With artificial intelligence and machine learning being adopted in nearly every industry, trading and investing is no exception.

With the overwhelming amount of traditional and alternative data available to investors, AI and machine learning are well suited to improve the research process as it can distill billions of data points into actionable trading insights.

There are many different applications of AI and machine learning for trading and investing—from sentiment analysis for text data, stock rankings, classification, crypto on-chain analysis, and more.

In this article, we've put together a list of 8 companies are that are helping investors improve their research process with AI and machine learning.

1. MLQ.ai

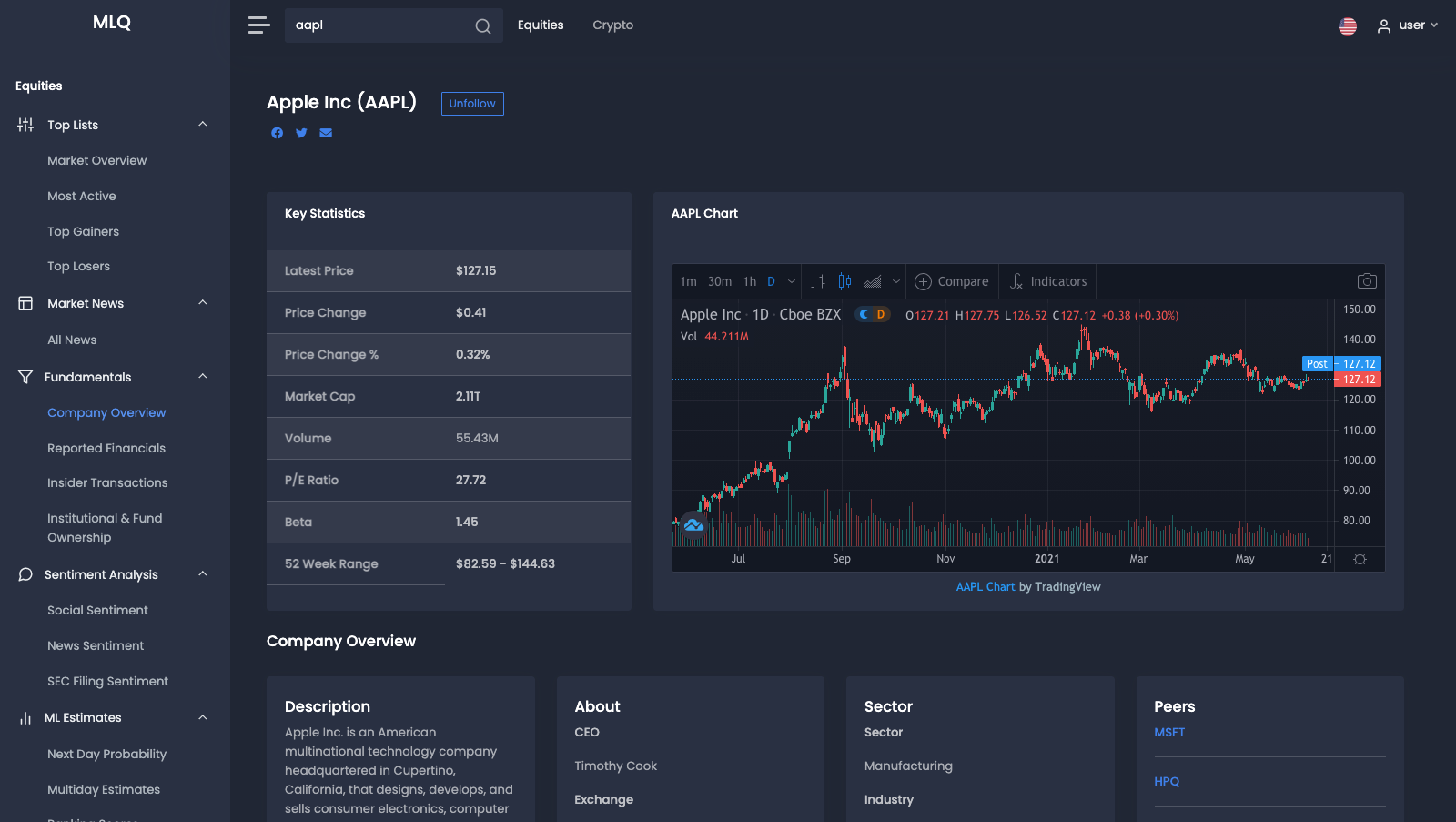

In order to bring the technological advances of AI to investors of all sizes, we built an AI investment research platform that combines fundamentals, alternative data, and machine learning-based insights for both equities and crypto-assets.

To do so, the platform sources institutional-grade financial data from traditional and alternative data providers. Below are several of the data sources featured in the MLQ app.

Fundamentals

In terms of fundamental data, the platform currently features data for 3000+ US equities, including:

- Market News

- Company News

- Basic & Advanced Statistics

- Reported Financials

- Insider Transactions

- Fund & Institutional Ownership

Alternative Data & ML-Based Inisghts

In addition to traditional fundamentals, the platform features the following alternative data and machine-learning-based insights.

Sentiment Analysis

The data providers use natural language processing algorithms to analyze text data for US equities and extract the following insights:

- Social sentiment

- News sentiment

- SEC filing sentiment

ML Estimates

The ML-based estimates we have include the probability of an up or down move the next day, multiday rankings, and predictive equity rankings.

- Next-Day Probabilities: The data provider uses six months of closing-price measurements and the mathematics of machine learning to calculate exact, closed-form expressions for Market Probabilities, Market Energy, Market Power, Market Resistance, and Market Noise.

- Multiday Estimates: The ML Alpha score is related to the confidence of a machine learning classifier in predicting top or bottom quintile returns for the next N trading days (e.g. next 21 days) for stock and ranges from -1 to +1.

- Predictive Equity Rankings: This data provider takes in over 200 factors and signals including fundamentals, pricing, technical indicators, and alternative data, and then uses an ensemble machine learning technique to analyze and rank stocks.

You can sign up for a free account here or learn more about the platform here.

Stay up to date with AI

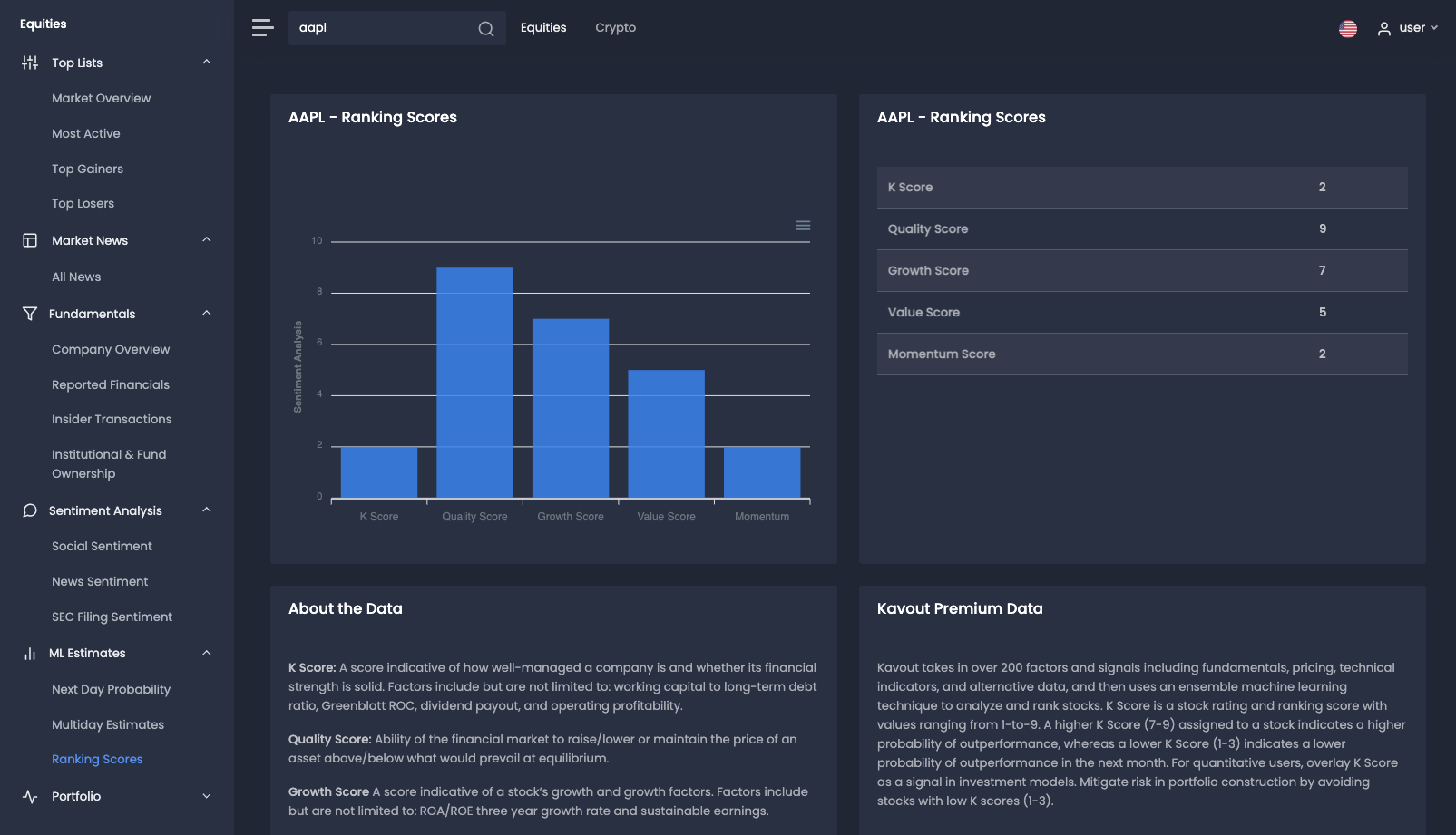

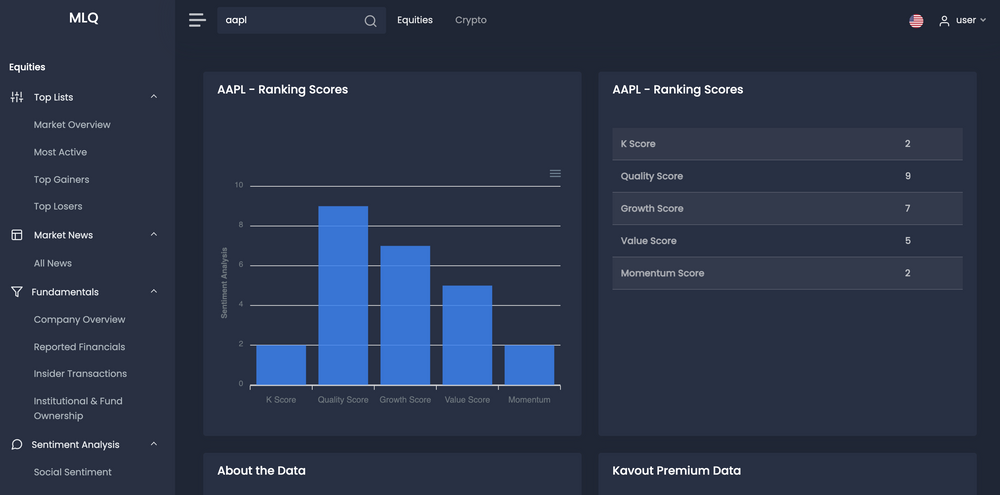

2. Kavout

Kavout is a company focused on applying AI for trading with its predictive equity ranking scores. As described in our article how to rank stocks with AI:

Predictive equity ranking refers to the process of generating stock rankings based on a variety of input data, trading signals, and machine learning algorithms.

Specifically, their core offering is the "K Score", which is described on their site as follows:

A derived equity rating score between 0 and 9 with high K Scores indicating higher probability of out-performance. Quantitative buyside firms overlay K Score with their investment models as buy/sell signals.

A higher K Score (7-9) assigned to a stock indicates a higher probability of outperformance, whereas a lower K Score (1-3) indicates a lower probability of outperformance in the next month.

In addition to the K Score, they offer several other ranking scores, including:

- Momentum Score: The momentum score measures the rate at which a company's price or volume is accelerating. Factors that go into calculating the momentum score include, but are not limited to, Relative strength index (RSI), 52-week high/low, earnings momentum, and more

- Value Score: The value score indicates whether a stock is overpriced or underpriced at current levels. Factors that go into calculating the value score include, but are not limited to, earnings yield, Price-to-book (P/B), Enterprise Value to EBITDA, and more.

- Growth Score: The growth score is indicative of a company's growth and related growth factors, including ROA/ROE, 3-year growth rate, sustainable earnings, and more.

- Quality Score: The quality score is indicative of how well-managed a company is and the company's financial health. Factors that go into the calculation include working capital to long-term debt ratio, Greenblatt ROC, and more.

Kavout is one of the alternative data providers featured in the MLQ app, which you can see below in the Ranking Scores section:

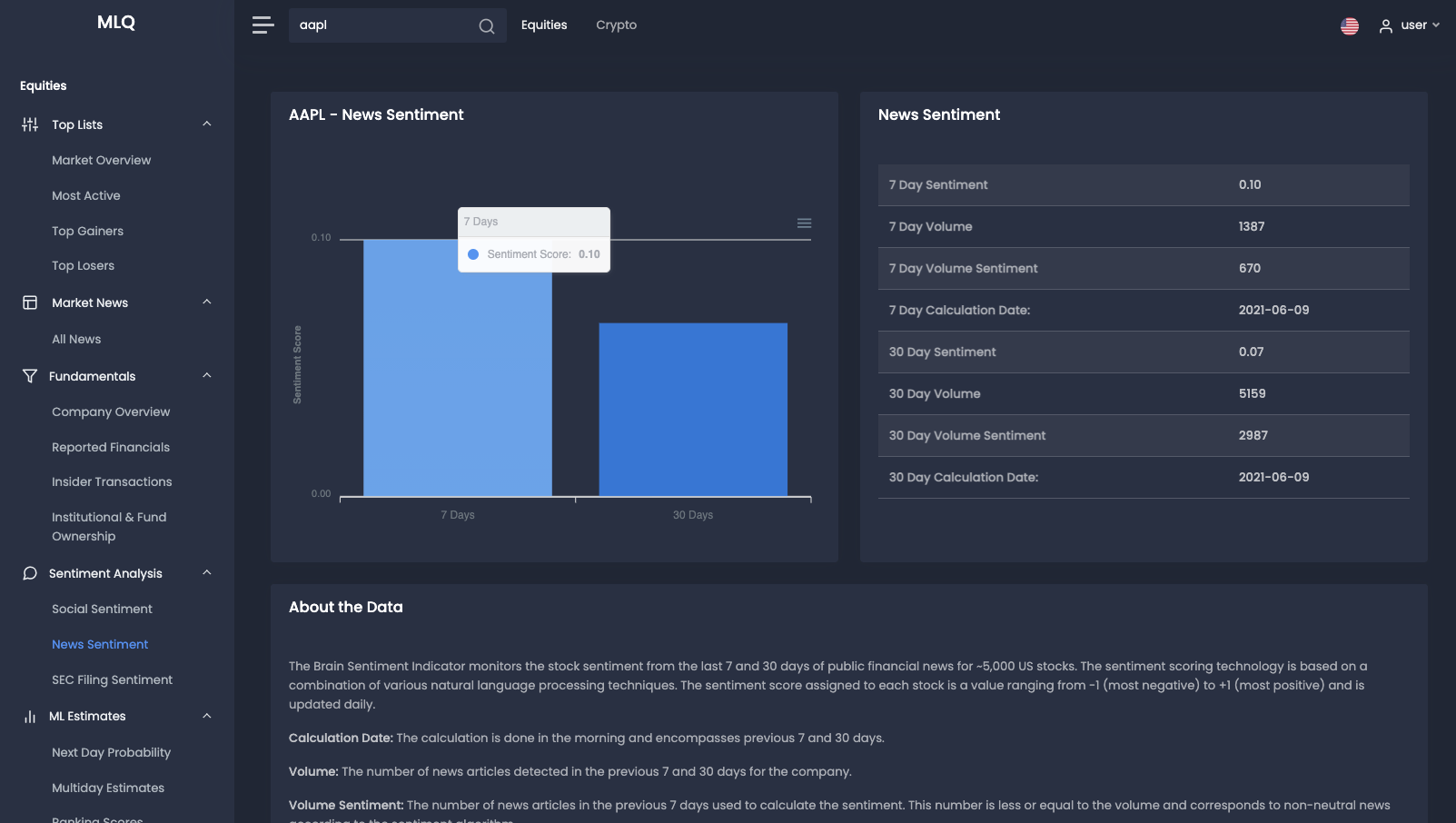

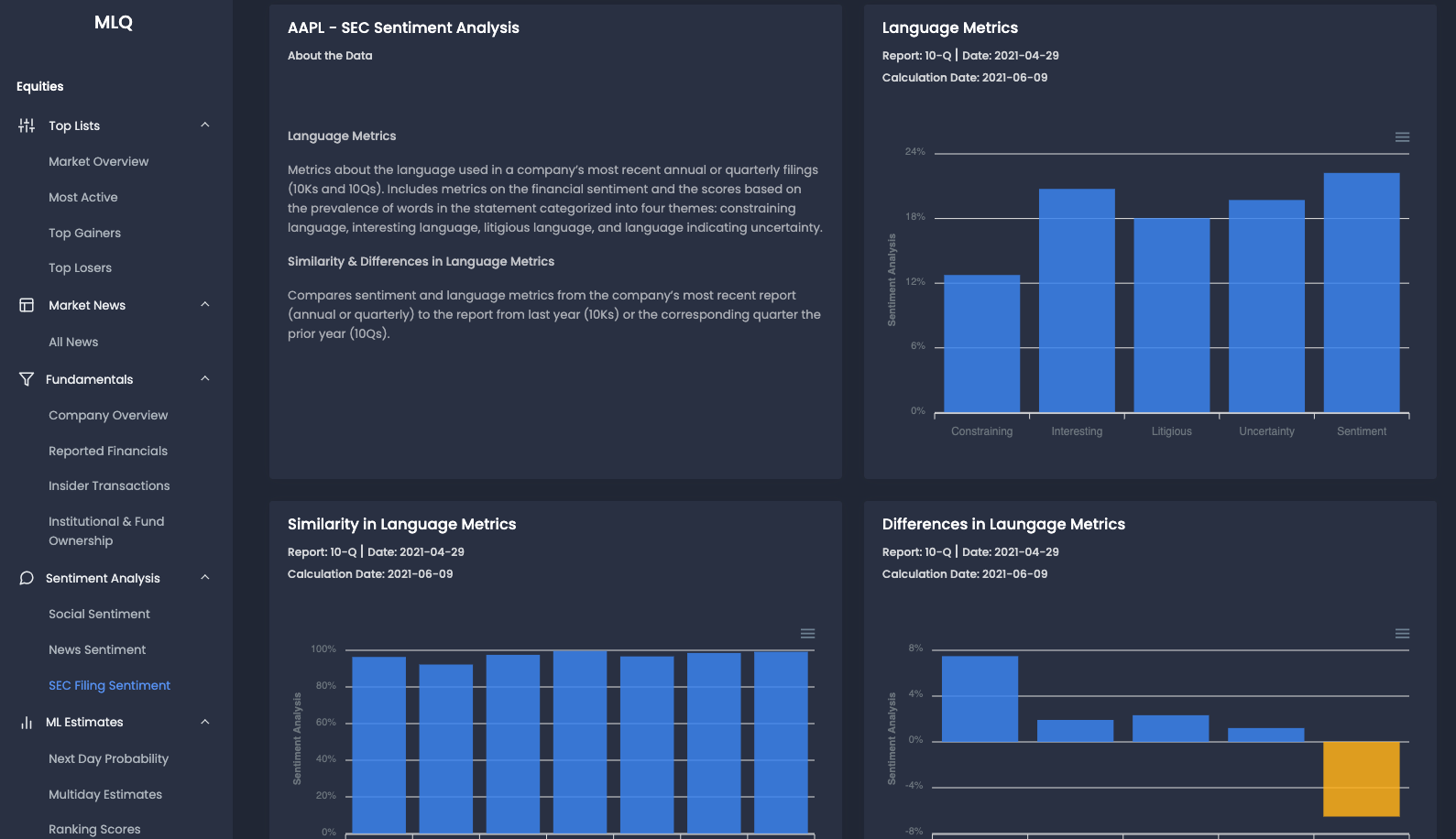

3. Brain Company

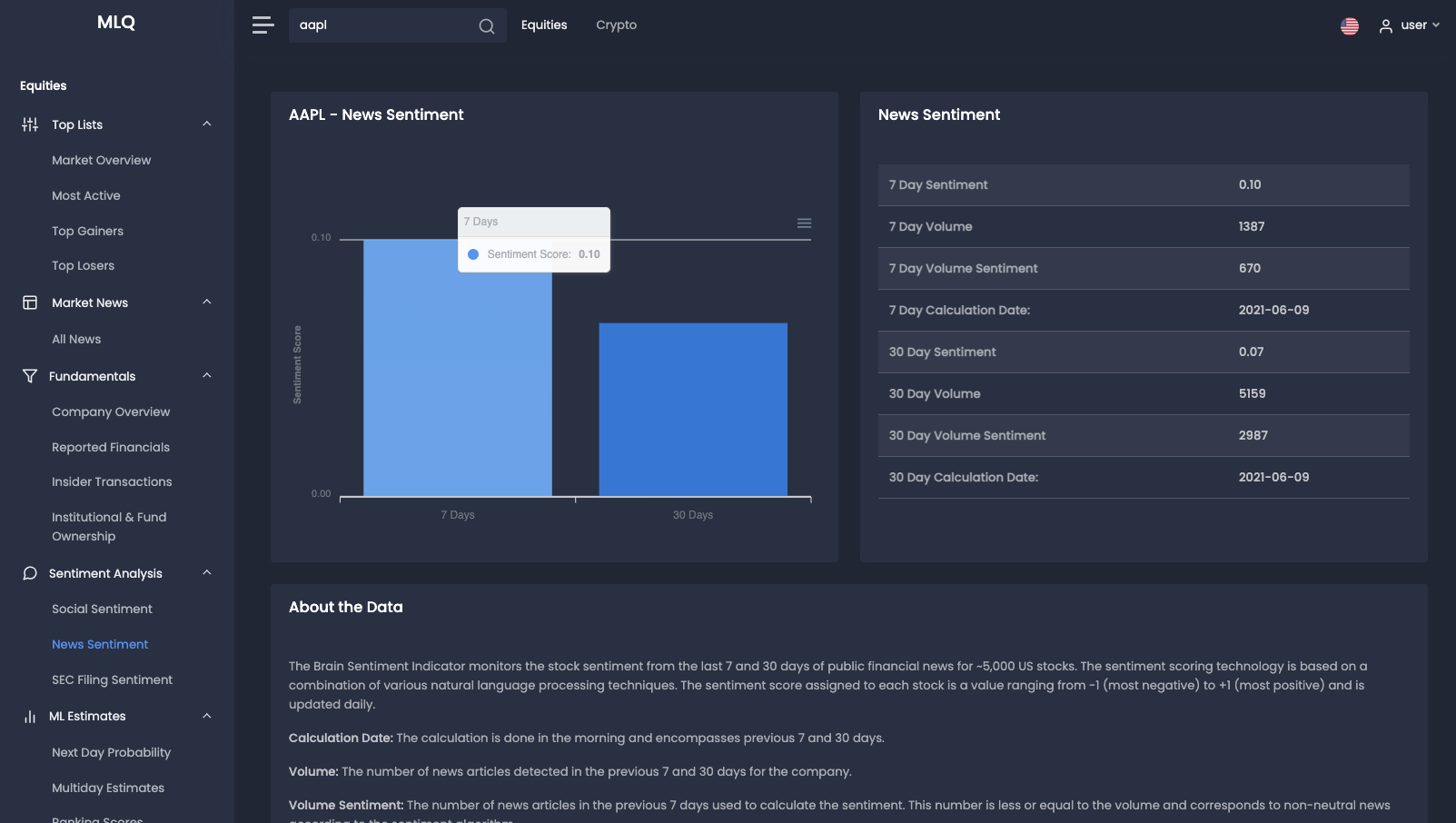

Brain Company is another alternative data provider for the MLQ app that describes itself as:

...a research company that creates proprietary datasets and algorithms for investment strategies, combining experience on financial markets with strong competencies in statistics, machine Learning, and natural language processing.

In particular, their core offerings for sentiment analysis include:

- News Sentiment: The sentiment scoring technology is based on a combination of various NLP techniques. The sentiment score assigned to each stock is a value ranging from -1 (most negative) to +1 (most positive) and is updated daily.

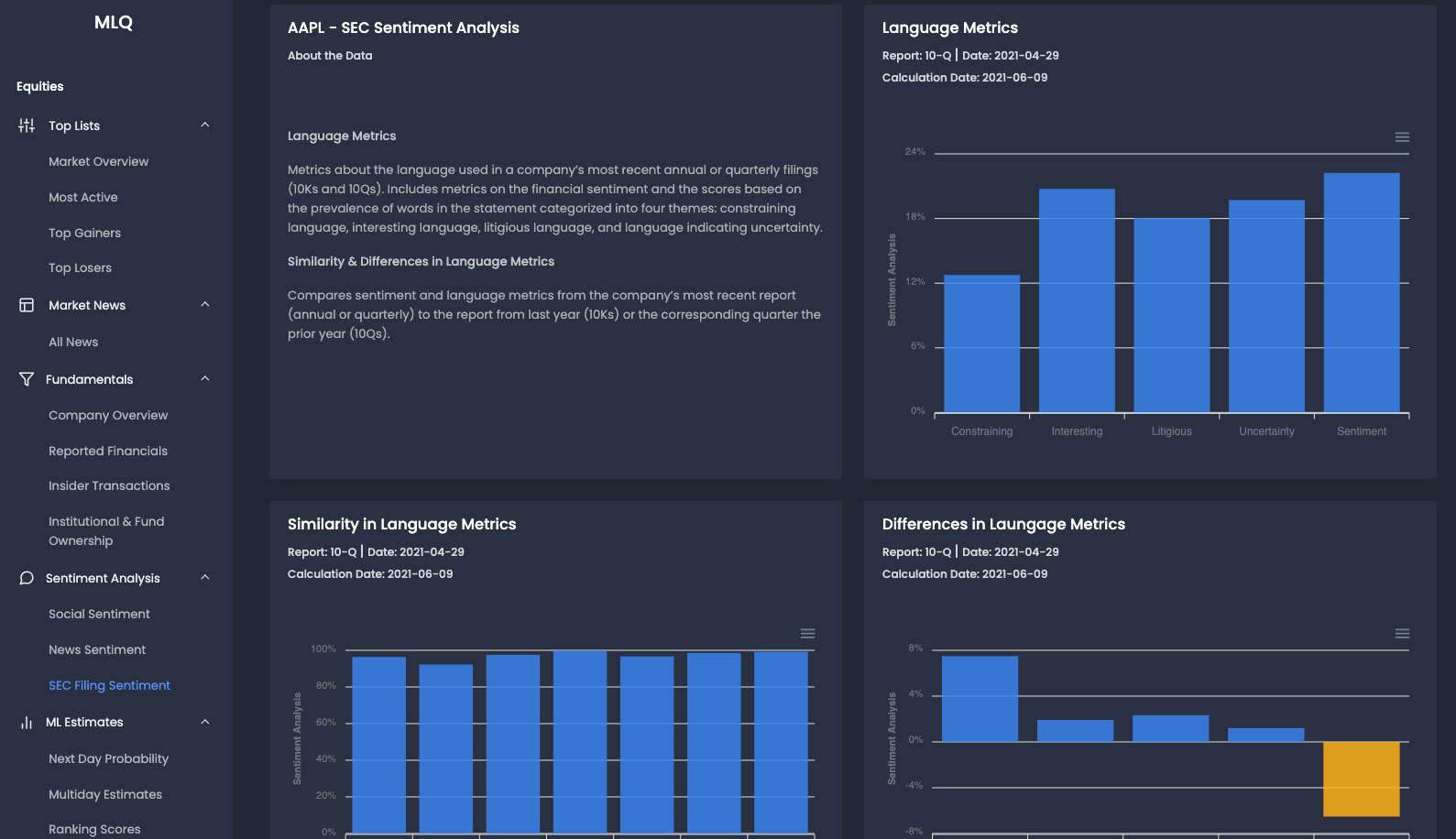

- SEC Filing Sentiment: Their SEC Filing Sentiment indicators include language metrics about the language used in a company’s most recent annual or quarterly filings (10Ks and 10Qs). They also have Similarity & Differences in Language Metrics, which compares sentiment and language metrics from the company’s most recent report to the report from last year (10K) or the corresponding quarter the prior year (10Q).

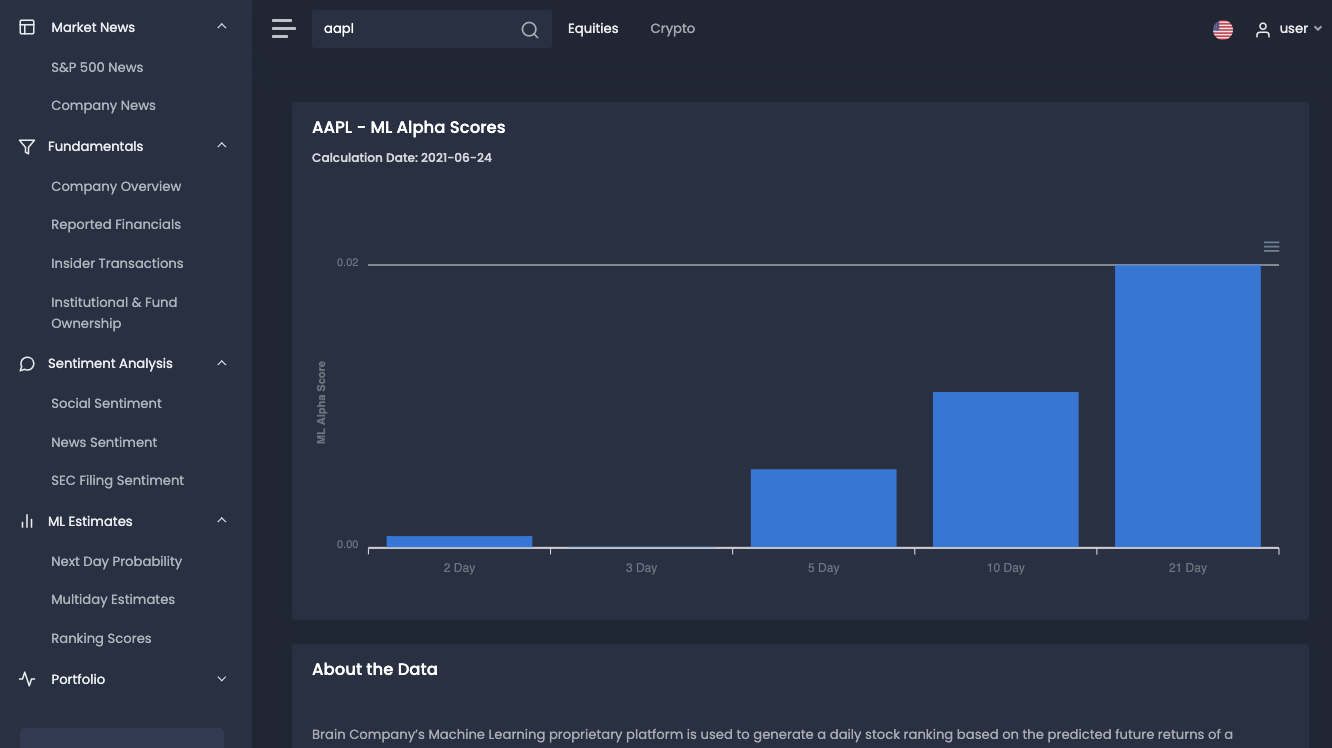

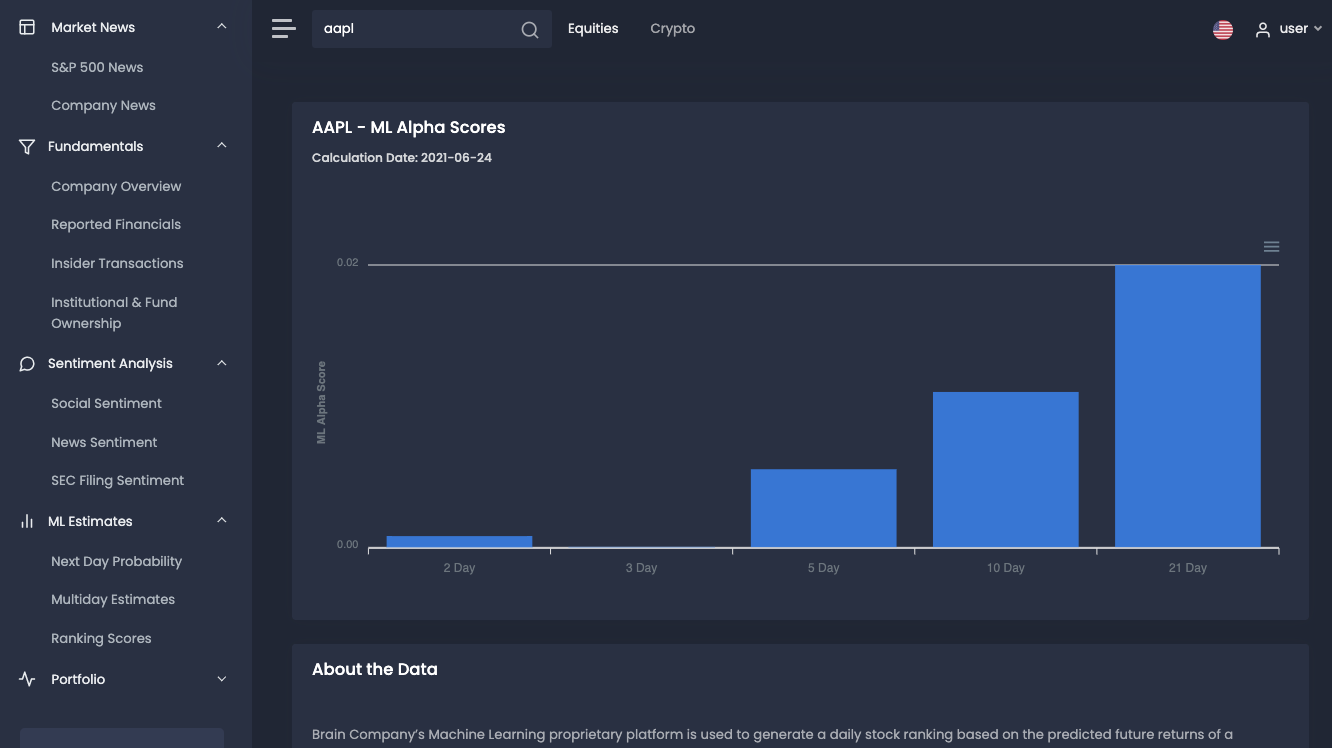

In addition to sentiment analysis, Brain Company’s machine learning algorithms are used to generate a daily stock ranking based on the predicted future returns of a universe of around 1,000 stocks over 2, 3, 5, 10, and 21 days.

These multiday estimates are summarized into the "ML Alpha Score", which is:

The ML Alpha score is related to the confidence of a machine learning classifier in predicting top or bottom quintile returns for the next N trading days (e.g. next 21 days) for stock and ranges from -1 to +1.

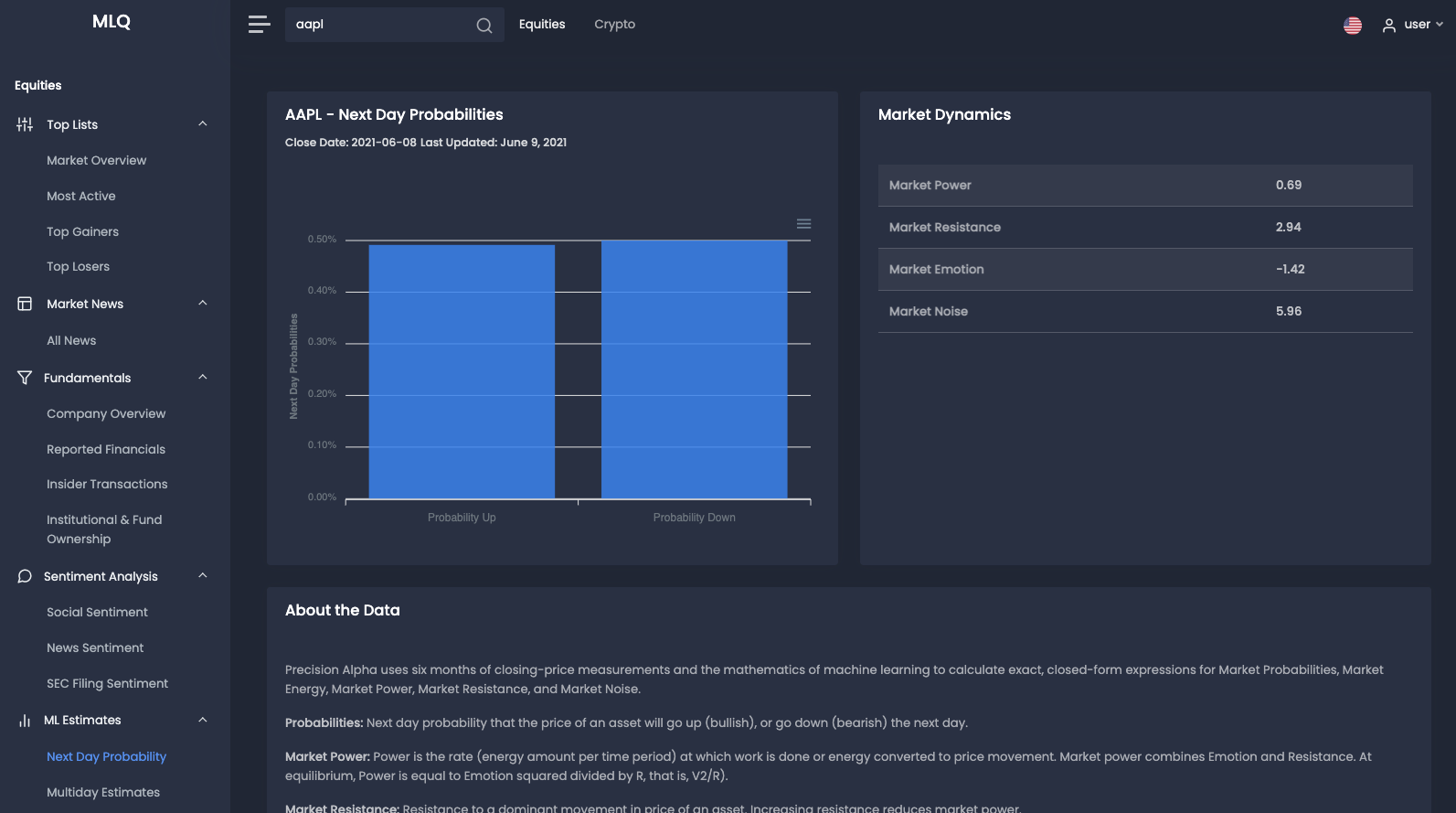

4. Precision Alpha

Precision Alpha is another interesting company that provides machine learning-based market signals for over 85+ global markets. As the company describes on their site:

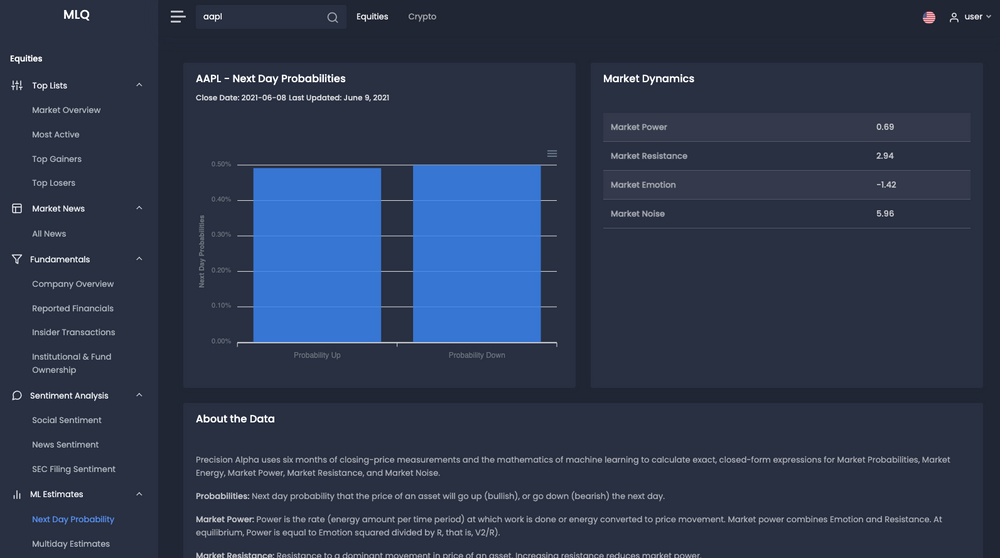

Precision Alpha uses six months of closing-price measurements and the mathematics of machine learning to calculate exact, closed-form expressions and numerically evaluate Market Probabilities, Market Energy, Market Power, Market Resistance, Market Noise, Market Temperature and Market Free Energy.

In particular, the market signals they provide include:

- Next-Day Probability: The probability of a next day up or down price move.

- Market Emotion: Market energy measured from the equilibrium energy as zero offsets. Positive: Bull, Negative: Bear.

- Market Power: Rate at which work is done, in other words, energy converted to price movement.

- Market Resistance: Entropic force resisting change to the dominant price direction.

- Market Noise: Diffusion that dissipates market energy (analogous to strain or viscosity) so that less energy is used to generate price movement.

- Market Temperature: Entropic temperature as defined by thermodynamics. When associated with (Helmholtz) Free Energy, a heat cycle is observed that identifies entry and exit points.

- Market Free Entropy: The (Helmholtz) Free Energy is the energy available to do price movement work. With the Market Temperature, optimal entry and exit points are identified.

PrecisionAlpha is another data provider in the MLQ app, which you can see below in the "Next Day Probability" section:

5. Trade Ideas

Trade Ideas is another tool that provides traders with AI-powered robo-advisement that...

...consists of several dozen different investment algorithms subjected to over a million trading scenarios overnight to arrive at a subset with the highest probability for alpha in the next market session.

Their AI-powered trading suggestions come from "Holly", which shares trade ideas that have a 60%+ success rate and a 2:1 profit factor each day.

6. Sentieo

Sentieo is a financial and corporate research platform that features tools such as AI-powered document search, an equity data terminal, data analysis, and research management. In terms of their AI-powered document search, they apply natural language processing (NLP) and advanced linguistic algorithms to search through millions of documents and speed up the research process.

7. Numerai

Numerai describes itself as the "hardest data science tournament on the planet". The platform allows data scientists to access hedge fund quality data that has been cleaned, regularized, and ready for analysis. Data scientists can then use this data and apply machine learning to predict future price movements and submit these predictions to their crowd-sourced hedge fund. With these predictions, the platform allows data scientists to stake their models and earn cryptocurrency based on the performance.

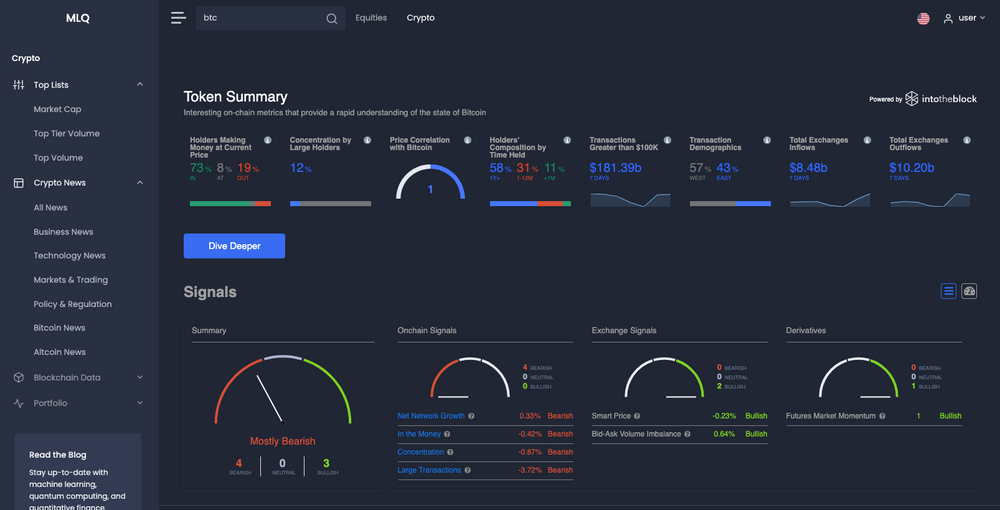

8. IntoTheBlock

IntoTheBlock is a data science company that is focused on applying cutting-edge AI and machine learning to deliver actionable insights and trading signals for the crypto market. Their analytics platform includes:

- Blockchain analytics

- Price predictions

- DeFi analytics

- Market analytics

As you can see below, the crypto section of the MLQ app features data from IntoTheBlock, including a token summary and trading signal for crypto-assets. The trading signals include:

- New Network Growth

- Large Transactions

- Concentration

- In the Money

As the field of AI and machine learning are advancing rapidly, these are just a few companies that are applying the technology to trading and investing. While AI for trading is still relatively niche, there's no question that the application of machine learning to finance will continue to grow in the coming decade.