Palantir Technologies (PLTR) stock experienced some volatility following its Q2 earnings release. While many analysts see potential in Palantir's years of AI experience, they also mention the need for patience in seeing financial results from these capabilities. Palantir's AI platform, AIP, continues to generate interest as more and more corporates understand and are eager to adopt LLMs in their business.

The company also announced a $1 billion buyback authorization program. Overall, Palantir's strong position as a leader in AI and positive revenue guidance for the future indicate a promising outlook in the long run, despite the stocks dip after Q2 earnings.

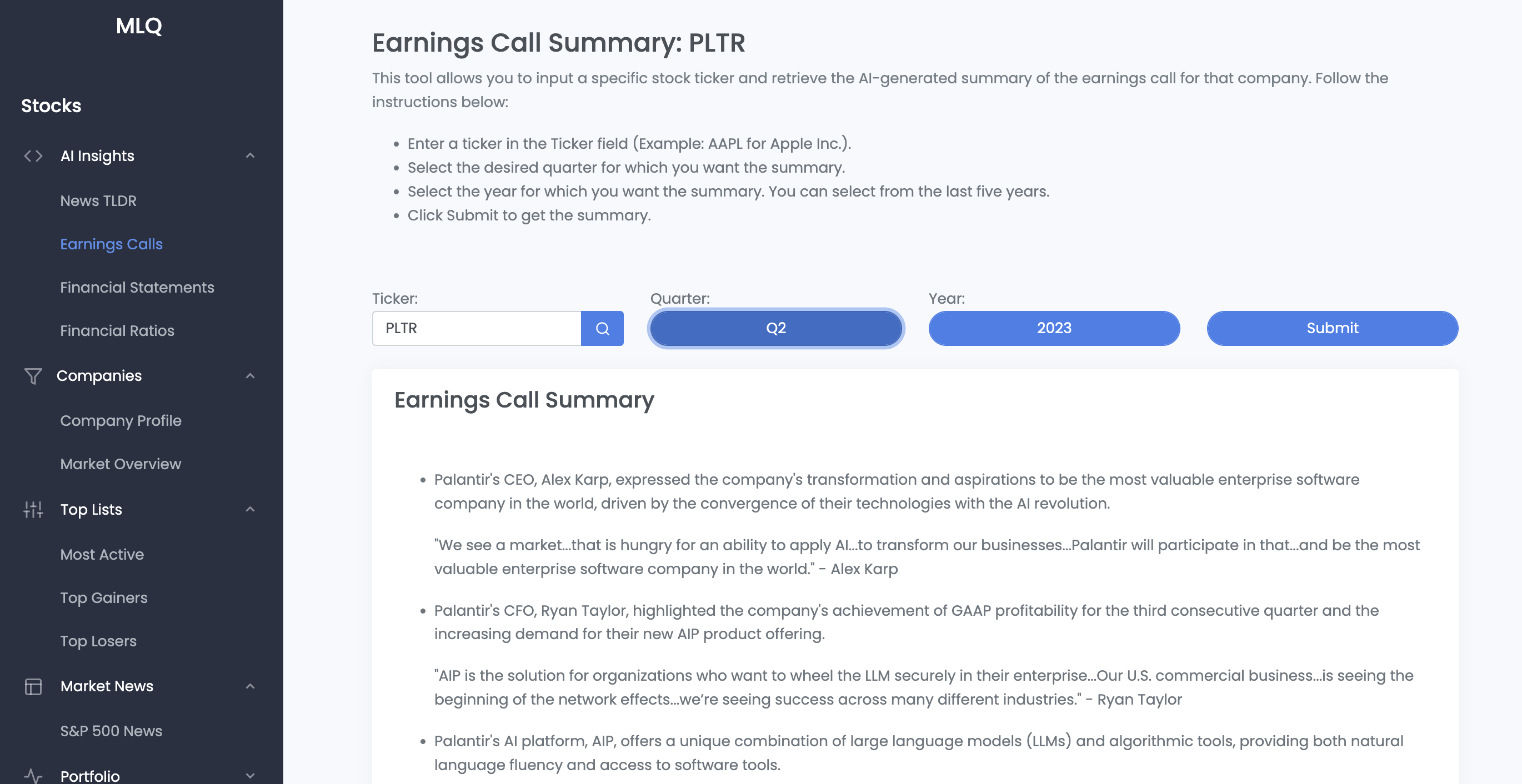

Palantir Q2 2023: Earnings Call Summary

Overview

- Palantir's AI platform, AIP, offers a unique combination of large language models (LLMs) and algorithmic tools, providing both natural language fluency and access to software tools.

"LLMs can’t, for example, calculate profitability or expected lead times, but they don’t have to. They need to have access to the software tools that can. This is why AIP is positioned to deliver outcomes so quickly." - Shyam Sankar, CEO

- More than 100 organizations are currently using AIP, and Palantir is having conversations with over 300 organizations, with many willing to use AIP on the Foundry platform.

"The ambition has gone way up. People expect this offer to work." - Shyam Sankar

- Palantir expects to be eligible for S&P 500 inclusion after reporting Q3 earnings.

Financial highlights

- Palantir's CFO, Ryan Taylor, highlighted the company's achievement of GAAP profitability for the third consecutive quarter and the increasing demand for their new AIP product offering.

"AIP is the solution for organizations who want to wheel the LLM securely in their enterprise...Our U.S. commercial business...is seeing the beginning of the network effects...we’re seeing success across many different industries." - Ryan Taylor

- The company's capital allocation priorities include investing in itself, rather than acquiring other companies, and focusing on profitability and stability to position itself as a leading enterprise software company.

- Palantir is focused on driving compounding usage of their products, with over 5,000 monthly users and 50% month-over-month growth.

"We have over 5,000 monthly users. The users are growing 50% month-over-month." - Shyam Sankar

AI highlights

- Palantir is seeing unprecedented interest in its AIP offering, with sales cycles shortening and expectations for continued acceleration.

- American institutions now understand the importance of AI in changing margins and outmaneuvering competition, leading to increased demand for Palantir's solutions.

- The company has deployed over 15 copilots with customers in the field in the last 10 weeks, demonstrating the value of its AI capabilities and the time to value.

- Palantir's CEO, Alex Karp, expressed the company's transformation and aspirations to be the most valuable enterprise software company in the world, driven by the convergence of their technologies with the AI revolution.

"We see a market...that is hungry for an ability to apply AI...to transform our businesses...Palantir will participate in that...and be the most valuable enterprise software company in the world." - Alex Karp

- The AIP platform enables enterprises to quickly build bespoke AI tools and applications, accelerating workflows across industries.

"AIP is not only the best tool bench in this context. It is a tool factory that enables enterprises to quickly forge new bespoke tools in hours." - Shyam Sankar, CEO

- The AIP product strategy aims to allow users to use AIP without the need for other Palantir products like Gotham, Foundry, or Apollo.

"The real focus on the AIP product strategy is to make sure that you can use AIP without Gotham, Foundry, or Apollo." - Shyam Sankar

Disclaimer

Please note this pages serves informational purposes only and does not constitute as financial advice, always use your own judgement and due diligence. The financial data and insights provided uses OpenAI's GPT API and are derived from a variety of sources which are believed to be reliable. However, we do not warrant the accuracy or completeness of this data, and the data should not be relied upon as such. All the financial data and insights are provided "as is", without warranty of any kind, either express or implied.