This week in AI, OpenAI launched GPT-5 and two open-weight models, Anthropic rolls out Claude Opus 4.1, and DeepMind debuts Genie 3 for real-time 3D world generation.

In the markets, Palantir blows past estimates with 93% U.S. commercial growth, AMD posts record revenue despite export headwinds, and Nebius reports 625% growth with positive EBITDA. Plus: Duolingo’s surge, Shopify’s $906M profit, and more.

In this newsletter:

- OpenAI Launches GPT-5 and Two Open Source Models

- Anthropic Releases Claude Opus 4.1, Targeting Advanced Coding and Agentic Tasks

- DeepMind Unveils Genie 3: A Major Advance Toward Artificial General Intelligence

- Nebius Reports Q2 2025 Earnings: Revenue Up 625%, Raises ARR Guidance, Achieves Positive Adjusted EBITDA

- AMD Reports Record Q2 2025 Revenue, Impacted by China Export Controls; Issues Strong Q3 Guidance

- Palantir Reports Blowout Q2 Earnings with 93% U.S. Commercial Revenue Growth, Raises Fiscal 2025 Guidance, and more

This Week in AI

OpenAI launches GPT-5, ushering in a new era for ChatGPT

OpenAI released its flagship GPT-5 model today, describing it as a major leap forward that unifies its prior advances in reasoning and speed, signaling broader ambitions toward AGI. GPT-5 now powers ChatGPT, enabling it to autonomously complete a wider array of tasks for users, such as code generation, scheduling, and research. CEO Sam Altman called GPT-5 'the best model in the world,' adding that its debut marks 'a significant step' on the path to building AI that can outperform humans at most economically valuable work.

OpenAI Releases Two Open-Weight AI Reasoning Models

OpenAI announced today the release of two open-weight large language models, gpt-oss-120b and gpt-oss-20b, in partnership with NVIDIA. These models, which rival capabilities of OpenAI's proprietary o-series, are optimized for NVIDIA’s Blackwell platform and can be accessed globally for generative, reasoning, and agentic AI applications. The models represent a significant advance for open-access AI, with optimized performance on NVIDIA GB200 NVL72 systems and strong positioning for enterprise and developer adoption across industries.

Anthropic Releases Claude Opus 4.1, Targeting Advanced Coding and Agentic Tasks

On August 5, 2025, Anthropic launched Claude Opus 4.1, positioning it as a significant upgrade for users handling complex, multi-step coding and agentic problems. The release delivers a marked boost to software engineering accuracy—now at 74.5%, up from 72.5% with the prior model—and offers improved detail tracking, agentic search, and research/data analysis skills. Claude Opus 4.1 is available for paid plans on Claude, Claude Code, and via Anthropic’s API, Amazon Bedrock, and Google Cloud’s Vertex AI, with pricing and availability remaining consistent with the previous Opus 4 release. The timing of the launch is notable as it comes shortly before an anticipated OpenAI GPT-5 announcement, suggesting heightened competition in the advanced enterprise AI segment. Amazon (AMZN) is cited as a major investor backing Anthropic.

DeepMind Introduces Genie 3: A Major Advance Toward Artificial General Intelligence

Google DeepMind has announced Genie 3, a breakthrough foundation world model capable of generating real-time, interactive 3D environments from text prompts. Genie 3 is being touted as a pivotal step toward artificial general intelligence (AGI), marking a substantial leap over previous models by supporting expansive, coherent virtual worlds at high resolution and maintaining physical consistency over extended simulations. DeepMind researchers emphasized the potential of Genie 3 to revolutionize agent training and simulation across industries, positioning it as a landmark in the development of general-purpose AI systems.

This Week in Markets

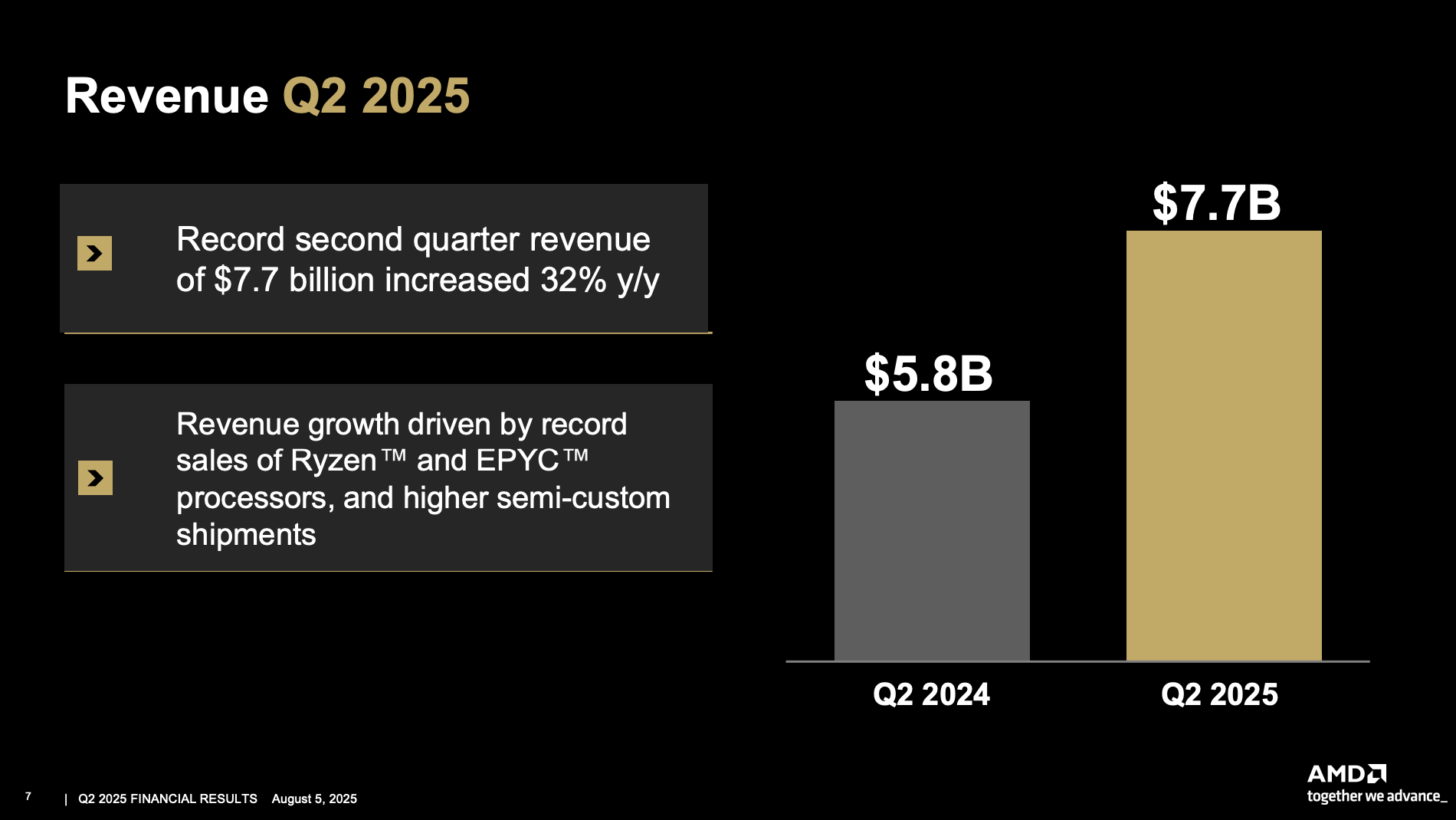

AMD Reports Record Q2 2025 Revenue, Impacted by China Export Controls; Issues Strong Q3 Guidance

AMD (NASDAQ:AMD) reported record second-quarter 2025 revenue of $7.7 billion, a 32% year-over-year increase, driven by robust server and PC processor sales. Despite strong growth, the company recorded an $800 million inventory charge due to U.S. export restrictions on its MI308 data center GPUs to China, resulting in a GAAP operating loss of $134 million; however, net income was $872 million. Looking ahead, AMD expects approximately $8.7 billion in Q3 revenue (plus or minus $300 million), projecting 28% year-over-year growth, and plans to streamline operations through the $3 billion sale of ZT Systems' data center infrastructure business to Sanmina.

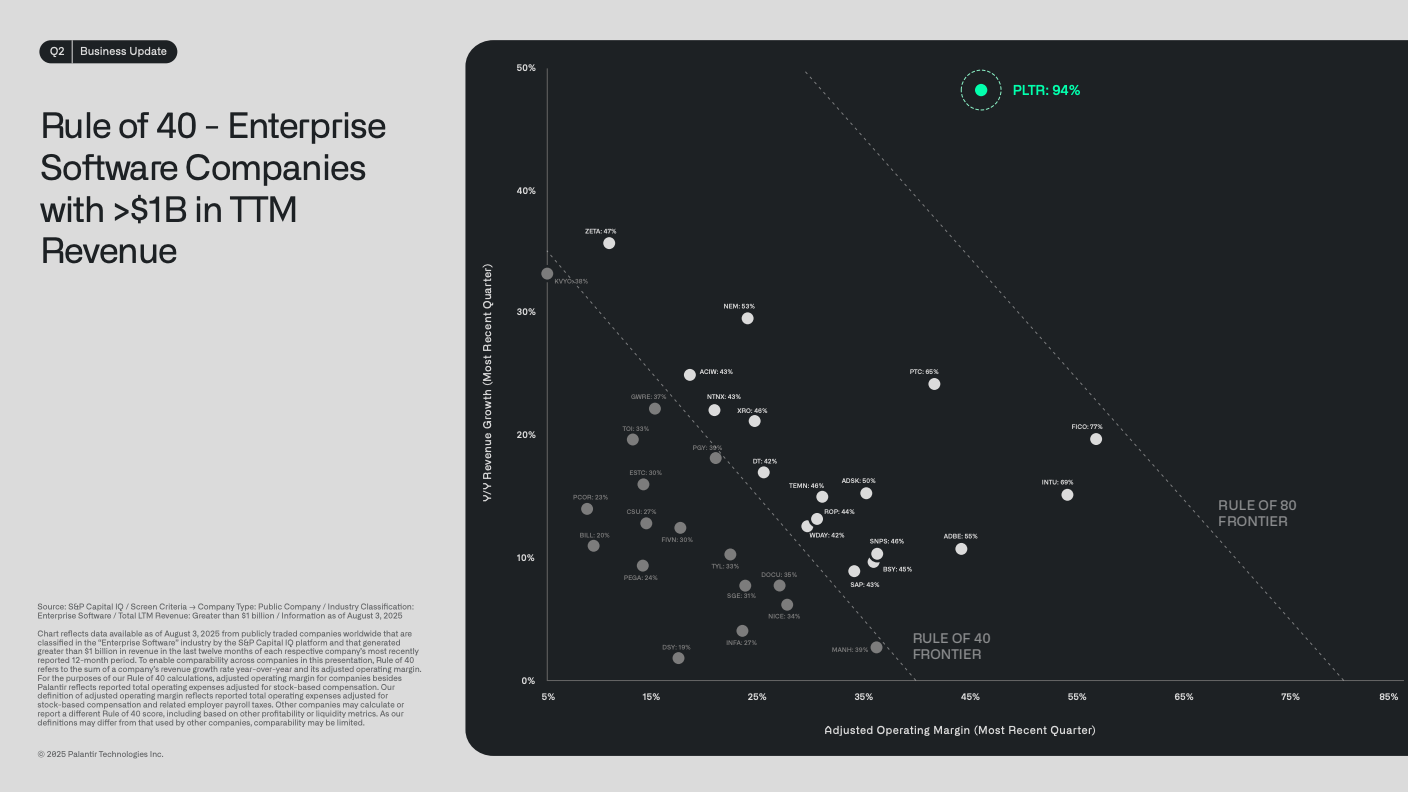

Palantir Reports Blowout Q2 Earnings with 93% U.S. Commercial Revenue Growth, Raises Fiscal 2025 Guidance

Palantir Technologies (PLTR) reported exceptional Q2 2025 results, with U.S. commercial revenue up 93% year-over-year and total revenue surging 48% to $1.004 billion. The company raised its full-year 2025 revenue guidance to 45% year-over-year growth and predicts record Q3 sequential growth, citing strong AI-driven demand. CEO Alex Karp called it 'a phenomenal quarter,' and the company continues to far exceed key growth and profit metrics.

Nebius Reports Q2 2025 Earnings: Revenue Up 625%, Raises ARR Guidance, Achieves Positive Adjusted EBITDA

Nebius Group N.V. (NASDAQ: NBIS) reported Q2 2025 revenue of $105.1 million, representing a 625% increase year-over-year and 106% sequential growth. The company achieved positive Adjusted EBITDA ahead of schedule and raised its annualized run-rate revenue guidance for year-end 2025 to $900 million–$1.1 billion. Nebius is aggressively scaling its AI infrastructure capacity, aiming to secure more than 1 GW of power by the end of 2026, amid strong demand for AI compute and services. Management also noted the publication of the CEO’s quarterly letter to shareholders alongside these results.

Rocket Lab Reports Record Q2 Results, Surpassing Expectations and Posts Strong Revenue Growth

Rocket Lab (NASDAQ: RKLB) reported its Q2 2025 earnings after the close, posting record quarterly revenue of $144 million—a 36% year-on-year increase—and expanded gross margins by 650 basis points. The company exceeded consensus forecasts and highlighted expansion via its Mynaric acquisition, formal onboarding to the U.S. Department of Defense's $5.6B National Security Space Launch (NSSL) program, and continued momentum on its Neutron rocket, which remains on track for a first launch in the second half of 2025. Management reaffirmed guidance for breakeven in 2026, underscoring improving launch cadence and space systems mix as drivers of future profitability.

Firefly Aerospace prices upsized IPO above the upwardly revised range at $45

Firefly Aerospace successfully raised $868 million in its IPO by offering 19.3 million shares at $45, surpassing its upwardly revised price range of $41 to $43. The company, which develops space launch vehicles and spacecraft, will trade on Nasdaq under the symbol FLY and had originally planned to offer 16.2 million shares in a lower price band. This marks a significant public market debut for the space and defense technology sector, with Firefly joining recent notable listings in the industry.

President Trump Calls for Intel CEO's Resignation Over Alleged Conflicts

President Trump publicly called for the resignation of Intel CEO Lip-Bu Tan, labeling him 'highly conflicted' and urging immediate action. The call follows a letter from Sen. Tom Cotton citing Tan’s alleged investments and ties to Chinese businesses, some reportedly linked to the Chinese military. Following Trump's statement, Intel's stock dropped over 4% in premarket trading, raising serious concerns for the company and broader semiconductor market.

IonQ Beats Q2 Revenue Estimates, Announces Major Acquisitions and Expands Quantum Roadmap

IonQ (NYSE: IONQ) reported second-quarter 2025 revenue of $20.7 million, beating the top end of guidance by 15%, but posted a net loss of $177.5 million, largely due to significant stock compensation and warrant revaluation expenses. The company unveiled major expansion moves, including the proposed $1.075 billion acquisition of Oxford Ionics and completed acquisitions of Lightsynq and Capella, aiming to accelerate quantum computing scalability, with pro-forma cash holdings reaching $1.6 billion after a $1 billion equity raise. Despite exceeding revenue estimates, the stock declined 7.6% post-earnings due to a large EPS miss, while management reaffirmed full-year guidance and highlighted commercial progress, including a major $22M deal with EPB.

Duolingo Shares Surge After Smashing Q2 Expectations and Raising Outlook

Duolingo delivered blowout second-quarter results, posting a 41% revenue jump to $252.3 million—well above analyst expectations—as daily active users soared 40% to 47.7 million. The company raised its full-year outlook following these results, and shares climbed over 16% after hours as net income nearly doubled year-over-year to $44.8 million, signaling strong momentum for the language-learning platform.

AppLovin Surges on Blockbuster Q2 Earnings, Revenue Soars 77% Amid AI Ad-Tech Pivot

AppLovin (APP) reported a massive 77% year-over-year revenue jump in Q2 2025, reaching $1.259 billion and smashing Wall Street expectations. Adjusted EBITDA surged 99% to $1.018 billion as the company's strategic shift to AI-powered ad technology and divestiture of its gaming business drove substantial profit margins, reinforcing its position as a leading player in ad-tech and fueling investor confidence.

Shopify Records US$906 Million Profit in Q2 as Revenue Jumps by 31%

Shopify Inc. reported a strong second-quarter profit of US$906 million, a significant increase from US$171 million a year ago, as revenue surged by 31% to US$2.68 billion. The company delivered adjusted earnings of 35 cents per share, well above Wall Street expectations, and achieved its eighth consecutive quarter with double-digit free cash flow margins. Both North America and international markets showed accelerating growth, contributing to the company's robust performance this quarter.

Uber Reports Record Q2 Earnings and Announces $20 Billion Share Buyback

Uber posted exceptional Q2 2025 results, with operating income soaring 82% year-over-year to $1.5 billion and Adjusted EBITDA up 35% YoY to $2.1 billion. The company reported strong growth in trips and gross bookings (both +18% YoY), record free cash flow, and a new $20 billion share repurchase authorization — signaling confidence in sustained profitable growth.

Bullish Crypto Exchange Launches $629 Million NYSE IPO Roadshow, Backed by Peter Thiel

Bullish, a global crypto exchange platform and parent of CoinDesk, launched its highly anticipated IPO roadshow today, targeting a $629 million raise and a $4.23 billion valuation on the New York Stock Exchange under the ticker 'BLSH'. The offering, backed by prominent investor Peter Thiel and led by J.P. Morgan, Jefferies, and Citigroup, will fund Bullish's expansion and stablecoin initiatives in a newly crypto-friendly U.S. regulatory climate. The proposed IPO is one of the largest for a crypto exchange this year, signaling renewed institutional momentum for digital asset firms entering public markets.

OpenAI Raises $8.3B at $300B Valuation in Oversubscribed Round

OpenAI has secured $8.3 billion in fresh funding, pushing its valuation to $300 billion, according to major reports today. The oversubscribed round was led by Dragoneer Investment Group, which contributed $2.8 billion, and included new participation from Blackstone, TPG, T. Rowe Price, and other major investors. The deal, part of OpenAI's broader $40 billion fundraising strategy for the year, comes as the company reportedly surpassed $13 billion in annualized revenue and 700 million weekly active users on ChatGPT; it positions OpenAI at the forefront of global AI investment amid surging competition in the space.