SoundHound AI (SOUN), a voice AI company, surged over 20% on Friday after their Q1 2024 earnings on May 9th.

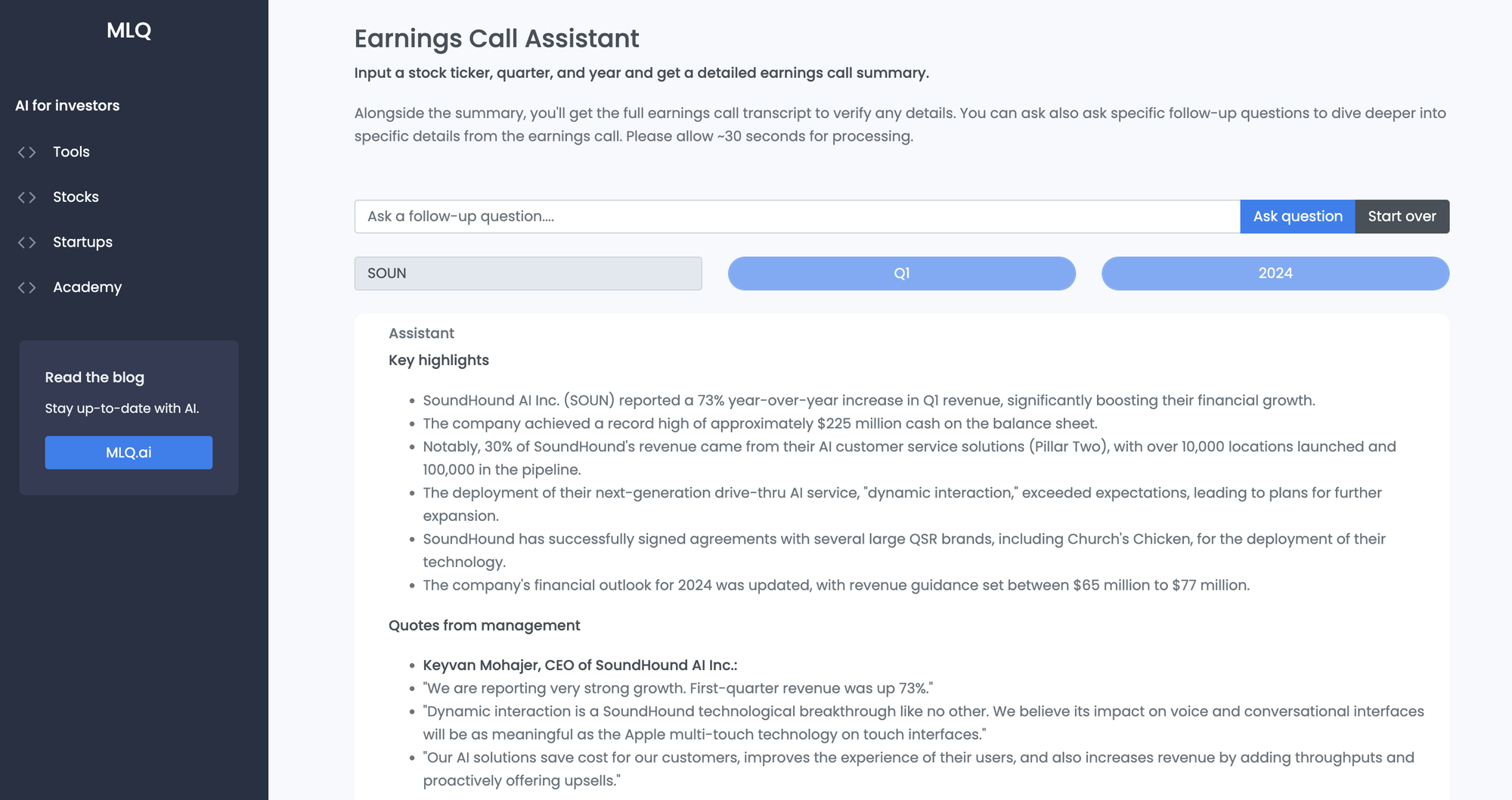

In this article, let's analyze the quarter with our earnings call assistant.

Key highlights: Q1 2024

- SoundHound AI reported a 73% year-over-year increase in Q1 revenue.

- The company achieved a record high of approximately $225 million cash on the balance sheet.

- Notably, 30% of SoundHound's revenue came from their AI customer service solutions (Pillar Two), with over 10,000 locations launched and 100,000 in the pipeline.

- The deployment of their next-generation drive-thru AI service, "dynamic interaction," exceeded expectations, leading to plans for further expansion.

- SoundHound has successfully signed agreements with several large QSR brands, including Church's Chicken, to deploy their technology.

- The company's financial outlook for 2024 was also updated, with revenue guidance set between $65 million to $77 million.

Quotes from management

As the CEO, Keyvan Mohajers stated:

"We are reporting very strong growth. First-quarter revenue was up 73%."

Dynamic interaction is a SoundHound technological breakthrough like no other. We believe its impact on voice and conversational interfaces will be as meaningful as the Apple multi-touch technology on touch interfaces.

This quarter was a special quarter for our pillar two, where we offer AI customer service solutions for businesses. About 30% of our revenue was from pillar two with over 10,000 locations laid in production and over 100,000 in our pipeline.

Our three-pillar strategy is working well, especially with the accelerated deployment and expansion of dynamic interaction. The results we are seeing with the first launch are beyond our expectations, leading immediately to decisions by the brand to expand their integration to more locations.

The company's CFO, Nitesh Sharan, stated:

Our AI solutions attractively reside at a critical intersection. Macro factors like persistent inflation and wage pressures drive many of our customers towards automation for productivity."

With our recent acquisitions, SYNQ3, now fully in the mix, the benefits of integrating this pioneering restaurant tech organization with our years of voice AI innovations are clear.

We expect both gross margins and adjusted EBITDA to improve as we move forward. With the SYNQ3 acquisition, we are working on migrating their cloud and AI infrastructure to SoundHound which, in the immediate term, has some duplicative costs.

We are ahead of pace in having pillar two exceed 20% of total revenue mix this year, and we see that mix increasing as we go into 2025. Given the Q1 performance, we are raising the lower end of our guidance and narrowing our initial range, which steps up our mid-point to $71 million. Therefore, our revenue guidance for the full year is now $65 million to $77 million.

Q&A session

Gil Luria, Analyst, D.A. Davidson, asked about the NVIDIA partnership and its impact:

The response from the CEO, Keyvan Mohajer emphasized the significance of the NVIDIA partnership, enabling large language models to run on the edge, which enhances the functionality without requiring cloud connectivity. This development is expected to expedite deployments beyond automotive applications.

Mike Latimore, Analyst, Northland Capital Markets, inquired about synergies from the SYNQ3 acquisition

The response from Keyvan Mohajer and Nitesh Sharan highlighted significant synergies, particularly in leveraging SYNQ3’s extensive restaurant industry data to enhance SoundHound’s AI models. They also noted accelerated customer engagement and expanded go-to-market opportunities resulting from the acquisition.

Brett Knoblauch, Analyst, Cantor Fitzgerald, focused on the source of increasing demand in the restaurant sector

Keyvan Mohajer explained the shift in market dynamics where previously SoundHound had to initiate contact with potential clients. Recently, many sought-after brands have been approaching the company, indicating a strong market acceptance and demand for their products.

Summary: SOUN Q1 2024

- SoundHound AI displayed strong financial performance in Q1 2024, marked by a significant increase in revenues and strategic expansion in their AI customer service solutions, especially in the QSR industry.

- The company’s technological advancements and partnerships, including with NVIDIA and SYNQ3, have not only enhanced their product offerings but also expanded their market presence and operational efficiency.

- SoundHound's leadership expressed optimism about the company's direction, emphasizing their strategic position at the intersection of AI innovation and market demand which is accelerating their growth trajectory.

- With increased guidance for 2024 and strategic initiatives in place, SoundHound appears well-positioned to capitalize on the expanding opportunities within AI-driven customer service solutions.

Disclaimer

Please note this page serves informational purposes only and does not constitute financial advice, always use your own judgement and due diligence. The financial insights provided use OpenAI's GPT API and are derived from a variety of sources that are believed to be reliable. A human editor has reviewed the facts, however, we do not warrant the accuracy or completeness of this data, and the data should not be relied upon as such. All the financial data and insights are provided "as is", without warranty of any kind, either express or implied. Please see our full terms of service for more details.