This week in AI, OpenAI and DeepMind models won gold at the Math Olympiad, xAI targets $12B for its next supercluster, and OpenAI confirms a $30B deal with Oracle.

Plus: Google reports strong Q2 2025 earnings driven by AI and cloud growth, Intel beats Q2 estimates, Tesla posts a revenue decline, and Figma kicks off its IPO roadshow.

In this newsletter

- Alibaba introduces Qwen3-Coder, a 480B-parameter agentic AI model

- OpenAI and DeepMind models win gold at the Math Olympia

- xAI targets $12B for Colossus 2 supercluster

- OpenAI confirms $30B-per-year Oracle deal

- Amazon acquires budget AI wearable startup Bee

- Nvidia AI chips flood China’s black market after export curbs

- Intel and Alphabet beat Q2 earnings expectations

- Tesla reports revenue drop, leans into AI and robotics

- Figma kicks off IPO roadshow at $16.4B valuation

- And more

This week in AI

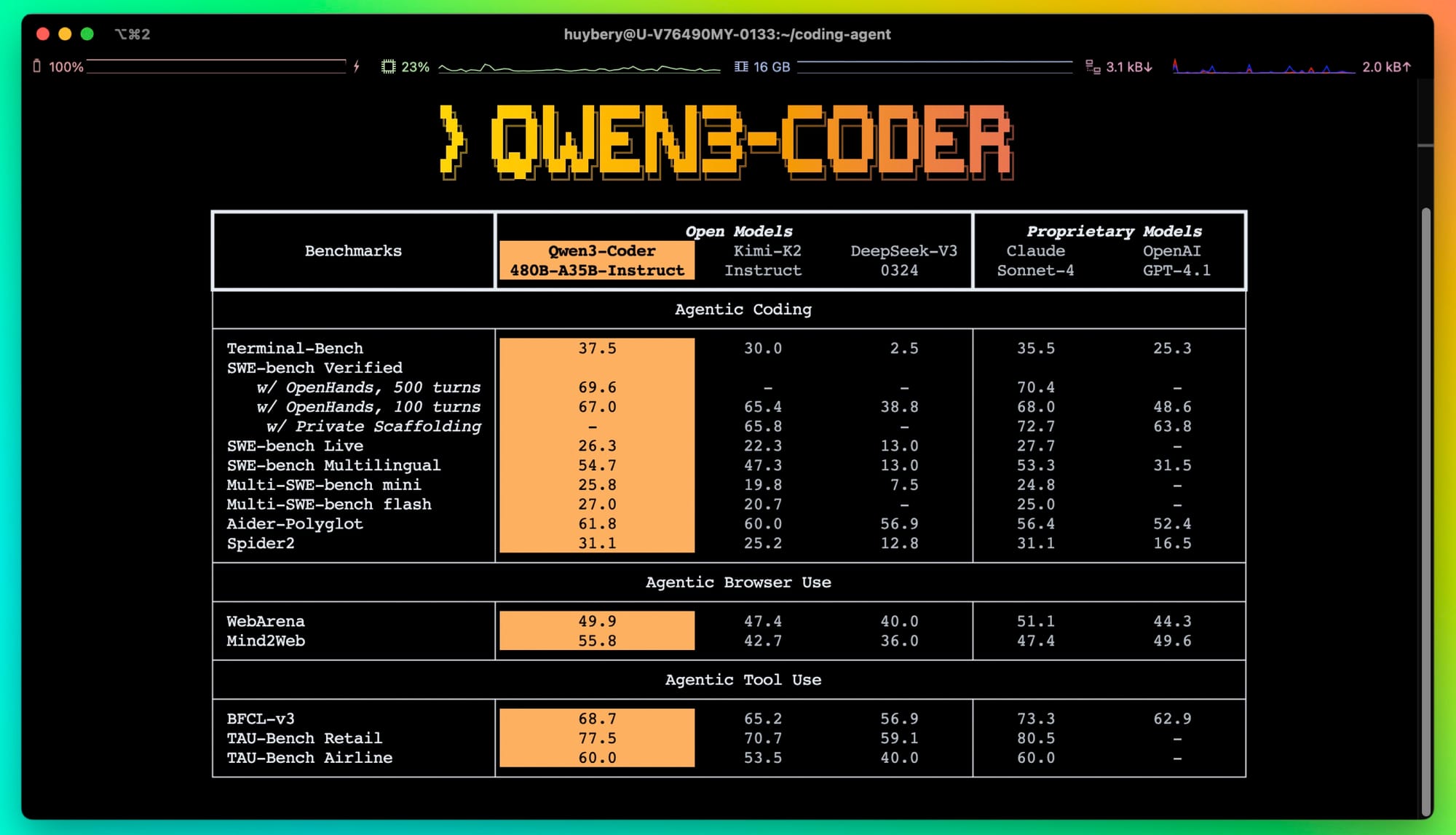

Alibaba Unveils Qwen3-Coder, a 480B-Parameter Agentic AI Model to Rival Global Leaders

Alibaba has released Qwen3-Coder, a state-of-the-art open-source AI coding model designed for complex, autonomous software development tasks. The flagship model, featuring 480 billion parameters in a Mixture-of-Experts architecture, aims to match or surpass competitors like Anthropic's Claude and OpenAI's GPT-4 in agentic code generation, logic-driven workflows, and memory-efficient programming. This launch is positioned as a milestone in the global AI race and signals growing parity between Chinese and US AI capabilities, though third-party validation of performance is still pending. Shares of Alibaba rose about 2% premarket on the news.

Google DeepMind’s Gemini and OpenAI Models Achieve Gold Medal at International Mathematical Olympiad

For the first time, AI systems have officially achieved gold medal status at the International Mathematical Olympiad (IMO), marking a major milestone for mathematical AI capabilities. Google DeepMind's Gemini, using an advanced Deep Think model, and OpenAI’s models both solved five out of six problems using natural language reasoning, meeting the gold medal threshold of 35 out of 42 points. The Gemini system operated autonomously within the contest time limit and did not require experts to translate problems, highlighting a leap in AI’s mathematical reasoning. Industry observers suggest these advances put the use of AI in cutting-edge mathematical research within a year of reality, and Google plans to make Gemini available to select testers before a broader release to AI Ultra subscribers.

1/N I’m excited to share that our latest @OpenAI experimental reasoning LLM has achieved a longstanding grand challenge in AI: gold medal-level performance on the world’s most prestigious math competition—the International Math Olympiad (IMO). pic.twitter.com/SG3k6EknaC

— Alexander Wei (@alexwei_) July 19, 2025

xAI Seeks $12 Billion Funding for Colossus 2 Supercluster, Unveils Deployment Timeline

Elon Musk's xAI is working with Valor Equity Partners to secure $12 billion in debt funding for the Colossus 2 data center, intended to house 550,000 Nvidia GB200 and GB300 AI chips. This major investment comes just weeks after raising $10 billion and will expand xAI's AI training capacity, with the first Colossus 2 chips going online in the coming weeks. The facility follows Colossus 1, which already ranks among the world's largest AI chip clusters, and highlights xAI's escalating capital requirements and financial risk profile as it seeks to lead the AI infrastructure race.

OpenAI Confirms $30B-Per-Year Oracle Deal, Unveils Details

OpenAI CEO Sam Altman has confirmed that OpenAI is the previously unnamed customer behind Oracle's $30 billion-a-year data center deal, originally disclosed in June. This landmark agreement represents one of the largest cloud infrastructure contracts in history and signals an unprecedented expansion of OpenAI’s compute capacity, with major implications for the competitive AI landscape and Oracle’s position in the cloud sector.

White House Unveils AI Action Plan to Boost Development

The White House today released its AI Action Plan, marking the Trump administration’s most significant policy directive on artificial intelligence to date. The plan calls for loosening regulations, expanding energy supply for data centers, and cutting funding to states with restrictive AI laws, aiming to assert US dominance over China. The 23-page blueprint also outlines fast-tracking infrastructure projects, promoting American tech globally, and introducing safeguards to prevent foreign adversaries from gaining a strategic edge. President Trump is scheduled to discuss the plan’s details this afternoon at an event with tech leaders and lawmakers.

Amazon Confirms Acquisition of Bee, the AI Wearable Startup

Amazon has confirmed plans to acquire Bee, a California-based AI wearable startup known for its low-cost wristband that continuously records and transcribes conversations using dual microphones. While the deal is not yet finalized and key financial terms remain undisclosed, Amazon has offered roles to Bee employees and plans to integrate the device—which also has an Apple Watch app—into its growing portfolio of AI-driven consumer products. The acquisition draws attention both for Bee's affordability compared to other AI gadgets and for potential privacy concerns surrounding always-on recording capabilities and data handling, an area where Amazon has faced scrutiny in the past. The co-founder of Bee announced the news via LinkedIn, and Amazon confirmed the deal to multiple major outlets today.

OpenAI CEO Warns of Impending AI Voice Fraud Crisis in Financial Sector

OpenAI CEO Sam Altman warned the financial industry of a 'significant impending fraud crisis' stemming from the ability of AI technologies to convincingly impersonate voices. Altman’s remarks highlighted growing concerns about the security and trustworthiness of financial transactions as AI-generated voice tools become increasingly sophisticated.

Nvidia AI Chips Worth $1 Billion Flood China's Black Market After US Export Curbs: FT reports

Nvidia's high-end AI processors, including the B200—banned under strengthened U.S. export controls—have been widely smuggled into China, with at least $1 billion worth of chips entering the country in the three months following tightened restrictions, according to a Financial Times investigation. Chinese distributors sourced these banned chips from Southeast Asian markets and sold them to data centers and AI groups, bypassing U.S. curbs, in what analysts described as a thriving black market for restricted U.S. technology. The U.S. Commerce Department is reportedly considering further controls on advanced AI chip exports to Southeast Asian countries in response to these developments.

This week in markets

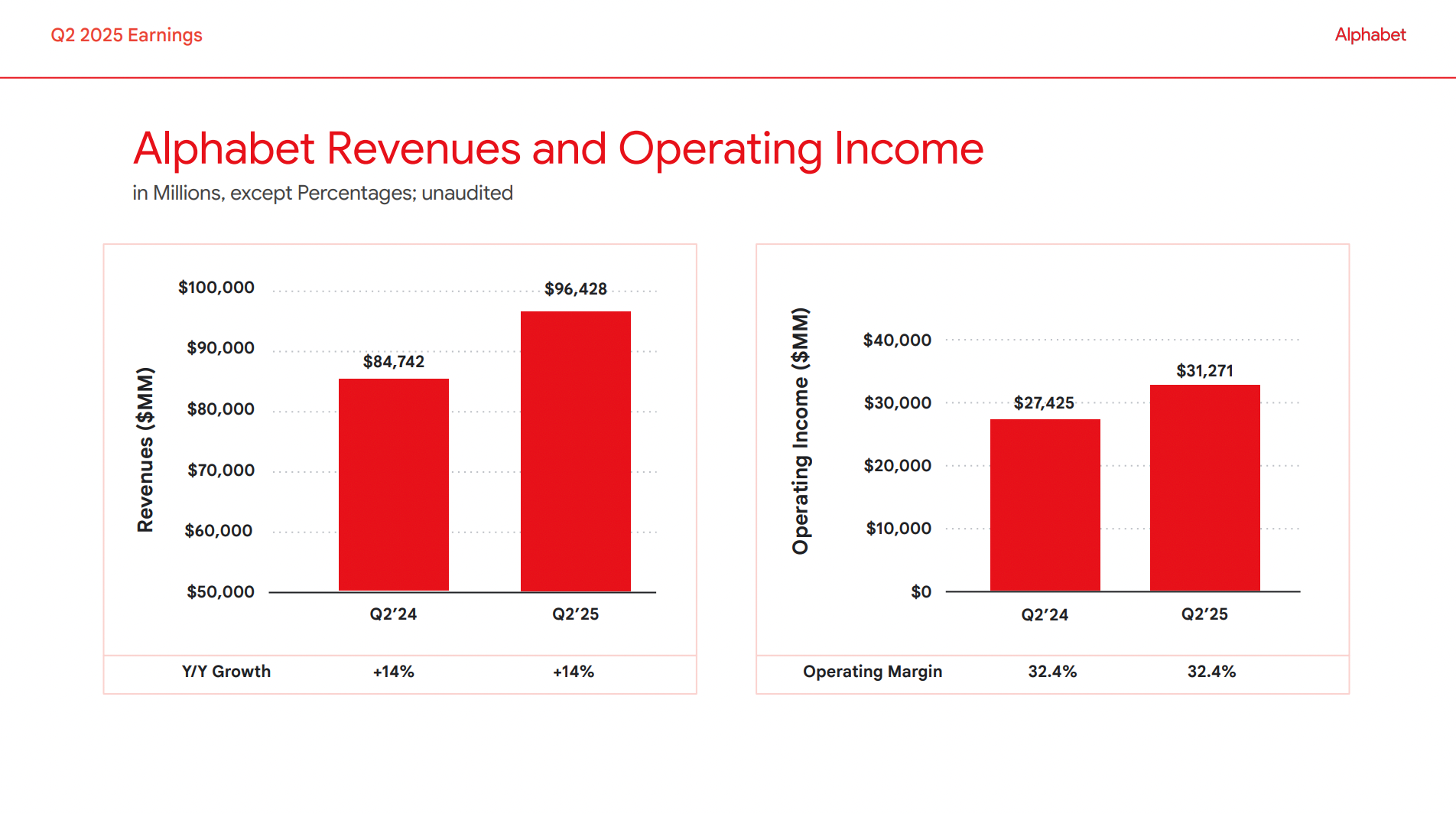

Alphabet Reports Strong Q2 2025 Earnings Driven by AI and Cloud Growth

Alphabet (GOOGL, GOOG) posted a strong Q2 2025, with revenue rising 14% year-over-year to $96.43 billion and net income jumping 19% to $28.2 billion. CEO Sundar Pichai cited AI advancements and strength in core businesses—such as Search, YouTube, and Cloud, which now has an over $50 billion annual revenue run-rate—as major contributors. Capital expenditures for 2025 are set to rise to approximately $85 billion, reflecting optimism around continued demand for Google Cloud and AI-powered products.

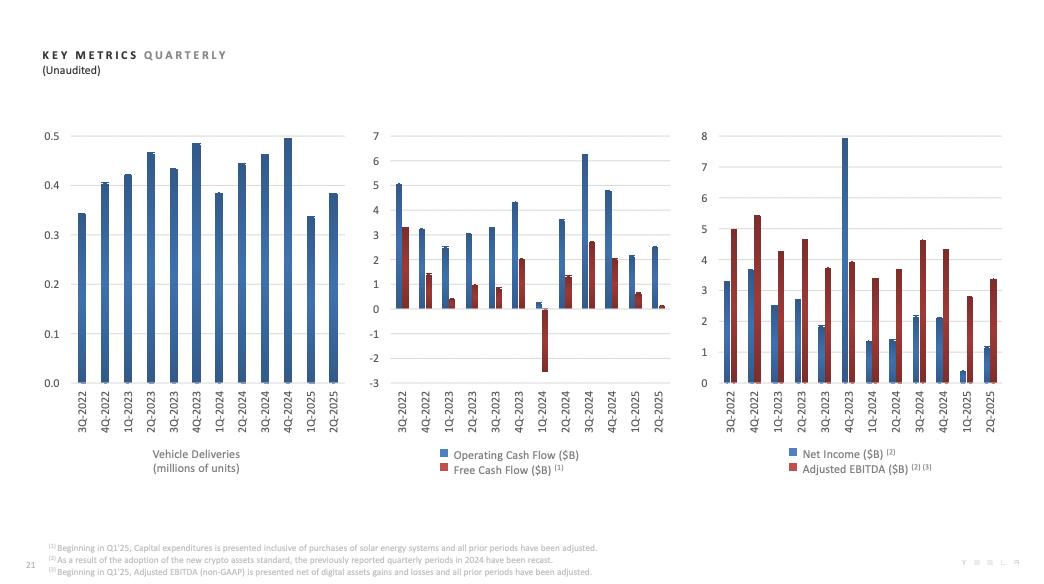

Tesla Q2 2025 Earnings: Revenue Declines as Company Accelerates Strategic Shift to AI and Robotics

Tesla released its Q2 2025 financial results today, reporting revenues of $22.5 billion, down 12% year-over-year, and diluted EPS of $0.33—slightly below Wall Street expectations. The decline was attributed to lower vehicle deliveries, reduced regulatory credits, and a drop in average selling prices. Despite these challenges, Tesla highlighted accelerated investment in artificial intelligence and robotics, notably the launch of its Roboaxi pilot in Austin, and ended the quarter with $36.8 billion in cash, though free cash flow fell sharply. Margins and operating income also contracted significantly year-over-year.

IBM Reports Q2 Earnings: Adjusted EPS Beats Estimates, Declares Quarterly Dividend

International Business Machines (IBM) reported adjusted earnings of $2.80 per share for Q2 2025, surpassing consensus expectations. The company also announced its board approved a quarterly cash dividend of $1.68 per common share, maintaining its commitment to shareholder returns in a competitive tech landscape.

Intel Reports Q2 2025 Earnings, Revenue Beats Expectations

Intel released its second-quarter 2025 financial results after the market closed on July 24. The company reported Q2 products revenue of $11.8 billion, which was up sequentially and above expectations, despite broader consensus forecasts having called for a revenue and earnings decline. The market will closely watch Intel’s forward guidance and CEO commentary at the conference call, given ongoing competitive pressures and macro uncertainty.

ServiceNow Reports Q2 2025 Earnings: Revenue Up 22.5%, EPS Crushes Estimates

ServiceNow delivered robust Q2 2025 results, with total revenues soaring to $3.215 billion—up 22.5% year-over-year. The company posted non-GAAP EPS of $4.13, far exceeding the consensus estimate of $1.70, and beat guidance across all topline growth and profitability metrics. Key highlights include a 30% increase in high-value enterprise customers and strong momentum from strategic partnerships and AI-driven platform innovations, reinforcing ServiceNow’s position as a leading enterprise software provider.

SAP Q2 2025 Earnings: Revenue Beats, EPS Misses, Stock Down on Outlook Caution

SAP reported Q2 2025 results with total revenue of €9.027 billion, narrowly beating analyst estimates. Cloud revenue surged 24% year-over-year to €5.13 billion, and cloud ERP Suite revenue jumped 30%, further strengthening SAP's core business. Non-IFRS basic EPS of €1.50, which beat estimates of €1.45 a share, however shares fell 3.5% in after-hours trading as investors reacted to the earnings miss and SAP's cautious outlook amid geopolitical and public sector uncertainty. Leadership highlighted ongoing AI innovation and a record cloud backlog, but the mixed results signal near-term growth and profitability pressures despite strong operational metrics.

Figma Launches IPO Roadshow, Seeks Up to $1B at $16.4B Valuation

Figma has officially launched its IPO roadshow, offering approximately 37.1 million shares (12.5 million new, 24.6 million from existing shareholders) at an expected price range of $25 to $28 per share. The listing could value the cloud-based design platform at up to $16.4 billion, raising just over $1 billion if priced at the top of the range. Figma will list on the NYSE under the ticker 'FIG.' CEO Dylan Field will maintain control of about 74% of the voting rights post-offering via a dual-class structure. The move comes nearly two years after Adobe’s failed $20 billion acquisition of the company and marks a major test of market appetite for growth-focused software IPOs in 2025 .