This week in AI, Nvidia posted $46.7B in revenue and announced a $60B buyback, while Dell beats but slips on weak PC guidance and Marvell disappoints.

Snowflake, MongoDB, and IREN all report strong earnings. Alphabet hits a $2.5T market cap, Google rolls out 'Nano Banana' image model, and Intel agrees to a 10% U.S. government stake.

Plus: IBM and AMD team up on quantum supercomputers, and Musk open-sources Grok 2.5.

In this newsletter:

- Nvidia Reports Q2 Revenue of $46.7 Billion, Continuing Its AI-Fueled Growth

- NVIDIA Announces $60 Billion Share Repurchase Authorization with Q2 FY2026 Earnings

- Dell's Earnings Beat Amid Stock Decline: Investors Weigh AI Growth Versus Weak PC Guidance

- Marvell Stock Slips After Q2 Earnings Report: Here's Why

- IREN Reports Record Earnings, Achieves NVIDIA Preferred Partner Status

- Snowflake (SNOW) Surpasses Q2 Earnings and Revenue Estimates

- MongoDB Surges After Smashing Q2 Earnings Estimates

- Google Confirms 'Nano Banana' as Gemini 2.5 Flash Image, Launches AI Image Editing Model in Gemini App

- IBM and AMD Announce Strategic Partnership to Develop Hybrid Quantum-Centric Supercomputers

- Alphabet Sets New Milestone with $2.5 Trillion Market Cap Amid AI-Fueled Growth

- Elon Musk Announces Open-Source Release of Grok 2.5 AI Model

- Intel Agrees to U.S. Government Taking a 10% Stake, Trump Announces

Nvidia Reports Q2 Revenue of $46.7 Billion, Continuing Its AI-Fueled Growth

Nvidia announced its fiscal 2026 second-quarter financial results today, reporting revenue of $46.7 billion, a 6% sequential increase and exceeding many analyst expectations for the period. The earnings highlight Nvidia's continued dominance in the AI and data center markets, with strong year-over-year growth and significant attention from Wall Street as the company remains at the heart of artificial intelligence infrastructure demand.

NVIDIA Announces $60 Billion Share Repurchase Authorization with Q2 FY2026 Earnings

On August 27, 2025, NVIDIA reported outstanding Q2 FY2026 results—including $46.7 billion in revenue and strong data center growth. The Board of Directors approved a massive $60.0 billion increase to its share buyback authorization, marking one of the largest technology stock buybacks in history. In the first half of the fiscal year, NVIDIA returned $24.3 billion to shareholders through repurchases and dividends, underscoring sustained confidence and aggressive capital return strategy. This new buyback authorization is expected to further bolster shareholder value and support NVDA's rally in the tech sector.

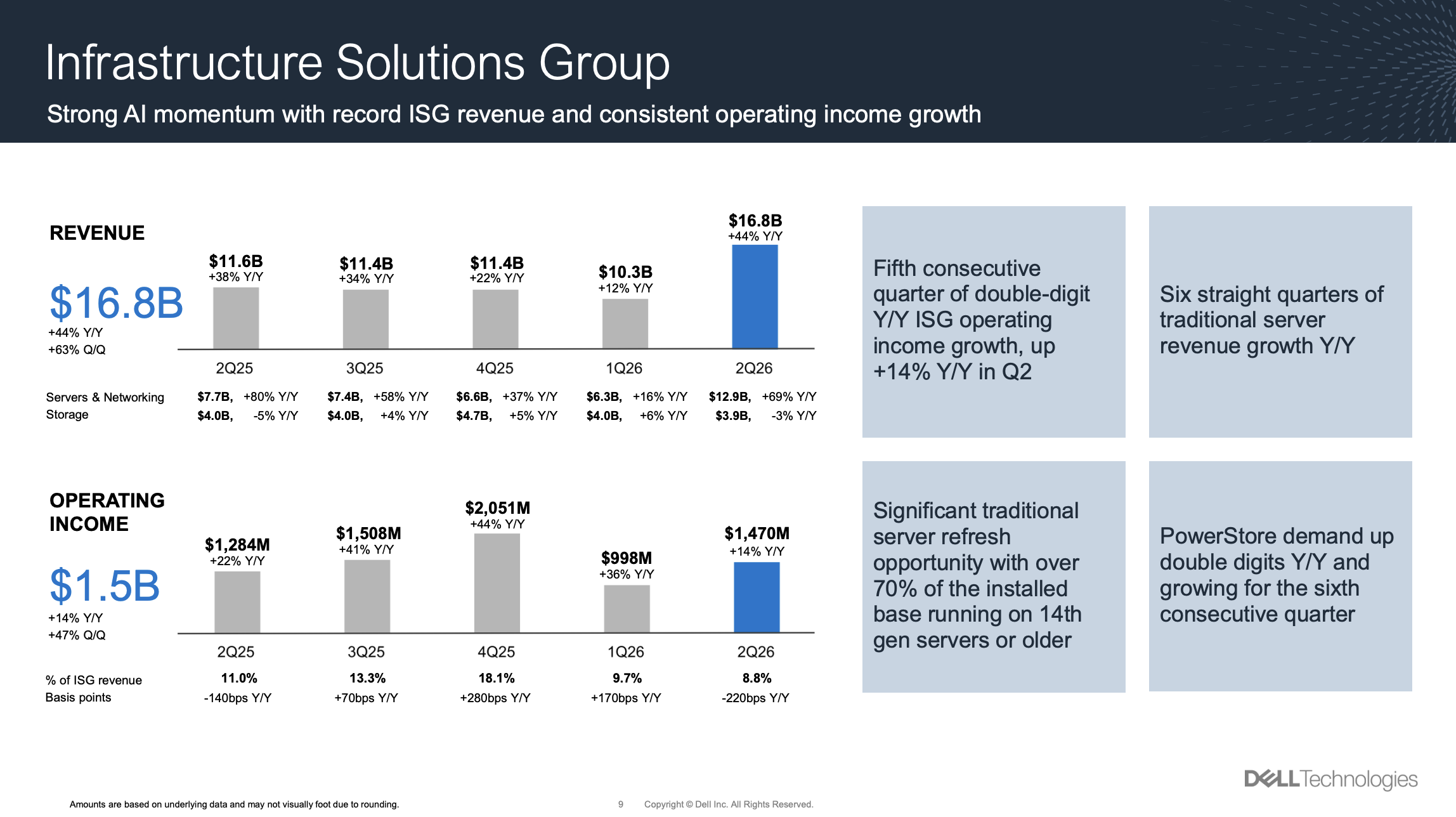

Dell's Earnings Beat Amid Stock Decline: Investors Weigh AI Growth Versus Weak PC Guidance

Dell Technologies reported record Q2 FY2026 revenue of $29.8 billion, up 19% year-over-year, driven by $8.2 billion in AI server shipments. Despite the strong results, the stock dropped over 5% today after issuing weaker-than-expected Q3 guidance ($2.45 EPS versus $2.55 consensus) and ongoing stagnation in its PC segment. The company's robust AI infrastructure sales and $11.7 billion order backlog contrast with valuation concerns and choppy PC market dynamics, making the results a focal point for investors.

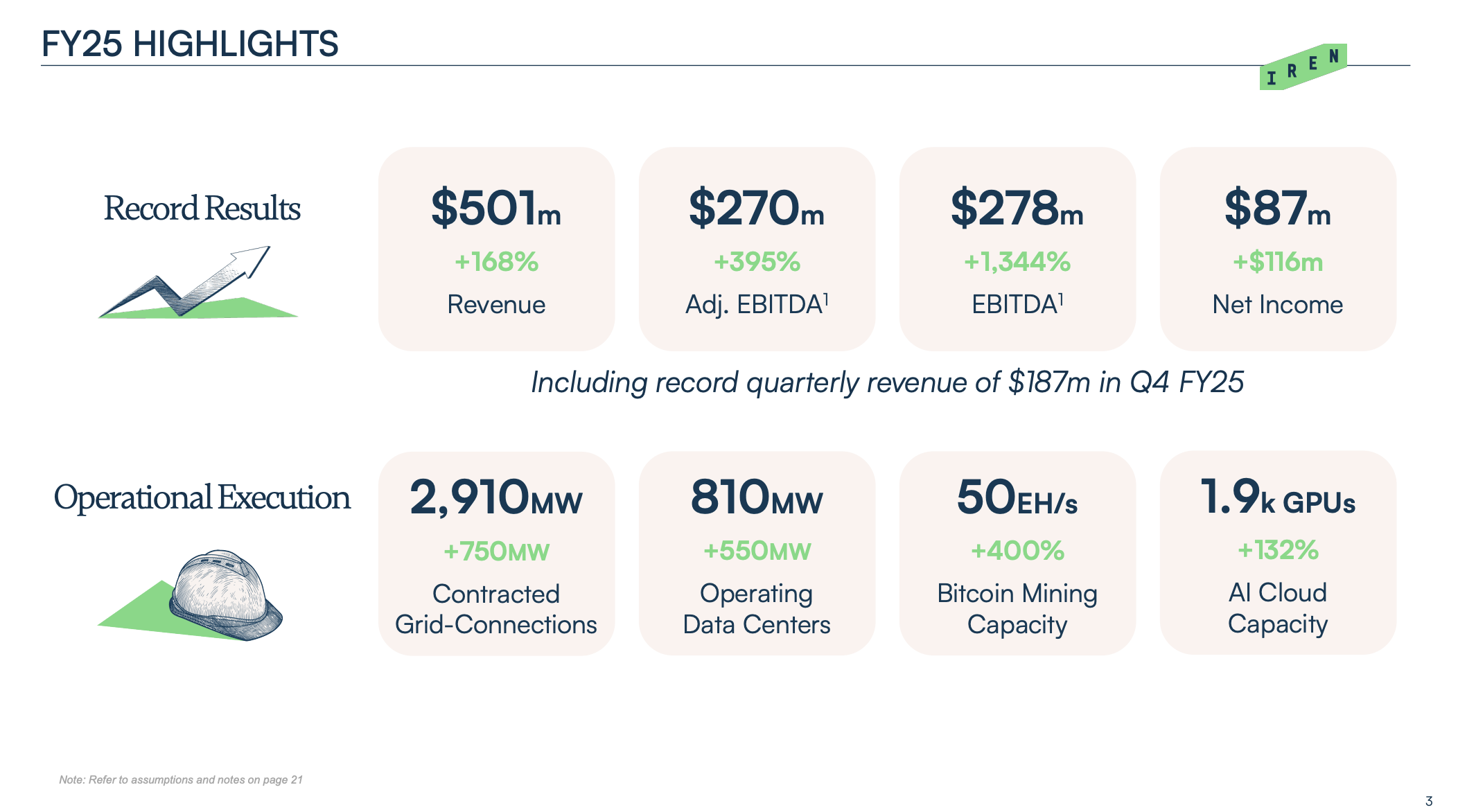

IREN Reports Record Earnings, Achieves NVIDIA Preferred Partner Status

IREN Ltd posted breakout Q4 2025 earnings, reporting $187.3 million revenue—up 226% year-over-year—and net income of $177 million, driven by rapid expansion in Bitcoin mining and AI cloud services. The company achieved NVIDIA Preferred Partner status, plans to expand to over 10,900 GPUs by December, and forecasts $200-$250 million annualized AI cloud revenue. Management highlighted a more than 10-fold EBITDA increase, tripling of data center capacity, and a strong 2025 financial and operational performance.

Snowflake (SNOW) Surpasses Q2 Earnings and Revenue Estimates

Snowflake (SNOW) reported an earnings beat for Q2 FY26, delivering an earnings surprise of +34.62% and a revenue surprise of +5.51% for the quarter ended July 2025. These results exceeded analyst expectations and signal strong performance for the data cloud company in its latest fiscal period.

Marvell Stock Slips After Q2 Earnings Report: Here's Why

Marvell Technology (MRVL) released its second-quarter results after the closing bell today, reporting adjusted earnings of $0.67 per share, narrowly beating analyst expectations. However, quarterly revenue of $2.006 billion missed estimates, and the stock fell as investors were disappointed that results—while showing a 58% year-over-year revenue jump—did not live up to high AI-fueled expectations for upside. CEO Matt Murphy highlighted strong AI demand and improving end-markets, and the company issued Q3 guidance with an earnings range that brackets consensus but a revenue outlook slightly short of analyst estimates.

MongoDB Surges After Smashing Q2 Earnings Estimates

MongoDB reported Q2 non-GAAP earnings per share of $1.00, significantly beating analyst expectations of $0.67 per share. Revenue reached $591.4 million, surpassing the consensus estimate of $553.57 million and representing a 23.7% year-over-year increase. The strong results were highlighted by robust growth in the Atlas segment, and the company expects full-year earnings in the range of $3.64 to $3.73 per share, with revenue guidance of $2.34 billion to $2.36 billion.

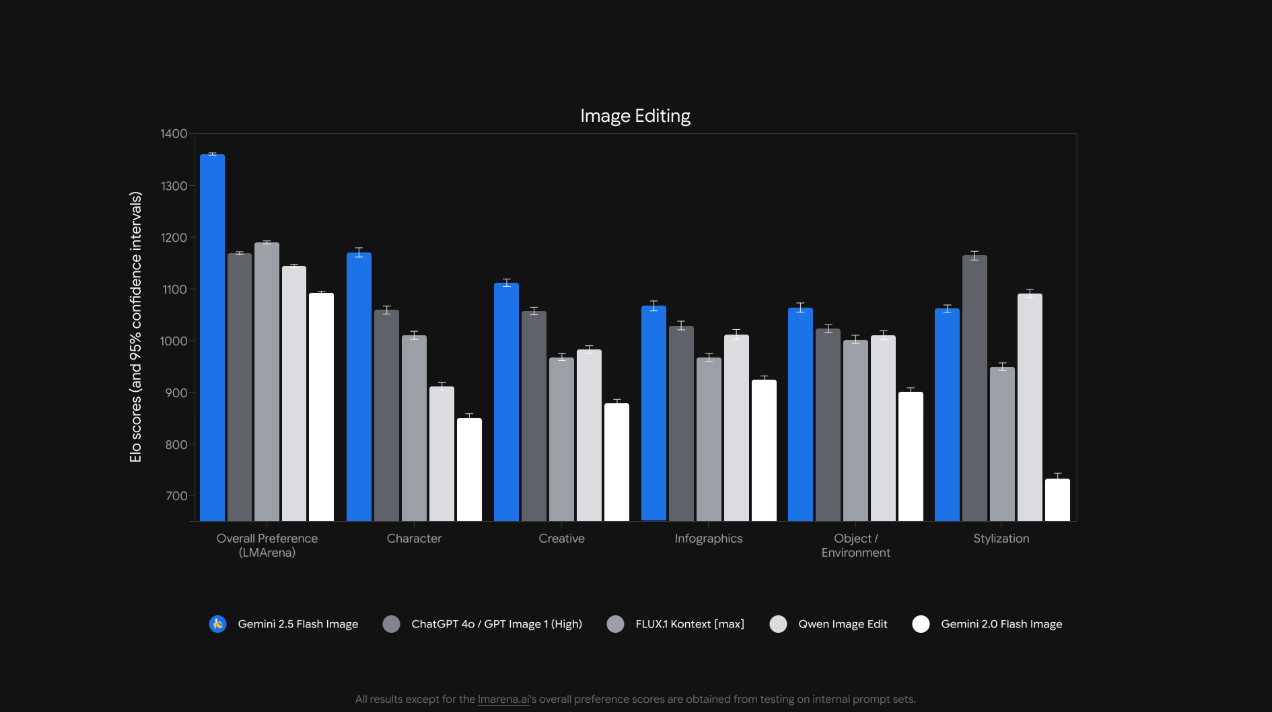

Google Confirms 'Nano Banana' as Gemini 2.5 Flash Image, Launches AI Image Editing Model in Gemini App

Google officially revealed that the viral 'Nano Banana' AI model is its own Gemini 2.5 Flash Image, now integrated into the Gemini app and web platform starting today. This state-of-the-art image editor, previously tested under a code name and already outperforming rivals in user ratings, offers advanced capabilities such as multi-step, natural language-driven image edits, character consistency across multiple images, and style blending. Available for both free and paid users, the tool cements Google's leadership in generative AI image editing, with broader developer and enterprise access available via the Gemini API and Google AI Studio.

IBM and AMD Announce Strategic Partnership to Develop Hybrid Quantum-Centric Supercomputers

IBM and AMD today announced a landmark collaboration to create new architectures that combine high-performance computing and quantum computing into 'quantum-centric supercomputing.' This partnership will leverage IBM’s quantum expertise and AMD’s leadership in CPUs, GPUs, and FPGAs, aiming to build scalable, open-source platforms that integrate quantum with classical HPC, promising breakthroughs in fields such as drug discovery and advanced material simulation. The companies expect to demonstrate initial integrations later this year, while leaders Arvind Krishna (IBM CEO) and Lisa Su (AMD CEO) emphasized the potential to accelerate real-world innovation and reach fault-tolerant quantum computing before 2030.

Alphabet Sets New Milestone with $2.5 Trillion Market Cap Amid AI-Fueled Growth

Alphabet (GOOGL) reached a $2.5 trillion market capitalization under CEO Sundar Pichai, cementing its leadership in AI and cloud technology. This milestone comes as Alphabet significantly boosts its 2025 capital expenditure forecast by $10 billion, up to $85 billion, to expand AI infrastructure and meet surging demand from enterprise and cloud businesses. The financial commitment is fueled by explosive growth in its Gemini AI platform, with over 85,000 enterprise customers and substantial order backlogs, positioning Google for continued dominance in AI-driven sectors.

Elon Musk Announces Open-Source Release of Grok 2.5 AI Model

Elon Musk has announced that the Grok 2.5 AI model, developed by xAI, is now open source. The model weights have been released, allowing the community and researchers to analyze and build upon Grok 2.5; Musk also revealed that Grok 3 is planned for open sourcing in about six months, signaling xAI's ongoing commitment to openness and rapid advancement in generative AI technology.

Intel Agrees to U.S. Government Taking a 10% Stake, Trump Announces

President Donald Trump announced this week that Intel has agreed to the U.S. government taking a 10% stake in the chip maker following weeks of public scrutiny into CEO Lip-Bu Tan's ties to China. Intel shares (INTC) rose nearly 7% on the news, marking a major development in U.S. semiconductor policy and raising speculation that other chip companies may follow suit.