Reddit is up over 7% in after-hours trading after releasing its first quarterly earnings report since its IPO for Q1 2024.

- The company increased revenue to $243 million, up 48%

- They reported an increase in daily active users (DAUs) by 37% year-over-year

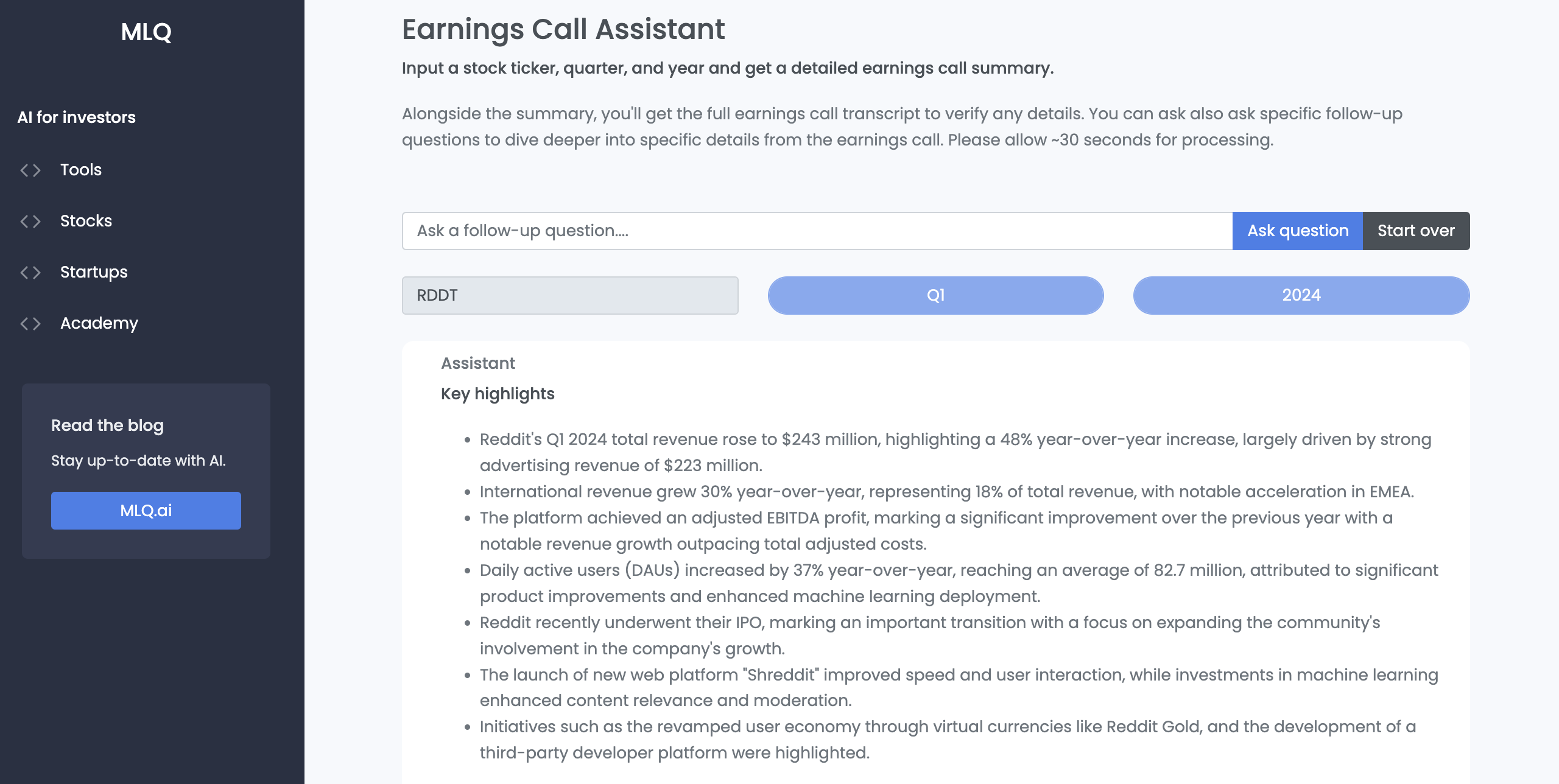

In this article, let's use our earnings call assistant to analyze the quarter 👇

Key highlights: Q1 2024

- Reddit's Q1 2024 total revenue rose to $243 million, highlighting a 48% year-over-year increase, largely driven by strong advertising revenue of $223 million.

- International revenue grew 30% year-over-year, representing 18% of total revenue, with notable acceleration in EMEA.

- The platform achieved an adjusted EBITDA profit, marking a significant improvement over the previous year with a notable revenue growth outpacing total adjusted costs.

- Daily active users (DAUs) increased by 37% year-over-year, reaching an average of 82.7 million, attributed to significant product improvements and enhanced machine learning deployment.

- The launch of new web platform "Shreddit" improved speed and user interaction, while investments in machine learning enhanced content relevance and moderation.

- Initiatives such as the revamped user economy through virtual currencies like Reddit Gold, and the development of a third-party developer platform were highlighted.

As the CEO, Steve Huffman stated:

"We're happy with our progress this quarter. More people are visiting Reddit than ever before. Our investments in making Reddit faster, easier to use, and safer are paying off with increased user retention and growth."

The cost of growth & going public

Despite this impressive growth in both revenue and daily active users, Reddit reported a net loss of $575.1 million for the quarter, significantly wider than the loss of $60.9 million from the same period last year.

This loss was primarily attributed to stock-based compensation expenses related to its IPO, totaling $595.5 million. As reddit's CFO Drew Vollero stated:

We did have a GAAP net loss of $575 million in Q1, driven by stock-based compensation related taxes from the IPO.

Stock-based compensation, including related taxes for the quarter was $595 million, up from $13 million a year ago, driven primarily by one-time expenses related to the vesting of restricted stock units in connection with our initial public offering.

In regards to EBITDA, Drew Vollero also highlighted:

In the first quarter, we reached an important inflection point where we became adjusted EBITDA profitable, a strong start to 2024 where revenue grew over 5x as fast as total adjusted costs.

International expansion and the role of AI

During the earnings call, Reddit CEO Steve Huffman highlighted the platform's focus on international growth and the use of AI to enhance user experience.

In regards to the main drivers of growth this quarter, Steve Huffman stated:

The main driver of growth is the product is better... And so the other thing we're looking forward to as we go forward is international growth. We're still 50/50 US versus non-US but our peers are more 80% to 90% non-US. And so I think there's a huge opportunity there. I think one of the big unlocks for us in the near to medium-term is machine translation

Huffman pointed out the use of machine translation tools to make Reddit more accessible globally, which has been critical to their international revenue growth of 30%, accounting for 18% of the total revenue this quarter.

As Huffman notes:

And to grow outside the US, we're using machine translation to unlock our mostly English corpus. We believe this will not only drive growth in the near-term, but also over time, will allow users from all over the world to connect regardless of the languages they speak.

Huffman also touched upon the potential of Reddit’s data in training AI models, suggesting future growth areas for the company.

Reddit's plan to increase search revenue

Another interesting potential for growth is Reddit's increasing their ad revenue related to search. As the CEO highlighted, they've been investing in their search backend and currently they have no ads on search results page, meaning this could be a major expansion opportunity:

So we've been investing in our search back end, some quality of life features like fail track and autocomplete are coming online as we speak. We've got some, I think, very sensible and overdue improvements to the user interface coming up this year as well...

And so I think just from a user experience point of view, on-platform search on Reddit being great is a huge opportunity. Now today we do over a billion queries per month on Reddit, but I think there's an opportunity for quite a bit more.

And then as the search product itself gets better, of course, then there's an opportunity to monetize those pages. So there are no ads today on search result pages. But that's obviously a very high-performing product elsewhere on the Internet. And I think there's no reason to believe that it wouldn't be for Reddit as well because the intention is so explicit when users are searching.

Summary: Reddit Q1 2024 earnings

- Reddit's Q1 2024 earnings call indicated strong revenue growth and notable user growth following its IPO in march.

- The company showed strong revenue growth led by substantial gains in advertising and expansion into international markets.

- User engagement also saw notable growth due to enhanced product capabilities and the deployment of new technologies like AI-driven content moderation and search.

- Management is focused on continuing this momentum through strategic investments in the platform's core capabilities and new initiatives such as the developer platform and enhanced user interaction models.

- The overall sentiment from the earnings call is optimistic, with Reddit positioning itself for sustained growth and innovation in the social media landscape.

Disclaimer

Please note this page serves informational purposes only and does not constitute financial advice, always use your own judgement and due diligence. The financial insights provided use OpenAI's GPT API and are derived from a variety of sources that are believed to be reliable. The facts have been reviewed by a human editor, however, we do not warrant the accuracy or completeness of this data, and the data should not be relied upon as such. All the financial data and insights are provided "as is", without warranty of any kind, either express or implied. Please see our full terms of service for more details.