In this Tesla earnings call summary, we summarize key metrics and topics discussed on the Q4 2022 call, including:

- Earnings Call Summary

- Revenue Highlights

- Profitability

- Industry Trends

- New Initiatives

- Key Partnerships

- Upcoming Product Launches

- Guidance

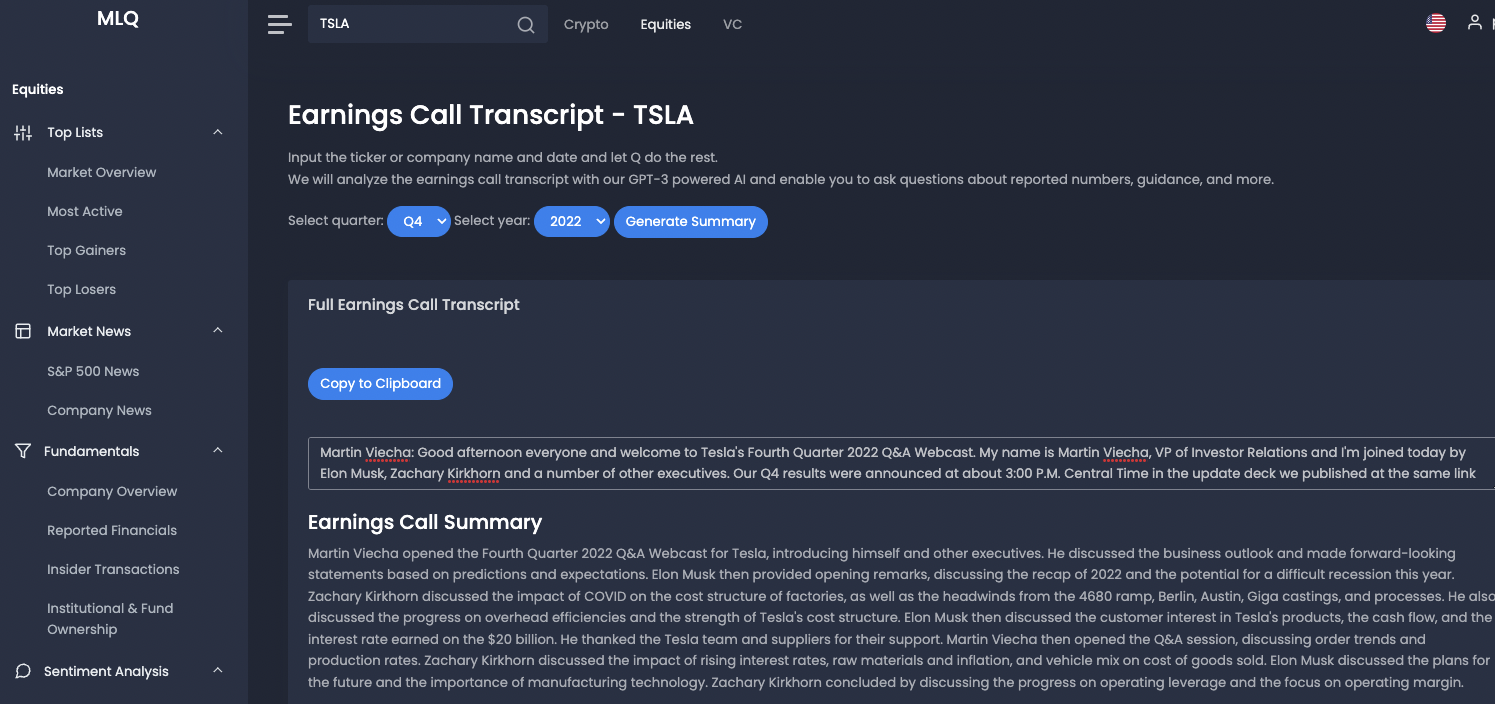

This earning call summary was partially done by our GPT-3 enabled earnings call assistant, which you can learn more about here.

Earnings Call Summary

Martin Viecha opened the Fourth Quarter 2022 Q&A Webcast for Tesla, introducing himself and other executives. He discussed the business outlook and made forward-looking statements based on predictions and expectations.

Elon Musk then provided opening remarks, discussing the recap of 2022 and the potential for a difficult recession this year. Zachary Kirkhorn discussed the impact of COVID on the cost structure of factories, as well as the headwinds from the 4680 ramp, Berlin, Austin, Giga castings, and processes. He also discussed the progress on overhead efficiencies and the strength of Tesla's cost structure.

Elon Musk then discussed the customer interest in Tesla's products, the cash flow, and the interest rate earned on the $20 billion. He thanked the Tesla team and suppliers for their support.

Elon Musk discussed the plans for the future and the importance of manufacturing technology. Zachary Kirkhorn concluded by discussing the progress on operating leverage and the focus on operating margin.

Revenue Highlights

Tesla reported a 50% increase in revenue on a full year basis for the fourth quarter of 2022. Operating income doubled, free cash flows increased by over 50%, and margins remained industry-leading. Additionally, Tesla reported a 17% operating margin, the highest among any volume carmaker, and generated $12.5 billion in net income and $7.5 billion in free cash flow.

Profitability

Tesla reported strong profitability this quarter, with operating income doubling and free cash flows increasing over 50%. Additionally, the company achieved a 17% operating margin, the highest among any volume carmaker, and generated $12.5 billion in net income and $7.5 billion in free cash flow.

This was driven by strong customer demand, cost reductions, and a shift in the product mix towards Model Y, which carries a slight cost premium to Model 3. Going forward, Tesla is focused on improving overhead efficiency and leveraging its strength in cost to remain industry-leading in terms of margins.

Industry Trends

This quarter, the global non-cells raw materials market was heavily influenced by geopolitical situations in Europe, high production costs due to labor cost increases and energy spikes, and disruptions due to natural disasters like typhoons and pandemic lockdowns.

This has caused meaningful price corrections, but it remains uncertain when these will take effect. Additionally, Tesla has seen record growth in their Energy business, with steady improvement in both retail and commercial storage. Lastly, customer interest in Tesla products remains high, with the strongest orders year-to-date than ever in their history.

New Initiatives

This quarter, Tesla implemented several initiatives to improve their cost structure and increase their operating margin. These initiatives included expanding in-house cell production, bringing the Cybertruck to market, developing a next-generation vehicle platform, expanding their manufacturing footprint, and growing their energy business.

Additionally, Tesla worked to reduce overhead costs and increase efficiency, as well as move towards a regionally balanced build of vehicles. Finally, Tesla is leveraging their strength and cost to accelerate improvements in their supply chain and logistics.

Key Partnerships

This quarter, Tesla continued to make progress on their long-term roadmap, which includes expanding in-house cell production, bringing Cybertruck to market, developing their next-generation vehicle platform, expanding their manufacturing footprint, and growing their energy business.

To support these initiatives, Tesla has been working with their supplier partners to find more efficiencies, streamline logistics and transportation, and produce cars. Additionally, Tesla has been leveraging their strength and cost to rapidly increase volume while improving overhead efficiency. Finally, Tesla has been using captives to support market caps and make sure customers have access to their vehicles.

Upcoming Product Launches

During the call, Elon Musk discussed the exciting future of the company and the many ideas they have for upcoming products. He mentioned expanding in-house cell production, bringing the Cybertruck to market, developing a next-generation vehicle platform, expanding their manufacturing footprint, and growing their energy business.

Additionally, he mentioned that they will discuss these plans in more detail on their Investor Day in a month. Lastly, he mentioned that they are moving forward aggressively leveraging their strength and cost, and that they are on a good trajectory for 2023.

Guidance

During the call, Tesla executives noted that their margins would remain healthy and industry-leading over the course of the year, and that they would be aggressively leveraging their strength and cost.

They also mentioned that they were working to improve overhead efficiencies and streamline logistics and transportation to produce cars. Additionally, they noted that customer interest in their products remained high and that they had seen the strongest orders year-to-date than ever in their history.

As always, none of this is financial advice, do your own research, and see our full terms and conditions for more.