Apple announced the largest buyback in history on Thursday, May 2nd, authorizing a $110 billion share repurchase. After this announcement, the stock rose ~7%, or an increase of almost $200 billion in market value.

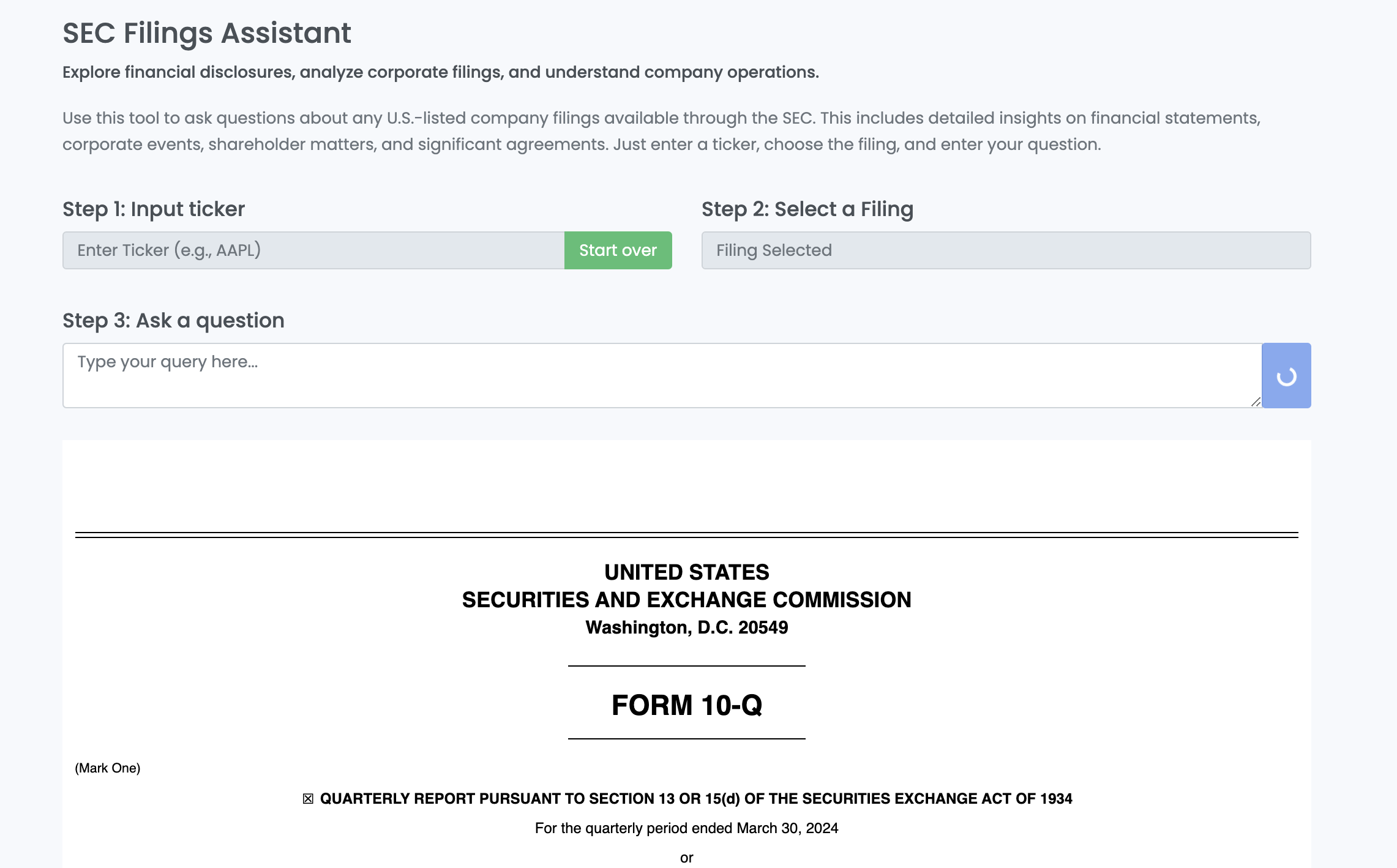

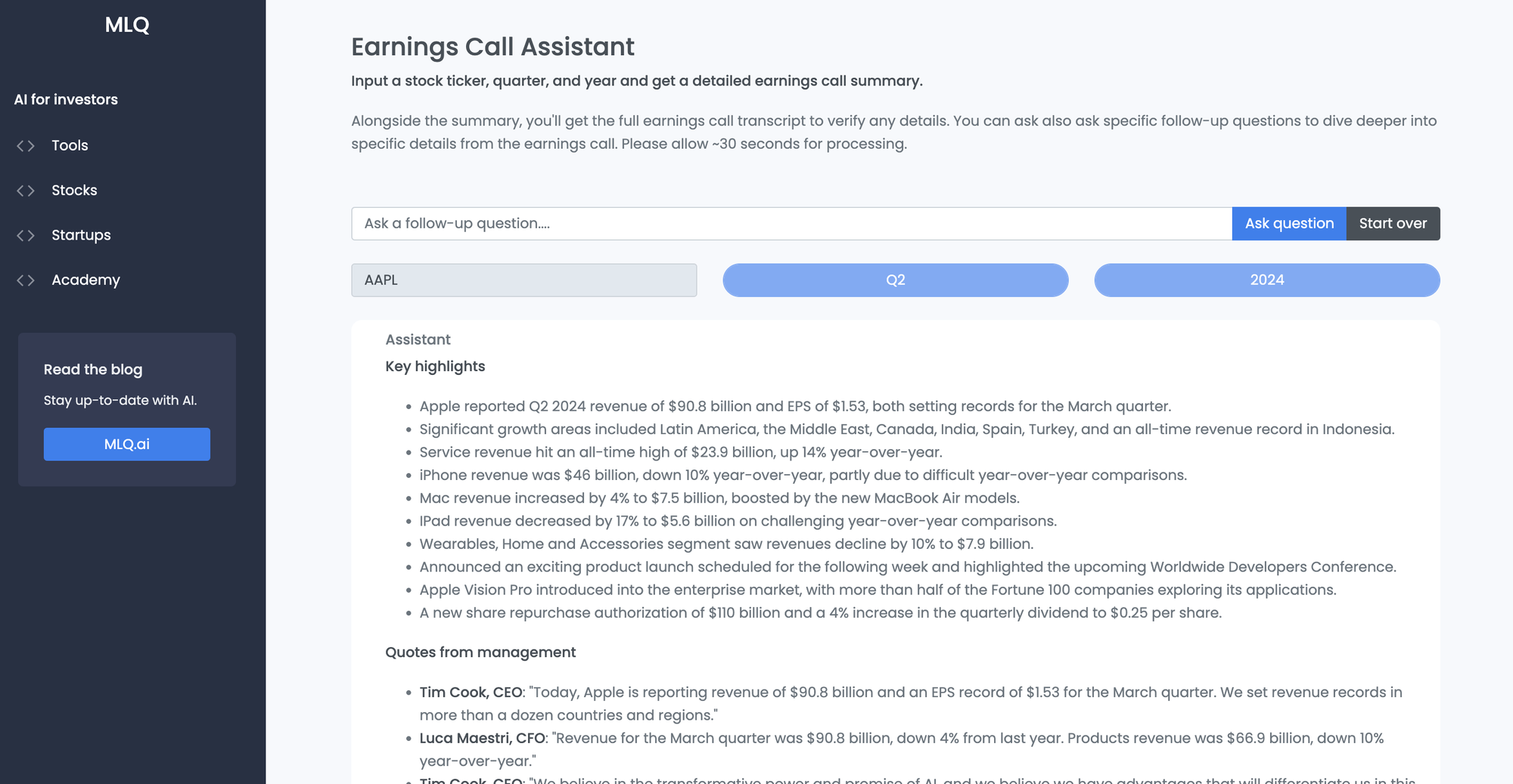

In this article, let's use our GPT-4 powered SEC filing assistant and earnings call assistant to analyze the quarter.

Apple's Q2 2024 financial performance

In their Q2 earnings report and earnings call, Apple mentioned a stable revenue stream and a solid product ecosystem, as well as several record-setting figures.

Revenue & EPS

- Apple reported Q2 2024 revenue of $90.8 billion and EPS of $1.53, setting records in various countries for the March quarter.

As Tim Cook noted:

Today, Apple is reporting revenue of $90.8 billion and an EPS record of $1.53 for the March quarter. We set revenue records in more than a dozen countries and regions.

- Significant growth areas included Latin America, the Middle East, Canada, India, Spain, Turkey, and an all-time revenue record in Indonesia.

Apple's CFO, Luca Maestri, stated:

Revenue for the March quarter was $90.8 billion, down 4% from last year. Products revenue was $66.9 billion, down 10% year-over-year.

Revenue by segment

- Service revenue hit an all-time high of $23.9 billion, up 14% year-over-year.

- Mac revenue increased by 4% to $7.5 billion, boosted by the new MacBook Air models.

- IPad revenue decreased by 17% to $5.6 billion on challenging year-over-year comparisons.

- The wearables and Home & Accessories segment saw revenues decline by 10% to $7.9 billion.

- Apple Vision Pro was introduced into the enterprise market, with more than half of the Fortune 100 companies exploring its applications.

Forward Guidance

- Expects low single-digit revenue growth for the June quarter, with double-digit growth in services and iPad revenues.

As the CFO, Luca Maestri highlighted:

We expect our June quarter total company revenue to grow low-single-digits year-over-year in spite of a foreign exchange headwind of about 2.5 percentage points. We expect our services business to grow double-digits at a rate similar to the growth we reported for the first-half of the fiscal year. And we expect iPad revenue to grow double-digits.

Apple authorizes $110B share buyback

Apple announced its largest buyback program in history, a decision largely influenced by its strong quarterly performance.

- A new share repurchase authorization of $110 billion and a 4% increase in the quarterly dividend to $0.25 per share.

- During the six months ended March 30, 2024, Apple repurchased 248 million shares of its common stock, amounting to a total cost of $44.0 billion.

- The share repurchase program is not designed to obligate the company to acquire a minimum number of shares. Shares can be repurchased through privately negotiated transactions or in the open market.

Luca Maestri, CFO, stated:

Given the continued confidence we have in our business now and into the future, our Board has authorized today an additional $110 billion for share repurchases, as we maintain our goal of getting to net cash-neutral over time.

Apple's AI strategy

Beyond the buyback, Apple's broader strategy is increasingly focused AI. CEO Tim Cook emphasized Apple's potential in generative AI, citing "incredible breakthrough potential" and the "transformative power of AI"...

We continue to feel very bullish about our opportunity in Generative AI. We are making significant investments, and we're looking forward to sharing some very exciting things with our customers soon.

We believe in the transformative power and promise of AI, and we believe we have advantages that will differentiate us in this new era, including Apple's unique combination of seamless hardware, software, and services integration, groundbreaking Apple's silicon, with our industry-leading neural engines and our unwavering focus on privacy, which underpins everything we create.

I think AI, Generative AI and AI, both are big opportunities for us across our products. And we'll talk more about it in the coming weeks. I think there are numerous ways there that are great for us. And we think that we're well-positioned.

Tim Cook acknowledged that Apple is investing significantly in AI and plans to unveil new advancements later this year.

Analyst Q&A session

Question on June quarter guidance

- Analysts asked about the assumptions behind expected low-single-digit growth. Luca Maestri explained that the projection includes double-digit service revenue growth and a similar growth trajectory for iPads while maintaining strong overall company performance.

Question on AI and CapEx

- Responding to how Apple's emphasis on AI might change its capital expenditure patterns, Luca Maestri emphasized continuity in Apple's investment approach, highlighting ongoing R&D expenditures and strategic use of both in-house and third-party resources.

Mike Ng, Analyst, Goldman Sachs asked:

As Apple leans more into AI and Generative AI, should we expect any changes to the historical CapEx cadence that we've seen in the last few years of about $10 billion to $11 billion per year or any changes to, you know, how we may have historically thought about the split between tooling, data center, and facilities?" - Mike Ng, Analyst, Goldman Sachs

Luca Maestri, CFO responded:

Just during the last five years, we spent more than a $100 billion in research and development. As you know, on the CapEx front, we have a bit of a hybrid model where we make some of the investments ourselves.

In other cases, we share them with our suppliers and partners on the manufacturing side, we purchased some of the tools and manufacturing equipment. In some of the cases, our suppliers make the investment. On the — and we do something similar on the data center side. We have our own data center capacity and then we use capacity from third parties. It's a model that has worked well for us historically and we plan to continue along the same lines going forward.

Summary: Apple's Q2 2024 Earnings

The tone of Apple's Q2 FY2024 earnings call was cautiously optimistic amid a challenging macroeconomic environment.

- Despite a year-over-year revenue dip, segments such as services and specific geographic regions reported strong growth.

- The introduction of the Apple Vision Pro and the deep emphasis on the possibilities within AI and spatial computing underscore Apple's ongoing commitment to innovation.

- The management expressed significant confidence in the company’s strategic initiatives, particularly those emerging in AI technologies and their subsequent impact on Apple's diverse product lines.

- The expansion in shareholder return programs and forward guidance reflecting modest growth suggest a stable outlook, supporting sustained investor confidence in Apple's strategic direction and market execution.