With all of the new crypto projects and protocols that are hitting the market these days, sometimes we forget about some of the originals. Both Ethereum and Litecoin have been around before cryptocurrencies went mainstream. Today, Ethereum is the second largest crypto by market cap and Litecoin is the twenty-first largest.

If we can be honest, the two projects are moving in somewhat opposite directions. Ethereum has established itself as the premier layer-1 blockchain solution and has the highest utility and projects associated with it. Litecoin on the other hand is mostly a store of value, like Bitcoin. In this comparison article, we take a look at the cultures of both tokens, and how Ethereum rose to prominence, while Litecoin has fallen into the background of the broader crypto discussion.

We will be covering the following topics in our comparison of Litecoin and Ethereum:

- An Overview of Litecoin

- What is Proof of Work?

- What is Scrypt?

- What is OmniLite?

- The Future of Litecoin

- Pros and Cons of Litecoin

- An Overview of Ethereum

- What is Proof of Stake?

- What is the Ethereum Merge?

- The Future of Ethereum

- Pros and Cons of Ethereum

- The Case for Litecoin

- The Case for Ethereum

This guide should not be used as financial advice, rather it is to provide a closer look at the benefits, drawbacks, use cases, and future potential for both Litecoin and Ethereum.

Stay up to date with AI

Disclaimer: None of this is financial advice. The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of MLQ.ai. Every investment involves risk and you should always do your own research. See of full terms of service for more information.

An Overview of Litecoin

In today’s crypto climate, not much mention is made of Litecoin as we move towards a world of smart contracts, NFTs, and DeFi. Litecoin was one of the original blockchains as it was established way back in 2011, just a couple of years after Bitcoin started in 2009. Technically speaking it is nearly identical to Bitcoin in every way. Compared to other blockchains like Ethereum or Solana, Litecoin will likely always be considered a store of value before anything else.

Litecoin is considered one of the first forks in the crypto space. In October of 2011, Charlie Lee made a software fork of the Bitcoin source code. When he released the Litecoin network on GitHub he had made four foundational changes to Bitcoin:

- Decreased block generation time

- The maximum number of tokens was raised from 21 million to 84 million

- Different hashing algorithms (Litecoin uses Scrypt and not SHA-256)

- Changed the Graphics User Interface or GUI

While Bitcoin is composed of 100 million Satoshis, Litecoin is composed of 100 million Litoshis. Other than that, both blockchains are treated as stores of value and potential digital currencies for real-world transactions.

Litecoin hit an all-time high price of $412.96 back in May of 2021, but has since fallen back down to its current levels of about 120 per LTC.

What is Proof of Work?

If you follow the crypto world, you’ve likely heard a lot about Proof of Work vs Proof of Stake. Like Bitcoin, Litecoin employs Proof of Work for its blockchain. Without going into the technical details, Proof of Work requires complex calculations and cryptography to verify data between nodes which upholds the security and consistency of the blockchain. It also uses a lot of energy to power the computers that are solving these equations.

It’s why we see facts like ‘Bitcoin uses as much power annually as Sweden’. Proof of Work is the reason why cryptocurrencies receive an environmentally unfriendly reputation. It is also much slower than Proof of Stake or Proof of History. Litecoin’s network is faster than Bitcoin in terms of TPS or transactions per second, but pales in comparison to Proof of Stake networks.

What is Scrypt?

Litecoin utilizes a unique form of hashing algorithm called Scrypt. It is a password-based hashing system that is used to solve and complete a blockchain computation. In comparison, Bitcoin uses a more commonly used form of hashing called SHA-256.

Scrypt has made it more difficult for crypt miners to mine Litecoin, as the hash miners are generally more expensive and harder to find. Most investors do not really need to be concerned with hashing unless they are thinking about getting into Litecoin mining. Another major crypto project that uses Scrypt hashing is the meme token, DogeCoin.

What is OmniLite?

In September of 2021, the Litecoin Network partnered with the Omni blockchain teams to produce OmniLite. This is in effect a layered protocol that is built on top of the Litecoin blockchain that can allow for the integration of Smart Contracts. This opens the doors for Litecoin to enter the NFT and DeFi space, as well as the creation of Litecoin-based stablecoins.

Can OmniLite succeed? It remains to be seen, though Litecoin’s network is known for its high security and low fees. What’s most important about OmniLite is that the Litecoin team is still trying to build upon the network and enhance the experience for Litecoin users.

The Future of Litecoin

If we can be honest, the future of Litecoin was looking bleak at one point. As crypto protocols have evolved, Proof of Work networks have generally been left behind with the exception of Bitcoin. Other than being accepted as a form of digital payment at online retailers, there hasn’t been a lot of progress with the Litecoin project until OmniLite came out last year. As already noted, it remains to be seen if Litecoin can ever return to being a prominent project in the crypto space, even with the introduction of smart contracts and stablecoins.

In the last year the market cap of Litecoin has already been surpassed by other layer-1 and layer-2 protocols, notably utility blockchains like Avalanche, Solana, and Terra. What was once a prominent crypto project has tumbled to outside of the top 20, and is nearly 75% off of its all-time high prices set last year.

Pros and Cons of Litecoin

- The network is faster than Bitcoin and transaction fees are minimal

- High security through its Proof of Work protocol

- Accepted at a large number of online retailers as a form of payment

- OmniLite has built-in smart contracts and stable coins to the Litecoin ecosystem

- The popularity of Litecoin has plunged with the introduction of new blockchains

- Proof of Work uses a large amount of power and isn’t as environmentally friendly as other consensus mechanisms like Proof of Stake

- The Scrypt hashing system is complicated and more expensive to mine

An Overview of Ethereum

Ethereum is the most widely used blockchain software in the world and is the second largest crypto project by market cap behind only Bitcoin. The idea for Ethereum was created back in 2013 by the world-famous Vitalik Buterin, and it officially went live in 2015. Since then, Ethereum has become a sprawling network of decentralized applications. Ethereum introduced smart contracts to the crypto industry, which revolutionized how new blockchain networks have been designed and utilized.

Ethereum is for now, a Proof of Work network, that uses a high amount of energy, and has also been known for its notoriously high gas fees. The network is undergoing a series of upgrades that will lead to the inevitable launch of Ethereum 2.0, which will move the project to a Proof of Stake network.

As of March, there was over 10 million ETH staked on the blockchain, as investors bet on higher staking rewards once Ethereum 2.0 changes over to the Proof of Stake network. While the market cap of Ethereum trails Bitcoin, most experts agree that if you include the value of all of the DeFI and NFT projects, the sheer size and value of the Ethereum network is far larger than that of Bitcoin.

What is Proof of Stake?

The main difference between Proof of Work and Proof of Stake is that Proof of Stake significantly reduces the amount of energy and it completely randomizes which miner can validate a block. Token holders can stake the blockchain’s native tokens to become a node validator, where they can earn rewards for establishing the integrity of the blockchain.

Proof of Stake generally has lower security than Proof of Work, but with a network as large as Ethereum, it seems almost impossible for the blockchain to be compromised by the threat of a 51% attack.

Ethereum is not quite at Proof of Stake yet, but has almost completed the transition. The change to Proof of Stake will make Ethereum more environmentally friendly and will significantly increase the TPS or transactions per second, something that has grown to hamper some features in the Ethereum network.

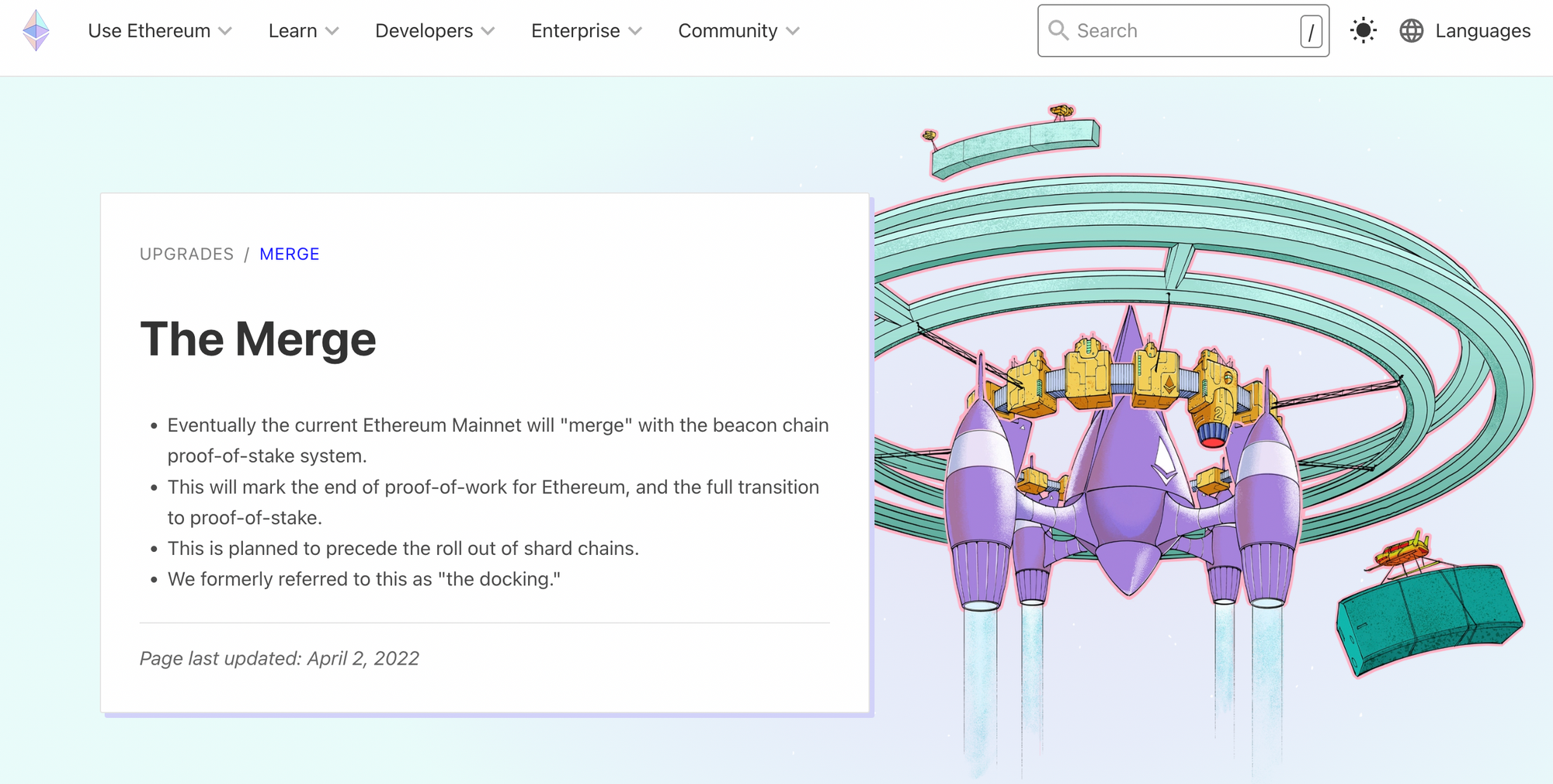

What is the Ethereum Merge?

If you have been following the crypto news, you have no doubt heard about the much anticipated Ethereum Merge. The Merge is really the next phase of the broader transition to Ethereum 2.0 and the Proof of Stake. The first phase was known as the Beacon Chain, which introduced native staking to the blockchain. The Merge is going to be the integration of the Beacon Chain into the native Ethereum mainnet. The final stage of the transition to Ethereum 2.0 is called Shard Chains, which will introduce sharding to Etherem and drastically increase the speed of the network.

Ethereum’s Merge is anticipated to be one of the major turning points in the crypto universe. When Ethereum moves to Proof of Stake, it could put a lot of other protocols in danger of being rendered obsolete. A faster, more efficient, and hopefully cheaper Ethereum Network will only increase its popularity for DeFi, NFT, and gaming, and make it the cultural hub of the Metaverse and Web3.0.

The Future of Ethereum

Unlike Litecoin, the future of Ethereum is clearly defined as the chosen protocol for decentralization. While many discuss ‘the flippening’ as when Ethereum overtakes Bitcoin as the largest crypto project, most would argue it already has surpassed Bitcoin in terms of utility.

With the impending arrival of the Metaverse and Web3.0, Ethereum is positioned to be the network of choice for decentralized applications. With some of the largest companies in the world investing heavily into the sector, there is no doubt that Ethereum’s network is one of the only ones that can handle such capacity. While most crypto investors will focus on the long-term price of the token, it is the scalability and technology behind Ethereum that should get people excited.

Ethereum flipping Bitcoin seems inevitable, but the roadmap of the broader Ethereum network is still in question. Even Vitalik has admitted he still fears for the future of cryptos, as he points out that there are a lot of potential dystopian outcomes if the right moves are not made. Ethereum itself has grown out of Vitalik’s control. Crypto protocols are not managed in the same way that companies are. There is generally not a unilateral decision maker, and the performance of the network is largely left to the users.

The sheer size of Ethereum makes the network nearly irreplaceable in the crypto universe. Eth bears will argue with the gas fees and the faster transaction speeds on networks like Solana, but overall, nothing has proven to be as reliable or scalable as Ethereum.

Pros and Cons of Ethereum

- Unparalleled scalability and reliability for decentralized applications

- The Ethereum 2.0 upgrade will bring staking and sharding to the network

- A move to Proof of Stake will lower energy usage and be better for the environment

- High gas fees make Ethereum expensive to use regularly for individuals

- There is no limit to the circulating supply of Eth tokens right now, despite regular burning

Summary: The Case for Litecoin

When compared to Ethereum, it might be difficult to make one for Litecoin. As the crypto world has evolved, there has been a much higher demand for scalable blockchains with smart contract integration. While OmniLite has seemingly achieved this for Litecoin, it has quite a bit of catching up to do with the likes of Ethereum and even Solana.

Litecoin remains, for now, a fork of Bitcoin and a decent transactionary token. It remains to be seen how good of a store of value it is, considering it is nearly 75% off of its all-time highs. It has not managed to replicate Bitcoin’s success or growth, and has tumbled down the list of highest-valued cryptos by market cap. While it is encouraging that so many retailers accept Litecoin, if nobody is holding the token then it makes this a moot point.

Summary: The Case for Ethereum

As the second most valuable crypto blockchain by market cap and likely the first in terms of total value of assets, Ethereum is a no-doubt investment for any crypto portfolio. It has cemented itself as the blockchain of choice for decentralized applications, DeFi, and NFTs, and is powering the world of Web3.0 and the upcoming Metaverse.

Ethereum will imminently be undergoing the latter phases of its transformation to Ethereum 2.0, which means it will be introducing the merge with the Beacon Chain and sharding in the near future. This will transform Ethereum into a Proof of Stake network which will cut down on power consumption and dramatically increase scalability and transaction speeds. The case for investing in Ethereum over Litecoin is fairly clear, but the case for investing in Ether over Bitcoin is becoming more evident as time goes on.