Honeywell’s Quantinuum raises $600M at a $10B valuation, and Finland’s IQM pulls in $320M to fund U.S. expansion and its million-qubit roadmap.

Anthropic lands $13B at a $183B valuation, OpenAI buys Statsig for $1.1B, and Stripe and Paradigm launch “agentic payments.”

UiPath and Broadcom beat earnings while C3.ai misses badly, and Atlassian acquires The Browser Company for $610M. Plus: Klarna revives IPO plans and Nvidia discloses heavy reliance on two mystery customers.

Let's dive in.

In this newsletter:

- Honeywell's Quantinuum Raises $600 Million at $10B Valuation to Advance Quantum Computing

- OpenAI Unveils AI Jobs Platform and Certifications Initiative

- UiPath Reports Strong Q2 Fiscal 2026 Earnings: Revenue Beats, ARR Growth

- Broadcom Reports Fiscal Q3 Earnings, Beats Revenue Estimates

- C3.ai Reports Major Q1 Earnings Miss, Announces CEO Transition and Withdraws Full-Year Forecast

- Stripe and Paradigm Announce 'Agentic Payments' via Tempo Blockchain for Stablecoin Speed and AI Integration

- Atlassian Agrees to Acquire The Browser Company for $610 Million

- Salesforce posts an earnings beat, but stock drops as outlook disappoints

- IQM Quantum raises $320M Series B to fuel US expansion and million-qubit roadmap

- OpenAI Acquires Statsig for $1.1 Billion; Statsig CEO Named CTO of Applications

- Google Won’t Have to Sell Chrome After Landmark Search Antitrust Ruling

- Anthropic Raises $13 Billion in Series F, Valued at $183 Billion Post-Money

- Klarna Revives IPO Plans, Aims to Raise $1.27 Billion

- OpenAI and Retro Biosciences Announce Breakthrough in Cellular Reprogramming Using AI-Engineered Proteins

- Nvidia's Q2 Revenue Reveals Major Dependence on Two Mystery Customers

Honeywell's Quantinuum Raises $600 Million at $10B Valuation to Advance Quantum Computing

On September 5, 2025, Honeywell announced a major $600 million capital raise for its quantum computing subsidiary, Quantinuum, resulting in a pre-money valuation of $10 billion. The round saw fresh investment from major global tech and financial entities, including NVIDIA's venture arm, Quanta Computer, and QED Investors, with continued support from major institutional backers like JPMorganChase, Amgen, and Mitsui. The funds will drive the upcoming launch of Quantinuum's 'Helios' quantum system and accelerate efforts towards achieving universal fault-tolerant quantum computing, with Honeywell reaffirming its commitment to leading the global quantum race through significant expansion and industry partnerships.

OpenAI Unveils AI Jobs Platform and Certifications Initiative

OpenAI announced significant new offerings today: an upcoming AI Jobs Platform set to launch in 2026, and a pilot program for AI skills certifications in late 2025. The new platform will use artificial intelligence to connect companies with AI-skilled talent at all levels, including a dedicated track for local businesses and governments, positioning OpenAI in direct competition with LinkedIn. The AI certification program, developed in partnership with major employers including Walmart and John Deere, aims to certify millions of workers and supports both basic workplace AI literacy and advanced skills, with preparation and testing available through ChatGPT.

UiPath Reports Strong Q2 Fiscal 2026 Earnings: Revenue Beats, ARR Growth

UiPath (NYSE: PATH) announced second quarter fiscal 2026 financial results today, reporting revenue of $362 million—a 14% year-over-year increase—which outpaced analysts' expectations. Annualized Renewal Run-rate (ARR) rose 11% year-over-year to $1.723 billion, and cash flow from operations reached $42 million, reflecting improved execution and momentum in agentic automation offerings. Management cited growing enterprise adoption, with orchestration of AI agents and robots driving real outcomes for customers.

Broadcom Reports Fiscal Q3 Earnings, Beats Revenue Estimates

Broadcom Inc. announced its fiscal third-quarter earnings today, reporting revenue of $15.95 billion, surpassing analyst expectations of $15.83 billion. The results indicate stronger-than-expected demand for the company's chip products and ongoing momentum in its core business segments.

C3.ai Reports Major Q1 Earnings Miss, Announces CEO Transition and Withdraws Full-Year Forecast

C3.ai reported Q1 revenue of $70.26 million, missing analyst expectations by a wide margin, with a non-GAAP loss per share of $0.37—significantly worse than forecasts. The company also announced a CEO transition, appointing Stephen Ehikian as CEO effective September 1, and withdrew its previous full-year fiscal 2026 forecast, further rattling investors. Shares fell over 13% in after-hours trading following the announcements and guidance that remains well below consensus expectations for the next quarter.

Stripe and Paradigm Announce 'Agentic Payments' via Tempo Blockchain for Stablecoin Speed and AI Integration

Stripe and Paradigm launched the Tempo blockchain to digitize global payments, with stablecoin support (such as USDC) for transaction fees and built-in AI-enabled agentic payments for automation. Tempo leverages Stripe's extensive payment ecosystem and Paradigm's technical expertise, aiming to streamline cross-border payments and payroll through fast, low-cost stablecoin transactions. The Layer-1 blockchain initiative underscores industry adoption of AI and blockchain as core infrastructure for next-generation financial workflows.

Atlassian Agrees to Acquire The Browser Company for $610 Million

On September 4, 2025, Atlassian Corp. announced a major agreement to acquire The Browser Company, creator of the Arc and AI-powered Dia browsers, for $610 million in cash. This strategic move aims to advance AI-powered productivity tools, with both companies emphasizing their ambition to create a browser optimized for knowledge work and SaaS app integration. The Browser Company will continue developing Dia independently, and its CEO cited access to Atlassian's resources as critical for achieving their vision of a cross-platform browser-as-operating-system.

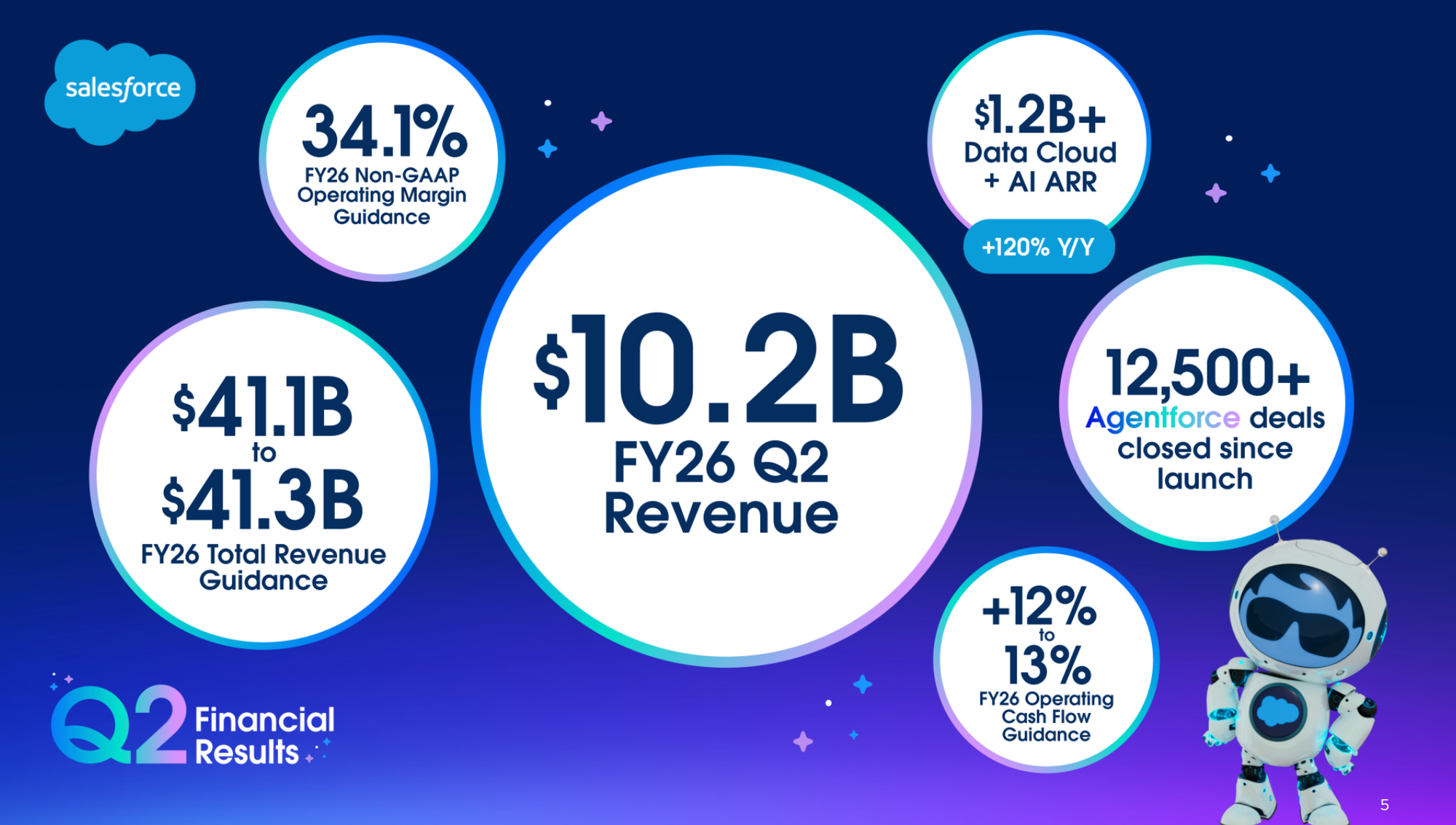

Salesforce posts an earnings beat, but stock drops as outlook disappoints

Salesforce (CRM) reported second-quarter revenue of $10.24 billion, representing a 10% year-over-year increase and surpassing analyst expectations. Though the company also beat EPS estimates and raised the lower end of its full-year guidance, investors were disappointed by a softer-than-expected sales outlook for the next quarter, leading to a decline in the stock price.

IQM Quantum raises $320M Series B to fuel US expansion and million-qubit roadmap

IQM Quantum Computers, a leading quantum computing startup based in Finland, has raised a landmark $320 million in Series B funding, the largest late-stage quantum raise to date. The round—led by US investor Ten Eleven Ventures—will fund US expansion and R&D to scale IQM’s superconducting quantum computers from hundreds to millions of qubits, aiming to compete with industry giants like IBM and Google. The new capital brings IQM’s total funding to $600 million and pushes its valuation to over $1 billion, signaling a major milestone for European quantum technology.

OpenAI Acquires Statsig for $1.1 Billion; Statsig CEO Named CTO of Applications

OpenAI announced today a definitive agreement to acquire product testing startup Statsig in an all-stock deal valued at $1.1 billion. Statsig CEO Vijaye Raji will join OpenAI as CTO of Applications, reporting to Fidji Simo, with OpenAI citing the move as a strategic step to accelerate experimentation and product development for its applications, including ChatGPT. The deal, subject to regulatory approval, is one of OpenAI's largest acquisitions and signals a push to strengthen its applications division while keeping Statsig's platform operating independently in Seattle.

Google Won’t Have to Sell Chrome After Landmark Search Antitrust Ruling

A federal judge ruled today that Google is not required to divest its Chrome browser or Android mobile operating system, decisively rejecting the U.S. Department of Justice's sweeping proposal for forced breakups. However, the court imposed significant restrictions: Google must end exclusive search deals and share its search data with rivals, aiming to address its unlawful monopoly in general search. The ruling is seen as the most consequential antitrust decision against a tech giant in over 25 years, and Google has announced plans to appeal.

Anthropic Raises $13 Billion in Series F, Valued at $183 Billion Post-Money

Anthropic has completed a $13 billion Series F fundraising round led by ICONIQ, giving the AI company a post-money valuation of $183 billion as of September 2, 2025. The round, among the largest ever in the AI sector, included major investors such as Fidelity Management & Research, Lightspeed Venture Partners, BlackRock affiliates, and D1 Capital. The capital will support increased enterprise demand, further AI safety research, and global expansion.

Klarna Revives IPO Plans, Aims to Raise $1.27 Billion

Klarna officially revived its initial public offering plans today, announcing an intent to raise up to $1.27 billion in a NYSE listing that could value the company at up to $14 billion. Klarna and some shareholders will sell roughly 34.3 million shares at $35–$37 each, with the offering led by major investment banks including Goldman Sachs, JP Morgan, and Morgan Stanley. Klarna’s IPO was long anticipated; the renewed launch follows significant revenue growth (up 54% year-on-year in Q2), despite ongoing net losses, and comes after the company’s previous $45 billion valuation plummeted in the post-pandemic downturn.

OpenAI and Retro Biosciences Announce Breakthrough in Cellular Reprogramming Using AI-Engineered Proteins

OpenAI and Retro Biosciences have jointly announced a major advance in life sciences, leveraging a specialized AI, GPT-4b micro, to design novel variants of the Yamanaka factors—proteins central to induced pluripotent stem cell (iPSC) generation. The new proteins produce over 50 times higher expression of stem cell reprogramming markers compared to wild-type controls and show enhanced DNA damage repair, suggesting a significant leap in cellular rejuvenation potential. These results have been validated across multiple donors, cell types, and delivery methods, with confirmed pluripotency and genomic stability, marking a substantial step forward in AI-directed biotechnology research.

Nvidia's Q2 Revenue Reveals Major Dependence on Two Mystery Customers

Nvidia's latest SEC filing disclosed that two unnamed direct customers accounted for a staggering 39% of its record $46.7 billion revenue in Q2 2025. 'Customer A' contributed 23% (approximately $10.7 billion) and 'Customer B' 16% ($7.5 billion), sparking fresh concerns over revenue concentration risk as investor scrutiny rises amid Nvidia's explosive AI growth. The company clarified these are not cloud giants but direct buyers such as OEMs, system integrators, or distributors, with major cloud firms remaining indirect customers purchasing through these intermediaries.