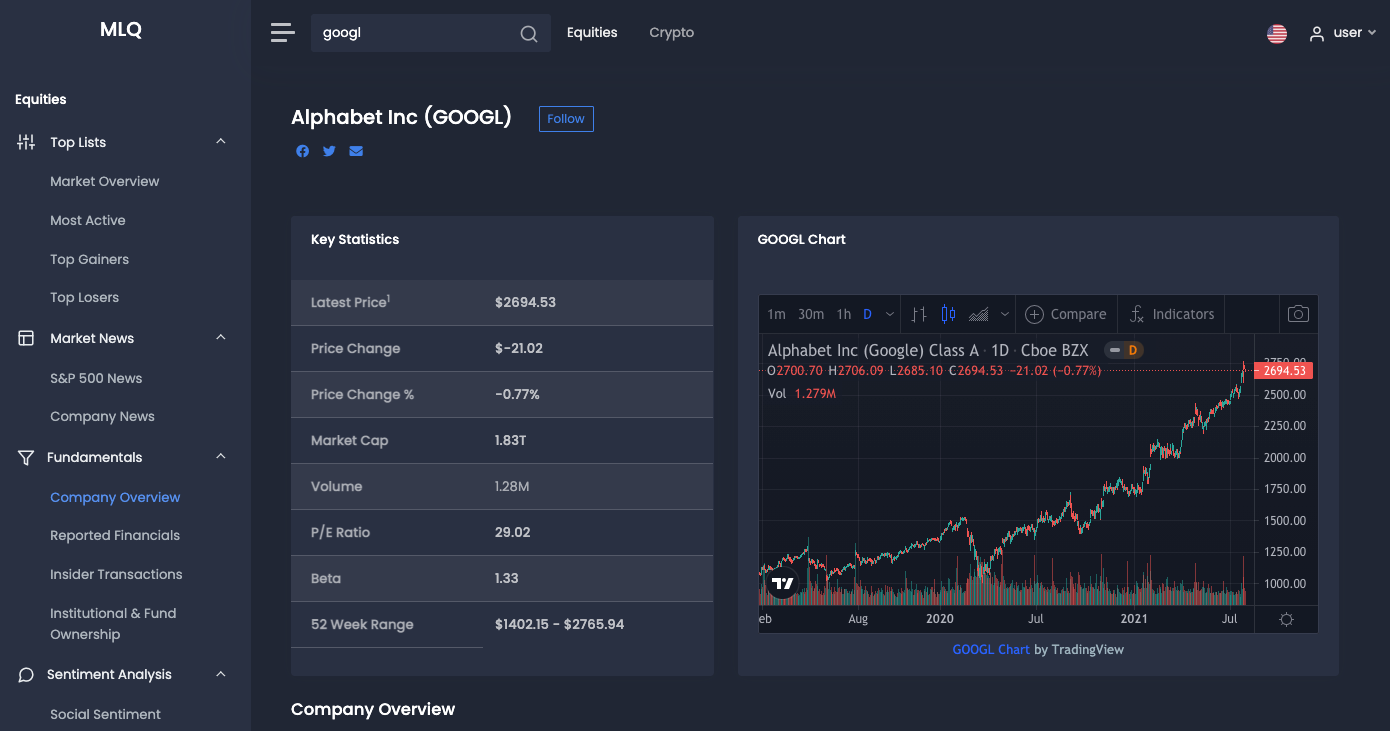

11. Alphabet's (GOOGL)

Alphabet (GOOGL) is entering the 5G space in several ways. As Bloomberg highlights, Google will use Ericsson AB's 5G wireless technology to bring its cloud services to users. Google and Ericsson have teamed up to provide cloud computing for time-sensitive applications like robotics and virtual reality. Google has also recently teamed up with NVIDIA to create a joint innovation lab that will focus on testing 5G and AI applications.

GOOGL has a Strong Buy rating consensus and an average price target of $3146 from analysts.

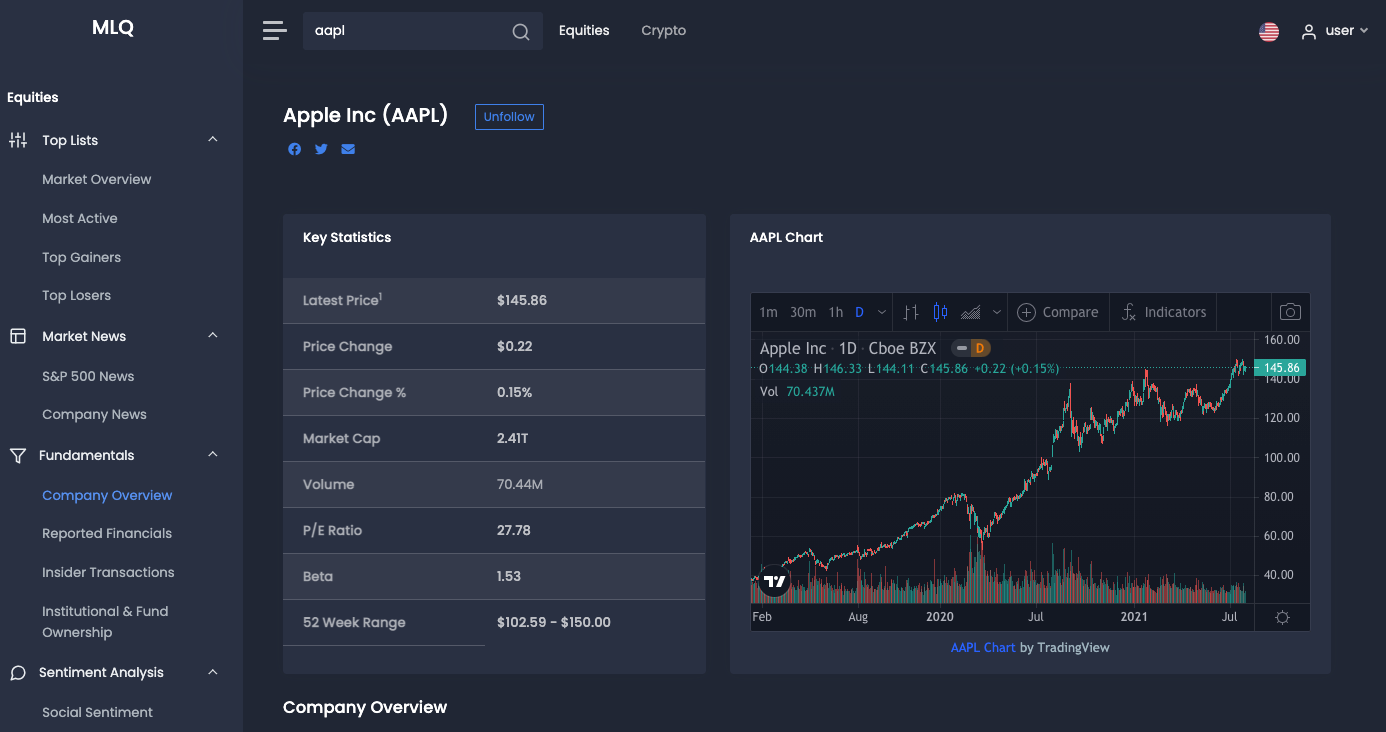

12. Apple Inc. (AAPL)

Apple (AAPL) is another important player in the 5G market with their release of the iPhone 12. As a Nasdaq author highlights, Samsung was the market leader in 5G smartphone sales before iPhone 12 entered the market.

With the release of iPhone 12, Apple has since risen the number one rated 5G smartphone. Apple has also been rapidly increasing its sales in developing markets, which will likely contribute to its strong 5G market share in the coming years.

Apple currently has a price target of $161 with a Moderate Buy rating from analysts.

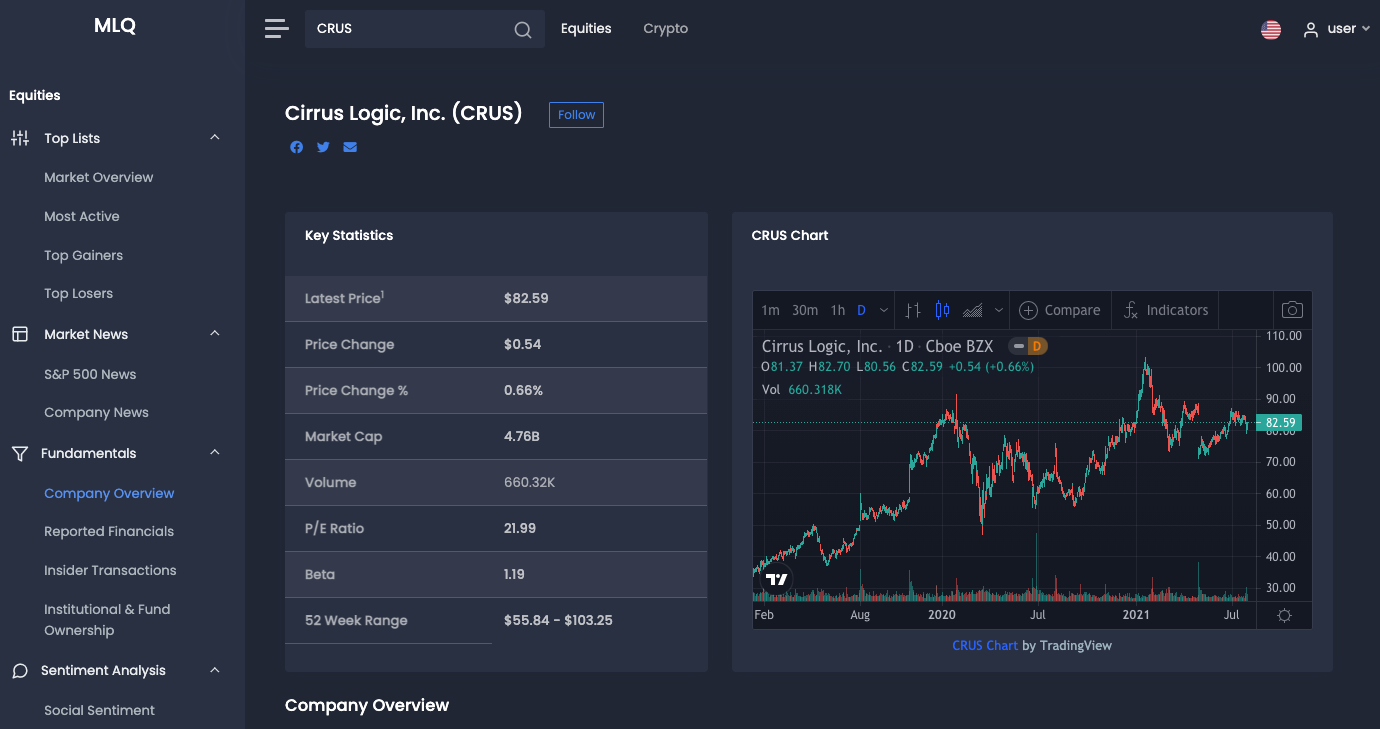

13. Cirrus Logic (CRUS)

Cirrus Logic (CRUS) is another noteworthy chipmaker in the 5G space. As the Fool writes, smartphone manufacturers rely on Cirrus for audio chips. Apple is the company's biggest customer, accounting for roughly 75% of total sales, followed by an Android smartphone maker with 10%. According to IDC, the chipmaker's quarterly performance should have been hurt during the pandemic shutdown by its significant reliance on smartphones. Despite this expectation, the chipmaker recorded 8% revenue growth in FY 2020.

Analysts have a Moderate Buy recommendation and an average price target of $102.25 per share.

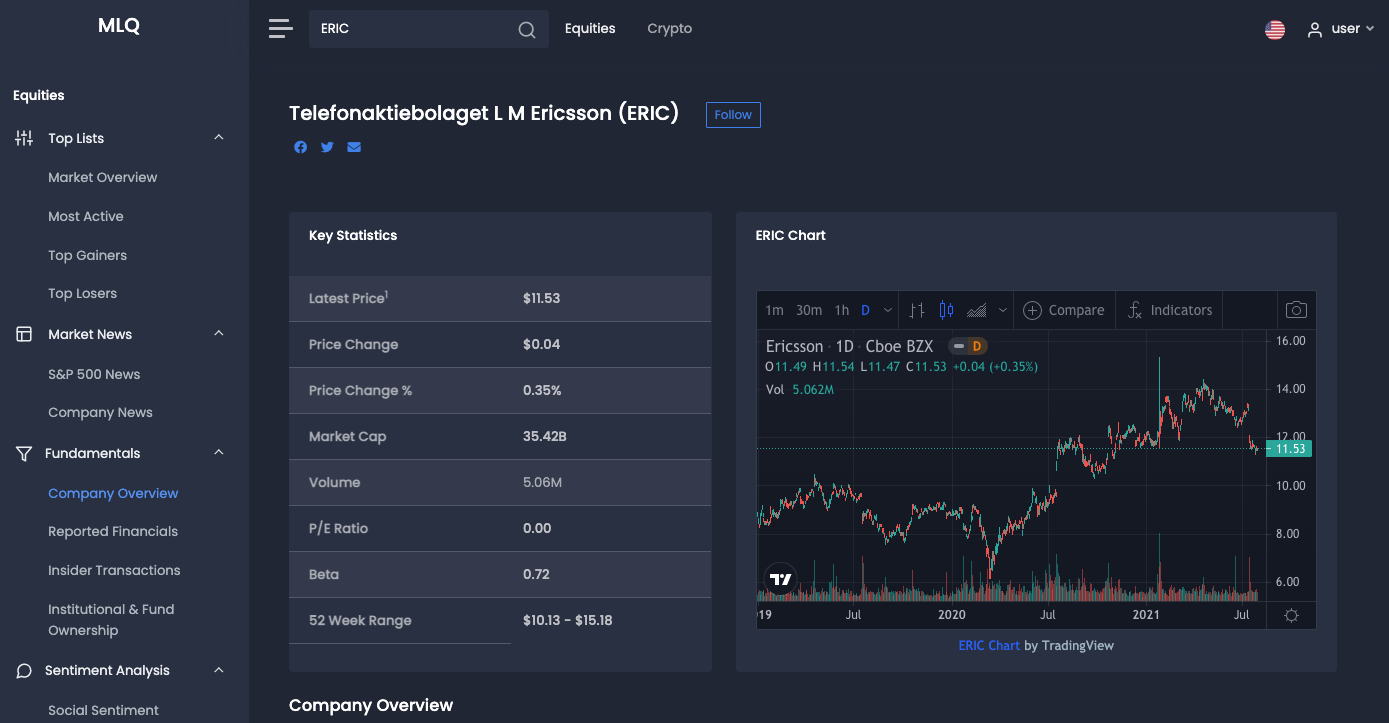

14. Ericsson (ERIC)

Based in Sweden, Ericsson (ERIC) is a telecom equipment manufacturer and services company. The company provides IT services, software, and infrastructure and is well-positioned to take a significant market share of the 5G revolution.

As CMC Markets writes, the company completed 81 partnerships in 2020 that will enable telecom operators to update their networks to match the speed and requirements of 5G technology. The company is also the first telco to build 5G networks across four continents, making it one of the largest providers of 5G compatible devices.

Analysts currently place the stock as a Moderate Buy with a $17.75 average price target.

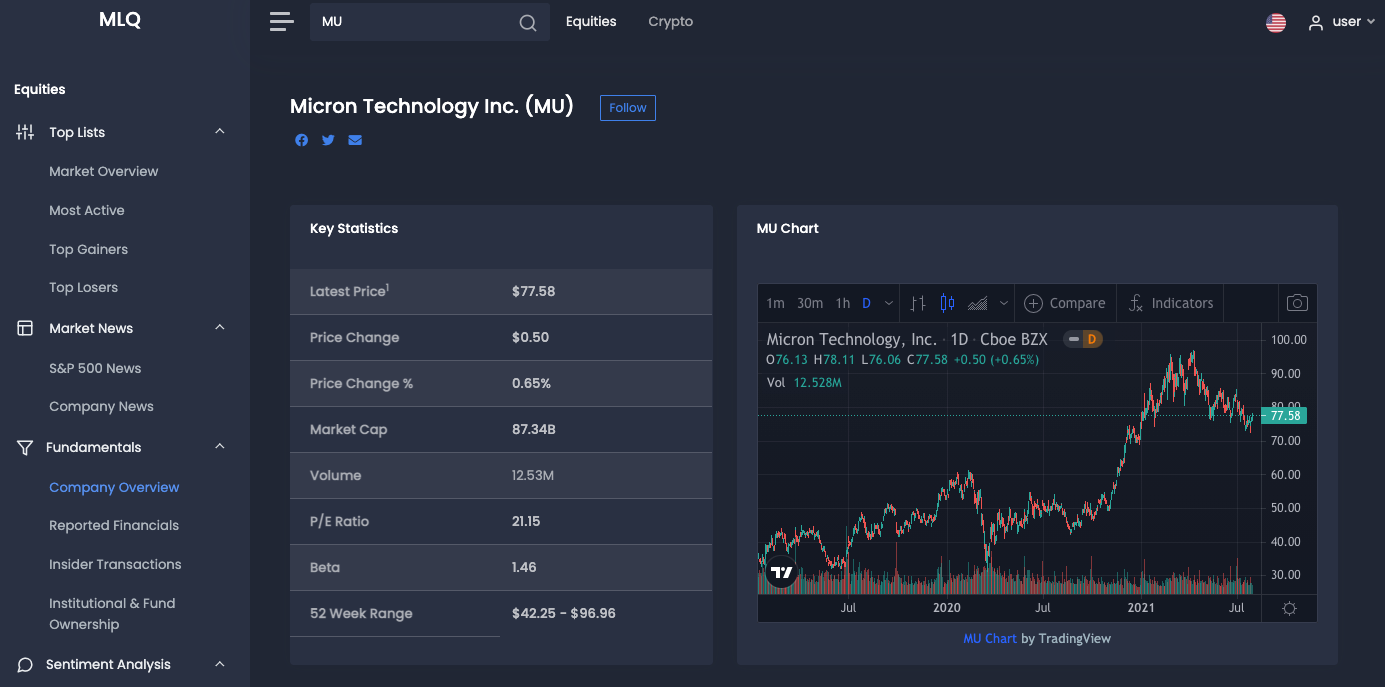

15. Micron Technology (MU)

Micron Technology (MU) is a memory and data storage company that is also well-positioned to benefit from the 5G revolution. Micron's mobile business segment in particular has benefited from this trend as 5G-compatible devices rely on greater memory. As customers continue to upgrade their phones, Micron is poised to capture market share with its storage solutions. What's more, the company may also benefit from rising demand for data center upgrades and edge devices.

Analysts currently have the stock as a Strong Buy with a $116 average price target.

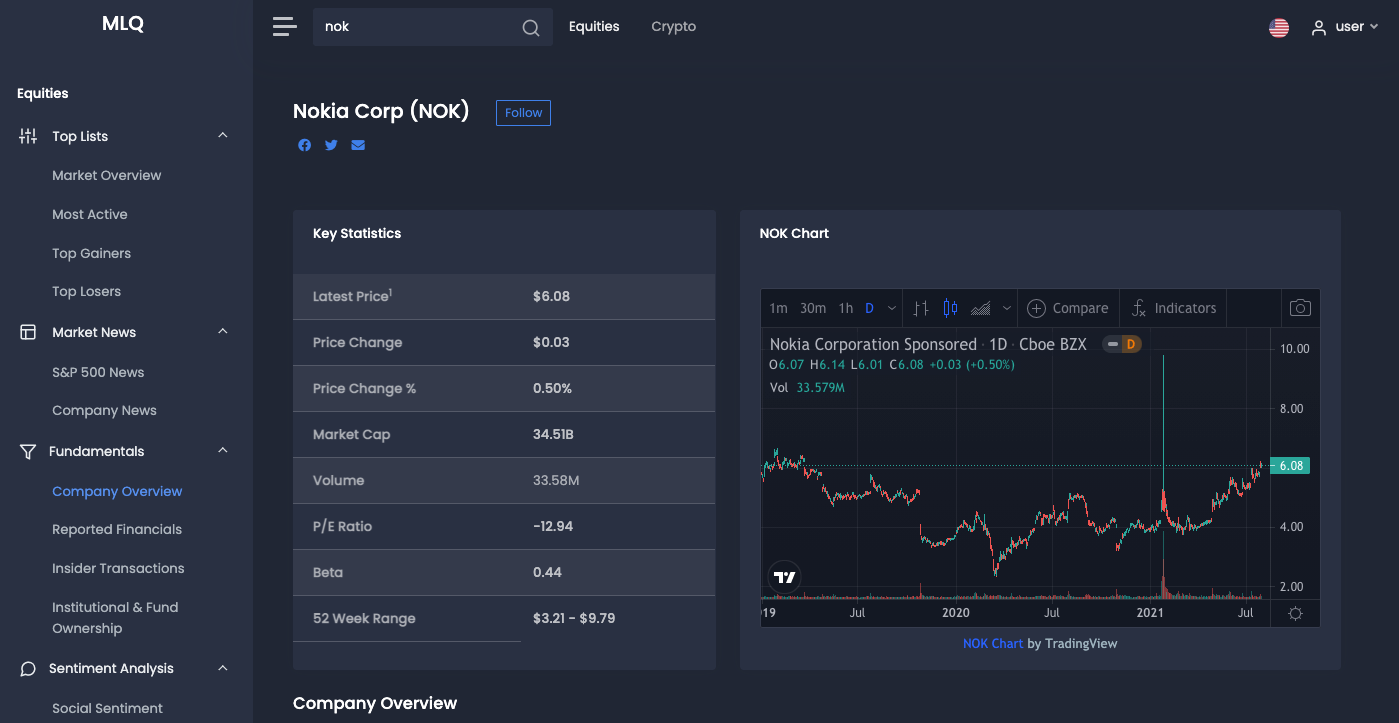

16. Nokia (NOK)

Finland-based Nokia (NOK) is another key contributor to the creation of 5G wireless networking standards and is one of the most well-known names in the 5G hardware industry.

Nokia's stock price has been on the rise in 2021, potentially signaling that investors expect its foothold in the 5G market to deliver higher revenues and profit margins in the coming quarters.

Analyst consensus for Nokia is currently a Strong Buy with an average price target of $7.05.

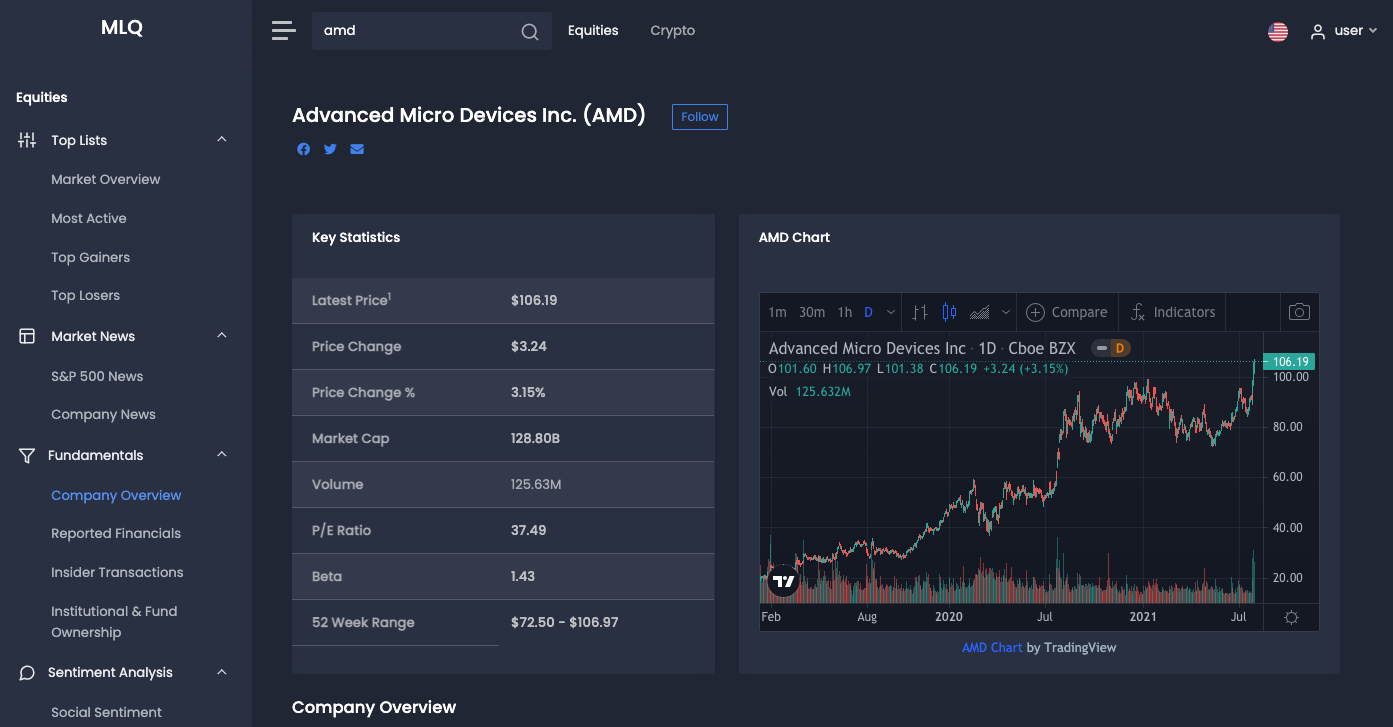

17. Advanced Micro Devices (AMD)

With AMD's (AMD) acquisition of Xilinx (XLNX)—which is a market leader in the field-programmable gate array (FPGA) market—AMD has now also entered the 5G industry. As the Fool writes, FPGA chips are well suited to deploy 5G technology due to their flexible architecture and ability to modify chips after they've been produced.

Xilinx also typically has higher profit margins than AMD, which may further add to its growth in the 5G market.

AMD currently has a Moderate Buy rating with an average analyst share price target of $107.93.

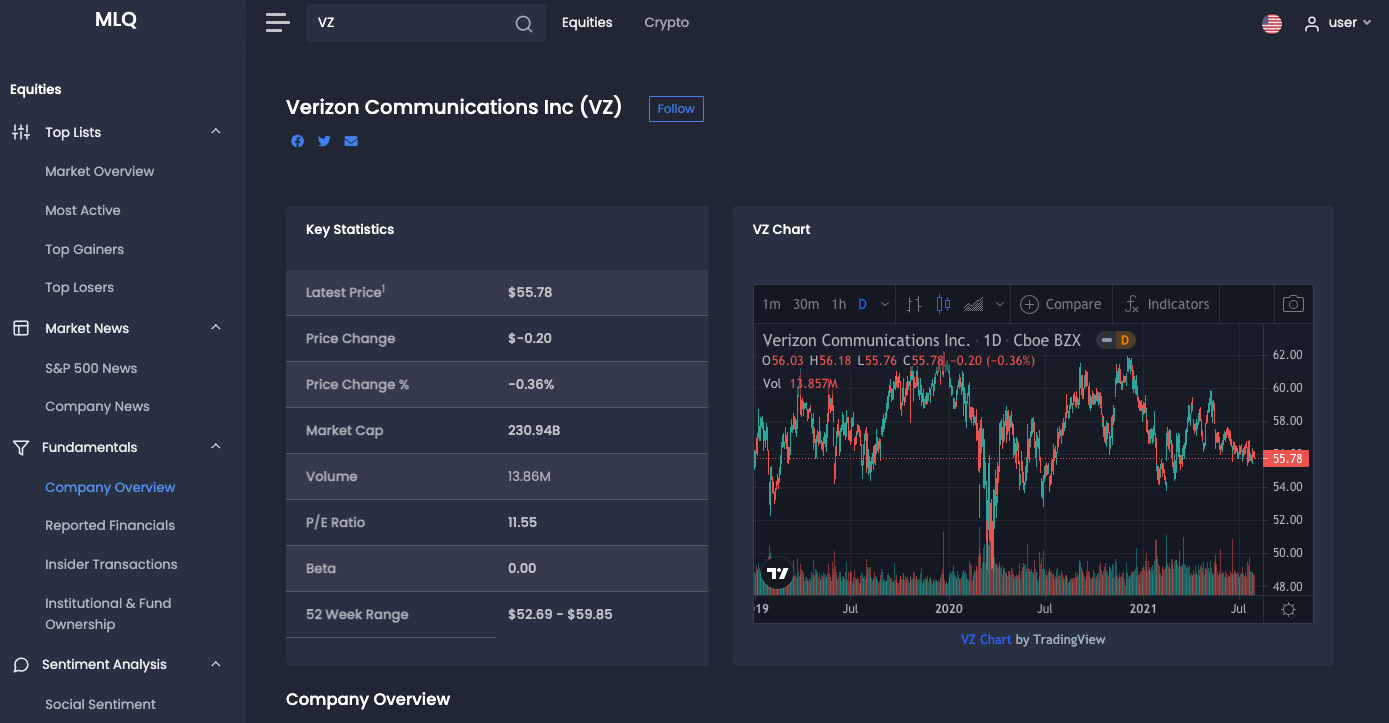

18. Verizon Communications (VZ)

Verizon Communications (NYSE: VZ) is another telecommunications company that has partnered with Ericsson to upgrade its core network to support 5G speeds. As CMC Markets writes, Verizon is the largest cellular communications provider in the US with a 35% market share and a market cap of roughly $230 billion. Based on this strong foothold in the telecom market, Verizon is expected to benefit significantly from 5G communication upgrades.

Verizon currently has a Moderate Buy rating and an average price target of $61.80 from analysts.

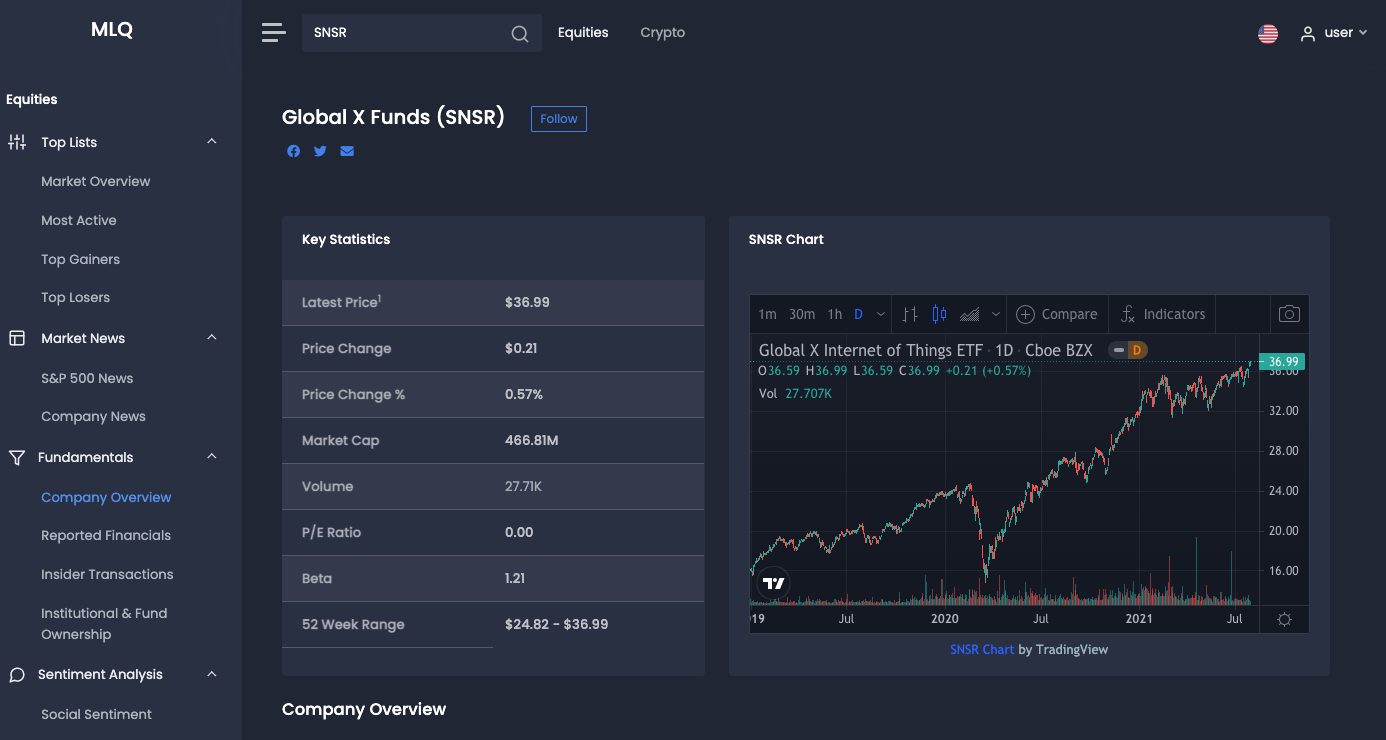

19. Global X Internet of Things ETF (SNSR)

Moving onto the ETF landscape, the Global X Internet of Things ETF (SNSR) offers exposure to 5G tech stocks. The investment objective of this 5G ETF is to invest in companies likely to benefit from the adoption of the Internet of Things (IoT), including technologies as 5G infrastructure, semiconductors, fiber optics, and more.

As Global X highlights, The Global X Internet of Things ETF (SNSR) aims to offer investment outcomes that are broadly comparable to the price and yield performance of the Indxx Global Internet of Things Thematic Index before fees and costs.

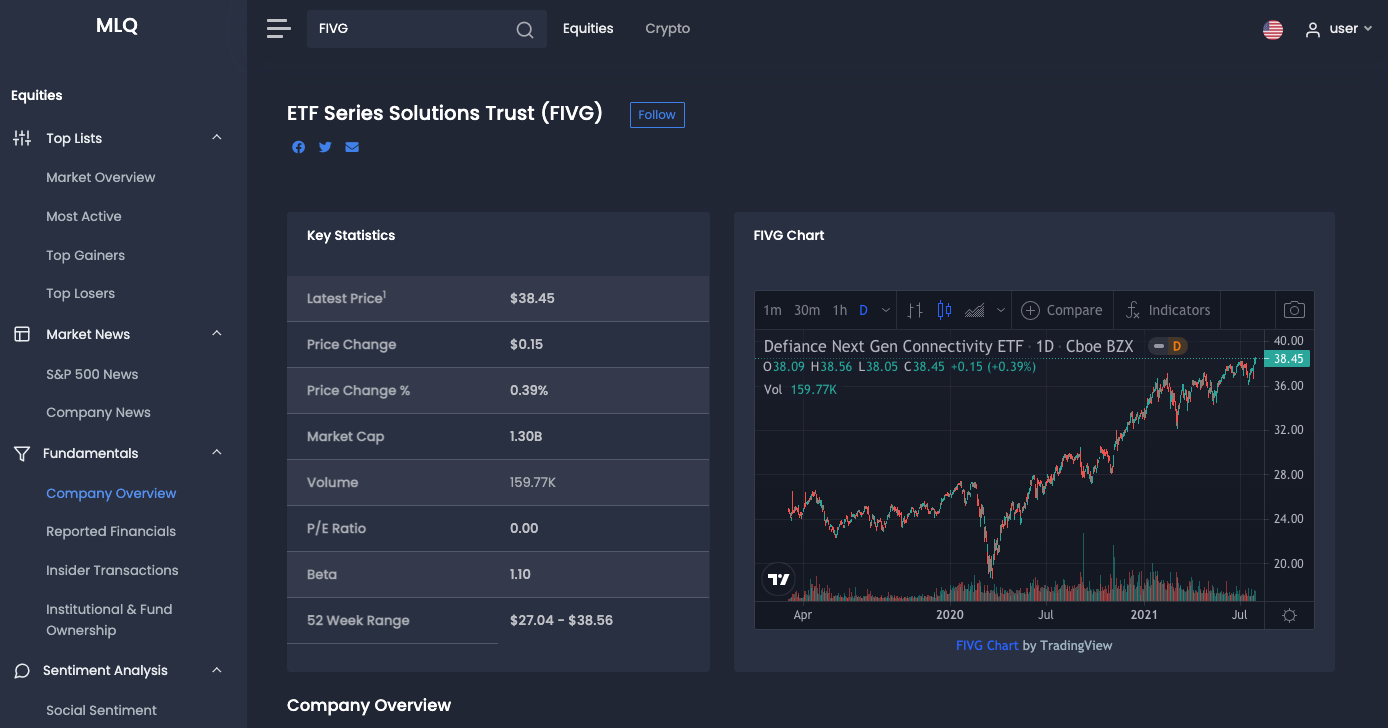

20. Defiance Next Gen Connectivity ETF (FIVG)

Another notable 5G ETF is the Defiance Next Gen Connectivity ETF (FIVG), which invests in firms that are involved in the R&D and commercialization of new infrastructure that underpins connective technologies.

The ETF tracks the BlueStarGlobal 5G Communications Index, which comprises roughly 60 US equities that are involved in developing 5G infrastructure. As ETFDB highlights, Ericsson, Qualcomm, Analog Devices, as well as well-known US telecoms like Verizon and AT&T, are among the fund's top holdings.

That's it for our list of the 20 5G stocks to watch in 2021, we'll be sure to keep this article updated as new companies enter the market.