Intel Corporation's CEO, Pat Gelsinger, and CFO, David Zinsner, discussed the company's second quarter 2023 earnings on Thursday, July 27th.

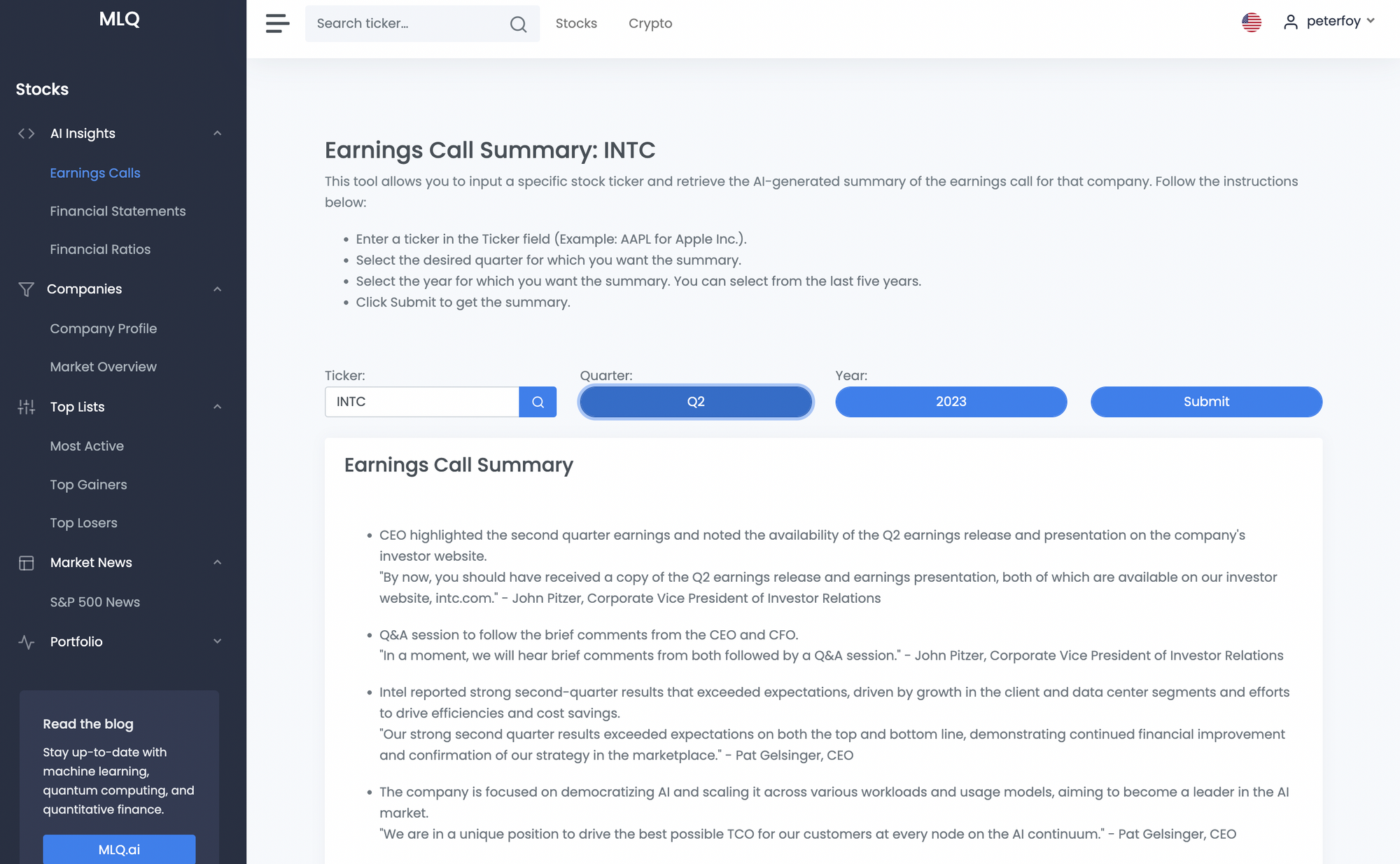

The following is derived from our Earnings Call AI Assistant, which you can access by signing up to the MLQ App.

Intel Earnings Call Summary: Q2 2023

Intel's strong Q2 results exceeded expectations, driven by strength in client and data center segments and cost savings across the organization.

"Our strong second quarter results exceeded expectations on both the top and bottom line, demonstrating continued financial improvement and confirmation of our strategy in the marketplace." - Pat Gelsinger

Intel is focused on democratizing AI and scaling it across various workloads and usage models. The company is championing an open ecosystem with a full suite of silicon and software IP.

"We believe we are in a unique position to drive the best possible TCO for our customers at every node on the AI continuum." - Pat Gelsinger

The company is prioritizing financial discipline, cost savings, and returning to profitability. They are also implementing an internal foundry model by 2024 and utilizing a Smart Capital strategy for future positioning.

"we also saw strong momentum on our financial discipline and cost savings as we return to profitability, are executing our internal foundry model by 2024, and are leveraging our Smart Capital strategy to effectively and efficiently position us for the future"

The company is focused on democratizing AI across various platforms and is experiencing success in this endeavor.

"we work to truly democratize AI from cloud to enterprise, network, edge and client"

Financial Highlights

Intel reported stronger than expected business results in the second quarter, with revenue exceeding expectations in various business segments.

- The Data Center Group (DCAI) showed strong performance, with revenue of $4 billion, ahead of expectations and up 8% sequentially.

- DCAI's operating loss improved sequentially on higher revenue and reduced operating expenses.

- Gross margin was 39.8%, better than guidance on stronger revenue.

- Intel expects third quarter revenue of $12.9 billion to $13.9 billion, with forecasted gross margin of 43%.

- The CEO highlighted the improving ASP (average selling price) due to increased core count and competitive product offerings, leading to more market confidence in pricing.

"ASP is obviously improving as we increase core count and as we get more competitive on the product offerings, that enables us to have more confidence in the market in terms of our pricing." - David Zinsner

- The CFO mentioned that the larger drivers of cost structure in the company will be related to the internal foundry model, scale, and start-up costs on 5 nodes. These factors are expected to be the main drivers of gross margin improvement.

"The longer term...will be the biggest drivers of gross margin improvement...as we get up in terms of scale and get away from these underloading charges, and as we get past the start-up costs on 5 nodes in 4 years." - David Zinsner

- The CEO acknowledged some weakness in the server market for Q3, driven by data center digestion, enterprise weakness, inventory, and pressure from accelerator spend in China. However, long-term opportunities in the data center are seen as optimistic.

"We do expect to be seeing the [Total Addressable Market] TAM down in Q3...we feel optimistic about the long-term opportunities that we have in the data center." - Pat Gelsinger

- The company expects to achieve breakeven free cash flow by the end of the year and anticipates improved gross margins in the fourth quarter compared to the third quarter.

"Our expectation is still by the end of the year to get to breakeven free cash flow...we’re likely to have some (PRQ reserves in the fourth quarter), but it should be a pretty good quarter-over-quarter improvement from the third quarter." - David Zinsner

Intel AI Highlights

- The CEO discussed the potential of AI as a TAM (Total Addressable Market) expander for servers, citing examples of workloads that could drive unit growth in both training and inference.

"We do see with Meteor Lake ushering in the AI PC generation...where you have tens of watts being responding in a second or two...we’re going to build AI into every product that we build.” - Pat Gelsinger

- The CEO expressed confidence in the outlook for the client business, citing growth opportunities in AI

- The company is focusing on the market for custom silicon in AI and has multiple ways to play in this space, including engaging with foundry customers and offering advanced packaging options.

"We have a good pipeline of foundry customers for 18A, foundry opportunities... we’re engaging with a number of those." - Pat Gelsinger

- The company anticipates deploying its AI accelerator, Gaudi, in hyperscale cloud providers and is already engaged with some Tier 1 providers, as well as next-generation ones.

"We already have Gaudi instances on AWS as available today already...we’re seeing a good pipeline of those opportunities." - Pat Gelsinger

Disclaimer

Please note this pages serves informational purposes only and does not constitute as financial advice, always use your own judgement and due diligence. The financial data and insights provided uses OpenAI's GPT API and are derived from a variety of sources which are believed to be reliable. However, we do not warrant the accuracy or completeness of this data, and the data should not be relied upon as such. All the financial data and insights are provided "as is", without warranty of any kind, either express or implied. Our AI system employs machine learning algorithms to provide insights, which are probabilistic in nature and should not be treated as definitive advice.