The AI bull market continues as NVIDIA (NVDA) crosses $1000 for the first time after posting their Q1 2025 earnings. They also announced a 10-for-1 stock split and a massive 150% dividend increase.

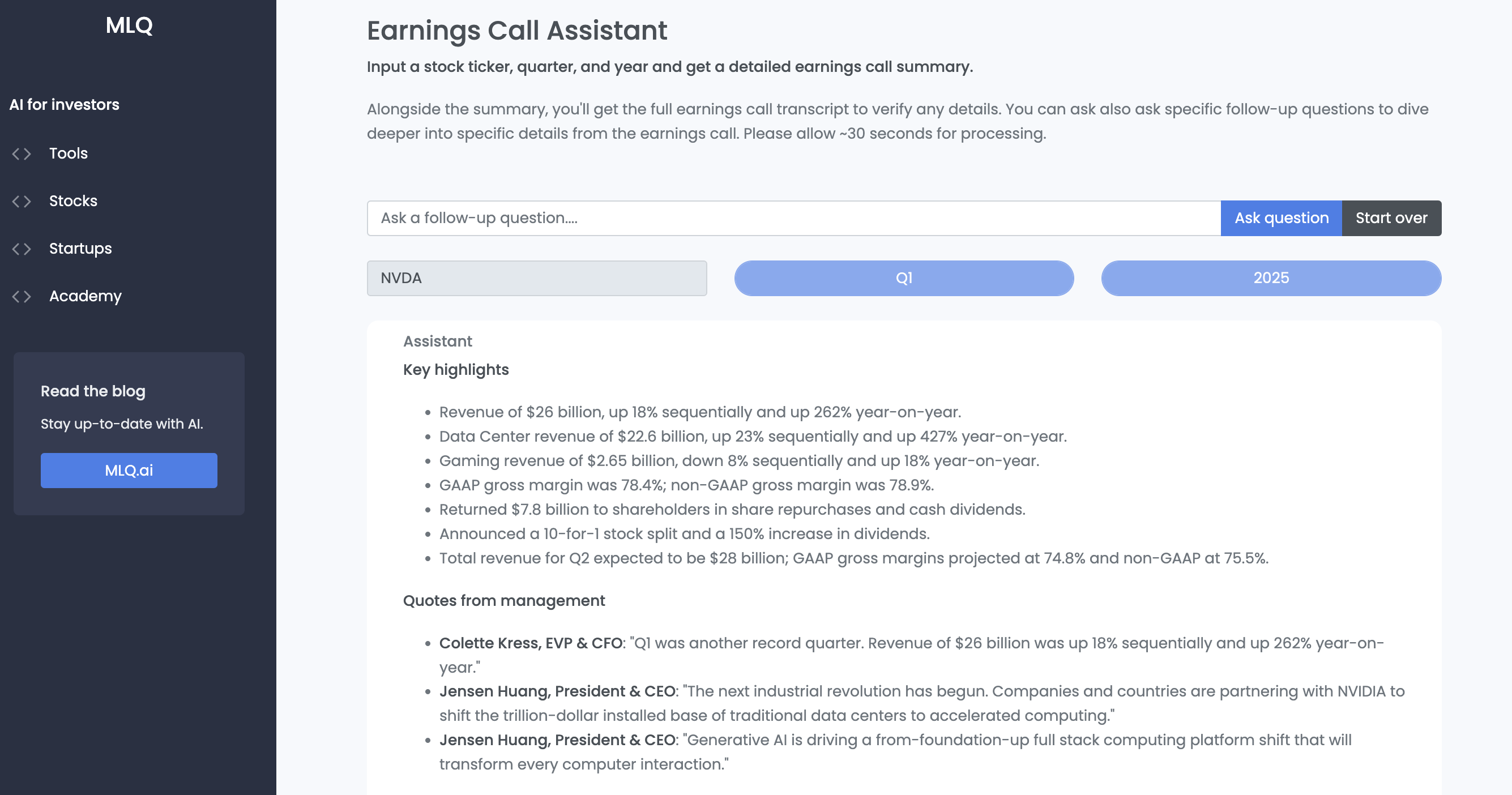

Let's dive into the quarter with the help of earnings call assistant 👇

Key highlights

- NVIDIA reported revenue of $26 billion, up 18% sequentially and up 262% year-on-year.

- Data Center revenue of $22.6 billion, up 23% sequentially and up 427% year-on-year.

- Gaming revenue of $2.65 billion, down 8% sequentially and up 18% year-on-year.

- GAAP gross margin was 78.4%; non-GAAP gross margin was 78.9%.

- The company returned $7.8 billion to shareholders in share repurchases and cash dividends.

- They also announced a 10-for-1 stock split and a 150% increase in dividends.

- Total revenue for Q2 is expected to be $28 billion; GAAP gross margins are projected at 74.8% and non-GAAP at 75.5%.

Quotes from Management

As Jensen Huang, President & CEO stated:

The next industrial revolution has begun. Companies and countries are partnering with NVIDIA to shift the trillion-dollar installed base of traditional data centers to accelerated computing.

Generative AI is driving a from-foundation-up full stack computing platform shift that will transform every computer interaction.

As the CFO, Colette Kress, stated:

As generative AI makes its way into more consumer Internet applications, we expect to see continued growth opportunities as inference scales both with model complexity as well as with the number of users and number of queries per user, driving much more demand for AI compute

NVIDIA Blackwell Platform

Here are a few of the key questions asked by analysts related to their new Blackwell platform, which as the company highlights:

The Blackwell GPU architecture features six transformative technologies for accelerated computing, which will help unlock breakthroughs in data processing, engineering simulation, electronic design automation, computer-aided drug design, quantum computing and generative AI — all emerging industry opportunities for NVIDIA.

In regards to Blackwell, Stacy Rasgon from Bernstein asked:

What does the full production of Blackwell suggest in terms of shipments and delivery timing?

Jensen Huang responded:

"We will be shipping. Well, we've been in production for a little bit of time. But our production shipments will start in Q2 and ramp in Q3, and customers should have data centers stood up in Q4."

Another question related to Blackwell came from Timothy Arcuri atUBS:

How does the deployment of Blackwell differ from Hopper especially considering liquid cooling?

Jensen Huang responded:

The architecture includes support for air cooling, liquid cooling, x86, Grace, and InfiniBand. It is designed to be backwards compatible, and we have been priming the ecosystem for liquid cooling.

Finally, Srini Pajjuri from Raymond James:

Why are you seeing strong demand for systems now?

Jensen responded:

We disaggregate all of the components and integrate them into computer makers. The Blackwell platform has expanded our offering, bringing more innovation and efficiency.

Summary: NVIDIA Q1 2025 Earnings

- NVIDIA's Q1 2025 earnings call highlighted stellar financial performance marked by unprecedented revenue growth, particularly in the Data Center segment.

- The company continues to benefit significantly from the surging demand for AI and accelerated computing solutions.

- Key strategic moves include the launch of the Blackwell GPU architecture and expanded product offerings across various computing environments, including air-cooled and liquid-cooled systems, as well as new software platforms.

- Management has set positive expectations for the upcoming quarters, citing robust demand across all market platforms and improved financial metrics.

- The call's tone reflected strong confidence in NVIDIA’s leadership and ongoing innovation in the AI and computing landscape.