OpenAI breaks $1B in monthly revenue and signals trillion-dollar AI infrastructure plans. Meta signs a $10B cloud deal with Google and reorganizes its AI division around superintelligence. China escalates scrutiny of Nvidia’s chips after U.S. export remarks. Databricks hits a $100B valuation, while Palo Alto Networks smashes earnings. Plus: Wedbush reshuffles its AI 30 list and MIT says 95% of enterprise AI pilots fail.

In this newsletter:

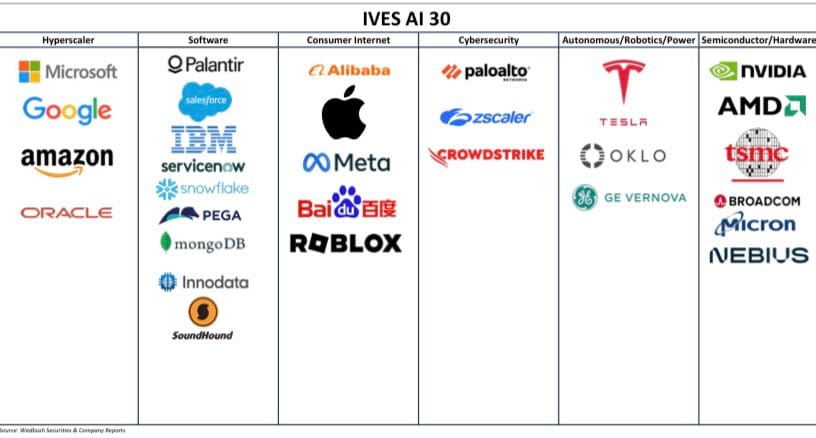

- Wedbush Updates IVES AI 30 List: CrowdStrike, Roblox, GE Vernova, and Nebius Added; Adobe Removed

- Palo Alto Networks Soars After Posting Q4 Earnings Beat and Upbeat Guidance

- MIT Study: 95% of Generative AI Pilots Fail to Deliver Business Impact in Enterprises

- Meta Signs $10 Billion Six-Year Cloud Deal with Google, Marking Major Shift in AI Infrastructure

- China Moves Against Nvidia's AI Chips After U.S. Remarks Spark Backlash

- OpenAI Breaks $1 Billion in Monthly Revenue for the First Time

- Meta Overhauls AI Division, Splitting Into Four Groups for Superintelligence Pursuit

- Databricks Announces Series K Funding at Over $100 Billion Valuation

- TeraWulf Announces Major Fluidstack Expansion with 160 MW CB-5 Lease, Supported by Google

- CoreWeave Insiders Sell Over $1 Billion in Shares After IPO Lock-Up Ends

Wedbush Updates IVES AI 30 List: CrowdStrike, Roblox, GE Vernova, and Nebius Added; Adobe Removed

On August 18, 2025, Wedbush analyst Dan Ives updated the IVES AI 30 list, a closely watched collection of leading AI-focused companies. Major additions include CrowdStrike, Roblox, GE Vernova, and Nebius, while CyberArk, C3.ai, and Adobe were removed. This reshuffle reflects shifting market sentiment and strategic pivots in enterprise AI leadership, with CrowdStrike and Roblox being recognized for their AI-driven growth trajectories.

Palo Alto Networks Soars After Posting Q4 Earnings Beat and Upbeat Guidance

Palo Alto Networks (PANW) surged over 5% in pre-market trading on August 19, 2025, after reporting stronger-than-expected fiscal Q4 earnings and issuing a robust outlook for 2026. The company also became the first dedicated cybersecurity firm to surpass the $10 billion annual revenue run rate, with Q4 revenues reaching $2.54 billion.

MIT Study: 95% of Generative AI Pilots Fail to Deliver Business Impact in Enterprises

A major MIT report released today finds that 95% of generative AI pilot programs in corporations fail to deliver measurable impact on profit and loss, largely due to integration issues rather than weaknesses in the AI models themselves. The study highlights that most failed pilots stem from poorly adapted generic tools and misaligned priorities, with successful implementations focused on targeted back-office automation rather than sales and marketing.

Meta Signs $10 Billion Six-Year Cloud Deal with Google, Marking Major Shift in AI Infrastructure

Meta Platforms and Google have entered a major six-year cloud computing agreement worth over $10 billion, under which Meta will utilize Google Cloud's servers, storage, networking, and advanced AI infrastructure. The partnership signals a strategic shift, as Meta looks to external partners for supporting its massive AI data center ambitions, and marks a growing trend of commoditization in cloud infrastructure tailored for AI demands. This deal follows Google's recent cloud agreement with OpenAI and positions Google Cloud as a leading provider of AI-optimized cloud services, challenging AWS and Azure's dominance in this area.

China Moves Against Nvidia's AI Chips After U.S. Remarks Spark Backlash

On August 21, 2025, China’s Cyberspace Administration (CAC) summoned Nvidia executives over allegations that Nvidia's AI chips contained embedded tracking and shutdown features. This move follows a surge in tension after recent remarks from U.S. officials about export controls and technology security. The CAC characterized the alleged issues as a threat to China's digital sovereignty and signaled intensified scrutiny of foreign tech firms, escalating diplomatic friction between the U.S. and China regarding advanced chip sales.

OpenAI Breaks $1 Billion in Monthly Revenue for the First Time

OpenAI has surpassed $1 billion in monthly revenue for the first time, announced by CFO Sarah Friar in a CNBC 'Squawk Box' interview. This milestone highlights the company's rapid growth in AI, though OpenAI continues to face significant bottlenecks due to intense demand for computing resources, prompting new partnerships with Oracle and Coreweave even as Microsoft remains its primary partner. CEO Sam Altman stated that OpenAI will invest tens of billions in data centers to meet escalating AI infrastructure demands.

Meta Overhauls AI Division, Splitting Into Four Groups for Superintelligence Pursuit

Meta announced a major reorganization of its artificial intelligence division, splitting it into four separate teams: TBD Lab (overseeing large language models like Llama), FAIR (long-term research), Product and Application Research, and MSL Infra (infrastructure). This restructuring is designed to advance Meta's push toward AI superintelligence and more strategically deploy its talent, following a period of rapid expansion and significant hiring of top AI leaders. Notably, this move comes amid internal tensions and could lead to executive departures and some employee reassignments, but currently no large-scale layoffs are planned according to internal memos.

Databricks Announces Series K Funding at Over $100 Billion Valuation

On August 19, 2025, Databricks revealed it has signed a term sheet for its Series K funding round, valuing the company at over $100 billion. This marks a major milestone and was driven by surging investor demand spurred by the company's rapid growth in AI products and services. Proceeds will accelerate its AI strategy, particularly around the Agent Bricks product and the new Lakebase operational database, while also supporting global expansion and further AI research.

TeraWulf Announces Major Fluidstack Expansion with 160 MW CB-5 Lease, Supported by Google

On August 18, 2025, TeraWulf Inc. (Nasdaq: WULF) announced a significant expansion at its Lake Mariner data center through Fluidstack, adding the CB-5 facility with 160 MW of critical IT load. This expansion brings TeraWulf's total contracted capacity to over 360 MW and increases contracted revenue potential to $16 billion with lease extensions. Notably, Google has increased its financial backstop to $3.2 billion and will hold a 14% stake in TeraWulf following the commitment, further cementing strategic partnerships for scaled AI infrastructure growth. Operations for the new facility are expected to begin in the second half of 2026, and ongoing discussions point to the potential for additional capacity in the future.

OpenAI's Sam Altman Signals Trillion-Dollar Spending Plan for AI Infrastructure

OpenAI CEO Sam Altman stated today that the company is prepared to invest trillions of dollars over time in artificial intelligence infrastructure, focusing on constructing massive data centers and exploring innovative financing methods. Altman suggested the potential development of new financial instruments for funding, despite industry skepticism, and reaffirmed OpenAI's commitment to scaling data infrastructure even as major initiatives like the Stargate project experience fundraising delays.

CoreWeave Insiders Sell Over $1 Billion in Shares After IPO Lock-Up Ends

Following the expiration of CoreWeave's IPO lock-up, insiders and early investors sold more than $1 billion in shares on August 17, 2025. Notably, director Jack Cogen offloaded $300 million via block trades coordinated by major investment banks. The stock saw a 35% drop over two days and stabilized around $100 as the selloff combined with a larger-than-expected Q2 loss spurred a volatile trading session.