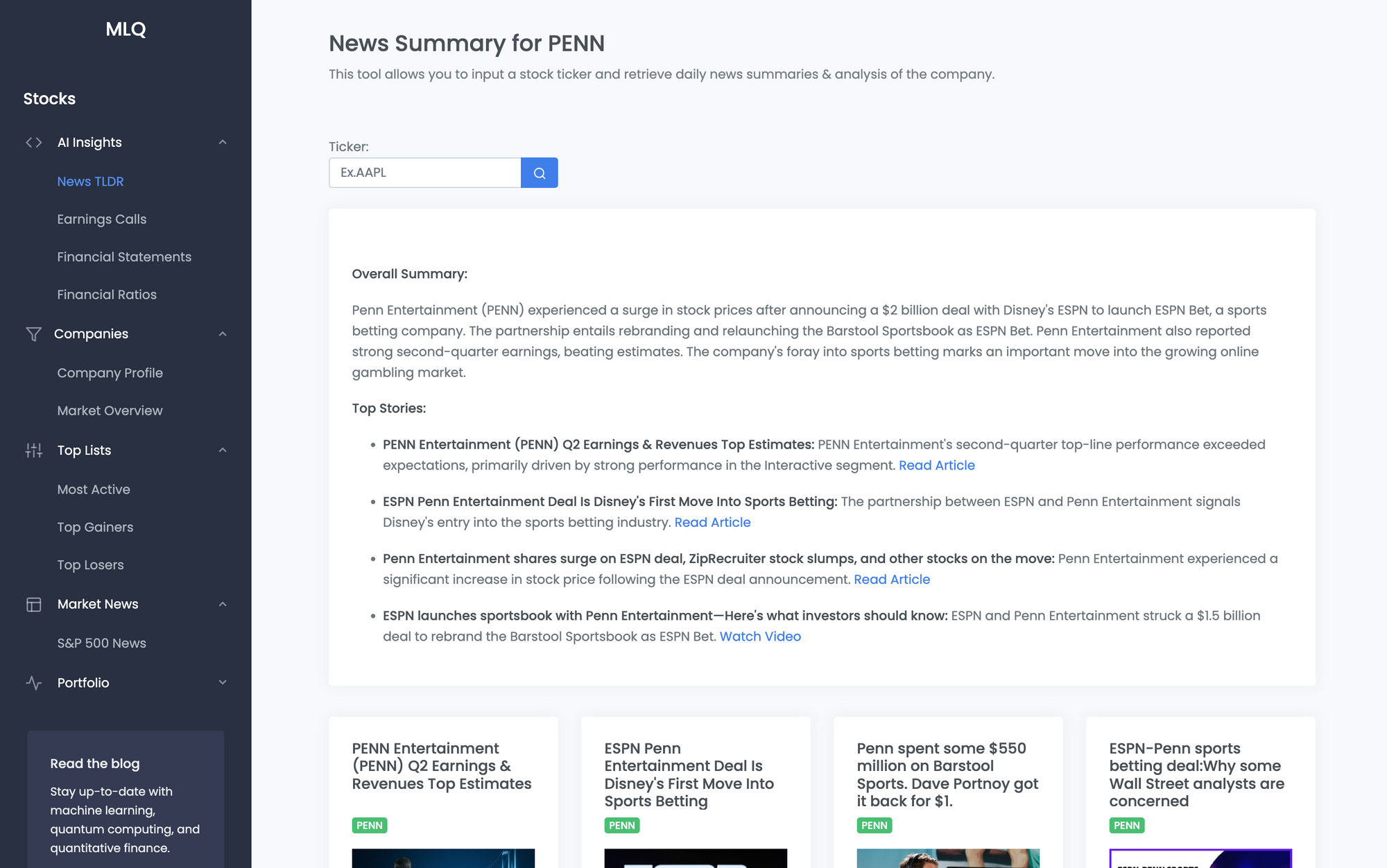

PENN Entertainment ($PENN) had a big day in the news, with multiple articles highlighting its second-quarter earnings and revenue beating estimates, as well as its partnership with Disney's ESPN to enter the sports betting market.

The company also announced they're selling BarStool Sports back to back Dave Portnoy got it back for $1 as part of the ESPN deal, which they paid some $550 million for 3.5 years ago...not a bad deal for Barstool.

Emergency Press Conference - I Bought Back Barstool Sports pic.twitter.com/dmUk0eNowx

— Dave Portnoy (@stoolpresidente) August 8, 2023

The company's stock surged following the $2 billion deal, which includes rebranding and relaunching its sportsbook as ESPN Bet. The partnership has drawn both praise and criticism, with some analysts concerned about potential conflicts of interest.

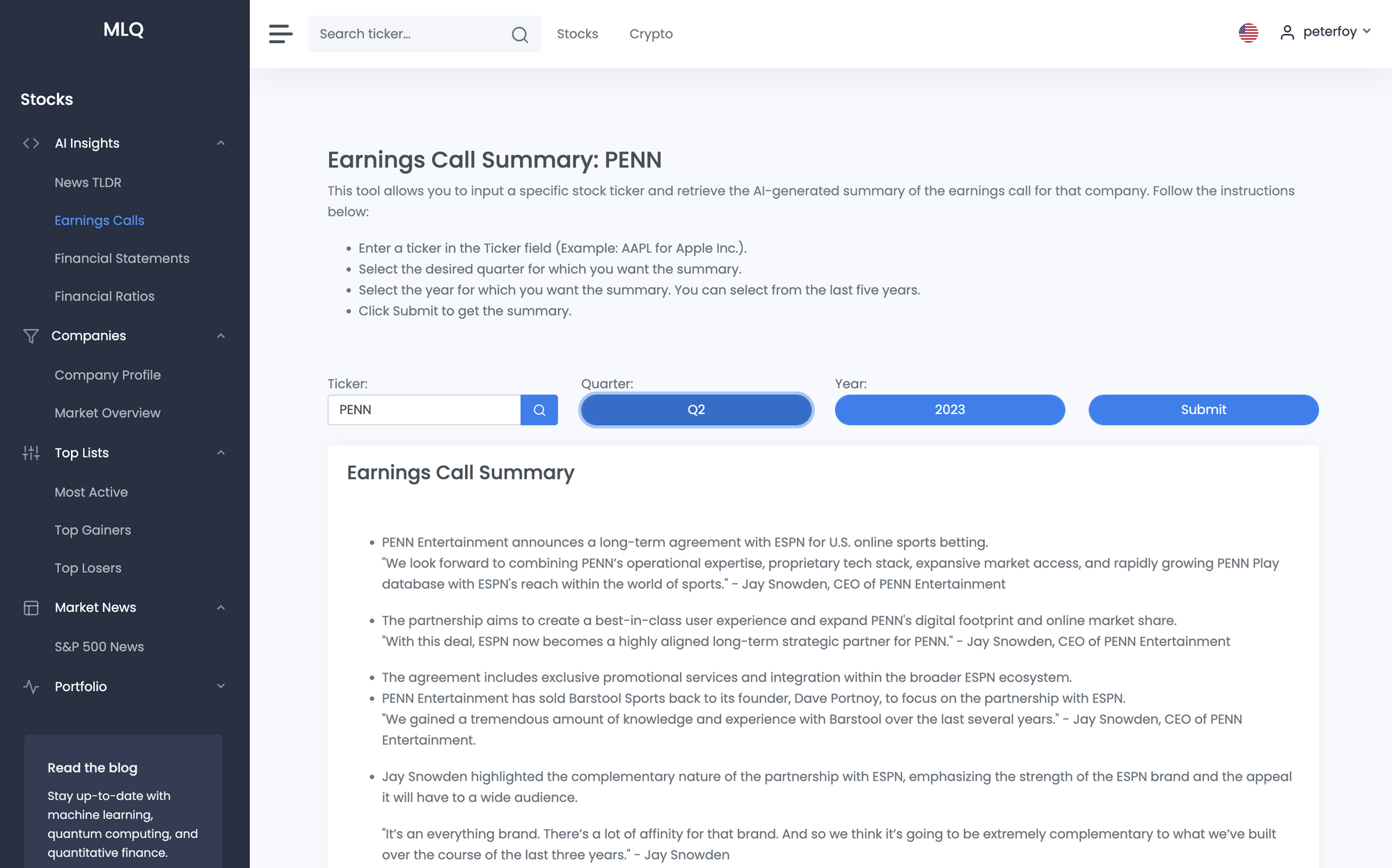

PENN Q2 2023 Earnings Call Summary

The following summary is from our Earnings Call Assistant, which you can learn more about here.

PENN sells Barstool Sports back to Dave Portnoy for $1

PENN Entertainment has sold Barstool Sports back to its founder, Dave Portnoy, to focus on the partnership with ESPN.

As part of this transaction, we are selling Barstool Sports back to its founder, Dave Portnoy. Dave, Erika, Big Cat and everyone at Barstool have been great to work with over the last 3.5 years and were the ideal partners to help us launch and rapidly scale our digital footprint across 16 jurisdictions in the U.S.

With the sale, Barstool will now be able to return to what it does best: provide unique and authentic entertainment content to their loyal fan base, without the restrictions and guardrails that come from being owned by a publicly traded, licensed, regulated gaming company. - Jay Snowden

PENN ESPN Deal

PENN Entertainment announces a long-term agreement with ESPN for U.S. online sports betting:

"We look forward to combining PENN’s operational expertise, proprietary tech stack, expansive market access, and rapidly growing PENN Play database with ESPN's reach within the world of sports." - Jay Snowden

Jay Snowden highlighted the complementary nature of the partnership with ESPN, emphasizing the strength of the ESPN brand and the appeal it will have to a wide audience.

"With this deal, ESPN now becomes a highly aligned long-term strategic partner for PENN." - Jay Snowden

Snowden discussed the promotional spend and marketing strategy for the launch of ESPN Bet, stating that the majority of promotional expenses will occur in Q4 2021 and Q1 2022, with a focus on big sporting events like the NFL playoffs and March Madness.

"As you think about it, there’s going to be – that’s where the lion’s share of your promotional expense is going to be as you’re bringing a lot of new people into the ecosystem with the first-time deposit match and the like." - Jay Snowden

Snowden addressed concerns about market share and stated that the exclusive, ESPN-branded, fully integrated partnership. The CEO mentioned that they will not provide a specific market share threshold for terminating the agreement, but they have no intention of being 4% or 5% market share players. They expect to be within the range provided in their investor presentation.

"We’re not doing this deal to be 4% or 5% market share players. That’s not going to be acceptable for us. It’s not going to be acceptable for ESPN." - Jay Snowden, CEO

The company plans to offer iGaming within the ESPN Bet sports betting platform in states where online casino is legal. They believe multiple brands are needed for online casino and are focusing on the Hollywood brand.

"We will have a Hollywood-branded iCasino offering within the ESPN Bet sports betting offering and platform in all states where online casino is legal." - Jay Snowden, CEO

Snowden mentioned that Penn owns the customers in the ESPN Bet ecosystem and that responsible gaming measures will be implemented.

"Anyone who is in the ESPN Bet, specifically the ESPN Bet ecosystem, is owned by PENN...We feel like we’ve got a path forward and a road map on how to market to the database in a very responsible way." - Jay Snowden

The executives expressed confidence in sustaining current profit margins, citing the rationality of labor and marketing expenses in the industry and the positive impact of technology enhancements.

"We’re very comfortable as we move forward with those being the two expense drivers that we’re in a good place. And then with our technology enhancements, we think that will continue to add to our margin profile." - Todd George

Disclaimer

Please note this pages serves informational purposes only and does not constitute as financial advice, always use your own judgement and due diligence. The financial data and insights provided uses OpenAI's GPT API and are derived from a variety of sources which are believed to be reliable. However, we do not warrant the accuracy or completeness of this data, and the data should not be relied upon as such. All the financial data and insights are provided "as is", without warranty of any kind, either express or implied.