Shares of Palantir Technologies (PLTR) fell in after-hours trading after their Q1 2024 earnings call on May 6, 2024.

Despite the AI company reporting better-than-expected financial results and strong growth in its commercial segment, investors were wary after their forward-looing guidance failed to meet expectations.

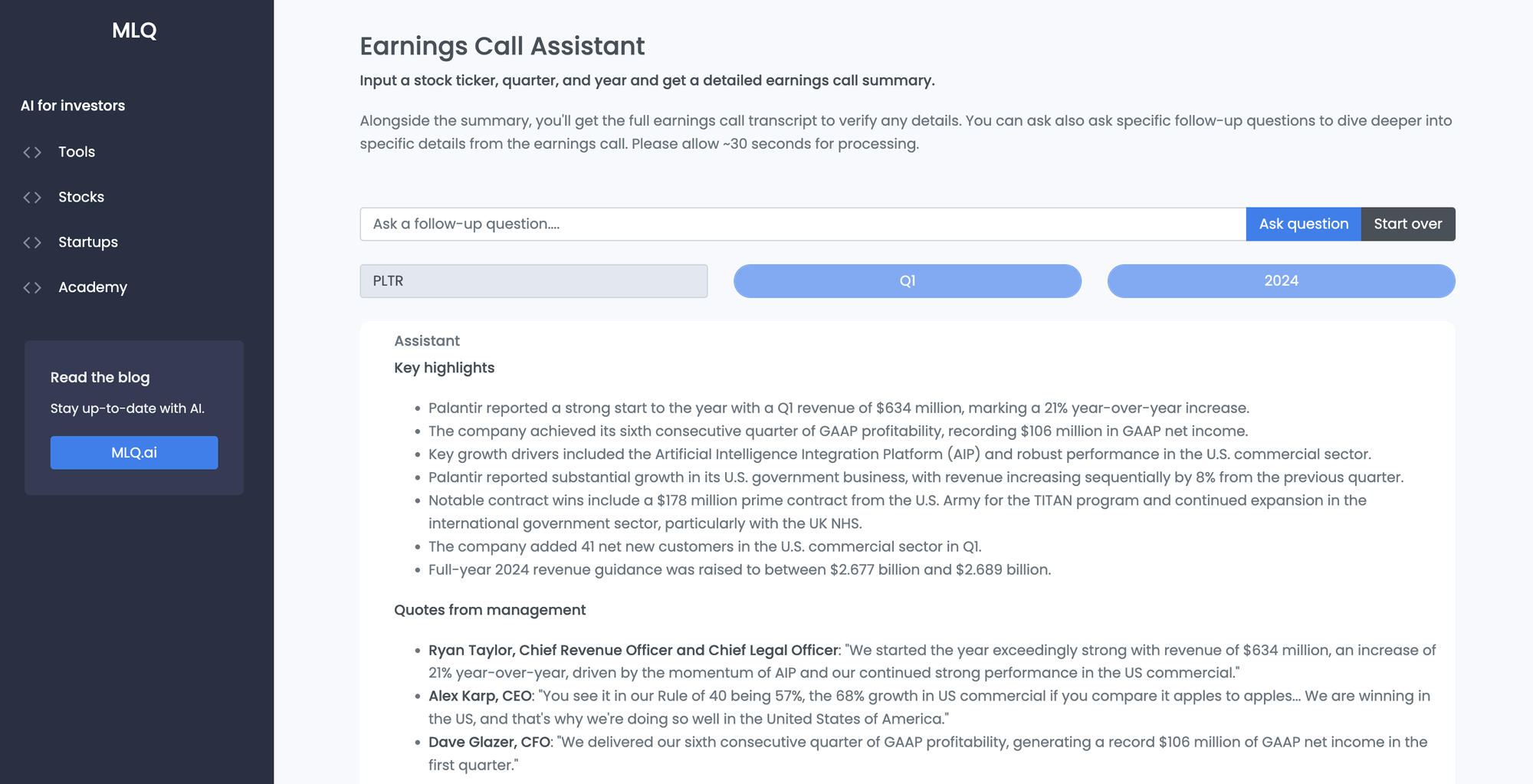

In this article, let's use our earnings call assistant to analyze key highlights and management discussions for the quarter.

Q1 2024: Key highlights

- Palantir reported a strong start to the year with a Q1 revenue of $634 million, marking a 21% year-over-year increase.

- The company achieved its sixth consecutive quarter of GAAP profitability, recording $106 million in GAAP net income.

- Key growth drivers included the Artificial Intelligence Integration Platform (AIP) and robust performance in the U.S. commercial sector.

- Palantir reported substantial growth in its U.S. government business, with revenue increasing sequentially by 8% from the previous quarter.

- Notable contract wins include a $178 million prime contract from the U.S. Army for the TITAN program and continued expansion in the international government sector, particularly with the UK NHS.

- The company added 41 net new customers in the U.S. commercial sector in Q1.

- Full-year 2024 revenue guidance was raised to between $2.677 billion and $2.689 billion.

Revenue guidance disappoints investors

Despite these positive revenue figures, Palantir's future revenue guidance sparked concerns among investors, leading to a sharp decline in the company's stock price in after-hours trading.

Palantir adjusted its full-year revenue forecast to between $2.68 billion and $2.69 billion, a slight increase from its previous projection. However, this revised guidance fell short of the consensus estimate of $2.71 billion expected by analysts.

This reaction from the market highlights a growing impatience among investors, who are eager to see Palantir not only continue its growth trajectory but also exceed market expectations.

Quotes from management

Here are a few key quotes from management during the earnings call:

Ryan Taylor, Chief Revenue Officer and Chief Legal Officer:

We started the year exceedingly strong with revenue of $634 million, an increase of 21% year-over-year, driven by the momentum of AIP and our continued strong performance in the US commercial.

We generated first quarter GAAP net income of $106 million, representing a 17% margin, our sixth consecutive quarter of GAAP profitability. First quarter adjusted earnings per share was $0.08 and GAAP earnings per share was $0.04.

Alex Karp, CEO

You see it in our Rule of 40 being 57%, the 68% growth in US commercial if you compare it apples to apples... We are winning in the US, and that's why we're doing so well in the United States of America.

Dave Glazer, CFO

We delivered our sixth consecutive quarter of GAAP profitability, generating a record $106 million of GAAP net income in the first quarter.

Q&A session

- Question: Daniel Ives from Wedbush Securities asked about the conversion rates from AIP bootcamps to actual sales.

- Response: Ryan Taylor highlighted that the bootcamps have significantly shortened the sales cycle from three months to about one day in many cases, often resulting in seven-figure deals soon after the BootCamp.

- Question: Mariana Perez Mora from Bank of America inquired about tackling the unprecedented demand and supporting a larger customer base.

- Response: Shyam Sankar, CTO, emphasized the role of 'Build with AIP' initiatives that empower customer’s builders to tackle use cases independently, while Ryan Taylor mentioned expanding partnerships to address this demand effectively.

Summary: PLTR Q1 2024 Earnings

Despite the after-hours fall in Palantir share price, the company's first-quarter earnings in 2024 reflect that it's on a solid growth trajectory, with strong performance metrics and strategic expansions.

However, the mixed reaction from investors following its earnings report highlights the challenges Palantir faces in investors growing impatient and their slightly lower revenue guidance for the year.

As the company continues to expand its reach in both government and commercial sectors, it remains to be seen how it will navigate the competitive and technological landscapes that lie ahead.

Disclaimer

Please note this page serves informational purposes only and does not constitute financial advice, always use your own judgement and due diligence. The financial insights provided uses OpenAI's GPT API and are derived from a variety of sources that are believed to be reliable. The facts have been reviewed by a human editor, however, we do not warrant the accuracy or completeness of this data, and the data should not be relied upon as such. All the financial data and insights are provided "as is", without warranty of any kind, either express or implied. Please see our full terms of service for more details.