Ethereum received a major upgrade to the network today: Ethereum Improvement Proposal (EIP) 1559.

The London Hard Fork contains Ethereum Improvement Proposal (EIP) 1559, which attempts to modify the way transaction costs, known as "gas fees," are calculated.

EIP-1559 also "burns", i.e. withdraws from circulation, a portion of each transaction fee, reducing the supply of ether and potentially increasing its price.

Ethereum is the most expensive blockchain in the world to use. As Coindesk research highlights, in order to connect with the Ethereum blockchain, users pay a total of approximately $5 million each day in transaction fees. Individuals and organizations spend just 28% of this amount (1.5 million) on Bitcoin each day.

Rather than using a blind auction-style procedure to determine transaction fees, the new network will automatically compute a price based on demand for block space.

In order for transactions to be completed, all users must pay this base charge. Instead of flowing directly to miners, the base transaction fee will now be reduced from supply.

As the report highlights, EIP 1559 is meant to have several positive implications for ether, including:

- Link the use of decentralized applications to the use of ether

- Reduce transaction times and reduce fee-market uncertainty

- Add a Bitcoin-style narrative about limited supply

It's important to note that the upgrade does offer a number of network risk, including:

- Due to a drop in transaction fees given to miners, there is a risk of miner capitulation or rebellion.

- There's a chance that both the developer and the user may be disappointed.

- Unexpected flaws, hackers, or an unintentional chain split pose a technological danger.

Stay up to date with AI

What EIP-1559 Means for Investors

While EIP-1559 intends to enhance Ethereum's ecosystem — which includess smart contract capabilities that enable DeFi, NFTs, among other things — it is unlikely to have a significant influence on investors in the immediate term.

Instead, EIP-1559 should make ether deflationary in the long run by lowering supply, which as CNBC highlights, would be "very helpful" to investors.

The upgrade would allow cryptocurrency investors to invest in a deflationary asset. However, the EIP-1559 upgrade will not be enough to make ether deflationary.

Nonetheless, the upgrade is critical since it has the potential to improve Ethereum's user experience and also potentially increasing the price of ether.

Ethereum On-Chain Analysis

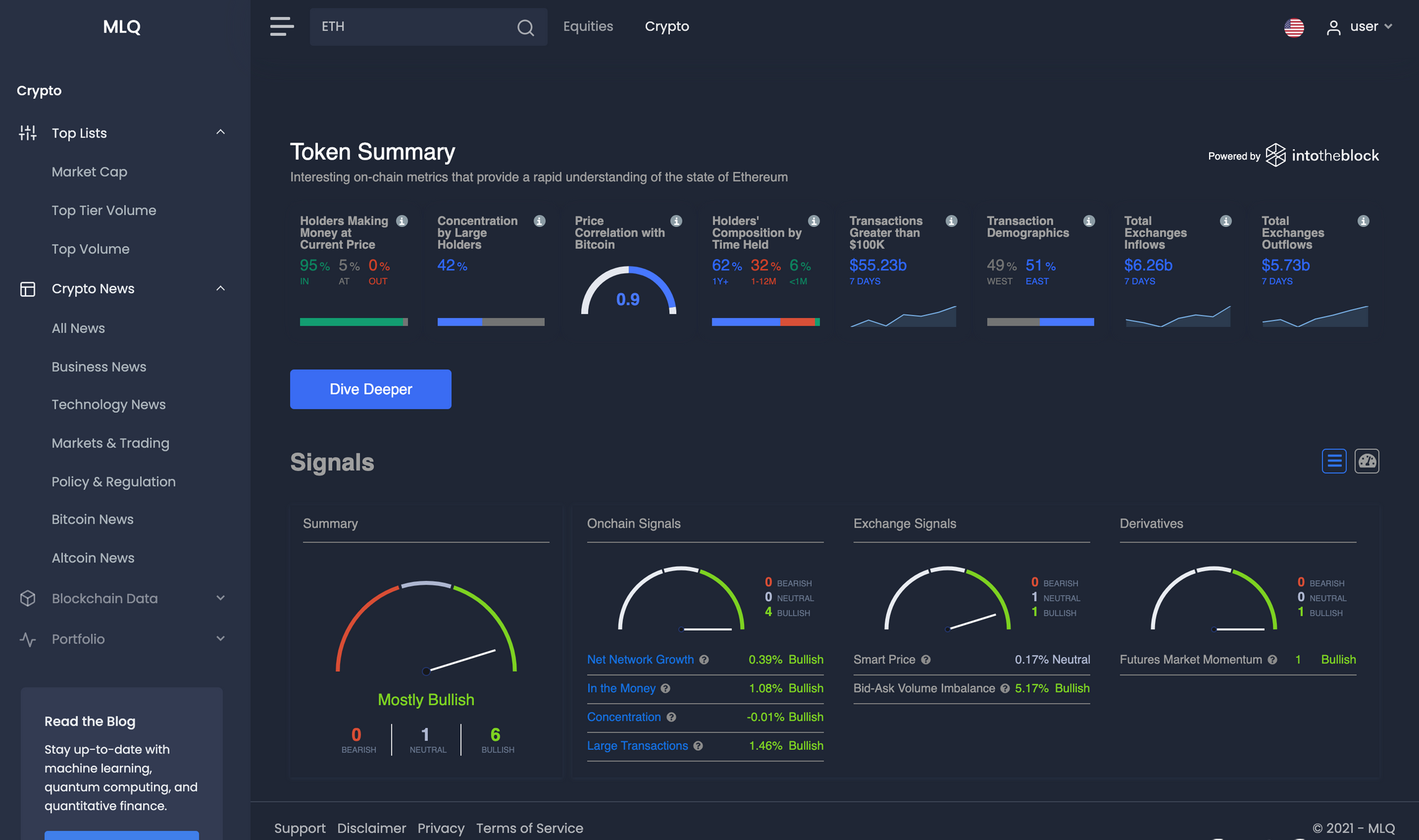

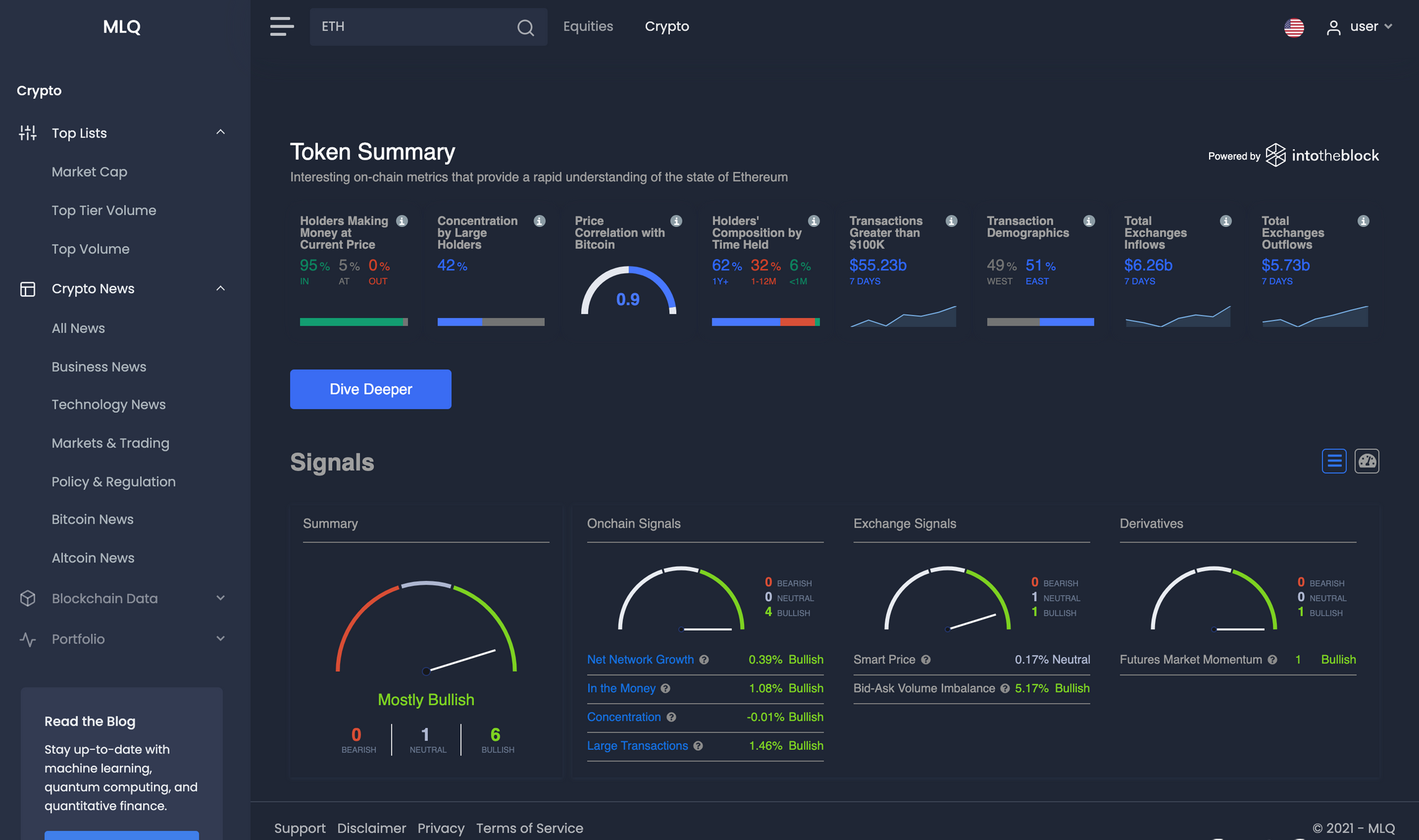

Now that we've reviewed what the EIP-1559 upgrade is and its potential implications for investors, let's review the on-chain metrics following the upgrade from the MLQ app.

Etherum On-Chain Metrics

Holders Making Money at Current Price:

- 95% In the Money

- 5% At the Money

- 0% Out of the Money

For any address with a balance of tokens, this identifies the average cost at which those tokens were purchased and compares it to the current price.

Concentration by Large Holders: 42%

The total holdings of whales (addresses that own more than 1% of the circulating supply) and Investors (addresses that own between 0.1% and 1% of the circulating supply)

Price Correlation with Bitcoin: 0.9

30-day price correlation with BTC

Total Exchange Inflows & Outflow(7 Days)

- $6.26 Billion Inflows

- $5.73 Billion Outflows

Total amount (in $ or tokens) entering or exiting exchange(s) deposit wallets.

On-Chain Signals

Net Network Growth: Bullish, 0.39%

Momentum signal that gives a pulse of the true growth of the token's underlying network (new addresses - addresses that go to zero)

In the Money: Bullish, 1.08%

Change in "In the Money" addresses momentum signal

Concentration: Bullish, -0.01%

Accumulation (bullish) or reduction (bearish) of large holders' positions

Large Transactions: Bullish, 1.46%

Momentum indicator of the number of transactions greater than $100,000

Exchange Signals

Smart Price: Neutral, 0.17%

A variation of the mid-price where the average of the bid and ask prices is weighted according to their inverse volume (ie the bid is weighted with the volume posted at the ask, and the ask is weighted with the volume posted at the bid)

Bid-Ask Volume Imbalance: Bullish, 6.61%

Volume at the bid price - Volume at the ask price

Derivatives Signals

Futures Market Momentum: Bullish, 1

A signal combining futures price, volume and open interest assessing bullish or bearish momentum

Overall we can see the on-chain metrics for Ethereum after EIP-1559 are highly bullish, although as mentioned before, this upgrade is likely to have a longer-term impact on prices as supply is reduced over time.

If you want to see more on-chain metrics for Ethereum, you can sign up for a free account of the MLQ app here.